India Cyclopentane Market Size, Share, and COVID-19 Impact Analysis, By Function (Blowing Agent and Refrigerant, Solvent and Reagent, Other Functions, and Other), By Application (Refrigeration, Insulation, and Other), By End-Use Industry (Household Appliances, Construction, and Other), and India Cyclopentane Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Cyclopentane Market Insights Forecasts to 2035

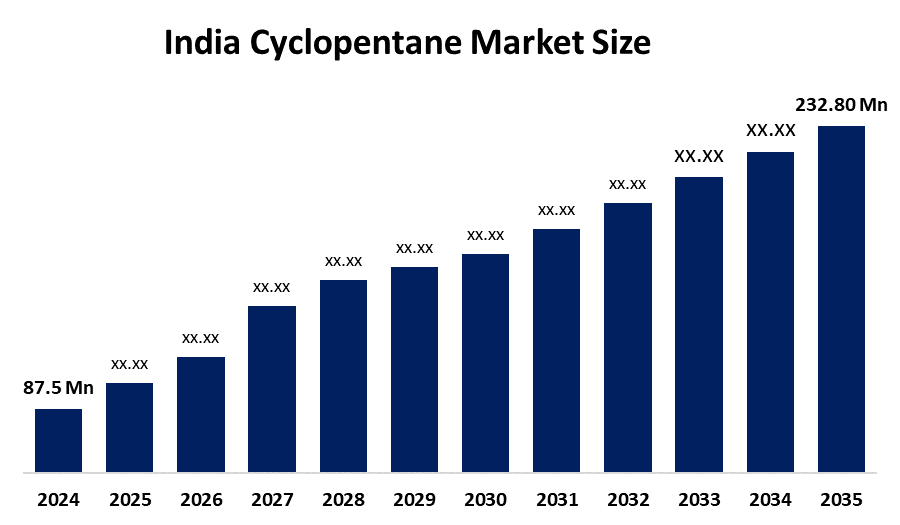

- The India Cyclopentane Market Size Was Estimated at USD 87.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.3% from 2025 to 2035

- The India Cyclopentane Market Size is Expected to Reach USD 232.80 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the India Cyclopentane Market Size size is anticipated to reach USD 232.80 million by 2035, growing at a CAGR of 9.3% from 2025 to 2035. The India cyclopentane market is driven by rising demand for eco-friendly blowing agents in refrigeration and insulation, growth in construction and cold chain industries, increasing adoption in polyurethane foam production, and stringent regulations restricting harmful HCFCs and CFCs.

Market Overview

Cyclopentane is a hydrocarbon compound widely used as a blowing agent in the production of polyurethane (PU) foams for refrigeration, insulation, and construction applications. It is considered an eco-friendly alternative to traditional chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs), as it has negligible ozone depletion potential (ODP) and low global warming potential (GWP). The India Cyclopentane Market Size is witnessing significant growth due to the expansion of the cold chain and refrigeration sectors, increasing demand for energy-efficient insulation solutions in residential and commercial buildings, and stricter environmental regulations encouraging the replacement of harmful blowing agents with sustainable options. Additionally, the growing automotive and packaging industries in India are boosting the adoption of PU foams, further driving cyclopentane consumption.

One major trend is the shift toward eco-friendly and energy-efficient building materials, which increases cyclopentane usage in insulation. Second, the growth of cold storage and refrigerated transport is driving higher demand in the cold chain industry. Third, manufacturers are focusing on developing high-purity cyclopentane for improved foam quality and reduced emissions. Fourth, collaborations between chemical suppliers and foam producers are becoming common to optimize the use of cyclopentane and enhance production efficiency. These trends indicate a strong market inclination toward sustainability, operational efficiency, and regulatory compliance, which are shaping the competitive landscape.

Technological advancements in cyclopentane production include improved catalytic processes and distillation methods that enhance purity, yield, and safety. New closed-loop systems are being implemented to minimize solvent losses and environmental impact. Additionally, innovations in PU foam manufacturing, such as precise temperature and pressure controls, allow better foam density and insulation properties while reducing cyclopentane consumption. Emerging research also focuses on blending cyclopentane with other low-GWP agents to achieve superior performance, energy efficiency, and compliance with global environmental standards, strengthening India’s position in the sustainable chemicals market.

Report Coverage

This research report categorizes the market for the India Cyclopentane Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India cyclopentane market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India cyclopentane market.

India Cyclopentane Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 87.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 9.3% |

| 2035 Value Projection: | USD 232.80 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Function ,By Application |

| Companies covered:: | Haldia Petrochemicals Ltd., Chevron Phillips Chemical Company LLC, LG Chem Ltd., HCS Group GmbH, INEOS Group Limited, Maruzen Petrochemical Co. Ltd., Yeochun NCC Co. Ltd., South Hampton Resources, Inc., Honeywell International, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India Cyclopentane Market Size is primarily driven by the rising demand for eco-friendly and energy-efficient insulation solutions in residential, commercial, and industrial sectors. Expansion of the cold chain and refrigeration industry, coupled with the growing automotive and packaging sectors, is boosting cyclopentane consumption. Strict environmental regulations restricting harmful HCFCs and CFCs are accelerating the shift toward sustainable blowing agents. Additionally, increasing awareness about low-global-warming-potential (GWP) alternatives and the focus on high-performance polyurethane foams for superior thermal insulation are further propelling market growth in India.

Restraining Factors

The India Cyclopentane Market Size faces restraints due to its flammable nature, which requires strict safety measures during storage, handling, and transportation. High production and purification costs also limit widespread adoption, especially for small-scale manufacturers. Additionally, competition from alternative blowing agents and fluctuating raw material prices can hinder market growth, making large-scale implementation challenging for some industries.

Market Segmentation

The India Cyclopentane Market share is classified into function, application, and end-use industry.

- The blowing agent and refrigerant segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Cyclopentane Market Size is segmented by function into blowing agent and refrigerant, solvent and reagent, other functions, and others. Among these, the blowing agent and refrigerant segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of the blowing agent and refrigerant segment in the market is driven by the increasing demand for energy-efficient insulation in refrigeration, cold storage, and construction industries. Cyclopentane’s low global warming potential (GWP) and negligible ozone depletion make it a preferred alternative to HCFCs and CFCs. Additionally, the rapid growth of the cold chain, automotive, and packaging sectors, along with stricter environmental regulations, has further boosted its adoption in polyurethane foam production, reinforcing its leading market position.

- The refrigeration segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Cyclopentane Market Size is segmented by application into refrigeration, insulation, and other. Among these, the refrigeration segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The refrigeration segment dominates the market due to the rapid expansion of the cold chain, commercial refrigeration, and domestic appliance sectors. Cyclopentane’s use as a blowing agent in polyurethane foams provides superior thermal insulation, enhancing energy efficiency and reducing operational costs. Environmental regulations restricting HCFCs and CFCs further encourage their adoption. Additionally, rising consumer demand for energy-efficient refrigerators and freezers, along with growth in the food storage and logistics industries, has strengthened the refrigeration segment’s leading position in the market.

- The household appliances segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Cyclopentane Market Size is segmented by end-use industry into household appliances, construction, and other. Among these, the household appliances segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The household appliances segment dominates the market due to the surging demand for energy-efficient refrigerators, freezers, and air conditioners. Cyclopentane’s eco-friendly properties, low global warming potential, and excellent insulation performance make it ideal for polyurethane foams used in these appliances. Rapid urbanization, rising disposable incomes, and growing awareness of sustainable products have further accelerated adoption. Additionally, the expansion of the domestic appliance industry and stringent environmental regulations phasing out HCFCs and CFCs have reinforced the segment’s leading position.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India Cyclopentane Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Haldia Petrochemicals Ltd.

- Chevron Phillips Chemical Company LLC

- LG Chem Ltd.

- HCS Group GmbH

- INEOS Group Limited

- Maruzen Petrochemical Co. Ltd.

- Yeochun NCC Co. Ltd.

- South Hampton Resources, Inc.

- Honeywell International

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Cyclopentane Market Size based on the below-mentioned segments:

India Cyclopentane Market, By Function

- Blowing Agent and Refrigerant

- Solvent and Reagent

- Other Functions

- Other

India Cyclopentane Market, By Application

- Refrigeration

- Insulation

- Other

India Cyclopentane Market, By End-Use Industry

- Household Appliances

- Construction

- Other

Frequently Asked Questions (FAQ)

-

1. What is the market size of India cyclopentane?The India cyclopentane market has been growing steadily, driven by demand in refrigeration, insulation, and household appliances sectors. Its market size is expanding due to the adoption of eco-friendly blowing agents and increased industrial applications.

-

2. What are the main applications of cyclopentane in India?Cyclopentane is primarily used as a blowing agent in polyurethane foams for refrigeration and insulation, as well as in household appliances and certain chemical processes.

-

3. Which end-use industry dominates the cyclopentane market in India?The household appliances sector dominates, particularly for refrigerators and freezers, due to high demand for energy-efficient and environmentally friendly products.

-

4. What are the key driving factors of the India cyclopentane market?The market is driven by environmental regulations restricting HCFCs/CFCs, growth in cold chain infrastructure, rising demand for energy-efficient insulation, and increased adoption in household appliances.

Need help to buy this report?