India Ethanol Market Size, Share, and COVID-19 Impact Analysis, By Type (Extra Neutral Ethanol (EN), Neutral Ethanol, Bioethanol, and Others), By Application (Fuel Blending, Alcoholic Beverages Production, Solvents and Chemical Intermediates, Disinfectants and Sanitizers, and Others), and India Ethanol Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Ethanol Market Insights Forecasts to 2035

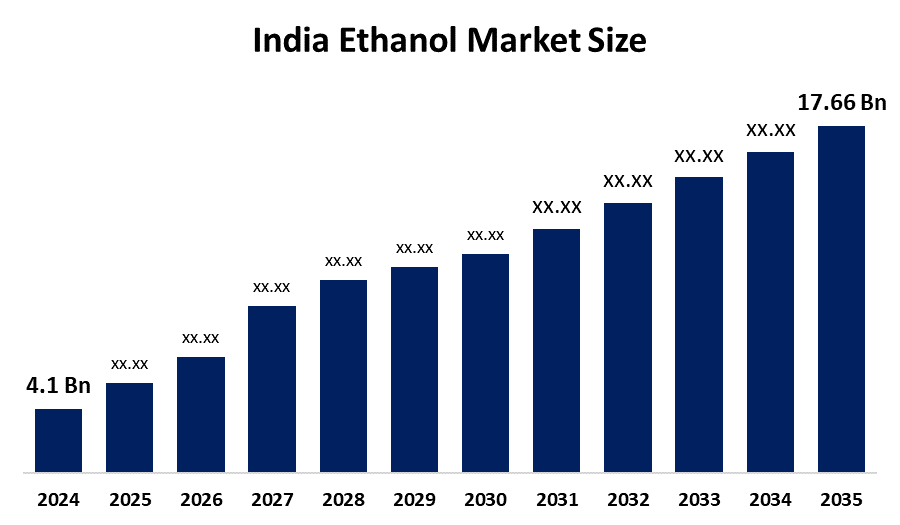

- The India Ethanol Market Size Was Estimated at USD 4.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 14.2% from 2025 to 2035

- The India Ethanol Market Size is Expected to Reach USD 17.66 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the India ethanol market size is anticipated to reach USD 17.66 billion by 2035, growing at a CAGR of 14.2 from 2025 to 2035. The India ethanol market is driven by government initiatives promoting biofuels, rising demand from the fuel and beverage industries, environmental regulations reducing carbon emissions, and increasing investment in ethanol production facilities to support sustainable energy and rural development.

Market Overview

The India ethanol market refers to the production, distribution, and consumption of ethanol, primarily derived from sugarcane, maize, and other biomass sources, for use in fuel, beverages, pharmaceuticals, and industrial applications. The market is experiencing significant growth due to increasing demand for renewable energy, rising fuel consumption, and the governments push for blending ethanol with petrol to reduce dependence on fossil fuels. Additionally, growing awareness of environmental sustainability and the need to curb greenhouse gas emissions are driving investments in ethanol production, making it a key component of India’s green energy initiatives.

Advancements in technology are revolutionizing India’s ethanol market. Second-generation ethanol production, using lignocellulosic biomass and advanced fermentation techniques are improving efficiency, yield, and cost-effectiveness. Enzyme-based hydrolysis and genetically engineered microbial strains further enhance production from non-food sources. The Indian government strongly supports this growth through policies such as the Ethanol Blended Petrol EBP program, subsidies for ethanol plants, and incentives for sugar mills to produce ethanol. These measures aim to achieve a 20 ethanol blending target by 2030, reduce crude oil imports, and promote sustainable rural economic development.

Several key trends are shaping the India ethanol market. First, the increasing adoption of ethanol-blended fuel is accelerating demand, as more states implement policies to blend petrol with 10 20 ethanol, reducing carbon emissions and dependence on crude oil. Second, expansion in production capacity is prominent, with sugar mills and private players investing in new ethanol plants and upgrading existing facilities to meet government blending mandates. Third, diversification of feedstock is gaining traction; manufacturers are exploring maize, wheat, and agricultural residues beyond sugarcane to ensure year-round production and reduce reliance on a single crop.

Report Coverage

This research report categorizes the market for the India ethanol market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India ethanol market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India ethanol market.

India Ethanol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.1 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 14.2% |

| 2035 Value Projection: | USD 17.66 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By Application |

| Companies covered:: | EID Parry India Ltd,Balrampur Chini Mills Ltd,Triveni Engineering Industries Ltd,Shree Renuka Sugars Ltd,Bajaj Hindusthan Sugar Ltd,Dalmia Bharat Sugar Industries Ltd,Dwarikesh Sugar Industries Ltd,Godavari Biorefineries Ltd And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India ethanol market is primarily driven by government initiatives promoting ethanol blending with petrol to reduce crude oil imports and carbon emissions. Rising fuel demand, coupled with increasing environmental awareness, encourages the adoption of renewable energy sources. Expansion of sugarcane cultivation and availability of alternative feedstocks like maize and lignocellulosic biomass support production growth. Technological advancements in fermentation and bio-refining enhance efficiency and cost-effectiveness. Additionally, incentives for sugar mills and private players, along with rising demand from the beverage and pharmaceutical industries, further propel the market’s rapid growth.

Restraining Factors

The India ethanol market faces restraints due to seasonal dependence on sugarcane, leading to supply fluctuations. High production costs, limited availability of advanced feedstocks, and infrastructure challenges in storage and transportation hinder scalability. Additionally, competition with food crops for raw materials and regulatory uncertainties can slow investment, affecting consistent ethanol supply and market growth in the country.

Market Segmentation

The India ethanol market share is classified into type and application.

- The bioethanol segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India ethanol market is segmented by type into extra neutral ethanol EN, neutral ethanol, bioethanol, and others. Among these, the bioethanol segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Bioethanol dominates the market because it is widely used for fuel blending under the government’s Ethanol Blended Petrol EBP program, aimed at reducing crude oil imports and lowering greenhouse gas emissions. Increasing fuel demand, coupled with strong policy support, encourages large-scale production from sugarcane and other feedstocks. Technological advancements in fermentation and bio-refining enhance efficiency and cost-effectiveness, while raising awareness of renewable energy benefits and environmental sustainability further drive adoption, making bioethanol the most preferred and rapidly expanding segment.

- The fuel blending segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India ethanol market is segmented by application into fuel blending, alcoholic beverages production, solvents and chemical intermediates, disinfectants and sanitizers, and others. Among these, the fuel blending segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The fuel blending segment dominates the market due to the government’s strong push for the Ethanol Blended Petrol EBP program, aiming to reduce crude oil imports and environmental pollution. Rising fuel consumption and increasing demand from the automotive sector further drive this growth. Additionally, incentives and subsidies for sugar mills and private players to produce ethanol for blending encourage large-scale production. These factors make fuel blending the primary and fastest-growing application, surpassing alcoholic beverages, solvents, disinfectants, and other uses.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations companies involved within the India ethanol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- EID Parry India Ltd.

- Balrampur Chini Mills Ltd.

- Triveni Engineering & Industries Ltd.

- Shree Renuka Sugars Ltd.

- Bajaj Hindusthan Sugar Ltd.

- Dalmia Bharat Sugar & Industries Ltd.

- Dwarikesh Sugar Industries Ltd.

- Godavari Biorefineries Ltd.

- Piccadily Agro Industries Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India ethanol market based on the below-mentioned segments:

India Ethanol Market, By Type

- Extra Neutral Ethanol EN

- Neutral Ethanol

- Bioethanol

- Others

India Ethanol Market, By Application

- Fuel Blending

- Alcoholic Beverages Production

- Solvents and Chemical Intermediates

- Disinfectants and Sanitizers

- Others

Frequently Asked Questions (FAQ)

-

1. What is the India ethanol market?The India ethanol market involves the production, distribution, and consumption of ethanol derived from sugarcane, maize, and other biomass for fuel blending, beverages, pharmaceuticals, and industrial applications.

-

2. What are the major applications of ethanol in India?Fuel blending, alcoholic beverages, solvents and chemical intermediates, disinfectants and sanitizers, and other industrial uses. Fuel blending is the dominant segment.

-

3. Which type of ethanol is most produced in India?Bioethanol is the dominant type, mainly used for fuel blending under the Ethanol Blended Petrol (EBP) program.

-

4. What drives the India ethanol market?Government initiatives, rising fuel demand, environmental sustainability goals, technological advancements, and incentives for sugar mills and private players.

-

5. What are the key challenges in the market?Seasonal dependence on sugarcane, high production costs, limited feedstock availability, infrastructure challenges, and competition with food crops.

Need help to buy this report?