India Ethylene Vinyl Acetate EVA Market Size, Share, By Sales Channel (Direct Sale and Indirect Sale), By End-Use (Footwear, Packaging, Photovoltaic Cell, and Others), India Ethylene Vinyl Acetate EVA Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Ethylene Vinyl Acetate EVA Market Size Insights Forecasts to 2035

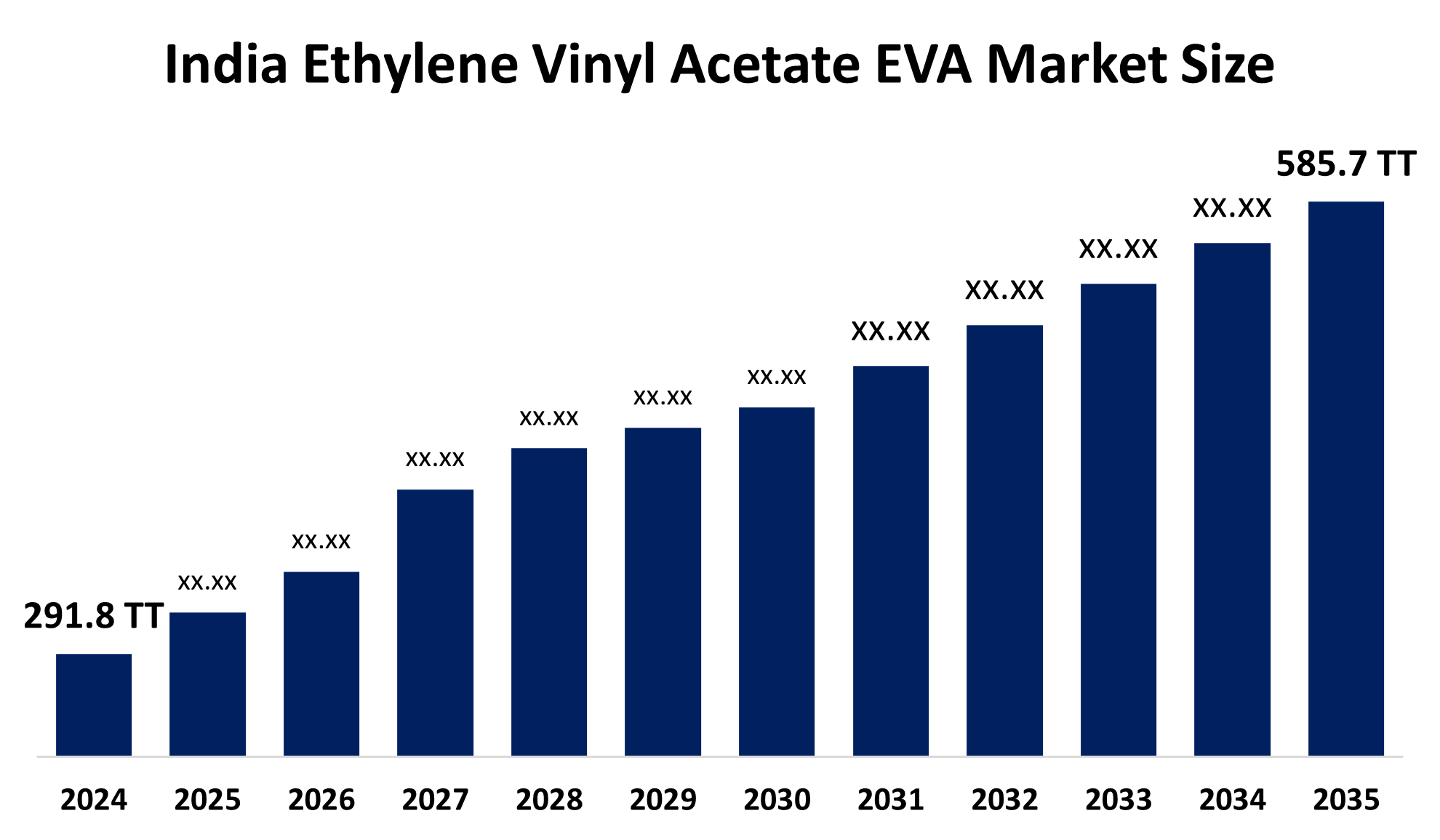

- India Ethylene Vinyl Acetate EVA Market Size 2024: 291.8 Thousand Tonnes

- India Ethylene Vinyl Acetate EVA Market Size 2035: 585.7 Thousand Tonnes

- India Ethylene Vinyl Acetate EVA Market CAGR 2024: 6.54%

- India Ethylene Vinyl Acetate EVA Market Segments: Sales Channel and End-Use

Get more details on this report -

The India Ethylene Vinyl Acetate EVA Market includes all activities which involve producing, importing, distributing and consuming ethylene vinyl acetate copolymer. This material finds applications in various industries, which include footwear production and packaging, solar photovoltaic modules, wire and cable manufacturing and adhesive applications. EVA functions as a primary material for footwear soles, solar panel encapsulation films, flexible packaging, hot-melt adhesives, foam products and wire and cable insulation because it possesses both flexible and durable and impact-resistant properties.

The EVA and LDPE Production Technology (2024) launch introduced Univision Technologies' new production technology system, which enables manufacturers to create both EVA and LDPE resins through improved production methods to achieve better resin operational performance.

The future of India's EVA market development shows strong potential because INDUSTRY growth occurs through three factors, which include rising solar PV installations, increasing footwear manufacturing, expanded flexible packaging production and government support for domestic petrochemicals development.

Market Dynamics of the India Ethylene Vinyl Acetate EVA Market:

The India Ethylene Vinyl Acetate EVA Market is driven by the solar photovoltaic sector needs encapsulation films, which leads to their rising demand, while footwear manufacturing expands, flexible packaging consumption increases and hot-melt adhesives, wire insulation and cable insulation markets grow, and government programs support domestic manufacturing and renewable energy expansion.

The India Ethylene Vinyl Acetate EVA Market is restrained by several challenges; it needs to rely on imports, while raw material prices and crude oil prices show unpredictable behavior and the company has limited ability to produce goods domestically. It faces price competition from alternative polymers, which include polyethylene and thermoplastic elastomers.

The future of India's ethylene vinyl acetate EVA market is bright and promising, with rising solar panel installations, expanding footwear manufacturing, growing packaging demand, and increasing domestic petrochemical investments reducing import dependence and strengthening supply chain resilience.

India Ethylene Vinyl Acetate EVA Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 291.8 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.54% |

| 2035 Value Projection: | 585.7 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Sales Channel, By End-Use |

| Companies covered:: | Reliance Industries Limited, Finolex Industries Limited, Supreme Petrochem Ltd., Haldia Petrochemicals Limited (HPL), Gujarat State Fertilizers & Chemicals (GSFC), and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The India ethylene vinyl acetate EVA market share is classified into sales channels and end-use.

By Sales Channel:

The India Ethylene Vinyl Acetate EVA Market is divided by sales channel type into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Due to bulk procurement by large industrial users through long-term contracts, ensuring stable pricing, consistent supply, and stronger manufacturer–buyer relationships.

By End-Use:

The India Ethylene Vinyl Acetate EVA Market is divided by end-use into footwear, packaging, photovoltaic cells, and others. Among these, the photovoltaic cell segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The photovoltaic cell segment is dominant owing to rising solar installations in India, increasing demand for EVA encapsulation films, and strong government support for renewable energy expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Ethylene Vinyl Acetate EVA Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Ethylene Vinyl Acetate EVA Market:

- Reliance Industries Limited

- Finolex Industries Limited

- Supreme Petrochem Ltd.

- Haldia Petrochemicals Limited (HPL)

- Gujarat State Fertilizers & Chemicals (GSFC)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Saudi Arabia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Ethylene Vinyl Acetate EVA Market based on the below-mentioned segments:

India Ethylene Vinyl Acetate EVA Market, By Sales Channel

- Direct Sale

- Indirect Sale

India Ethylene Vinyl Acetate EVA Market, By End-Use

- Footwear

- Packaging

- Photovoltaic Cell

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India ethylene vinyl acetate EVA market size?A: India ethylene vinyl acetate EVA market is expected to grow from 291.8 thousand tonnes in 2024 to 585.7 thousand tonnes by 2035, growing at a CAGR of 6.54% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the solar photovoltaic sector needs encapsulation films, which leads to their rising demand, while footwear manufacturing expands, flexible packaging consumption increases and hot-melt adhesives, wire insulation and cable insulation markets grow, and government programs support domestic manufacturing and renewable energy expansion.

-

Q: What factors restrain the India ethylene vinyl acetate EVA market?A: Constraints include several challenges; it needs to rely on imports, while raw material prices and crude oil prices show unpredictable behavior and the company has limited ability to produce goods domestically. It faces price competition from alternative polymers, which include polyethylene and thermoplastic elastomers.

-

Q: Who are the key players in the India ethylene vinyl acetate EVA market?A: Key companies include Reliance Industries Limited, Finolex Industries Limited, Supreme Petrochem Ltd., Haldia Petrochemicals Limited (HPL), Gujarat State Fertilizers & Chemicals (GSFC), and Others.

Need help to buy this report?