India Electronic Chemicals Market Size, Share, By Form (Liquid Chemicals, Gaseous Chemicals, And Solid), By Sales Channel (Direct Sales And Indirect Sales), And India Electronic Chemicals Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Electronic Chemicals Market Insights Forecasts to 2035

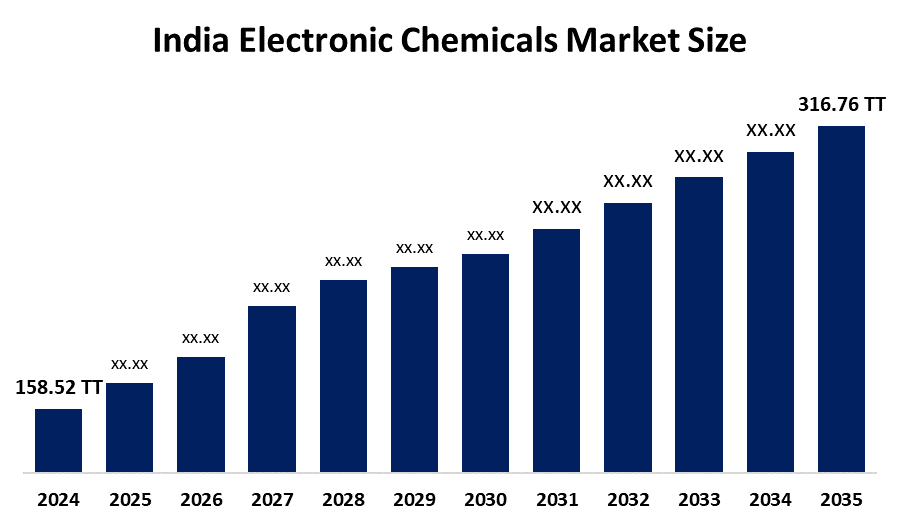

- India Electronic Chemicals Market Size 2024: 158.52 Thousand Tonnes

- India Electronic Chemicals Market Size 2035: 316.76 Thousand Tonnes

- India Electronic Chemicals Market CAGR 2024: 6.5%

- India Electronic Chemicals Market Segments: Form and Sales Channel

Get more details on this report -

The India Electronic Chemicals Market Size includes producing, supplying, and using high-purity specialty chemicals required for manufacturing semiconductors, printed circuit boards, display panels, LEDs, and other electronic devices. Example of these chemicals include photoresist, etching chemistries, cleaning solvent, doping agents and deposition precursors, all of which are critical during fabrication, assembly, testing and packaging when creating any electronic device.

The electronic chemicals in India are backed by government support, including the Production Linked Incentive (PLI) schemes and related electronics manufacturing policies that aim to incentivize domestic production of semiconductors, electronic components, and associated materials, including high-purity chemicals with significant approvals and investments in electronic component projects worth RS 418.63 billion across multiple Indian states, designed to strengthen local manufacturing capacity.

As technology advances, Indian electronic chemicals providers are now using semiconductor fabrication operations and ATMP facilities in India with increasing focus on the use of precision process chemicals, ultra-pure wet process chemicals, advanced photoresists, as well as next generation deposition and etching materials that enable processes that produce finer feature sizes in advanced devices. In addition, adoption of digital process control, analytics-based quality assurance and automated chemical dispensing systems help to ensure consistent and safe chemical use while also meeting strict purity standards.

India Electronic Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 158.52 Thousand Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.5% |

| 2035 Value Projection: | 316.76 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Form ,By Sales Channel |

| Companies covered:: | Navin Fluorine International Ltd., Deepak Fertilisers And Petrochemicals Corp Ltd., Gujarat Fluorochemicals Ltd., BASF India Ltd., Aether Industries Ltd., Neogen Chemicals Ltd., Fine Organic Industries Ltd., Anupam Rasayan India Ltd., SRF Ltd., Tatva Chintan Pharma Chem Ltd., Grauer & Weil (India) Ltd., Clean Science and Technology, Laxmi Organic Industries Ltd., and Other Key Players |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics of the India Electronic Chemicals Market:

The India Electronic Chemicals Market Size is driven by the rapid growth of India’s electronics manufacturing sector, strong consumer demand for smartphones, laptops, IoT devices, and automotive electronics, expansion of semiconductor fabrication, increased PCB and display production increased need for specialized electronic chemicals, strong government policies support, increasing domestic chemical suppliers to capture rising demand, and technological trends supporting deeper integration of electronic chemicals further propel the market growth.

The India Electronic Chemicals Market Size is restrained by the challenges related to environmental regulations, supply chain disruptions, volatile raw material prices, requirement of sophisticated production infrastructure, heavy compliance with rigorous quality standards, and consistent demand for advanced electronic chemicals emerging challenges.

The future of India Electronic Chemicals Market Size is bright and promising, with versatile opportunities emerging from the growing semiconductor ecosystem driven by government incentives and strategic investments provides a sustained long-term recurring demand for both process and specialty chemicals. The acceleration of advanced technologies, such as 5G, AI, and electric vehicles, will continue to drive the additional demand for high-tech electronic component parts, which require complex chemical inputs. India is focused on developing capacity to produce domestically high-purity chemicals, thereby creating opportunities to substitute imports, expand exports, and generate export growth opportunities for specialized domestic providers of high purity chemicals in the global supply chain.

Market Segmentation

The India Electronic Chemicals Market share is classified into form and sales channel.

By Form:

The India Electronic Chemicals Market Size is divided by form into liquid chemicals, gaseous chemicals, and solid. Among these, the liquid chemicals segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Essential cleaning agent, high volume use in semiconductor production, and ability to remove microscopic impurities during the water fabrication process all contribute to the liquid chemicals segment's largest share and higher spending on electronic chemicals when compared to other form.

By Sales Channel:

The India Electronic Chemicals Market Size is divided by sales channel into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The direct sales segment dominates because of need for high purity chemicals used in semiconductors manufacturing, requirement of high volume supply, favoring direct contact with consumers, and offers direct supply for manufacturing processes such as etching and cleaning.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Electronic Chemicals Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Electronic Chemicals Market:

- Navin Fluorine International Ltd.

- Deepak Fertilisers And Petrochemicals Corp Ltd.

- Gujarat Fluorochemicals Ltd.

- BASF India Ltd.

- Aether Industries Ltd.

- Neogen Chemicals Ltd.

- Fine Organic Industries Ltd.

- Anupam Rasayan India Ltd.

- SRF Ltd.

- Tatva Chintan Pharma Chem Ltd.

- Grauer & Weil (India) Ltd.

- Clean Science and Technology

- Laxmi Organic Industries Ltd.

- Others

Recent Developments in India Electronic Chemicals Market:

In January 2026, Continental Device India Private Limited announced expansion of its semiconductor manufacturing facility in Punjab with an investment of Rs117 crore for high power discrete semiconductor devices.

In August 2025, in partnership with Renesas Electronics and Stars Microelectronics, CG Power inaugurated a semiconductor OSAT pilot line in Sanand, Gujarat, with an investment of over Rs7600 crore.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Electronic Chemicals Market Size based on the below-mentioned segments:

India Electronic Chemicals Market, By Form

- Liquid Chemicals

- Gaseous Chemicals

- Solid

India Electronic Chemicals Market, By Sales Channel

- Direct Sales

- Indirect Sales

Frequently Asked Questions (FAQ)

-

Q: What is the India electronic chemicals market size?A: India electronic chemicals market is expected to grow from 158.52 thousand tonnes in 2024 to 316.76 thousand tonnes by 2035, growing at a CAGR of 6.5% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rapid growth of India’s electronics manufacturing sector, strong consumer demand for smartphones, laptops, IoT devices, and automotive electronics, expansion of semiconductor fabrication, increased PCB and display production increased need for specialized electronic chemicals, strong government policies support, increasing domestic chemical suppliers to capture rising demand, and technological trends supporting deeper integration of electronic chemicals further propel the market growth.

-

Q: What factors restrain the India electronic chemicals market?A: Constraints include the challenges related to environmental regulations, supply chain disruptions, volatile raw material prices, requirement of sophisticated production infrastructure, heavy compliance with rigorous quality standards, and consistent demand for advanced electronic chemicals emerging challenges.

-

Q: How is the market segmented by form?A: The market is segmented into liquid chemicals, gaseous chemicals, and solid.

-

Q: Who are the key players in the India electronic chemicals market?A: Key companies include Navin Fluorine International Ltd., Deepak Fertilisers And Petrochemicals Corp Ltd., Gujarat Fluorochemicals Ltd., BASF India Ltd., Aether Industries Ltd., Neogen Chemicals Ltd., Fine Organic Industries Ltd., Anupam Rasayan India Ltd., SRF Ltd., Tatva Chintan Pharma Chem Ltd., Grauer & Weil (India) Ltd., Clean Science and Technology, Laxmi Organic Industries Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?