India Cloud Computing Market Size, Share, By Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS)), By Workload (Application Development & Testing, Data Storage & Backup, Resource Management, Orchestration Services, Others), By Deployment (Public, Private, Hybrid), By Enterprise Size (Small & Medium Enterprises, Large Enterprise), By End Use (BFSI, IT & Telecom, Retail & Consumer Goods, Manufacturing, Energy & Utilities, Healthcare, Media & Entertainment, Government & Public Sector, Others), India Cloud Computing Market Size Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyIndia Cloud Computing Market Size Insights Forecasts to 2035

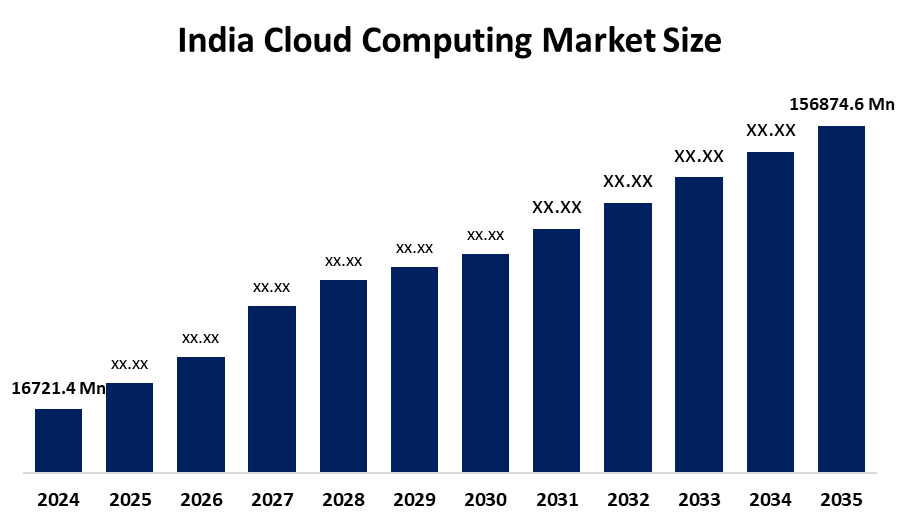

- India Cloud Computing Market Size 2024: USD 16721.4 Mn

- India Cloud Computing Market Size 2035: USD 156874.6 Mn

- India Cloud Computing Market Size CAGR 2024: 22.5%

- India Cloud Computing Market Size Segments: Service, Workload, Deployment, Enterprise Size, End Use

Get more details on this report -

The India Cloud Computing Market Size comprises services and platforms that are specifically established to assist enterprises, the government, startups, as well as institutions in storing, managing, processing, or analysing data with the help of cloud infrastructure in a secure manner. The India Cloud Computing Market Size is aided by the fast pace of digitalization in the region, rise in the adaptation of artificial intelligence, business analytics, and the Internet of Things, surging demand for cloud solutions for enterprises, and the significant migration of businesses towards cloud operations.

The Adoption of Cloud Computing in India has received drives from governmental initiatives such as Digital India, Smart Cities Mission, and Make in India to enhance digital and data centre infrastructure and cloud readiness in the public and private sectors in India. Huge investments in data centers integrated with renewable energy and IT infrastructure have also increased cloud capabilities in India. Technological evolution has enabled cloud service providers in India to adopt artificial intelligence, automation, orchestration, and analytics to enhance scalability and workload management and cloud performance in India. The increasing adoption of hybrid cloud computing has enabled companies in India to synchronize security, flexibility, and costs for quicker deployment and digital transformation in India.

India Cloud Computing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 16721.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 22.5% |

| 2035 Value Projection: | 156874.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service, By Workload |

| Companies covered:: | Amazon Web Services, Microsoft Azure, Google Cloud, IBM Cloud, Oracle Cloud, Alibaba Cloud, Salesforce, SAP SE, VMware, Tata Consultancy Services, Wipro, Infosys, HCLTech, Bharti Airtel (Nxtra / Airtel Cloud), Reliance Jio Cloud, Zoho Corporation, CtrlS Datacenters, NTT (Netmagic), Lumen Technologies India, Rackspace Technology India, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Cloud Computing Market Size:

The Indian Cloud Computing Market Size is driven by the digital transformation that is happening at the enterprise level, the use of AI, IoT, and analytics, and the need for cost-effective computing and storage solutions. With the increase in the remote working culture, companies are moving from existing on-premises solutions to the cloud platform as part of app modernization and business continuity efforts. Initiatives related to cloud-driven digital governance have also boosted the Indian cloud computing market.

The India Cloud Computing Market Size faces restraints in data security and privacy issues, complexity in regulatory compliances, cloud awareness in small companies in India, lack of talent in cloud computing, and cost of migrating legacy systems to cloud computing. Ineffective connectivity in some areas and data localization issues also impact cloud computing adoption and functioning in companies.

The future outlook for cloud computing in India is bright with many opportunities, attributed to hyperscale data center investments, renewable energy-enabled infrastructure, and AI-powered cloud services. The increasing adoption of hybrid cloud or multi-cloud strategies, the rise of 5G networks, and increasing demand for cloud services from BFSI, healthcare, and the government sector are likely to boost cloud adoption and mass-scale digital transformation.

Market Segmentation

The India Cloud Computing Market Size share is classified into service, workload, deployment, enterprise size, and end use.

By Service:

The India Cloud Computing Market Size is divided by service into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). Among these, the IaaS segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. It is guided by the strong demand for scalable computing resources, storage, and networking resources from enterprises, data centers, and digital platforms, along with the rapid migration away from on-premise infrastructure to flexible, pay-as-you-use cloud environments.

By Workload:

The India Cloud Computing Market Size is divided by workload into application development & testing, data storage & backup, resource management, orchestration services, and others. Among these, the data storage & backup segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR. The dominance is fueled by the growing enterprise data, the demand for data retention by governments, awareness regarding cyber security threats, and the escalating demand for disaster recovery in cloud-based infrastructure in BFSI, healthcare, and government.

By Deployment:

The India Cloud Computing Market Size is divided by deployment into public, private, and hybrid. Among these, the hybrid segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is because the leadership position for this sector is a result of enterprises’ efforts to achieve a balance between data security, scalability, regulatory compliances, integration requirements, and the rising demand for flexible infrastructure for IT, BFSI, and the manufacturing sector.

By Enterprise Size:

The India Cloud Computing Market Size is divided by enterprise size into small & medium enterprises and large enterprises. Among these, the large enterprises segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR. The reason behind this dominance is the higher capacity of IT spending, large-scale projects for digital transformation, adoption of AI and analytics, complex workload requirements, and high demand for secure and high-performance cloud infrastructure across the banking, telecom, and manufacturing sectors.

By End Use:

The India Cloud Computing Market Size is divided by end use into BFSI, IT & telecom, retail & consumer goods, manufacturing, energy & utilities, healthcare, media & entertainment, government & public sector, and others. Among these, the BFSI segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR. The dominance is driven by the growth of digital banking, the demand for safe transaction processing, the drive for regulatory compliance, the use of real-time analytics, and the increasing adoption of cloud-based core banking and payments platforms.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Cloud Computing Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Cloud Computing Market Size:

- Amazon Web Services

- Microsoft Azure

- Google Cloud

- IBM Cloud

- Oracle Cloud

- Alibaba Cloud

- Salesforce

- SAP SE

- VMware

- Tata Consultancy Services

- Wipro

- Infosys

- HCLTech

- Bharti Airtel (Nxtra / Airtel Cloud)

- Reliance Jio Cloud

- Zoho Corporation

- CtrlS Datacenters

- NTT (Netmagic)

- Lumen Technologies India

- Rackspace Technology India

Recent Developments in India Cloud Computing Market Size

In March 2025, Amazon Web Services (AWS) confirmed an investment of USD 8.2 billion aimed at expanding data center capacity, integrating renewable energy infrastructure, enhancing cloud service scalability, and supporting a sustainable digital transformation in India.

In February 2025, Tata Power selected Amazon Web Services to modernize electric grid operations using artificial intelligence, the Internet of Things (IoT), and advanced analytics. Through AWS cloud-based analytics and machine learning services, Tata Power will manage real-time data and implement predictive maintenance, improving operational efficiency, reliability, and data-driven decision-making. This partnership is expected to accelerate cloud adoption in India’s utility sector.

In January 2025, Microsoft announced a USD 3 billion investment to develop new AI and cloud infrastructure projects. This initiative aims to enhance cloud and AI service capabilities, support enterprise digital transformation, and expand access to scalable computing infrastructure. Key beneficiary sectors include technology, healthcare, and financial services.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Cloud Computing Market Size based on the below-mentioned segments:

India Cloud Computing Market Size, By Service

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

India Cloud Computing Market Size, By Workload

- Application Development & Testing

- Data Storage & Backup

- Resource Management

- Orchestration Services

- Others

India Cloud Computing Market Size, By Deployment

- Public

- Private

- Hybrid

India Cloud Computing Market Size, By Enterprise Size

- Small & Medium Enterprises

- Large Enterprise

India Cloud Computing Market Size, By End Use

- BFSI

- IT & Telecom

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Healthcare

- Media & Entertainment

- Government & Public Sector

- Others

Frequently Asked Questions (FAQ)

-

What is the India Cloud Computing Market Size?India Cloud Computing Market Size is expected to grow from USD 16,721.4 million in 2024 to USD 156,874.6 million by 2035, at a CAGR of 22.5% during 2025-2035.

-

What are the key growth drivers of the market?Growth is driven by digital transformation, AI, IoT adoption, hybrid cloud solutions, rising enterprise demand, government initiatives like Digital India and Smart Cities, and investments in scalable cloud infrastructure.

-

What factors restrain the India Cloud Computing Market Size?Constraints include data security concerns, regulatory compliance complexity, low cloud awareness in SMEs, shortage of skilled talent, legacy system migration costs, and connectivity or data localization issues.

-

How is the market segmented by service?The market is segmented into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS).

-

Which enterprise size dominates the India Cloud Computing Market Size?Large enterprises dominate due to higher IT budgets, complex workloads, adoption of AI and analytics, and large-scale digital transformation projects.

-

Who are the key target audiences for this market report?Target audiences include market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?