India Chloroform Market Size, Share, By Grade (Technical, Fluorocarbon, And Alcohol Stabilized), By Application (Solvent, Refrigerant, Intermediate, And Reagent), And India Chloroform Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsIndia Chloroform Market Insights Forecasts to 2035

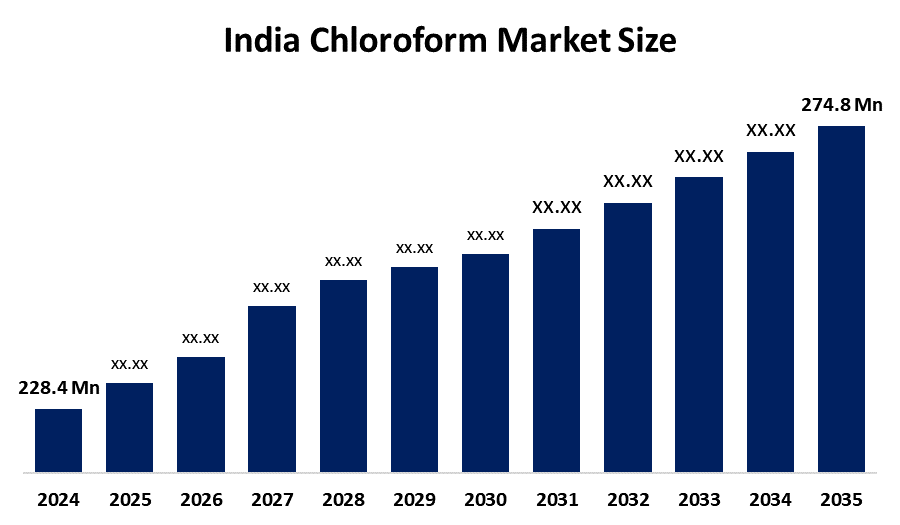

- India Chloroform Market 2024: USD 228.4 Mn

- India Chloroform Market Size 2035: USD 274.8 Mn

- India Chloroform Market CAGR 2024: 1.7%

- India Chloroform Market Segments: Grade and Application

Get more details on this report -

The India chloroform market encompasses a sector for commercial production, distribution, and use of chloroform. It is a clear, colourless, volatile organic solvent primarily made through chlorination processes. The majority of chloroform is produced by chlorination processes, using chlorine gas to produce chloroform through organic synthesis. Chloroform can be used in different industries including pharmaceuticals to purify chemicals, as well as the manufacture of refrigerants or dyes and pesticides and used in laboratory applications due to its ability to dissolve other organic material.

The chloroform in India are backed by government support, including the Production Linked Incentive (PLI) schemes and related industrial policies under Make in India and Atmanirbhar Bharat aim to boost domestic manufacturing capacity, enhance value chains, and reduce dependence on imports of chemical intermediates, including pharmaceuticals and associated materials. Demand for chemicals and petrochemicals in India is expected to nearly triple and reach around USD 1 trillion by 2040, highlighting the strategic importance of chemicals in India’s economic growth and reinforces the environment in which specific intermediate markets like chloroform operate.

As technology advances, India’s chloroform providers are now using new processes to help produce higher yields and create less impact on the environment. The modern manufacturing industry is now primarily concerned with reducing energy consumption and improving the quality of the products to comply with strict standards for health and safety as well as the environment. Increasingly, manufacturers have created specialized grades of chloroform specifically designed to meet unique analytical requirements, research-grade materials, and industrial usage. In addition, advances in technology for producing chloroform have already begun to allow for greater reliability, automation, and sustainability of producing pure chloroform; thus, chemical production is also evolving toward a more sustainable and precise model- supported by multiple manufacturers.

India Chloroform Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 228.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 1.7% |

| 2035 Value Projection: | USD 274.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 239 |

| Tables, Charts & Figures: | 187 |

| Segments covered: | By Grade,By Application |

| Companies covered:: | Gujarat Alkalies and Chemicals Ltd. SRF Limited Chemplast Sanmar Limited Grasim Industries Limited DCM Shriram Ltd. Meghmani Finechem Limited Kutch Chemical Industries Ltd. Epigral Limited Lords Chloro Alkali Limited Tata Chemicals Limited The Andhra Sugars Limited Reliance Industries Limited Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Chloroform Market:

The India chloroform market is driven by the rapid expansion of pharmaceutical industry, growth in agrochemical and industrial sectors, major role in intermediate production for refrigerants and fluoropolymers, industrialization, rise in demand for specialty and bulk chemicals, strong government support schemes, and increased R&D activity in life sciences and materials science that depend on high-purity solvents.

The India chloroform market is restrained by the potentially hazardous and toxic substance, strict environmental and health regulations, rise in compliance costs for producers and users, shifts toward greener chemistry, and increasingly scrutinizing chloroform use in industries.

The future of India chloroform market is bright and promising, with versatile opportunities emerging from the increased environmentally friendly production methods, chemical producers have an opportunity to create a unique selling proposition based on the use of safe methods or materials. As more customers look for specialty chemical products like solvents used in laboratories like deuterated chloroform for NMR, there has been growth in the demand for value-added products. Additionally, as India's chemical industry continues to become increasingly oriented toward exporting, and through government-supported policies to encourage exports, there will be increased opportunities for chloroform and its derivatives to participate in the global marketplace.

Market Segmentation

The India Chloroform Market share is classified into grade and application.

By Grade:

The India chloroform market is divided by grade into technical, fluorocarbon, and alcohol stabilized. Among these, the technical segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High efficiency, versatility, extensive used as a chemical intermediate, growth in pharmaceutical, agrochemical, and refrigerant industries in India, and cost effective volume of the chemical all contribute to the technical segment’s largest share and higher spending on chloroform segment when compared to other grade

By Application:

The India chloroform market is divided by application into solvent, refrigerant, intermediate, and reagent. Among these, the refrigerant segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The refrigerant segment dominates because of massive use in air conditioners and refrigerators, rapidly growing HVAC and auto sector, persistent demand for R-22 with low cost and high efficiency, and well established industrial hubs in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India chloroform market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Chloroform Market:

- Gujarat Alkalies and Chemicals Ltd.

- SRF Limited

- Chemplast Sanmar Limited

- Grasim Industries Limited

- DCM Shriram Ltd.

- Meghmani Finechem Limited

- Kutch Chemical Industries Ltd.

- Epigral Limited

- Lords Chloro Alkali Limited

- Tata Chemicals Limited

- The Andhra Sugars Limited

- Reliance Industries Limited

- Others

Recent Developments in India Chloroform Market:

In September 2025, DCM Shriram established a long term, exclusive partnership to supply chlorine to Aarti Industries new facility in Jhagadia, Gujarat. This expansion involved a new underground pipeline, significantly increasing regional, daily chlorine consumption for chemical derivatives like chloroform.

In March 2025, Gujarat Alkalies and Chemicals Limited inaugurated a 30,000-tonne-per-annum chlorotoluenes plant in Dahej. This facility utilized chlorine to produce high value chlorinated products, contributing to the regional demand for chlorine-based intermediates.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035.Spherical Insights has segmented the India chloroform market based on the below-mentioned segments:

India Chloroform Market, By Grade

- Technical

- Fluorocarbon

- Alcohol Stabilized

India Chloroform Market, By Application

- Solvent

- Refrigerant

- Intermediate

- Reagent

Frequently Asked Questions (FAQ)

-

Q: What is the India chloroform market size?A: India chloroform market is expected to grow from USD 228.4 million in 2024 to USD 274.8 million by 2035, growing at a CAGR of 1.7% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rapid expansion of pharmaceutical industry, growth in agrochemical and industrial sectors, major role in intermediate production for refrigerants and fluoropolymers, industrialization, rise in demand for specialty and bulk chemicals, strong government support schemes, and increased R&D activity in life sciences and materials science that depend on high-purity solvents.

-

Q: What factors restrain the India chloroform market?A: Constraints include the potentially hazardous and toxic substance, strict environmental and health regulations, raising compliance costs for producers and users, shifts toward greener chemistry, and increasingly scrutinizing chloroform use in industries.

-

Q: How is the market segmented by grade?A: The market is segmented into technical, fluorocarbon, and alcohol stabilized.

-

Q: Who are the key players in the India chloroform market?A: Key companies include Gujarat Alkalies and Chemicals Ltd., SRF Limited, Chemplast Sanmar Limited, Grasim Industries Limited, DCM Shriram Ltd., Meghmani Finechem Limited, Kutch Chemical Industries Ltd., Epigral Limited, Lords Chloro Alkali Limited, Tata Chemicals Limited, The Andhra Sugars Limited, Reliance Industries Limited, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?