India Ethylene Oxide Market Size, Share, and COVID-19 Impact Analysis, By Derivative (Ethylene Glycols, Ethoxylates, Ethanolamines, and Other), By Application (Polyester Fiber and PET Resins, Surfactants and Detergents, and Other), and India Ethylene Oxide Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Ethylene Oxide Market Insights Forecasts to 2035

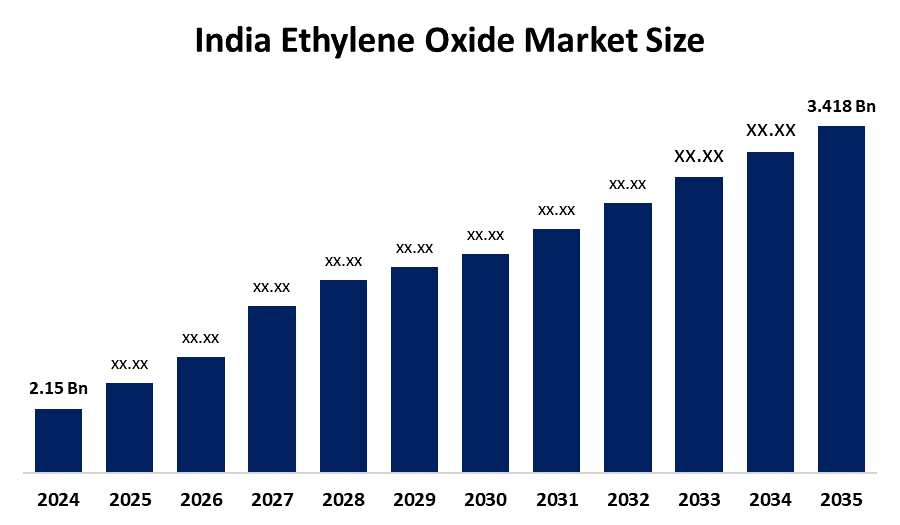

- The India Ethylene Oxide Market Size Was Estimated at USD 2.15 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.3% from 2025 to 2035

- The India Ethylene Oxide Market Size is Expected to Reach USD 3.418 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the India Ethylene Oxide Market Size is anticipated to reach USD 3.418 billion by 2035, growing at a CAGR of 4.3% from 2025 to 2035. India’s ethylene oxide market is driven by rising demand from pharmaceuticals, detergents, personal care products, and antifreeze, along with rapid growth in healthcare, textiles, and packaging industries, increasing urbanization, and expanding domestic manufacturing capacities across the country.

Market Overview

The India Ethylene Oxide Market Size refers to the production and use of ethylene oxide, a vital petrochemical intermediate mainly used to manufacture ethylene glycols, surfactants, ethanolamines, and glycol ethers. These derivatives are essential for pharmaceuticals, detergents, personal care products, textiles, packaging, and automotive antifreeze applications. Market growth is supported by rising population, rapid urbanization, and increasing consumer spending on hygiene, healthcare, and packaged goods. Strong growth in the polyester fiber and PET resin industries, driven by the textile and packaging sectors, significantly boosts demand for ethylene oxide. Additionally, expansion of domestic petrochemical capacities and backward integration with refineries are improving supply security and supporting steady market expansion across India.

Key trends in the India Ethylene Oxide Market Size include growing demand for value-added downstream products and a gradual shift toward specialty and high-performance surfactants. Increasing awareness of environmental sustainability is encouraging the development of low-toxicity and biodegradable formulations, especially in home and personal care products. Technological advancements focus on improved catalytic oxidation processes that increase conversion efficiency while reducing energy consumption and emissions. Manufacturers are also adopting advanced automation, digital process control, and real-time safety monitoring systems to manage operational risks associated with ethylene oxide handling. Integration of ethylene oxide plants with large petrochemical complexes is another key trend, enabling cost efficiency, stable raw material supply, and optimized production economics.

Government support plays an important role in shaping the market outlook. Initiatives such as Make in India, Production Linked Incentive (PLI) schemes, and the development of petroleum, chemicals, and petrochemicals investment regions (PCPIRs) are encouraging domestic manufacturing and capacity expansion. Supportive foreign direct investment policies, improved logistics infrastructure, and industrial corridor development are attracting global and domestic players. At the same time, stricter environmental and safety regulations are pushing companies to adopt cleaner technologies and international best practices. Collectively, these factors are expected to ensure sustained growth of India’s ethylene oxide market over the forecast period.

Report Coverage

This research report categorizes the market for the India Ethylene Oxide Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India ethylene oxide market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India ethylene oxide market.

India Ethylene Oxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.15 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.3% |

| 2035 Value Projection: | USD 3.418 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Derivative ,By Application |

| Companies covered:: | Reliance Industries Limited, Indian Oil Corporation Limited (IOCL), India Glycols Limited, HPCL-Mittal Energy Limited (HMEL), Bharat Petroleum Corporation Ltd (BPCL), BASF SE, SABIC, DowDuPont Inc., Indorama Ventures Public Company Limited, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India Ethylene Oxide Market Size is driven by rising demand from pharmaceuticals, detergents, and personal care products due to increasing population, urbanization, and hygiene awareness. Strong growth in the textile and packaging industries boosts the consumption of ethylene glycol for polyester and PET production. Expansion of the healthcare sector, automotive antifreeze demand, and FMCG manufacturing further support market growth. Additionally, increasing domestic petrochemical capacity, backward integration with refineries, and government initiatives promoting local chemical manufacturing enhance supply stability and encourage sustained market expansion across India.

Restraining Factors

The India Ethylene Oxide Market Size faces restraints from stringent environmental and safety regulations due to the hazardous and flammable nature of ethylene oxide. High capital investment and operating costs, strict handling requirements, and risks associated with storage and transportation limit new capacity additions. Volatility in crude oil and ethylene prices also affects production costs and profit margins.

Market Segmentation

The India Ethylene Oxide Market share is classified into derivative and application.

- The ethylene glycols segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Ethylene Oxide Market Size is segmented by derivative into ethylene glycols, ethoxylates, ethanolamines, and others. Among these, the ethylene glycols segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Ethylene glycols dominate the market because they are the primary raw material for manufacturing polyester fibres and PET resins, which are widely used in textiles, packaging, and bottled beverages. The rapid growth of India’s textile industry, increasing demand for flexible and rigid packaging, and rising consumption of packaged food and drinks significantly boost ethylene glycol demand. Additionally, its use in automotive antifreeze and industrial coolants further strengthens its market leadership.

- The polyester fiber and PET resins segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Ethylene Oxide Market Size is segmented by application into polyester fiber and PET resins, surfactants and detergents, and others. Among these, the polyester fiber and PET resins segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The polyester fiber and PET resins segment dominates the market due to its large-scale consumption in textiles, apparel, packaging, and beverage bottles. India’s expanding textile manufacturing base, rising exports, and increasing domestic demand for affordable synthetic fabrics significantly boost polyester fiber production. At the same time, growing consumption of packaged food, soft drinks, and bottled water drives PET resin demand, resulting in higher ethylene oxide utilization.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India Ethylene Oxide Market Size , along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Reliance Industries Limited

- Indian Oil Corporation Limited (IOCL)

- India Glycols Limited

- HPCL-Mittal Energy Limited (HMEL)

- Bharat Petroleum Corporation Ltd (BPCL)

- BASF SE

- SABIC

- DowDuPont Inc.

- Indorama Ventures Public Company Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Ethylene Oxide Market Size based on the below-mentioned segments:

India Ethylene Oxide Market, By Derivative

- Ethylene Glycols

- Ethoxylates

- Ethanolamines

- Other

India Ethylene Oxide Market, By Application

- Polyester Fiber and PET Resins

- Surfactants and Detergents

- Other

Frequently Asked Questions (FAQ)

-

1. What is ethylene oxide mainly used for in India?Ethylene oxide is mainly used to produce ethylene glycols, surfactants, ethanolamines, and glycol ethers for textiles, packaging, detergents, personal care, and pharmaceuticals.

-

2. Which derivative holds the largest share in the Indian market?Ethylene glycols hold the largest share due to their extensive use in polyester fiber, PET resins, antifreeze, and industrial coolants.

-

3. Which application segment dominates the market?The polyester fiber and PET resins segment dominates, supported by strong growth in textiles, packaging, and bottled beverage industries.

-

4. What are the key growth drivers of the market?Growth is driven by rising demand from textiles, FMCG, healthcare, detergents, and packaging, along with expanding domestic petrochemical capacities.

-

5. What are the major challenges faced by the market?Major challenges include strict safety and environmental regulations, high capital costs, and risks related to the storage and transportation of ethylene oxide.

Need help to buy this report?