India Gold Mining Market Size, Share, By Mining Method (Placer Mining And Hardrock Mining), By End Use (Investment, Jewelry, And Others), And India Gold Mining Method Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentIndia Gold Mining Market Insights Forecasts to 2035

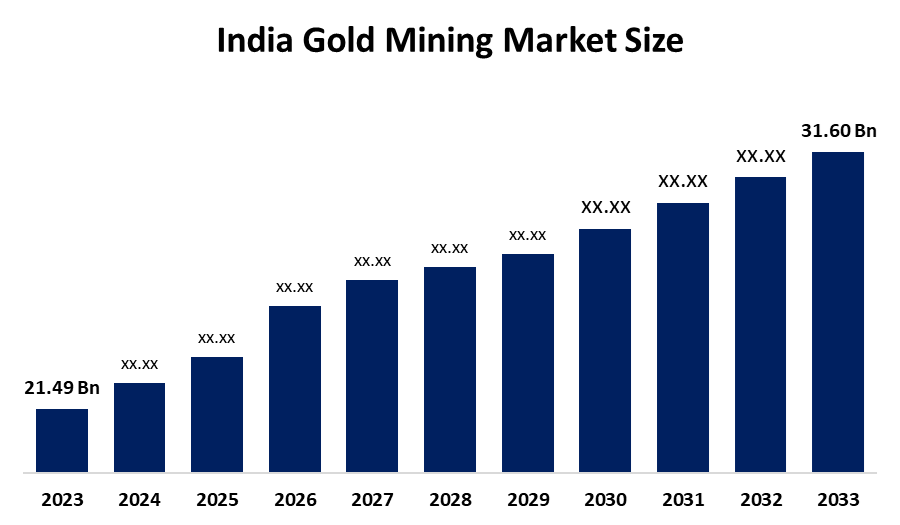

- India Gold Mining Market Size 2024: USD 21.49 Bn

- India Gold Mining Market Size 2035: USD 31.60 Bn

- India Gold Mining Market CAGR 2024: 3.57%

- India Gold Mining Market Segments: Mining Method and End Use

Get more details on this report -

The India gold mining market refers to the exploration, extraction, processing, and production of gold ore and the associated industry activities in India. Although India is one of the largest consumers of gold globally, its domestic gold mining output is historically very low often just about 1.4–1.5 tonnes annually from mines like the Hutti Gold Mine in Karnataka against annual consumption often exceeding 800 tonnes, necessitating heavy reliance on imports driven by cultural demand for gold jewelry, investment demand, and the safe-haven appeal of gold during economic uncertainty.

The gold mining in India are backed by government support, including the Mining Tenement System (MTS), which was introduced by the Indian Bureau of Mines, allows for digital tracking of all applications for permission to mines operate within the country. The Gold Monetisation Scheme (GMS) was introduced in recognition of the large amount of gold held by Indian households. Additionally, both the GMS and MTS demonstrate how India has been making efforts that relate to the broader gold market, including the creation of an avenue to mobilise 34,600 tonnes of gold owned by Indian households and representing nearly 89% of the total GDP generated by India, thereby demonstrating both culturally how significant gold is to Indian people and the size of the demand for gold includes both mining and related policies and is very large.

As technology advances, India’s gold mining providers are now using digital mine planning software, real-time monitoring systems, and advanced geological survey procedures for resource modelling, environmental compliance and operational efficiencies has improved substantially. Indian miners and their associates are becoming increasingly interested in the use of international best practices. Sustainable mining practices and recycling technologies that allow gold to be retrieved from electronic waste and scrap metals are now becoming important influences in Indian market thinking, providing alternatives for reducing environmental impact and supplementing traditional mining outputs with recycled gold.

Market Dynamics of the India Gold Mining Market:

The India gold mining market is driven by the strong domestic demand for gold, its role as a safe-haven investment, increase of income levels, urbanisation, increased investment interest in gold ETFs and digital gold, as well as increasing government support schemes, and overall uncertainty in the global economy and inflation, there has been increased

The India gold mining market is restrained by the very low domestic gold production, high dependence on imports, regulatory and environmental clearance challenges, high extraction costs, limited exploration activity, low ore grades, and lack of advanced mining infrastructure.

The future of India gold mining market is bright and promising, with versatile opportunities emerging from the improving modern mining & exploration technologies, to increase mining recovery rates, reduce costs, & enhance the competitiveness of domestic mining in comparison to international markets. There are also many opportunities to be found in downstream activities along the value-chain, such as refining, jewellery manufacturing, & export oriented processing units, where India currently has existing global competitive advantage. Additionally, policy reforms and the integration of financial instruments with mining may allow India to further stimulate new investment and export opportunities in gold mining market.

Hutti Gold Mines Company Limited, Deccan Gold Mines Ltd., Geomysore Service India Private Limited, Manmohan Industries Private Limited, Vedanta Resources, Hindalco Industries, and Other kay palyers

India Gold Mining Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 21.49 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 3.57% |

| 2035 Value Projection: | USD 31.60 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Mining Method |

| Companies covered:: | Hutti Gold Mines Company Limited, Deccan Gold Mines Ltd., Geomysore Service India Private Limited, Manmohan Industries Private Limited, Vedanta Resources, Hindalco Industries, and Other kay palyers |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India Gold Mining Market share is classified into mining method and end use.

By Mining Method:

The India gold mining market is divided by mining method into placer mining and hardrock mining. Among these, the placer mining segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Low cost, simple technology suitable for alluvial deposits, attracting small-scale miners, less capital-intensive nature, and allowing extraction from surface-level gold all contribute to the placer mining segment's largest share and higher spending on gold mining when compared to other mining method.

By End Use:

The India gold mining market is divided by end use into investment, Jewelry, and others. Among these, the jewelry segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The jewelry segment dominates because of expanding market demand for deep cultural significance, auspicious investment and tradition, urbanization and rising disposable income, alongside government support for manufacturing and exports.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India gold mining market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Gold Mining Market:

- Hutti Gold Mines Company Limited

- Deccan Gold Mines Ltd.

- Geomysore Service India Private Limited

- Manmohan Industries Private Limited

- Vedanta Resources

- Hindalco Industries

- Others

Recent Developments in India Gold Mining Market:

In September 2025, Deccan Gold Mines Limited announced that the mine is poised to begin full-scale production shortly, following the stabilization of the processing plant. The mine is expected to produce 750 kg of gold annually, scaling upto 1,000 kg/yrs within two to three years.

In September 2025, Hutti Gold Mines Company primarily involved general operational and maintenance tendors, such as reorientation of power feeders at its facilities, rather than new mine developments.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the India gold mining market based on the below-mentioned segments:

India Gold Mining Market, By Mining Method

- Placer Mining

- Hardrock Mining

India Gold Mining Market, By End Use

- Investment

- Jewelry

- Others

Frequently Asked Questions (FAQ)

-

What is the India Gold Mining Market size?India Gold Mining Market is expected to grow from USD 21.49 billion in 2024 to USD 31.60 billion by 2035, growing at a CAGR of 3.57% during the forecast period 2025-2035

-

What are the key growth drivers of the market?Market growth is driven by the strong domestic demand for gold, its role as a safe-haven investment. Rising income levels, urbanisation, growing investor interest through gold ETFs and digital gold, government support schemes, global economic uncertainty and inflation increase gold’s attractiveness, indirectly encouraging focus on strengthening domestic gold supply

-

What factors restrain the India Gold Mining Market?Constraints include the very low domestic gold production, high dependence on imports, regulatory and environmental clearance challenges, high extraction costs, limited exploration activity, low ore grades, and lack of advanced mining infrastructure.

-

How is the market segmented by mining method?The market is segmented into placer mining and hardrock mining.

-

Who are the key players in the India Gold Mining Market?Key companies include Hutti Gold Mines Company Limited, Deccan Gold Mines Ltd., Geomysore Service India Private Limited, Manmohan Industries Private Limited, Vedanta Resources, Hindalco Industries, and Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?