India Cellulose Ether Market Size, Share, By Product Type (Methyl Cellulose & Derivatives, Carboxymethyl Cellulose, Ethyl Cellulose, And Others), By End Use (Paints & Coatings, Pharmaceuticals & Personal Care, Construction, Food Additives, And Others), And India Cellulose Ether Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsIndia Cellulose Ether Market Insights Forecasts to 2035

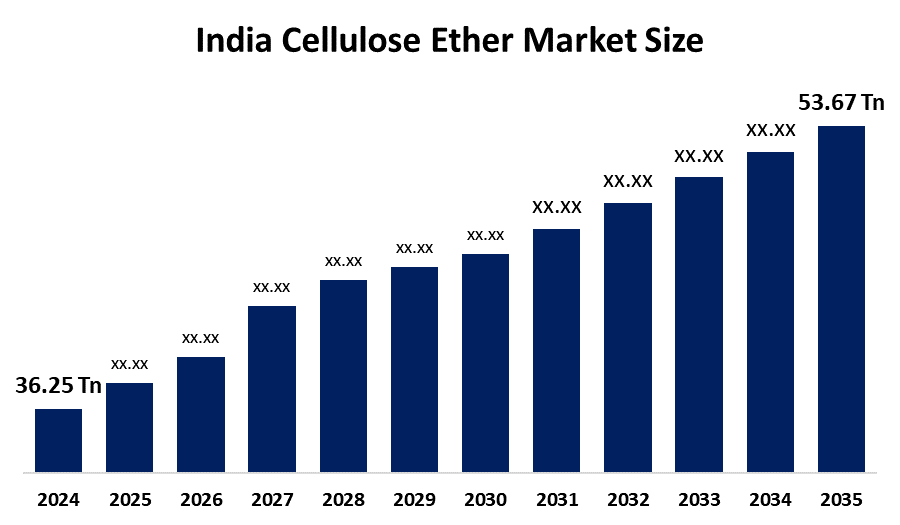

- India Cellulose Ether Market 2024: 36.25 Thousand Tonnes

- India Cellulose Ether Market Size 2035: 53.67 Thousand Tonnes

- India Cellulose Ether Market CAGR 2024: 3.63%

- India Cellulose Ether Market Segments: Product Type and End Use

Get more details on this report -

The India cellulose ether market refers to an industrial ecosystem that is based on the production, supply and use of cellulose ethers. Cellulose ethers are water soluble polymers derived from cellulose through chemical modification includes methyl cellulose, hydroxypropyl methyl cellulose and carboxymethyl cellulose. They have various qualities such as thickening, binding, water retention, stabilizing and rheology modification that make them valuable to many different types of applications including construction industry, pharmaceutical industry, personal care products, food & beverage, paint and coating industries, and detergent industry in India.

The cellulose ether in India are backed by government support, including the Production Linked Incentive (PLI) Scheme framework, which has been extended to cover specialty chemicals and related value chains as part of the national manufacturing push. The federal government has committed to record infrastructure spending, underscoring sustained public investment in construction and urban development. Since cellulose ethers are extensively used in construction chemicals for water retention and performance enhancement, this surge in infrastructure outlays signals robust underlying demand for construction-related additives.

As technology advances, India’s cellulose ether providers are now using optimized etherification methods and advanced purification processes allows for accurate viscosity and functions according to specific end-use requirements. There is also a growing emphasis on producing eco-friendly products and utilizing renewable raw materials, which is consistent with general regulations governing biodegradable additives. Developmental innovations are currently being seen within controlled-release pharma excipients and performance construction formulations as a result of continued research and development activities in the area of cellulose ethers being used in high-value applications.

India Cellulose Ether Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 36.25 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.63% |

| 2035 Value Projection: | 53.67 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 201 |

| Tables, Charts & Figures: | 134 |

| Segments covered: | By Product Type,By End Use |

| Companies covered:: | Ashland India Pvt. Ltd. Dow Chemical International Pvt. Ltd. AkzoNobel India Ltd. Shin-Etsu Chemical Co., Ltd. LOTTE Fine Chemical Nouryon Chemicals Reliance Cellulose Products Ltd. Sigachi Industries Limited Borregaard South Asia Pvt. Ltd. Colorcon Asia Pvt. Ltd. CP Kelco Encore Natural Polymers Private Limited Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Cellulose Ether Market:

The India cellulose ether market is driven by the rapid urbanization and infrastructure growth, demand for construction chemicals, the expansion of India’s pharmaceutical industry as an excipient in tablet formulations and controlled release systems, rising consumer incomes, increased spending on personal care and home care products, shift toward natural, biodegradable ingredients, growing food processing sector, and technological advancements further propel the growth.

The India cellulose ether market is restrained by the volatility and cost of raw materials prices, environmental concerns, stringent regulations on chemical manufacturing, limited awareness of the full benefits of cellulose ethers, slowing adoption in certain applications, and strategic investment in supply chain resilience and education of end-users challenges.

The future of India cellulose ether market is bright and promising, with versatile opportunities emerging from the increase demand for high-performance and sustainable product alternatives has resulted in a trend towards green chemistry worldwide. Cellulose ether producers that manufacture biodegradable and renewable-based grades have a competitive advantage over other cellulose ether. There's also a large potential to add value in niche or fast-growing applications. Development of global export markets, enabled by policies supporting exports and improved production efficiencies, provides opportunity for growth, as well as developing partnerships with international cellulose ether manufacturers and investing in downstream R&D that will produce new product developments based on changing industrial requirements.

Market Segmentation

The India Cellulose Ether Market share is classified into product type and end use.

By Product Type:

The India cellulose ether market is divided by product type into methyl cellulose & derivatives, carboxymethyl cellulose, ethyl cellulose, and others. Among these, the methyl cellulose & derivatives held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Widely used key excipient in pharmaceuticals, excellent water retension and binding capabilities, biodegradable nature, sustainable and eco-friendly material all contribute to the methyl cellulose & derivatives segment's largest share and higher spending on cellulose ether when compared to other product type.

By End Use:

The India cellulose ether market is divided by end use into paints & coatings, pharmaceuticals & personal care, construction, food additives, and others. Among these, the paints & coatings segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The paints & coatings segment dominates because of rapid growth of the decorative paint sector, urbanization, rise in disposable income, wide shift towards eco-friendly water-based formulations, and providing essential functional properties in achieving high quality finishes.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India cellulose ether market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Cellulose Ether Market:

- Ashland India Pvt. Ltd.

- Dow Chemical International Pvt. Ltd.

- AkzoNobel India Ltd.

- Shin-Etsu Chemical Co., Ltd.

- LOTTE Fine Chemical

- Nouryon Chemicals

- Reliance Cellulose Products Ltd.

- Sigachi Industries Limited

- Borregaard South Asia Pvt. Ltd.

- Colorcon Asia Pvt. Ltd.

- CP Kelco

- Encore Natural Polymers Private Limited

- Others

Recent Developments in India Cellulose Ether Market:

In June 2025, Sigachi Industries announced a major expansion of its API leadership and set new standards in Microcrystalline Cellulose with a new manufacturing facility to serve the pharmaceutical and nutraceuticals sectors.

In March 2025, Oji Holdings acquired a strategic stake in Indian producer Chemfield Cellulose Pvt Ltd to establish a comprehensive production and sales system for pulp-based items, including cellulose ethers, expanding its footprint in the high value added Indian market.

In February 2025, Sigachi Industries revealed plans to invest USD 1 million in a new R&D facility in Hyderabad, India, focusing on developing refined, high-performance cellulose variants for food, beverage, and cosmetic applications.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India cellulose ether market based on the below-mentioned segments:

India Cellulose Ether Market, By Product Type

- Methyl Cellulose & Derivatives

- Carboxymethyl Cellulose

- Ethyl Cellulose

- Others

India Cellulose Ether Market, By End Use

- Paints & Coatings

- Pharmaceuticals & Personal Care

- Construction

- Food Additives

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India cellulose ether market size?A: India cellulose ether market is expected to grow from 36.25 thousand tonnes in 2024 to 53.67 thousand tonnes by 2035, growing at a CAGR of 3.63% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rapid urbanization and infrastructure growth, demand for construction chemicals, the expansion of India’s pharmaceutical industry as an excipient in tablet formulations and controlled release systems, rising consumer incomes, increased spending on personal care and home care products, shift toward natural, biodegradable ingredients, growing food processing sector, and technological advancements further propel the growth.

-

Q: What factors restrain the India cellulose ether market?A: Constraints include the volatility and cost of raw materials prices, environmental concerns, stringent regulations on chemical manufacturing, limited awareness of the full benefits of cellulose ethers, slowing adoption in certain applications, and strategic investment in supply chain resilience and education of end-users challenges.

-

Q: How is the market segmented by product type?A: The market is segmented into methyl cellulose & derivatives, carboxymethyl cellulose, ethyl cellulose, and others.

-

Q: Who are the key players in the India cellulose ether market?A: Key companies include Ashland India Pvt. Ltd., Dow Chemical International Pvt. Ltd., AkzoNobel India Ltd., Shin-Etsu Chemical Co., Ltd., LOTTE Fine Chemical, Nouryon Chemicals, Reliance Cellulose Products Ltd., Sigachi Industries Limited, Borregaard South Asia Pvt. Ltd., Colorcon Asia Pvt. Ltd., CP Kelco, Encore Natural Polymers Private Limited, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?