India Drug Discovery Outsourcing Market Size, Share, and COVID-19 Impact Analysis, By Drug Type (Small Molecules and Large Molecules), By Workflow (Target Identification & Screening, Target Validation & Functional Informatics, Lead Identification & Candidate Optimization, Preclinical Development, and Others), By Therapeutics Area (Respiratory System, Pain & Anesthesia, Oncology, Ophthalmology, Hematology, Cardiovascular, Endocrine, Gastrointestinal, Immunomodulation, Anti-Infective, Central Nervous System, Dermatology, and Genitourinary System), By Service Type (Chemistry Service, and Biology Service), By End User (Pharmaceutical & Biotechnology Companies, Academic Institutes, and Others), and India Drug discovery outsourcing Market, Insight, Industry Trend, Forecasts to 2035

Industry: HealthcareIndia Drug Discovery Outsourcing Market Insights Forecasts to 2035

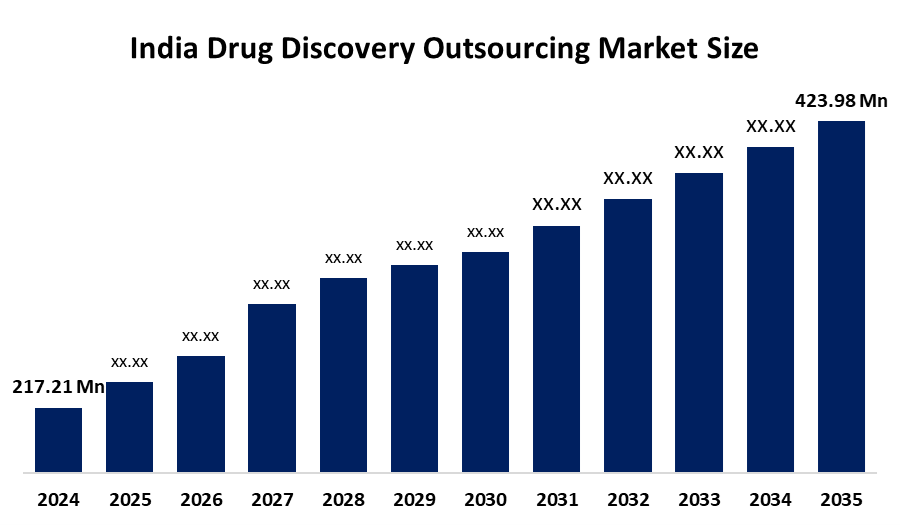

- India Drug Discovery Outsourcing Market Size 2024: USD 217.21 Million

- India Drug Discovery Outsourcing Market Size 2035: USD 423.98 Million

- India Drug Discovery Outsourcing Market CAGR: 6.27%

- India Drug Discovery Outsourcing Market Segments: Drug Type, Workflow, Therapeutics Area, Service Type, and End User

Get more details on this report -

Drug discovery outsourcing services are a term that denotes a strategy where pharmaceutical companies hire third-party partners to carry out different phases of the drug discovery and development process. Drug discovery outsourcing services act as a bridge in the process of turning laboratory drugs into clinical ones for biotechnology and pharmaceutical companies. The benefits are numerous, such as gaining access to a worldwide network of cGMP facilities that have high capacity and are staffed by highly qualified experts in multiple disciplines, thus enabling the smooth handover of projects through all stages of development.

Pharmaceutical and biotech companies choose to outsource drug discovery activities as a way of cutting down on development costs. Governments and public-private partnerships are actively supporting the pharmaceutical ecosystem through targeted policies and funding. For example, in India, various research and development (R&D) incentives, such as the Promotion of Research and Innovation in Pharma/MedTech and the Production-Linked Incentive (PLI) programs, not only support pharmaceutical R&D but also attract foreign direct investment (FDI) into the Contract Research Organization (CRO) and Contract Development and Manufacturing Organization (CDMO) sectors. Additionally, there is an effort to align regulations with global standards to facilitate clinical outsourcing, alongside the establishment of national research clusters and trial networks that aim to enhance the discovery infrastructure.

Indian CROs and CRDMOs are rapidly adapting to the cutting-edge technological changes by implementing the latest AI/ML, driven drug design and predictive modeling, high-throughput screening platforms, and integrated end-to-end service models that cover from target identification to regulatory support, thus helping to achieve faster timelines and successful candidate selection. Besides that, Indian players are globally collaborating with multinational pharma for discovery and clinical work, while their investment in state, of, the, art infrastructure and quality compliance is also generating trust and increasing international demand, thus placing India as an attractive location for drug discovery outsourcing and innovation.

Market Dynamics of the India Drug Discovery Outsourcing Market:

The continuous research and development programs, together with the implementation of AI, powered drug discovery techniques, are driving the acquisition of the market. Market growth is supported by the deeper penetration of innovation, the lowering of costs, and the pharmaceutical companies' collaboration for the research part. Drug discovery is becoming simpler with the help of AI in protein modeling, digital organ simulation, and organ, on, a, chip. India is gradually turning into a pharmaceutical revolution hub with large-scale drug production and extensive research and development programs. AI, based drug discovery is expected to trigger capital investment in overseas locations to increase their production and research workforce.

Major limitations for the drug discovery outsourcing market include governmental limitations, increasing outsourcing costs, and tariffs that hinder market growth. The rapidly growing area of traditional medicine and the scarce medical budgets are only going to put the brakes on the market expansion.

Advancements in computational chemistry, structure-based design, and combinatorial screening have further strengthened their position in early discovery pipelines. Outsourcing partners provide specialized services, including lead optimization, ADME studies, and toxicity profiling, which are critical for small molecule development. The strong regulatory familiarity and robust commercial potential of small molecules have reinforced their dominance, ensuring continued investment and reliance on outsourcing models within this category.

India Drug Discovery Outsourcing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 217.21 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.27% |

| 2035 Value Projection: | USD 423.98 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Drug Type |

| Companies covered:: | Clininvent Research Pvt. Ltd., GVK BIO Informatics, GVK Biosciences, Jubilant Biosys, Lambda Therapeutic Research, ProRelix Research, Sai Life Sciences, Syngene International Ltd., TherDose Pharma Pvt. Ltd., Veeda Clinical Research, , and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India drug discovery outsourcing market share is classified into drug type, workflow, therapeutics area, service type, and end user.

By Drug Type:

The India drug discovery outsourcing market is divided by drug type into small molecules and large molecules. Among these, the small molecules segment controlled the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The small molecules segment dominated due to mature chemistry expertise, lower discovery costs, faster timelines, and strong generic-to-innovator capabilities in India, while large molecules are set to grow faster, driven by rising biologics demand, biosimilars, and expanding biologics-focused CRO infrastructure.

By Workflow:

The India drug discovery outsourcing market is divided by workflow into target identification & screening, target validation & functional informatics, lead identification & candidate optimization, preclinical development, and others. Among these, the lead identification & candidate optimization segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment dominance is driven by the most outsourced, value-intensive phase requiring strong medicinal chemistry, biology, and cost efficiency areas where Indian CROs excel, while its complexity and AI-driven optimization need support for strong forecast-period growth.

By Therapeutics Area:

The India drug discovery outsourcing market is divided by therapeutics area into respiratory system, pain & anesthesia, oncology, ophthalmology, hematology, cardiovascular, endocrine, gastrointestinal, immunomodulation, anti-infective, central nervous system, dermatology, and genitourinary system. Among these, the oncology segment accounted for the highest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This growth is supported by its high disease burden in India, strong global funding for cancer R&D, complex biology requiring extensive outsourcing, and growing focus on targeted therapies, biologics, and precision medicine that drive sustained demand.

By Service Type:

The India drug discovery outsourcing market is divided by service type into chemistry service and biology service. Among these, the chemistry services segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Chemistry services are led due to India’s strong medicinal chemistry expertise, large-scale synthesis capability, and cost advantage, while biology services are growing faster as demand rises for complex assays, biologics research, and target validation.

By End User:

The India drug discovery outsourcing market is divided by end user into pharmaceutical & biotechnology companies, academic institutes, and others. Among these, the pharmaceutical & biotechnology companies segment accounted for the highest market share in 2024 and is anticipated to grow at a notable CAGR over the forecast period. Pharmaceutical & biotech firms segment lead because they are the primary drivers of outsourced discovery work seeking cost efficiencies, access to specialized expertise, and accelerated timelines while increasing global collaborations and expanding pipelines support strong future growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India drug discovery outsourcing market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Drug Discovery Outsourcing Market:

- Clininvent Research Pvt. Ltd.

- GVK BIO Informatics

- GVK Biosciences

- Jubilant Biosys

- Lambda Therapeutic Research

- ProRelix Research

- Sai Life Sciences

- Syngene International Ltd.

- TherDose Pharma Pvt. Ltd.

- Veeda Clinical Research

- Others

Recent Developments in India Drug Discovery Outsourcing Market:

In July 2025, The Indian Council for Medical Research established the ICMR Network for Phase 1 Clinical Trials. This document describes the need to establish the Network and elaborates on its vision, governance, and operational aspects.

In February 2025, A strong foundation in small-molecule capabilities, emerging expertise in biologics, and cost advantages that are viewed as sustainable are the highlights of a new report that suggests the contract research, development, and manufacturing organization (CRDMO) sector in India has the potential to grow to between $22 billion and $25 billion by the year 2035.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India drug discovery outsourcing market based on the below-mentioned segments:

India Drug Discovery Outsourcing Market, By Drug Type

- Small Molecules

- Large Molecules

India Drug Discovery Outsourcing Market, By Workflow

- Target Identification & Screening

- Target Validation & Functional Informatics

- Lead Identification & Candidate Optimization

- Preclinical Development

- Others

India Drug Discovery Outsourcing Market, By Therapeutic Area

- Respiratory System

- Pain & Anesthesia

- Oncology

- Ophthalmology

- Hematology

- Cardiovascular Endocrine

- Gastrointestinal

- Immunomodulation

- Anti-Infective

- Central Nervous System

- Dermatology

- Genitourinary System

India Drug Discovery Outsourcing Market, By Service Type

- Chemistry Service

- Biology Service

India Drug Discovery Outsourcing Market, By End User

- Pharmaceutical & Biotechnology Companies

- Academic Institutes

- Others

Frequently Asked Questions (FAQ)

-

What is the India Drug Discovery Outsourcing Market size in 2024?The India drug discovery outsourcing market was valued at USD 217.21 million in 2024.

-

How fast is the India Drug Discovery Outsourcing Market expected to grow?The market is projected to grow at a CAGR of 6.27% from 2025 to 2035, reaching USD 423.98 million by 2035.

-

What factors are driving the growth of the India drug discovery outsourcing market?Key growth drivers include rising pharmaceutical R&D outsourcing, cost efficiency, strong chemistry and biology expertise, adoption of AI-driven drug discovery, supportive government policies, and increasing global collaborations.

-

Which drug type dominates the India drug discovery outsourcing market?The small molecules segment dominated the market in 2024 due to mature medicinal chemistry capabilities, faster development timelines, and lower costs, while large molecules are expected to grow rapidly.

-

Which workflow segment held the largest market share in 2024?The lead identification & candidate optimization segment accounted for the highest market share in 2024, driven by its value-intensive nature and India’s strength in medicinal chemistry and AI-based optimization.

-

Which therapeutic area leads the India drug discovery outsourcing market?Oncology held the largest market share in 2024 and is expected to grow at a strong CAGR due to high disease prevalence, global R&D funding, and increasing focus on precision medicine.

-

Which service type dominates the market?The chemistry services segment led the market in 2024, owing to India’s strong synthesis capabilities, regulatory familiarity, and cost advantages, while biology services are witnessing faster growth

Need help to buy this report?