India Graphene-enhanced Conductive Polymers Market Size, Share, and COVID-19 Impact Analysis, By Product (Graphene-Enhanced Conductive Masterbatches, Graphene-Enhanced Conductive Compounds, Graphene-Based Conductive Inks & Coatings, and Graphene-Integrated Elastomers & Flexible Polymers), By Application (Electronics & ESD Components, EMI/RFI Shielding Parts, Printed Electronics & Sensors, Energy Storage Components, Automotive & Aerospace Lightweight Conductive Parts, and Other applications), and India Graphene-enhanced Conductive Polymers Market, Insight, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsIndia Graphene-enhanced Conductive Polymers Market Insights Forecasts to 2035

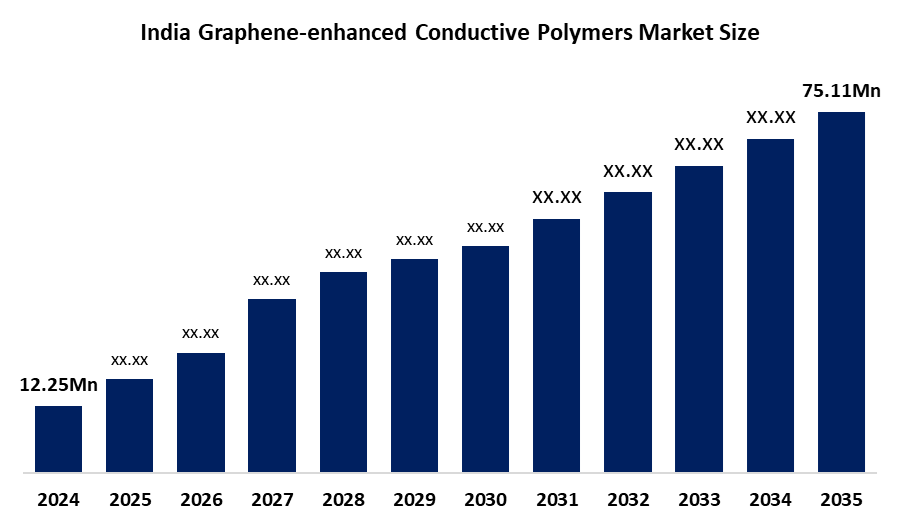

- India Graphene-enhanced Conductive Polymers Market Size 2024: USD 12.25 Million

- India Graphene-enhanced Conductive Polymers Market Size 2035: USD 75.11 Million

- India Graphene-enhanced Conductive Polymers Market CAGR: 17.92%

- India Graphene-enhanced Conductive Polymers Market Segments: Product and Application

Get more details on this report -

A graphene-enhanced conductive polymer is basically a plastic that has been mixed with a tiny bit of graphene to make it a lot more conductive, stronger, and tougher. The graphene is spread out inside the polymer base, thus a network of conductive paths is formed without losing the elasticity or processability of the polymer. The market is moving away from the use of single-function fillers towards multifunctional graphene, polymer systems that are not only electrically conductive but also mechanically reinforced and thermally managed. Such materials are capable of producing lighter and more energy-efficient pieces of equipment for electronics, sensors, energy storage, automotive parts, and other areas where high performance is required.

The India innovation centre for graphene (IICG), supported by the Ministry of Electronics & IT, with an investment of around 86 crore to promote R&D, product innovation and capacity building in graphene and other 2D materials, and the India graphene engineering & innovation centre (I, GEIC), which is also under the same ministry and aims to bridge the gap between laboratory research and industrial applications, including polymer composites. The technological advancement in the production process is powering the growth. This advancement in the production process is making the production more cost-effective, which has increased the adoption in small and medium enterprises. Further, it has improved the appeal of the final product by producing consistent flake size, purity, and dispersion compatibility.

Graphene, enhanced conductive polymers are at the forefront of innovation as they unite graphene's remarkable electrical, mechanical and thermal characteristics with the flexibility of polymers, resulting in materials that are lighter, tougher and highly conductive for next, generation electronics, sensors, energy storage and smart devices; recent developments include multifunctional systems with better graphene dispersion and scalable processing which allow printable graphene, based inks and coatings to be used for flexible circuits and wearable tech, as well as investigations of self-healing, 3D printable graphene polymer composites and hybrid formulations for enhanced battery and structural component performance.

Market Dynamics of the India Graphene-enhanced Conductive Polymers Market:

There is a high demand for graphene and enhanced conductive polymers in the automotive industry. Manufacturers are increasingly turning to lightweight, high-performance conductive materials to improve vehicle efficiency and meet stringent emissions and fuel economy standards. The trend towards miniaturization and improved electronic performance has been the main factor in the acceleration of the use of graphene-based conductive polymers in the automotive sector, as traditional metal conductors add unnecessary weight to electronic components of vehicles. Additionally, global production of personal vehicles is increasing due to the expanding middle class and government incentives for the automotive industry, which are driving up the demand for materials.

Commercial deployment is limited by problems of uneven graphene quality, difficulties in dispersion, and expensive raw materials. To make consistent percolation networks in polymer matrices, very careful functionalization and controlled processing are needed, which in turn increases the complexity and price. Besides that, scarce large-scale, cheap production of good-quality graphene and immature industry standards additionally hinder the uptake.

In India, the usage of energy storage systems is rapidly increasing, alongside the growing demand for batteries and supercapacitors in various sectors, including consumer electronics, renewable energy integration, and the automotive industry. As a result, there is an increasing demand for graphene and advanced conductive polymers, as they enhance electron transport, improve electrode stability, and enable faster charging and discharging. The growth of electric vehicles, facilitated by government incentives and the development of charging infrastructure, is significantly helping in the uptake of such advanced materials, thus contributing to market growth.

India Graphene-enhanced Conductive Polymers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.25 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 17.92% |

| 2035 Value Projection: | USD 75.11 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product |

| Companies covered:: | Ad Nano Technologies Pvt. Ltd., Gujarat Fluorochemicals Ltd. (GFL), IIT Delhi - Research Collaborations, IIT Madras - Research Collaborations, Log9 Materials Scientific Pvt. Ltd., Nanomaterials Innovation Centre, IIT Bombay, Nanospan Pvt. Ltd., PlasmaChem India, Techinstro, Tirupati Graphite & Graphene, and Others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India Graphene-enhanced Conductive Polymers market share is classified into product and application.

By Product:

The India graphene-enhanced conductive polymers market is divided by product into graphene-enhanced conductive masterbatches, graphene-enhanced conductive compounds, graphene-based conductive inks & coatings, and graphene-integrated elastomers & flexible polymers. Among these, the graphene-based conductive ink & coatings segment controlled the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The graphene-based conductive inks & coatings segment dominated due to its ease of application, compatibility with large-area and low-cost manufacturing processes, and growing use in EV components and smart devices continue to position this segment as the key revenue contributor and fastest-expanding category.

By Application:

The India graphene-enhanced conductive polymers market is divided by application into electronics & ESD components, EMI/RFI shielding parts, printed electronics & sensors, energy storage components, automotive & aerospace lightweight conductive parts, and other applications. Among these, the electronics & ESD components segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment dominance is driven by the rapid expansion of electronics manufacturing in India, increasing use of graphene-enhanced conductive polymers in antistatic packaging, connectors, housings, and circuit protection, and strong demand from consumer electronics, industrial electronics, and EV electronics.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India graphene-enhanced conductive polymers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Graphene-enhanced Conductive Polymers Market:

-

Ad Nano Technologies Pvt. Ltd.

-

Gujarat Fluorochemicals Ltd. (GFL)

-

IIT Delhi – Research Collaborations

-

IIT Madras – Research Collaborations

-

Log9 Materials Scientific Pvt. Ltd.

-

Nanomaterials Innovation Centre, IIT Bombay

-

Nanospan Pvt. Ltd.

-

PlasmaChem India

-

Techinstro

-

Tirupati Graphite & Graphene

-

Others

Recent Developments in India Graphene-enhanced Conductive Polymers Market:

In July 2025, The partnership between TACC Limited and NCB focuses on integrating graphene's exceptional properties into concrete. Graphene, a single layer of carbon atoms arranged in a hexagonal lattice, is renowned for its strength, conductivity, and lightweight characteristics. By incorporating graphene-based additives into concrete, the collaboration aims to enhance.

In February 2023, The commercial production of graphene marked a significant milestone in transforming the state's industrial sector. The Murugappa Group, based in Chennai, has initiated this production at the Kochi plant of Carborundum Universal Ltd, which has been operating in Kerala for the past five decades. Graphene is often referred to as the wonder material of the future.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insight has segmented the India graphene-enhanced conductive polymers market based on the below-mentioned segments:

India Graphene-enhanced Conductive Polymers Market, By Product

- Graphene-Enhanced Conductive Masterbatches

- Graphene-Enhanced Conductive Compounds

- Graphene-Based Conductive Inks & Coatings

- Graphene-Integrated Elastomers & Flexible Polymers

India Graphene-enhanced Conductive Polymers Market, By Application

- Electronics & ESD Components

- EMI/RFI Shielding Parts

- Printed Electronics & Sensors

- Energy Storage Components

- Automotive & Aerospace Lightweight Conductive Parts

- Other applications

Frequently Asked Questions (FAQ)

-

What is the size and growth of the India graphene-enhanced conductive polymers market?The India graphene-enhanced conductive polymers market starts at USD 12.25 million in 2024 and reaches USD 75.11 million by 2035, with a CAGR of 17.92% from 2025 to 2035

-

What are graphene-enhanced conductive polymers in the Indian market for these materials?In the Indian graphene-enhanced conductive polymers market, they are plastics mixed with graphene to boost conductivity, strength, and toughness while retaining polymer flexibility for electronics and sensors.

-

What drives growth in the India graphene-enhanced conductive polymers market?The India graphene-enhanced conductive polymers market grows due to automotive lightweighting, energy storage for EVs, electronics expansion, and initiatives like the India Innovation Centre for Graphene (IICG).

-

What are the main product segments in the India graphene-enhanced conductive polymers market?graphene-enhanced conductive masterbatches, graphene-enhanced conductive compounds, graphene-based conductive inks & coatings (largest share in 2024), and graphene-integrated elastomers & flexible polymers.

-

What are the top applications in the India graphene-enhanced conductive polymers market?electronics & ESD components (dominant in 2024), EMI/RFI shielding parts, printed electronics & sensors, energy storage components, automotive & aerospace lightweight conductive parts, and other applications

-

What challenges face the India graphene-enhanced conductive polymers market?The India graphene-enhanced conductive polymers market faces hurdles like uneven graphene quality, dispersion issues, high costs, and limited scalable production

-

Who are the top companies in the India graphene-enhanced conductive polymers market?Key players in the India graphene-enhanced conductive polymers market include Ad-Nano Technologies Pvt. Ltd., Log9 Materials Scientific Pvt. Ltd., Techinstro, Gujarat Fluorochemicals Ltd., Nanospan Pvt. Ltd., Tirupati Graphite & Graphene, and its research collaborations

-

What recent developments impact the India graphene-enhanced conductive polymers market?Recent highlights for the India graphene-enhanced conductive polymers market include TACC Limited's July 2025 partnership with NCB for graphene additives and Kerala's February 2023 commercial graphene production at Murugappa Group's Kochi plant

Need help to buy this report?