India Crude Acrylic Acid Market Size, Share, By End Use (Acrylate Ester, Super Absorbent Polymer, Water Treatment, Detergent, Paper, And Others), By Sales Channel (Direct Sales And Indirect Sales), And India Crude Acrylic Acid Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Crude Acrylic Acid Market Size Insights Forecasts To 2035

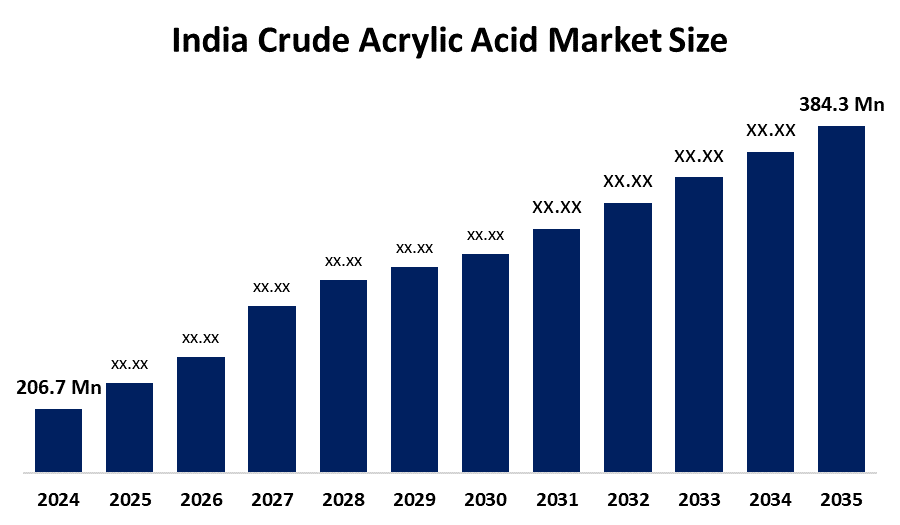

- India Crude Acrylic Acid Market Size 2024: 206.7 Thousand Tonnes

- India Crude Acrylic Acid Market Size 2035: 384.3 Thousand Tonnes

- India Crude Acrylic Acid Market Size CAGR 2024: 5.8%

- India Crude Acrylic Acid Market Size Segments: End Use and Sales Channel

Get more details on this report -

The India crude acrylic acid market size encompasses the production, sale, use, and distribution of crude acrylic acid, which is a critical intermediate petrochemical, takes place and that there are many industries that use and rely on crude acrylic acid for making polyacrylate products as polyacrylates are the main source of superabsorbent polymer, coating materials, adhesive material, sealants, rheological modifiers and specialty chemistry as well as being used to create finished products in many industries, some of which include textiles, paint and coatings, building and construction, automotive, and hygiene product manufacturing industry.

The crude acrylic acid in India are backed by government support, including the Make in India campaign, which aims to boost domestic manufacturing and improve production capacity for intermediate chemicals like acrylic acid. This initiative has helped attract investments in chemical processing and polymer sectors, which in turn stimulates demand for acrylic acid and its derivatives. Additionally, India’s infrastructure and urban development programs such as Smart Cities Mission and Pradhan Mantri Awas Yojana contribute to market expansion by driving demand for construction materials that use acrylic-based coatings and sealants.

As technology advances, India’s crude acrylic acid providers are now using innovation in production and product development will improve efficiency, sustainability and performance. The developments include bio-based acrylic acid production through fermentation, bio-refining technologies which will end reliance on traditional petrochemical raw materials, reduce production costs, and help achieve environmental sustainability targets. These technologies improve the competiveness of products as well as enable the development of eco-friendly uses biodegradable polymers, environmentally-friendly water treatment chemicals, and more.

India Crude Acrylic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 206.7 |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 5.8% |

| 2023 Value Projection: | 384.3 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By End Use, By Sales |

| Companies covered:: | Bharat Petroleum Corporation Limited, BASF SE, Arkema, Nippon Shokubai Co., Ltd., LG Chem, The Dow Chemical Company, Evonik Industries AG, Mtsubishi Chemical Corporation, Vizag Chemical International, Maxwell Additives Private Limited, Acuro Organics Limited, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Crude Acrylic Acid Market:

The India crude acrylic acid market size is driven by the increasing demand for bio-based and sustainable acrylic acid products, regulatory pressures for greener chemicals, consumer preference for eco-friendly solutions, technological progress in renewable production processes, expansion of domestic manufacturing capacity, import substitution initiatives, and growing applications superabsorbent polymers and advanced coatings, urbanization, rising disposable incomes, and increased industrial output for crude acrylic acid.

The India crude acrylic acid market size is restrained by the volatility in raw material prices, supply chain dependencies, crude oil fluctuations, increase production costs and pressure profit margins, stringent environmental regulations, and compliance costs particularly for smaller manufacturers.

The future of India crude acrylic acid market size is bright and promising, with versatile opportunities emerging from the growing interest in sustainable and bio-based solutions for acrylic acid product development is due to the increasing number of laws governing environmental management, consumers' desire for environmentally friendly options, and advancements in clean production methods. New domestic production capacity, as well as initiatives to reduce imports, along with expanding uses in high growth areas like superabsorbent polymers and advanced coatings will create exceptional opportunities for investment and innovation in this sector.

Market Segmentation

The India Crude Acrylic Acid Market share is classified into end use and sales channel.

By End Use:

The India crude acrylic acid market size is divided by end use into acrylate ester, super absorbent polymer, water treatment, detergent, paper, and others. Among these, the super absorbent polymer segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High demand for disposable personal hygiene, rising disposable income, population growth, increasing hygiene awareness, and cost effectiveness all contribute to the super absorbent polymer segment's largest share and higher spending on crude acrylic acid when compared to other end use.

By Sales Channel:

The India crude acrylic acid market size is divided by sales channel into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The direct sales segment dominates because of high volume demand, rises in B2B sales to major industrial end users, bulk supply chain logistics, increase in importing demand, and involves direct contracts between manufacturers and large consumers in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India crude acrylic acid market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Crude Acrylic Acid Market:

- Bharat Petroleum Corporation Limited

- BASF SE

- Arkema

- Nippon Shokubai Co., Ltd.

- LG Chem

- The Dow Chemical Company

- Evonik Industries AG

- Mtsubishi Chemical Corporation

- Vizag Chemical International

- Maxwell Additives Private Limited

- Acuro Organics Limited

- Others

Recent Developments in India Crude Acrylic Acid Market:

- In September 2025, Prime Minister Narendra Modi inaugurated IndianOil’s new Acrylics/Oxo-Alcohol Complex at the Gujarat Refinery in Vadodara. This facility includes an acrylic acid unit designed to convert refinery byproduct propylene into high-value acrylic acid, reducing reliance on imports. This complex also features a 150 KTA Butyl Acrylate plant.

- In March 2024, Arkema finalized the acquisition of Glenmark Pharmaceuticals adhesive business in India to strengthen its position in specialty acrylic based adhesives in the South Asian market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India crude acrylic acid market based on the below-mentioned segments:

India Crude Acrylic Acid Market, By End Use

- Acrylate Ester

- Super Absorbent Polymer

- Water Treatment

- Detergent

- Paper

- Others

India Crude Acrylic Acid Market, By Sales Channel

- Direct Sales

- Indirect Sales

Frequently Asked Questions (FAQ)

-

What is the India crude acrylic acid market size?India crude acrylic acid market is expected to grow from 206.7 thousand tonnes in 2024 to 384.3 thousand tonnes by 2035, growing at a CAGR of 5.8% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the increasing demand for bio-based and sustainable acrylic acid products, regulatory pressures for greener chemicals, consumer preference for eco-friendly solutions, technological progress in renewable production processes, expansion of domestic manufacturing capacity, import substitution initiatives, and growing applications superabsorbent polymers and advanced coatings, urbanization, rising disposable incomes, and increased industrial output for crude acrylic acid.

-

What factors restrain the India crude acrylic acid market?Constraints include the volatility in raw material prices, supply chain dependencies, crude oil fluctuations, increase production costs and pressure profit margins, stringent environmental regulations, and compliance costs particularly for smaller manufacturers

-

How is the market segmented by end use?The market is segmented into acrylate ester, super absorbent polymer, water treatment, detergent, paper, and others.

-

Who are the key players in the India crude acrylic acid market?Key companies include Bharat Petroleum Corporation Limited, BASF SE, Arkema, Nippon Shokubai Co., Ltd., LG Chem, The Dow Chemical Company, Evonik Industries AG, Mtsubishi Chemical Corporation, Vizag Chemical International, Maxwell Additives Private Limited, Acuro Organics Limited, and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Need help to buy this report?