India Glacial Acrylic Acid Market Size, Share, By Sales Channel (Direct Sales and Indirect Sales), By End-Use (Water Treatment, Detergent, Paints & Coatings, and others), India Glacial Acrylic Acid Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Glacial Acrylic Acid Market Insights Forecasts to 2035

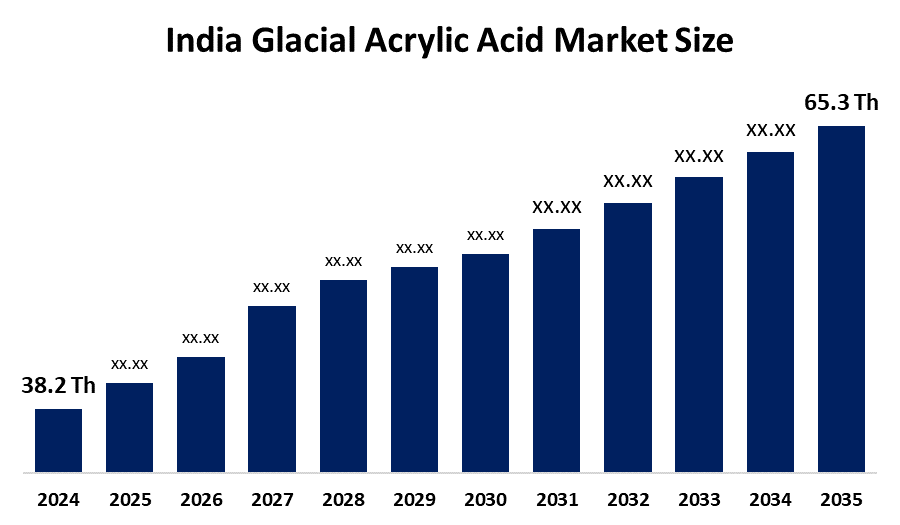

- India Glacial Acrylic Acid Market Size 2024: 38.2 thousand tonnes

- India Glacial Acrylic Acid Market Size 2035: 65.3 thousand tonnes

- India Glacial Acrylic Acid Market CAGR 2024: 4.99%

- India Glacial Acrylic Acid Market Segments: Sales Channel and End-Use

Get more details on this report -

The India glacial acrylic acid GAA market refers to the industry involved in the production, distribution, and sale of glacial acrylic acid, a key raw material that various industrial applications use to manufacture adhesives and coatings, superabsorbents and other chemical products across India.

LG Chem developed and launched two eco friendly biobased glacial acrylic acid products, which achieved a major reduction in carbon emissions when compared to traditional petrochemical manufacturing methods because these products meet current industry requirements for environmentally sustainable chemical solutions.

PCPIRs function as extensive industrial zones that contain shared facilities to attract investment for petrochemical and speciality chemical manufacturing operations. The region provides essential services to its acrylic acid derivative industry, which includes both utilities and logistics and shared operational spaces that help decrease production expenses while boosting the ability to export products.

The India glacial acrylic acid market provides future opportunities through domestic production growth and development of bio-based sustainable products and expansion of superabsorbent polymers, adhesives and coatings, and replacement of imported products, which industrial sectors will drive and government programs will support.

Market Dynamics of the India Glacial Acrylic Acid Market:

The India glacial acrylic acid market is driven by the superabsorbent polymers, which are used in diapers and hygiene products, together with adhesives and coatings and paint products, driving market growth. The market for chemical production in India is expanding because of rising industrialization and growing end-use applications, government support for local chemical manufacturers and the increasing demand for sustainable bio-based acrylic acid.

The India glacial acrylic acid market is restrained by the manufacturing process facing obstacles because of expensive production needs and its reliance on crude oil, plastics and environmental rules and availability shortages of essential local materials, which exist in the market.

The future of Indias glacial acrylic acid market is bright and promising, with the market for superabsorbent polymers, adhesives and coatings products growing because of increased domestic production, rising industrial demand and the adoption of eco friendly bio based materials and supportive government initiatives.

India Glacial Acrylic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 38.2 Thousand |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.99% |

| 2035 Value Projection: | 65.3 Thousand |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Sales Channel, By End-Use |

| Companies covered:: | Bharat Petroleum Corporation Limited,Indian Oil Corporation Ltd,Prakash Chemicals Agencies Pvt. Ltd,SNF India Pvt Ltd,Vizag Chemical,Joshi Agrochem Pharma Private Limited,Meru Chem Pvt. Ltd,Dhalop Chemicals And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India glacial acrylic acid market share is classified into sales channel and end-use.

By Sales Channel:

The India glacial acrylic acid market is divided by sales channel type into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Because industrial customers require large quantities of products, which they purchase through permanent contracts that establish fixed prices, while manufacturers supply their products directly to major chemical, steel and water treatment companies.

By End-Use:

The India glacial acrylic acid market is divided by end-use into water treatment, detergent, paints & coatings, and others. Among these, the water treatment segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. GAA is widely used to produce superabsorbent polymers, flocculants, and coagulants that are critical for industrial and municipal water treatment applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India glacial acrylic acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Glacial Acrylic Acid Market:

- Bharat Petroleum Corporation Limited (BPCL)

- Indian Oil Corporation Ltd (IOCL)

- Vimal Intertrade Pvt Ltd

- Prakash Chemicals Agencies Pvt. Ltd. (PCAPL)

- SNF India Pvt Ltd

- Vizag Chemical

- Joshi Agrochem Pharma Private Limited

- Meru Chem Pvt. Ltd.

- Dhalop Chemicals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India glacial acrylic acid market based on the below-mentioned segments:

India Glacial Acrylic Acid Market, By Sales Channel

- Direct Sales

- Indirect Sales

India Glacial Acrylic Acid Market, By End-Use

- Water Treatment

- Detergent

- Paints & Coatings

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India glacial acrylic acid market size?A: India glacial acrylic acid market is expected to grow from 38.2 thousand tonnes in 2024 to 65.3 thousand tonnes by 2035, growing at a CAGR of 4.99% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the superabsorbent polymers, which are used in diapers and hygiene products, together with adhesives and coatings and paint products, driving market growth. The market for chemical production in India is expanding because of rising industrialization and growing end-use applications, government support for local chemical manufacturers and the increasing demand for sustainable bio-based acrylic acid.

-

Q: What factors restrain the India glacial acrylic acid market?A: Constraints include the manufacturing process facing obstacles because of expensive production needs and its reliance on crude oil, plastics and environmental rules and availability shortages of essential local materials, which exist in the market.

-

Q: How is the market segmented by sales channel?A: The market is segmented into direct sales and indirect sales.

-

Q: Who are the key players in the India glacial acrylic acid market?A: Key companies include Bharat Petroleum Corporation Limited (BPCL), Indian Oil Corporation Ltd (IOCL), Vimal Intertrade Pvt Ltd, Prakash Chemicals Agencies Pvt. Ltd. (PCAPL), SNF India Pvt Ltd, Vizag Chemical, Joshi Agrochem Pharma Private Limited, Meru Chem Pvt. Ltd., Dhalop Chemicals and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?