India Diisopropyl Ether Market Size, Share, By End Use Pharmaceuticals, Petrochemicals, Paints, Coatings, & Adhesives, Agrochemical, And Others), By Sales Channel (Direct Sales And Indirect Sales), And India Diisopropyl Ether Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsIndia Diisopropyl Ether Market Insights Forecasts to 2035

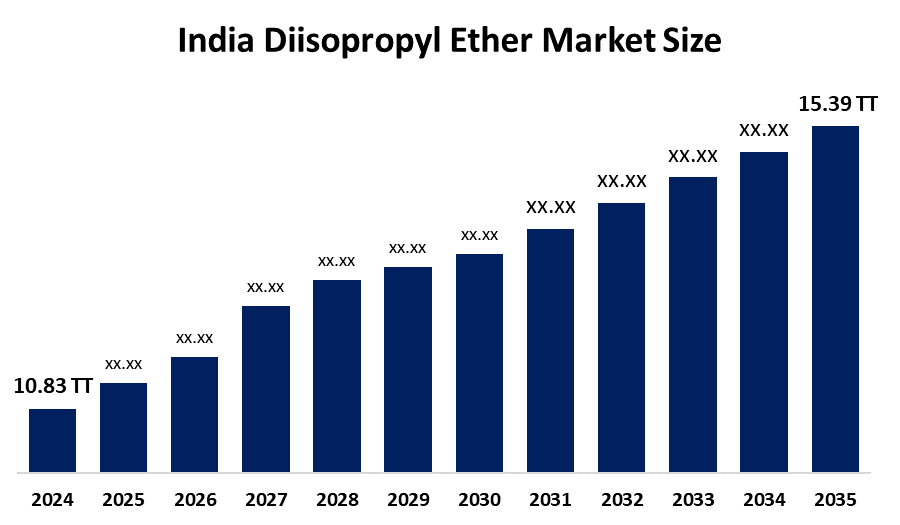

- India Diisopropyl Ether Market 2024: 10.83 Thousand Tonnes

- India Diisopropyl Ether Market Size 2035: 15.39 Thousand Tonnes

- India Diisopropyl Ether Market CAGR 2024: 3.25%

- India Diisopropyl Ether Market Segments: End Use and Sales Channel

Get more details on this report -

The India diisopropyl ether (DIPE) market encompasses the whole business environment that surrounds the manufacture, importation, delivery, and use of diisopropyl ether, a colourless and secondary ether solvent, commonly used across industries as a reaction medium and as a solvent for extractions as well as an oxygenating agent for fuels. It is used in many different industries such as pharmaceuticals, agrochemicals, and paints & coatings, as well as being used as an additive to increase the combustion efficiency of fuels.

The diisopropyl ether in India are backed by government support, including the Petroleum, Chemicals and Petrochemicals Investment Regions (PCPIRs) under the Make in India program, designed to create integrated, environmentally sustainable industrial hubs to attract investment in chemical production and related activities, India’s chemical sector contributes around 1.4% to national GDP and nearly 9% to the gross value added of the economy, while India ranks as the sixth-largest chemical producer globally, underscoring the market’s foundational importance.

As technology advances, India’s diisopropyl ether providers are now focused toward more efficient, sustainable and pure production methods. Through developments like AI-based process control for optimized catalytic hydration of propylene, exploration of methanol-free synthetic routes, and the adoption of digitalized supply chain management and real-time quality control systems, companies are increasing their levels of production with reduced energy use and environmental impact. The result is lower operational costs and more consistent product specifications, creating higher competition.

India Diisopropyl Ether Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 10.83 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.25% |

| 2035 Value Projection: | 15.39 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 165 |

| Segments covered: | By End Use, By Sales Channel |

| Companies covered:: | Prasol Chemicals Pvt Ltd., Kairav Chemofarbe Industries Ltd., Manas Petro Chem, Arpana Industries, Meru Chem Pvt. Ltd., Multichem Specialties Pvt Ltd., Triveni Chemicals, Antares Chem Pvt Ltd., Leo Chemo Plast Pvt Ltd., A B Enterprises, Sanjay Chemicals India Pvt Ltd and other |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Diisopropyl Ether Market:

The India diisopropyl ether market is driven by the expanding pharmaceutical sector, improved combustion efficiency and reduce emissions, rising industrialization, increasing demand for high-performance coatings, adhesives, and specialty chemical applications, investments in R&D to develop greener synthesis pathways, eco-friendly solvent system, and strong government support further propel the growth.

The India diisopropyl ether market is restrained by the reliance on imports for DIPE supply, global supply chain disruptions, freight cost volatility, feedstock price fluctuations, stringent environmental and safety regulations, and solvent emissions may add compliance costs issues.

The future of India diisopropyl ether market is bright and promising, with versatile opportunities emerging from the domestic production and reduce their reliance on foreign suppliers, the development of an import substitution policy combined with value chain development is a way for many to capture the maximum value from a project within their own country. Continued growth in demand for end products derived from DIPE, especially eco-friendly solvents, more sustainable fuel blends, and higher-purity products for the advanced pharmaceutical and electronics industries are providing many opportunities for increased investment in this sector and will strengthen India's position as an important player within the regional supply network for diisopropyl ether.

Market Segmentation

The India Diisopropyl Ether Market share is classified into end use and sales channel.

By End Use:

The India diisopropyl ether market is divided by end use into pharmaceuticals, petrochemicals, paints, coatings, and adhesives, agrochemicals, and others. Among these, the pharmaceuticals segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Critical role as a high-purity extraction and reaction solvent in API, demand for cost-efficient solvents, growing chronic disease, and increased production of medicine supplies all contribute to the pharmaceuticals segment’s largest share and higher spending on diisopropyl ether segment when compared to other end use.

By Sales Channel:

The India diisopropyl ether market is divided by sales channel into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The direct sales segment dominates because of continuous bulk requirements of the pharmaceutical sector require long term supply contracts, ensure supply security and better pricing, and favouring direct business-to-business channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India diisopropyl ether market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Diisopropyl Ether Market t:

- Prasol Chemicals Pvt Ltd.

- Kairav Chemofarbe Industries Ltd.

- Manas Petro Chem

- Arpana Industries

- Meru Chem Pvt. Ltd.

- Multichem Specialties Pvt Ltd.

- Triveni Chemicals

- Antares Chem Pvt Ltd.

- Leo Chemo Plast Pvt Ltd.

- A B Enterprises

- Sanjay Chemicals India Pvt Ltd

- Others

Recent Developments in India Diisopropyl Ether Market:

In September 2025, Reliance Industries Limited announced major capacity expansion projects to cater to the growing domestic demand for specialty chemicals, which drives the demand for intermediates like diisopropyl ether used in solvent extraction.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India diisopropyl ether market based on the below-mentioned segments:

India Diisopropyl Ether Market, By End Use

- Pharmaceuticals

- Petrochemicals

- Paints, Coatings, & Adhesives

- Agrochemicals

- Others

India Diisopropyl Ether Market, By Sales Channel

- Direct Sales

- Indirect Salest lo

Frequently Asked Questions (FAQ)

-

Q: What is the India diisopropyl ether market size?A: India diisopropyl ether market is expected to grow from 10.83 thousand tonnes in 2024 to 15.39 thousand tonnes by 2035, growing at a CAGR of 3.25% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the expanding pharmaceutical sector, improved combustion efficiency and reduce emissions, rising industrialization, increasing demand for high-performance coatings, adhesives, and specialty chemical applications, investments in R&D to develop greener synthesis pathways, eco-friendly solvent system, and strong government support further propel the growth.

-

Q: What factors restrain the India diisopropyl ether market?A: Constraints include the reliance on imports for DIPE supply, global supply chain disruptions, freight cost volatility, feedstock price fluctuations, stringent environmental and safety regulations, and solvent emissions may add compliance costs issues.

-

Q: How is the market segmented by end use?A: The market is segmented into pharmaceuticals, petrochemicals, paints, coatings, and adhesives, agrochemicals, and others.

-

Q: Who are the key players in the India diisopropyl ether market?A: Key companies include Prasol Chemicals Pvt Ltd., Kairav Chemofarbe Industries Ltd., Manas Petro Chem, Arpana Industries, Meru Chem Pvt. Ltd., Multichem Specialties Pvt Ltd., Triveni Chemicals, Antares Chem Pvt Ltd., Leo Chemo Plast Pvt Ltd., A B Enterprises, Sanjay Chemicals India Pvt Ltd, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?