India Concentrated Nitric Acid Market Size, Share, By Type (Ammonium Nitrate & Calcium Ammonium Nitrate, Nitrobenzene, Adipic Acid, TDI, And Others), By Distribution Channel (Direct And Indirect), And India Concentrated Nitric Acid Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Concentrated Nitric Acid Market Insights Forecasts to 2035

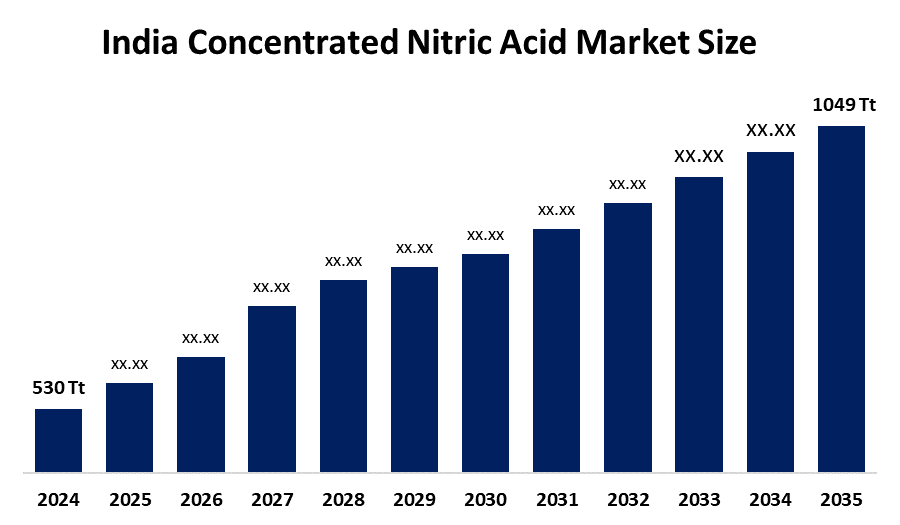

- India Concentrated Nitric Acid Market Size 2024: 530 Thousand Tonnes

- India Concentrated Nitric Acid Market Size 2035: 1049 Thousand Tonnes

- India Concentrated Nitric Acid Market CAGR 2024: 6.4%

- India Concentrated Nitric Acid Market Segments: Type and Distribution Channel

Get more details on this report -

The India Concentrated Nitric Acid Market Size encompasses the commercial landscape surrounding the production, distribution, and consumption of concentrated nitric acid (HNO3) in India. It is a critical raw material used in the production of nitrogen-based fertilizers, particularly ammonium nitrate, and is widely utilized in the manufacture of nitroaromatics, adipic acid, toluene di-isocyanate (TDI), and several other downstream chemical intermediates. These intermediates support key end-use industries such as agriculture and agrochemicals, explosives, pharmaceuticals, rubber, and dyes.

The India Concentrated Nitric Acid Market Size is supported by government initiatives such as the Production-Linked Incentive (PLI) scheme, which aims to boost domestic chemical manufacturing capacity, enhance self-reliance, and reduce import dependence. In addition, sustained budgetary support for the fertilizer sector—where concentrated nitric acid plays an indirect yet critical role—is reflected in the Department of Fertilizers’ revised allocation of approximately rs.1,91,836 crore for FY 2024–25. This support strengthens fertilizer production capacity and, in turn, drives demand for nitric acid across the country.

As technology advances, India’s concentrated nitric acid providers are now using high-capacity sustainable concentrated nitric acid production facilities, all employing new process technologies, represents the utilisation of modern manufacturing technologies that recycle waste process water, provide emissions reductions and increase energy efficiency. The successful use of these novel technologies increases manufacturers' ability to compete on an operational cost basis. Furthermore, it enables manufacturers to align themselves with broader environmental accountability and circular industrial practices, resulting in investment opportunities and continued research and development in the industry sector.

India Concentrated Nitric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 530 Thousand Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.4% |

| 2035 Value Projection: | 1049 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type ,By Distribution Channel |

| Companies covered:: | Deepak Fertilisers & Petrochemicals Corporation Ltd., Gujarat Narmada Valley Fertilizers & Chemicals Limited, Rashtriya Chemicals & Fertilizers Limited, National Fertilizers Limited, Seya Industries Ltd., Aarti Industries Ltd., Hindustan Organic Chemicals Ltd., Vizag Chemicals, Parth Industries, Alpha Chemika, Prakash Chemicals International Pvt. Ltd., Vijay Gas Industry Pvt. Ltd., Navin Chemicals, Sukha Chemical Industries, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Concentrated Nitric Acid Market:

The India Concentrated Nitric Acid Market Size is driven by the growing demand for nitrogenous fertilizers to support higher crop yields, increased requirement for ammonium nitrate production, rising industrial activities in mining and construction, expansion of chemical manufacturing, technological upgrades that reduce production costs, strong government schemes, and environmental impacts also promote market expansion by making localized manufacturing more competitive.

The India Concentrated Nitric Acid Market Size is restrained by the concentrated nitric acid production and handling risks, environmental concerns, stringent regulatory compliance costs related to emissions control, hazardous waste management, and workplace safety, volatility in raw material prices, supply cost pressures, and specialized storage and transportation requirements issues.

The future of India Concentrated Nitric Acid Market Size is bright and promising, with versatile opportunities emerging from the agrochemicals and pharmaceuticals sectors. The area of opportunity for creating new capacities, replacing imported products, and exporting more sophisticated types of chemical intermediates made from high concentrations of nitric acid. Potentially competitive advantages for producers in this area will provide an opportunity for continued innovation of green chemistry technologies, through the implementation of sustainable methods of production, and through the use of digital manufacturing technologies. In addition various government policies creating a strong R&D base, developing human resources, and enhancing the quality of environmental management practices.

Market Segmentation

The India Concentrated Nitric Acid Market share is classified into type and distribution channel.

By Type:

The India Concentrated Nitric Acid Market Size is divided by type into ammonium nitrate & calcium ammonium nitrate, nitrobenzene, adipic acid, TDI, and others. Among these, the ammonium nitrate & calcium ammonium nitrate segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High agricultural demand to supply both calcium and nitrogen to enhance crop yield, heavily used as an industrial explosive in mining, rapid urbanization, and well established infrastructure in India all contribute to the ammonium nitrate & calcium ammonium nitrate segment's largest share and higher spending on concentrated nitric acid when compared to other type.

By Distribution Channel:

The India Concentrated Nitric Acid Market Size is divided by distribution channel into direct and indirect. Among these, the indirect segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The indirect segment dominates because of need for specialized, safe handling of the highly corrosive material, widespread geographic dispersal of small-to-medium end users, and the regulatory complexities involved in transporting hazardous chemicals.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Concentrated Nitric Acid Market Size , along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Concentrated Nitric Acid Market:

- Deepak Fertilisers & Petrochemicals Corporation Ltd.

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- Rashtriya Chemicals & Fertilizers Limited

- National Fertilizers Limited

- Seya Industries Ltd.

- Aarti Industries Ltd.

- Hindustan Organic Chemicals Ltd.

- Vizag Chemicals

- Parth Industries

- Alpha Chemika

- Prakash Chemicals International Pvt. Ltd.

- Vijay Gas Industry Pvt. Ltd.

- Navin Chemicals

- Sukha Chemical Industries

- Others

Recent Developments in India Concentrated Nitric Acid Market:

In December 2025, A-1 Ltd, a company with five decades of experience in acid trading, announced a significant tri-party supply agreement with GNFC and Solar Industries India Limited to supply 10,000 metric tonnes of concentrated nitric acid.

In June 2025, Deepak Nitrite reported revenue of INR 1897 crore, driven by steady volumes and improved product mix in its Phenolics segment, which uses nitric acid as a key raw material.

In March 2025, Gujarat Narmada Valley Fertilizers & Chemicals Ltd. awarded a contract to thyssenkrupp Udhe India Private Ltd. for a new 600 metric tons per day weak nitric acid plant. This expansion is part of the “Make in India” initiative and will increase the company’s overall nitric acid capacity, supporting the domestic market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the India Concentrated Nitric Acid Market Size based on the below-mentioned segments:

India Concentrated Nitric Acid Market, By Type

- Ammonium Nitrate & Calcium Ammonium Nitrate

- Nitrobenzene

- Adipic Acid

- TDI

- Others

India Concentrated Nitric Acid Market, By Distribution Channel

- Direct

- Indirect

Frequently Asked Questions (FAQ)

-

Q: What is the India concentrated nitric acid market size?A: India concentrated nitric acid market is expected to grow from 530 thousand tonnes in 2024 to 1049 thousand tonnes by 2035, growing at a CAGR of 6.4% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the growing demand for nitrogenous fertilizers to support higher crop yields, increased requirement for ammonium nitrate production, rising industrial activities in mining and construction, expansion of chemical manufacturing, technological upgrades that reduce production costs, strong government schemes, and environmental impacts also promote market expansion by making localized manufacturing more competitive.

-

Q: What factors restrain the India concentrated nitric acid market?A: Constraints include the concentrated nitric acid production and handling risks, environmental concerns, stringent regulatory compliance costs related to emissions control, hazardous waste management, and workplace safety, volatility in raw material prices, supply cost pressures, and specialized storage and transportation requirements issues.

-

Q: How is the market segmented by type?A: The market is segmented into ammonium nitrate & calcium ammonium nitrate, nitrobenzene, adipic acid, TDI, and others.

-

Q: Who are the key players in the India concentrated nitric acid market?A: Key companies include Deepak Fertilisers & Petrochemicals Corporation Ltd., Gujarat Narmada Valley Fertilizers & Chemicals Limited, Rashtriya Chemicals & Fertilizers Limited, National Fertilizers Limited, Seya Industries Ltd., Aarti Industries Ltd., Hindustan Organic Chemicals Ltd., Vizag Chemicals, Parth Industries, Alpha Chemika, Prakash Chemicals International Pvt. Ltd., Vijay Gas Industry Pvt. Ltd., Navin Chemicals, Sukha Chemical Industries, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?