India Caustic Soda Market Size, Share, and COVID-19 Impact Analysis, By Production Process (Membrane Cell, Diaphragm Cell, and Others), By Application (Pulp & Paper, Organic Chemical, Inorganic Chemical, Soap & Detergent, Alumina, Water Treatment, Textile, & Other), and India Caustic Soda Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Caustic Soda Market Insights Forecasts to 2035

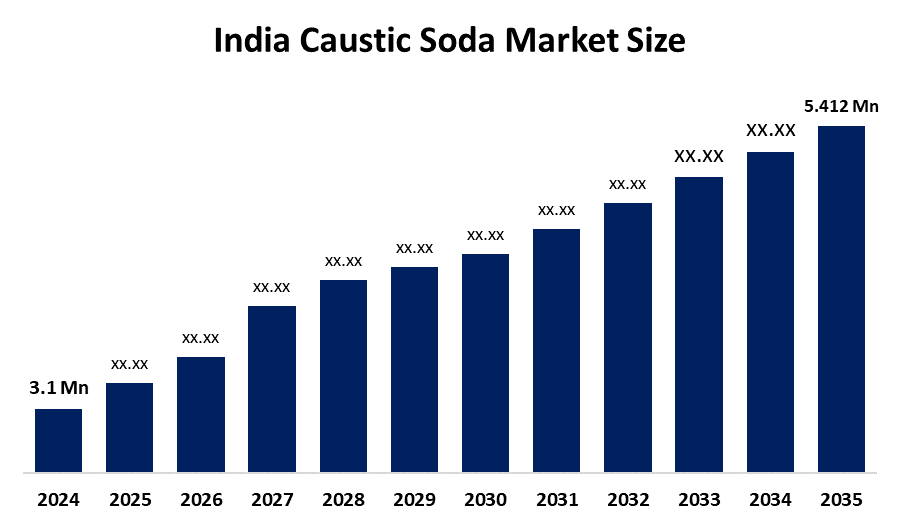

- The India Caustic Soda Market Size Was Estimated at USD 3.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.2% from 2025 to 2035

- The India Caustic Soda Market Size is Expected to Reach USD 5.412 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the India caustic soda market size is anticipated to reach USD 5.412 million by 2035, growing at a CAGR of 5.2% from 2025 to 2035. India’s caustic soda market is driven by strong demand from alumina, paper & pulp, textiles, soaps & detergents, and water treatment industries, supported by rapid industrialization, infrastructure development, rising urbanization, and expanding chemical manufacturing capacity across the country.

Market Overview

India Caustic Soda Market Size refers to the domestic production, distribution, and consumption of sodium hydroxide, a vital inorganic chemical widely used across core industries. The market’s growth is strongly supported by expanding alumina and aluminium production, increasing demand from paper and pulp, textiles, soaps and detergents, chemicals, and water treatment sectors. Rapid industrialization, urban infrastructure development, and rising population-driven consumption of packaged goods further accelerate demand. Additionally, government initiatives promoting manufacturing, wastewater treatment, and clean water availability have strengthened caustic soda usage, while steady capacity expansions by chlor-alkali producers continue to support long-term market growth.

Technological advancement plays a critical role in shaping the India Caustic Soda Market Size, particularly through the widespread adoption of membrane cell technology. This technology has largely replaced mercury and diaphragm processes due to its higher energy efficiency, lower operating costs, and reduced environmental impact. Membrane cells enable higher purity caustic soda production while consuming less electricity, which is a key advantage in a power-intensive industry. Automation, process digitization, and energy recovery systems have further improved operational efficiency, plant safety, and output consistency, helping manufacturers reduce costs and comply with stricter environmental regulations, thereby supporting market expansion.

Key trends influencing the market include capacity modernization, sustainability focus, and rising downstream integration. First, producers are upgrading older plants to membrane-based systems to enhance efficiency and meet environmental standards. Second, there is growing emphasis on sustainable production, including renewable power usage and better chlorine by-product management. Third, increased integration with downstream industries such as PVC, alumina, and specialty chemicals is improving supply stability, reducing transportation costs, and strengthening profitability, making the market more resilient and growth-oriented.

Report Coverage

This research report categorizes the market for the India Caustic Soda Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India caustic soda market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India caustic soda market.

India Caustic Soda Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.1 million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.2% |

| 2035 Value Projection: | USD 5.412 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Production Process ,By Application |

| Companies covered:: | Gujarat Alkalies and Chemicals Ltd., Aditya Birla Chemicals (India) Ltd., DCM Shriram Ltd., Chemfab Alkalis Ltd., Kutch Chemical Industries Ltd., Mundra Petrochemicals (Adani Group), Tamil Nadu Petroproducts Ltd., Atul Ltd., Tata Chemicals Ltd., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

India Caustic Soda Market Size is driven by robust demand from end-use industries such as alumina refining, paper and pulp, textiles, soaps and detergents, chemicals, and water treatment. Rapid industrialization, infrastructure development, and urban population growth are increasing consumption of these products. Government initiatives supporting manufacturing, wastewater treatment, and clean drinking water projects further boost demand. Additionally, rising aluminum production, expanding chemical exports, and continuous capacity additions by domestic chlor-alkali producers strengthen supply availability and support sustained market growth across the country.

Restraining Factors

The India Caustic Soda Market Size faces restraints from high energy and power costs, as production is electricity intensive. Environmental regulations and compliance costs also limit expansion. Additionally, fluctuating raw material prices, logistics challenges, and dependence on chlorine demand as a co-product can impact profitability and restrict overall market growth.

Market Segmentation

The India Caustic Soda Market share is classified into production process and application.

- The membrane cell segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Caustic Soda Market Size is segmented by production process into membrane cell, diaphragm cell, and others. Among these, the membrane cell segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The membrane cell segment dominates the market because it offers higher energy efficiency, lower electricity consumption, and superior product purity compared to diaphragm and other processes. It is environmentally safer, as it avoids mercury use and generates fewer emissions. Strict environmental regulations, rising power costs, and the need for sustainable manufacturing have pushed producers to upgrade existing plants. Additionally, membrane technology enables better management of chlorine co-products, improving overall plant economics and long-term operational viability.

- The alumina segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Caustic Soda Market Size is segmented by application into pulp & paper, organic chemical, inorganic chemical, soap & detergent, alumina, water treatment, textile, & other. Among these, the alumina segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The alumina segment dominates the market because large volumes of caustic soda are required in the Bayer process to extract alumina from bauxite. India’s growing aluminium production, driven by infrastructure, construction, power, and transportation sectors, ensures steady demand. Alumina refineries consume caustic soda continuously and in bulk, unlike many other applications. Additionally, long-term supply contracts between caustic soda producers and aluminium manufacturers provide demand stability, reinforcing alumina’s leading market position.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India Caustic Soda Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gujarat Alkalies and Chemicals Ltd.

- Aditya Birla Chemicals (India) Ltd.

- DCM Shriram Ltd.

- Chemfab Alkalis Ltd.

- Kutch Chemical Industries Ltd.

- Mundra Petrochemicals (Adani Group)

- Tamil Nadu Petroproducts Ltd.

- Atul Ltd.

- Tata Chemicals Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Caustic Soda Market Size based on the below-mentioned segments:

India Caustic Soda Market, By Production Process

- Membrane Cell

- Diaphragm Cell

- Others

India Caustic Soda Market, By Application

- Pulp & Paper

- Organic Chemical

- Inorganic Chemical

- Soap & Detergent

- Alumina

- Water Treatment

- Textile

- Other

Frequently Asked Questions (FAQ)

-

1.What is the market size of the India caustic soda market?The India caustic soda market size is expected to grow from USD 3.1 million in 2024

-

2. What are the major driving factors of the market?Key drivers include growth in alumina and aluminum production, rising chemical manufacturing, increasing water and wastewater treatment projects, and rapid industrialization across India.

-

3. Which production process dominates the market?The membrane cell process dominates due to its energy efficiency, environmental compliance, and ability to produce high-purity caustic soda.

-

4. Which application segment holds the largest share?The alumina segment leads the market, as caustic soda is essential for bauxite refining in aluminum production.

-

5. What are the key restraints of the market?High electricity costs, strict environmental regulations, chlorine demand dependency, and logistics challenges act as major restraints.

Need help to buy this report?