India Ethylene Market Size, Share, By Additive (Ethylene Oxide, SB Rubber, Solvents, Polypropylene, Polyethylene, And Others), By End Use (Packaging, Textiles, Building & Construction, Automotive, And Agriculture & Agrochemicals), And India Ethylene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Ethylene Market Size Insights Forecasts to 2035

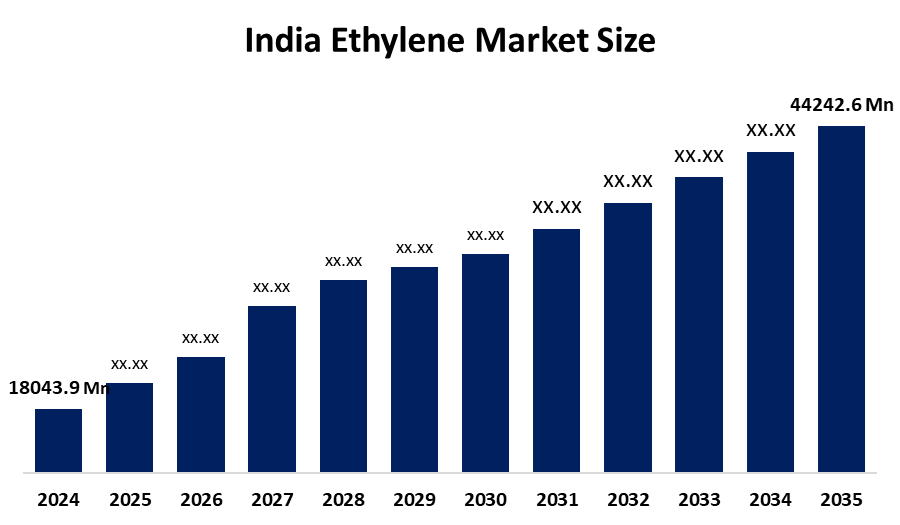

- India Ethylene Market 2024: USD 18043.9 Million

- India Ethylene Market Size 2035: USD 44242.6 Million

- India Ethylene Market CAGR 2024: 8.5%

- India Ethylene Market Segments: Additive and End Use

Get more details on this report -

The India ethylene market refers to the production, distribution, and consumption ecosystem surrounding ethylene, a foundational light olefin and one of the most important basic petrochemical intermediates used to manufacture polyethylene, ethylene oxide, ethyl benzene, and a host of polymers and chemicals that feed into packaging, consumer goods, construction materials, automotive parts, textiles, and agricultural films.

The ethylene in India are backed by government support, including the National Policy on Petrochemicals, which aims to foster long-term growth of the petrochemical sector, including ethylene production through incentives, ease of doing business reforms, and the establishment of Petroleum, Chemicals and Petrochemicals Investment Regions (PCPIRs) where integrated petrochemical and polymer manufacturing can flourish. India’s overall petrochemical industry was valued at approximately USD 220 billion in 2024 and is projected to approach USD 300 billion by 2025, underscoring robust growth and the strategic importance of key intermediates like ethylene within the broader chemicals sector.

As technology advances, India’s ethylene providers are now using production technologies and feedstock flexibility that enhance yield, efficiency, and environmental performance. Innovations such as advanced steam cracking and catalytic cracking technologies improve ethylene output and energy efficiency, while digitalization, automation, and real-time process optimization help lower operational costs and improve product consistency in modern ethylene crackers. Additionally, the shift toward gas-based feedstocks like ethane and propane often imported but supported by emerging infrastructure enables cleaner and more cost-competitive ethylene production compared to traditional naphtha routes.

Market Dynamics of the India Ethylene Market:

The India ethylene market is driven by the robust demand from packaging, rapid urbanization, the growth of e-commerce, expanding manufacturing sectors stimulate consumption of ethylene-based polymers, increased investments in new cracker capacities, strong government support, and integrated petrochemical complexes by major players enhance supply responsiveness to domestic and regional demand.

The India ethylene market is restrained by the highly sensitive to feedstock availability, crude oil price volatility, environmental and sustainability concerns, regulatory and operational challenges, stringent environmental standards, and the need for greener processes may require significant capital investment.

The future of India ethylene market is bright and promising, with versatile opportunities emerging from the expanding domestic production capacities and reducing import dependency for feedstocks and intermediate chemicals. There is potential to leverage gas-based crackers and emerging infrastructure to improve cost competitiveness and environmental performance. Opportunities also lie in tapping new end-use segments such as healthcare packaging, high-performance materials, and advanced construction composites, as well as aligning with export-oriented petrochemical zones to integrate India more deeply into global supply chains. Continued policy support, technological innovation, and strategic investments in sustainability could further unlock demand and strengthen India’s position in the global ethylene market.

India Ethylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18043.9 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 8.5% |

| 2035 Value Projection: | USD 44242.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Additive |

| Companies covered:: | Reliance Industries Limited, Indian Oil Corporation Limited, Haldia Petrochemicals Limited, GAIL (India) Ltd., SABIC, India Glycols Limited, BASF India Limited, Manali Petrochemicals Limited, The Dow Chemical Company, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India ethylene market share is classified into additive and end use.

By Additive:

The India ethylene market is divided by additive into ethylene oxide, SB rubber, solvents, polypropylene, polyethylene, and others. Among these,the polyethylene segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Massive demand from packaging, agriculture, and construction sector, rapid industrialization, urban expansion, increasing consumption of personal care, and packaged goods, and cost effectiveness all contribute to the polyethylene segment’s largest share and higher spending on ethylene segment when compared to other additives.

By End Use:

The India ethylene market is divided by end use into packaging, textiles, building & construction, automotive, agriculture & agrochemicals, and others. Among these, the packaging segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The packaging segment dominates because of rapid growth of the packaging industry, increasing demand for food & beverages, growth in e-commerce packaging, urbanization and rising disposable incomes, and low per capita consumption indicating sustainability.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India ethylene market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Ethylene Market:

- Reliance Industries Limited

- Indian Oil Corporation Limited

- Haldia Petrochemicals Limited

- GAIL (India) Ltd.

- SABIC

- India Glycols Limited

- BASF India Limited

- Manali Petrochemicals Limited

- The Dow Chemical Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India ethylene market based on the below-mentioned segments:

India Ethylene Market, By Additive

- Ethylene Oxide

- SB Rubber

- Solvents

- Polypropylene

- Polyethylene

- Others

India Ethylene Market, By End Use

- Packaging

- Textiles

- Building & Construction

- Automotive

- Agriculture & Agrochemicals

- Others

Frequently Asked Questions (FAQ)

-

What is the India ethylene market size?India ethylene market is expected to grow from USD 18043.9 million in 2024 to USD 44242.6 million by 2035, growing at a CAGR of 8.5% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the robust demand from packaging, rapid urbanization, the growth of e-commerce, expanding manufacturing sectors stimulate consumption of ethylene-based polymers, increased investments in new cracker capacities, strong government support, and integrated petrochemical complexes by major players enhance supply responsiveness to domestic and regional demand.

-

What factors restrain the India ethylene market?Constraints include the highly sensitive to feedstock availability, crude oil price volatility, environmental and sustainability concerns, regulatory and operational challenges, stringent environmental standards, and the need for greener processes may require significant capital investment

-

How is the market segmented by additive?The market is segmented into ethylene oxide, SB rubber, solvents, polypropylene, polyethylene, and others.

-

Who are the key players in the India ethylene market?Key companies include Reliance Industries Limited, Indian Oil Corporation Limited, Haldia Petrochemicals Limited, GAIL (India) Ltd., SABIC, India Glycols Limited, BASF India Limited, Manali Petrochemicals Limited, The Dow Chemical Company, and Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?