India Fintech Market Size, Share, By Service Proposition (Digital Payments, Digital Lending and Financing, Digital Investments, Insurtech, and Neobanking), By End-User (Retail and Businesses), By User Interface (Mobile Applications, Web / Browser, and POS / IoT Devices), India Fintech Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyIndia Fintech Market Size Insights Forecasts to 2035

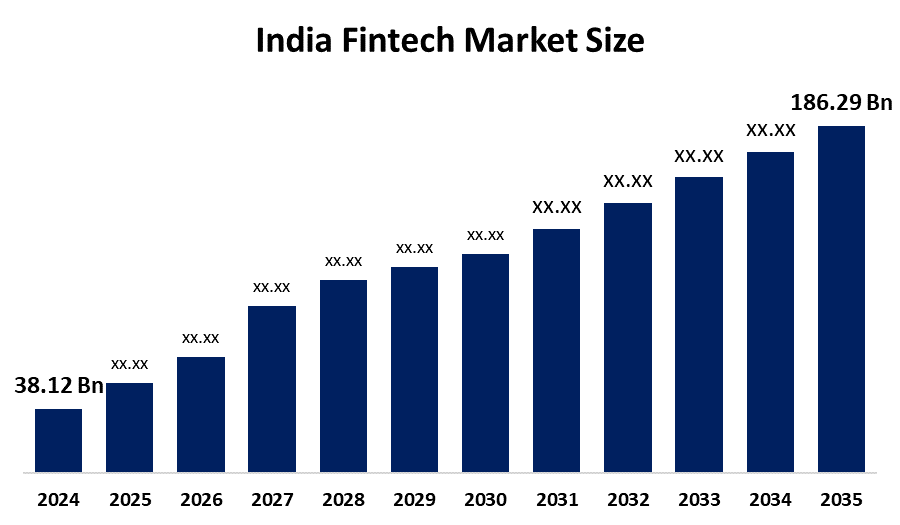

- India Fintech Market Size 2024: USD 38.12 Bn

- India Fintech Market Size 2035: USD 186.29 Bn

- India Fintech Market CAGR 2024: 15.52%

- India Fintech Market Segments: Service Proposition, End-User, User Interface

Get more details on this report -

The India Fintech Market Size refers to digital financial services that use technology to ensure quick and efficient financial transactions for payment, lending, investment, insurance, and banking services for retail and commercial purposes. The services can be largely adopted in digital payment systems, online lending platforms, wealth management solutions, insurance platforms, and neo-banking for serving individual clients and businesses for efficient financial transactions. India is one of the leaders globally in digital payment services with UPI transactions topping 10.5 billion and amounting to more than USD 19 trillion in 2025, while fintech exports added approximately USD 5.2 billion to the country’s IT export earnings.

Government initiatives such as Digital India, PMGDISHA’s financial literacy initiatives, and RBI’s Digital Lending guidelines have been positive for the fintech industry and helped digital payments become safe. Technology innovations include AI-powered credit rating, use of blockchain for cross-border payments, robo-advisory investment platforms, mobile-led banking, which has helped enhance the efficiency of operations. The future prospects for the Indian fintech industry look bright due to the rising awareness among Indians for digital education, embedded finance for e-commerce, financing for SMEs, growth in cross-border payments, and the use of AI for financial applications.

Market Dynamics of the India Fintech Market:

The Indian fintech sector is fueled by the increasing use of digital payments, digital lending, neobanking, and insurtech platforms. This is mainly fueled by increasing smartphone use and internet connectivity in India, along with a growing demand for faster and more reliable financial processes in the country. This has further been aided by support from RBI, SEBI, and government-backed initiatives such as development in UPI, digital lending guidelines, and development in fintech sandboxes. Development in AI and blockchain is also helping to improve efficiency.

The India fintech market faces restraints in terms of cybersecurity threats, regulatory issues in complying with regulations, credit risks offered by digital lenders, and low awareness among consumers in specific regions regarding financial literacy. This may further hamper adoption rates and enhance costs for fintech companies. Moreover, semi-urban and rural areas experience limitations in convergence of traditional banking systems with digital platforms.

The future outlook for fintech in India looks bright, with scopes developing in areas like embedded finance, international payments, wealth tech, as well as digital insurance. Technologies like AI-powered credit underwriting, robo-advisory, or mobile-centric investment platforms are to come up with smarter operations, improved accessibility, as well as customer engagement. Growth trends for digital loans, BNPL services, as well as collaboration with e-commerce and telecommunication industries, are going to work as catalysers for future growth.

Market Segmentation

The India Fintech Market share is classified into service proposition, end-user, and user interface.

By Service Proposition:

The India fintech market is divided by service proposition into digital payments, digital lending and financing, digital investments, insurtech, and neobanking. Among these, the digital payments segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is primarily due to the increasing use of UPI, digital wallets, and QR-based payments. It is helping to create a payment experience that is faster, secure, and convenient.

By End-User:

The India fintech market is divided by end-user into retail and businesses. Among these, the retail segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Growth is encouraged by the rising number of smartphone users, improved financial literacy, e-commerce penetration, as well as an affinity for online lending, insurance, and investment services.

By User Interface:

The India fintech market is divided by user interface into mobile applications, web/browser, and POS/IoT devices. Among these, the mobile applications segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The dominance is aided by increasing smartphone penetration, friendly app designs, notifications, digital banking, as well as AI-powered personalization capabilities.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India fintech market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Fintech Market:

- Paytm

- PhonePe Pvt Ltd

- Razorpay Software Pvt Ltd

- Pine Labs Pvt Ltd

- PayU Payments Pvt Ltd

- BharatPe

- MobiKwik

- PolicyBazaar

- Zerodha Broking Ltd

- Upstox

- Other

Recent Developments in India Fintech Market:

In March 2025, The RBI came out with unified Digital Lending Directions that regulated disclosures, introduced compulsory cooling-off periods, and heightened borrower protection for all digital lending platforms. This ensures better transparency, reduced mis-selling, increase in consumer trust, and directly supports the long-run stability and credibility of India's fintech lending ecosystem.

In February 2025, India and the UAE signed an agreement on interlinking real-time payment systems of the two countries that will facilitate UPI-based cross-border payments. The move further fortifies India's fintech export capability, boosts remittance flows, supports international merchant acceptance, positions UPI as a global digital payment standard, and accelerates fintech market expansion.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Inshights has segmented the India fintech market based on the below-mentioned segments:

India Fintech Market, By Service Proposition

- Digital Payments

- Digital Lending and Financing

- Digital Investments

- Insurtech

- Neobanking

India Fintech Market, By End-User

- Retail

- Businesses

India Fintech Market, By User Interface

- Mobile Applications

- Web / Browser

- POS / IoT Devices

Frequently Asked Questions (FAQ)

-

Q: What is the India fintech market size?A: India Fintech Market is expected to grow from USD 38.12 billion in 2024 to USD 186.29 billion by 2035, growing at a CAGR of 15.52% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rapid adoption of digital payments, expansion of UPI, increasing smartphone and internet penetration, rising demand for digital lending and neobanking services, government initiatives such as Digital India and RBI fintech guidelines, and growing use of AI, blockchain, and embedded finance across retail and business segments.

-

Q: What factors restrain the India fintech market?A: Constraints include cybersecurity risks, regulatory compliance challenges, credit risk in digital lending, low financial literacy in certain regions, integration issues between traditional banking and digital platforms, and limited digital infrastructure in semi-urban and rural areas.

-

Q: How is the market segmented by service proposition?A: The market is segmented into digital payments, digital lending and financing, digital investments, insurtech, and neobanking.

-

Q: How is the market segmented by end-user?A: The market is segmented into retail users and businesses.

-

Q: How is the market segmented by user interface?A: The market is segmented into mobile applications, web or browser platforms, and POS or IoT devices.

-

Q: Who are the key players in the India fintech market?A: Key companies include Paytm, PhonePe Pvt Ltd, Razorpay Software Pvt Ltd, Pine Labs Pvt Ltd, PayU Payments Pvt Ltd, BharatPe, MobiKwik, PolicyBazaar, Zerodha Broking Ltd, Upstox, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?