India High-Density Polyethylene (HDPE) Market Size, Share, and COVID-19 Impact Analysis, By Application (Pipes and Tubes, Sheets and Films, Rigid Articles, and Other), By End-User Industry (Packaging, Building and Construction, Agriculture, Transportation, Electrical and Electronics, and Other), and India High-Density Polyethylene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia High-Density Polyethylene HDPE Market Insights Forecasts to 2035

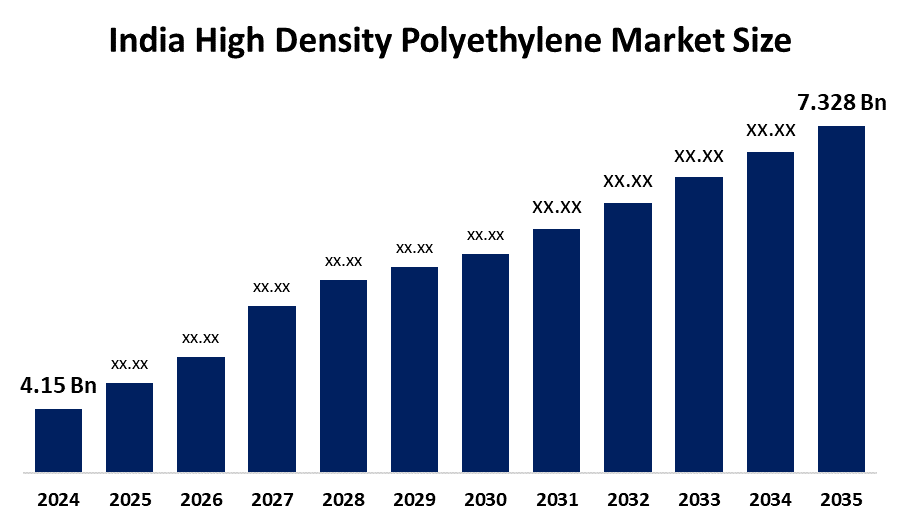

- The India High-Density Polyethylene HDPE Market Size Was Estimated at USD 4.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.3% from 2025 to 2035

- The India High-Density Polyethylene HDPE Market Size is Expected to Reach USD 7.328 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the India high-density polyethylene HDPE market size is anticipated to reach USD 7.328 billion by 2035, growing at a CAGR of 5.3 from 2025 to 2035. The India High Density Polyethylene HDPE market is driven by rapid infrastructure development, rising demand from the packaging and construction sectors, increasing use in pipes and fittings, growth of the automotive industry, and supportive government initiatives promoting industrial expansion.

Market Overview

The India high-density polyethylene HDPE market refers to the production and consumption of a strong, lightweight, and chemically resistant thermoplastic widely used across multiple industries. HDPE is valued for its high strength-to-density ratio, durability, and recyclability. Market growth is primarily driven by expanding infrastructure projects, increasing demand for packaging materials, rising use in pipes and fittings for water and gas distribution, and growth in agriculture and automotive applications. Supportive government policies and rapid urbanization further accelerate HDPE consumption in India.

Advanced polymerization technologies, particularly metallocene catalysts and bimodal process technologies, are significantly boosting the Indian HDPE market. These technologies enable precise control over molecular weight distribution, resulting in superior mechanical strength, crack resistance, and processability. Improved reactor designs also enhance production efficiency, reduce energy consumption, and allow manufacturers to develop application-specific HDPE grades, supporting demand from high-performance packaging, pressure pipes, and industrial applications.

A major trend driving the India HDPE market is the growing focus on sustainability and recyclability. Increasing adoption of recycled HDPE lightweight packaging solutions, and circular economy practices is reshaping product development. Additionally, rising investments in water supply, sanitation, and gas pipeline infrastructure, along with demand for flexible and durable packaging in e commerce and FMCG sectors, are creating sustained growth opportunities for HDPE manufacturers across India.

Report Coverage

This research report categorizes the market for the India high density polyethylene HDPE market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India high-density polyethylene HDPE market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India high-density polyethylene HDPE market.

India High-Density Polyethylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.15 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.3% |

| 2035 Value Projection: | USD 7.328 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Application, By End-User Industry |

| Companies covered:: | Reliance Industries Limited,indian oil corporation limited,gail india limited, ongc petro additions limited,Haldia Petrochemicals Limited,Bharat Petroleum Corporation Limited And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

the india high-density polyethylene market is driven by rapid urbanization and large-scale infrastructure development, especially in water supply, sanitation, and gas distribution pipelines. Rising demand from the packaging industry due to growth in fmcg and e-commerce sectors is increasing HDPE consumption. expanding agricultural applications such as irrigation pipes, films, and containers further support demand. In addition, growth in the automotive and construction sectors, along with increasing preference for lightweight, durable, and recyclable materials, continues to propel the HDPE market in india.

Restraining Factors

The india high density polyethylene market is restrained by volatility in crude oil prices, which directly impacts raw material costs and profit margins. environmental concerns related to plastic waste, strict government regulations on single use plastics, and limited recycling infrastructure also hinder market growth and create challenges for manufacturers.

Market Segmentation

The India high-density polyethylene HDPE market share is classified into application and end-user industry.

- The pipes and tubes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India high-density polyethylene HDPE market is segmented by application into pipes and tubes, sheets and films, rigid articles, and others. Among these, the pipes and tubes segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The pipes and tubes segment dominates the market due to large scale investments in water supply, sanitation, sewage, and gas pipeline infrastructure. HDPE pipes are preferred for their high strength, flexibility, corrosion resistance, and long operational life compared to traditional materials. Increasing adoption in agricultural irrigation systems and government initiatives such as smart cities, jal jeevan mission, and rural infrastructure development further drive strong and consistent demand for HDPE pipes and tubes across the country.

- The building and construction segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India high-density polyethylene (HDPE) market is segmented by end-user industry into packaging, building and construction, agriculture, transportation, electrical and electronics, and other. Among these, the building and construction segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The building and construction segment dominates the market due to the extensive use of HDPE pipes and fittings in water supply, sewage, drainage, and gas distribution systems. Rapid urbanization, smart city projects, and large-scale government initiatives such as Jal Jeevan Mission and housing development programs have significantly increased demand. HDPEs advantages, including corrosion resistance, flexibility, lightweight nature, and long service life, make it a preferred material over traditional metal and concrete alternatives, ensuring sustained consumption within the construction sector across india.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India high-density polyethylene (HDPE) market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Reliance Industries Limited

- indian oil corporation limited

- gail india limited

- ongc petro additions limited (opal)

- Haldia Petrochemicals Limited

- HPCL Mittal Energy Limited

- Bharat Petroleum Corporation Limited

- brahmaputra cracker and polymers limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India high-density polyethylene HDPE market based on the below-mentioned segments:

India High-Density Polyethylene HDPE Market, By Application

- Pipes and Tubes

- Sheets and Films

- Rigid Articles

- Other

India High-Density Polyethylene HDPE Market, By End User Industry

- Packaging

- Building and Construction

- Agriculture

- Transportation

- Electrical and Electronics

- Other

Frequently Asked Questions (FAQ)

-

1. What is HDPE and why is it widely used in India?HDPE is a strong, lightweight, and corrosion-resistant plastic used across packaging, pipes, construction, agriculture, and automotive industries.

-

2. Which application dominates the india hdpe market?pipes and tubes dominate due to high demand from water supply, sanitation, irrigation, and gas distribution infrastructure projects.

-

3. Which end-user industry leads HDPE consumption in India?The building and construction sector leads, driven by urbanization and government infrastructure initiatives.

-

4. What are the key growth drivers of the India HDPE market?infrastructure development, packaging demand, agricultural irrigation needs, and preference for durable and recyclable materials.

-

5. What are the major challenges faced by the HDPE market in India?fluctuating crude oil prices, environmental regulations, plastic waste concerns, and limited recycling infrastructure.

-

6. What trends are shaping the future of the India HDPE market?growing adoption of recycled hdpe, sustainable packaging solutions, and expansion of water and gas pipeline networks.

Need help to buy this report?