India Carbon Dioxide Market Size, Share, and COVID-19 Impact Analysis, By Source (Hydrogen, Ethyl Alcohol, Ethylene Oxide, Substitute Natural Gas, Others), By Application (Food & Beverages, Oil & Gas, Medical, Rubber, Fire Fighting, Others), and India Carbon Dioxide Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Carbon Dioxide Market Insights Forecasts to 2035

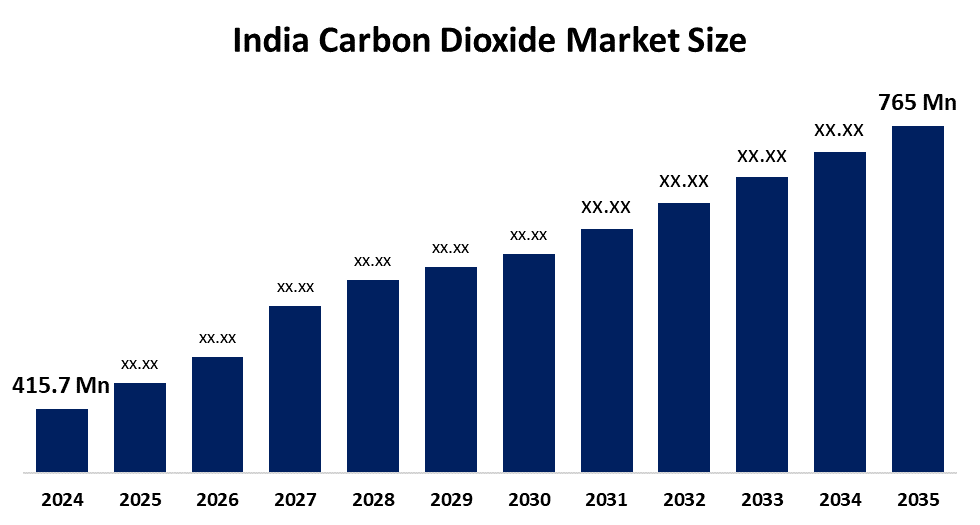

- The India Carbon Dioxide Market Size Was Estimated at USD 415.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.7% from 2025 to 2035

- The India Carbon Dioxide Market Size is Expected to Reach USD 765 Million by 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The India Carbon Dioxide Market Size Is Anticipated To Reach USD 765 Million By 2035, Growing At A CAGR Of 5.7% From 2025 To 2035. The India carbon dioxide market is driven by rising demand from the food and beverage sector, increasing industrial applications in chemicals and pharmaceuticals, growth in healthcare and medical uses, and expansion in the oil and gas and welding industries.

Market Overview

The India carbon dioxide market refers to the production, distribution, and utilization of carbon dioxide (CO2) across various industries such as food and beverage, healthcare, chemicals, and oil and gas. Carbon dioxide is widely used as a preservative in packaged foods, a refrigerant in cooling systems, and in medical applications such as anesthesia and respiratory treatments. The market is experiencing growth due to increasing demand from the food and beverage sector, industrial expansion in chemicals and pharmaceuticals, rising healthcare requirements, and growing usage in oil and gas operations and welding applications. Urbanization, a growing population, and increased industrial activity further contribute to the market’s expansion.

Key trends in the India carbon dioxide market include the rising adoption of liquid CO2 in beverage carbonation and packaging, which improves shelf life and product quality. Second, the growing use of dry ice in cold chain logistics and e-commerce deliveries enhances the transportation of perishable goods. Third, environmental regulations are driving companies to implement CO2 capture and recycling methods, promoting sustainability. Fourth, the food and beverage sector is witnessing an increase in demand for ready-to-drink beverages, processed foods, and packaged products, which rely heavily on CO2 for preservation and carbonation. These trends collectively highlight the market’s focus on efficiency, sustainability, and expanding applications.

Technological advancements are shaping the India carbon dioxide market, with innovations in CO2 capture and purification techniques allowing industries to utilize high-purity CO2 for medical and industrial use. New technologies in dry ice production and storage improve logistics and reduce wastage. Additionally, integration of automation and IoT in CO2 monitoring and distribution systems ensures precise handling and safety compliance. Emerging research in carbon capture and utilization (CCU) is also enabling the transformation of CO2 into value-added chemicals, fuels, and other industrial products, supporting both environmental sustainability and economic growth. These technological developments are strengthening the market’s efficiency, scalability, and application diversity.

Report Coverage

This research report categorizes the market for the India carbon dioxide market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India carbon dioxide market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India carbon dioxide market.

India Carbon Dioxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 415.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.7% |

| 2035 Value Projection: | USD 765 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Source, By Application |

| Companies covered:: | Sicgil India Limited, Southern Petrochemical Industries Corporation Limited (SPIC), Punjab Carbonic Private Limited, indian farmers fertilizer cooperative limited (IFFCO), National Fertilizers Limited, nagarjuna fertilizers and chemicals limited, Bathinda Industrial Gases Pvt. ltd., Inox Air Products, India Glycols Limited, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India carbon dioxide market is primarily driven by increasing demand from the food and beverage industry, where CO2 is used for carbonation, preservation, and packaging. Industrial growth in chemicals, pharmaceuticals, and metal processing further fuels demand. Rising healthcare applications, including medical-grade CO2 for surgeries and respiratory treatments, contribute significantly. Expansion in oil and gas operations, welding, and cold chain logistics also boosts market growth. Additionally, urbanization, rising disposable income, and government initiatives supporting industrial development enhance the overall demand for carbon dioxide across various sectors.

Restraining Factors

The India carbon dioxide market faces restraints due to supply shortages linked to dependence on ammonia and hydrogen plants. Fluctuating raw material availability, high transportation and storage costs, and safety concerns related to handling and distribution further limit market growth, especially in remote and price-sensitive regions.

Market Segmentation

The India carbon dioxide market share is classified into source and application.

- The hydrogen segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India carbon dioxide market is segmented by source into hydrogen, ethyl alcohol, ethylene oxide, substitute natural gas, and others. Among these, the hydrogen segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The hydrogen segment dominates the market due to its strong linkage with ammonia and fertilizer production, where CO2 is generated as a by-product. India has a well-established fertilizer industry, ensuring a continuous and large-volume CO2 supply. This source offers cost advantages, stable availability, and easy integration with existing industrial infrastructure, making it more reliable than ethyl alcohol, ethylene oxide, or substitute natural gas sources.

- The food & beverages segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India carbon dioxide market is segmented by application into food & beverages, oil & gas, medical, rubber, firefighting, and others. Among these, the food & beverages segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The food and beverages segment dominates the market due to the widespread use of CO2 in carbonated drinks, packaged foods, and food preservation processes. Rapid urbanization, changing consumer lifestyles, and rising demand for ready-to-drink beverages and processed foods support this growth. Additionally, the expansion of cold chain logistics and food safety standards increases the need for CO2 in refrigeration and modified atmosphere packaging across India.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India carbon dioxide market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sicgil India Limited

- Southern Petrochemical Industries Corporation Limited (SPIC)

- Punjab Carbonic Private Limited

- indian farmers fertilizer cooperative limited (IFFCO)

- National Fertilizers Limited

- nagarjuna fertilizers and chemicals limited

- Bathinda Industrial Gases Pvt. ltd.

- Inox Air Products

- India Glycols Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India carbon dioxide market based on the below-mentioned segments:

India Carbon Dioxide Market, By Source

- Hydrogen

- Ethyl Alcohol

- Ethylene Oxide

- Substitute Natural Gas

- Others

India Carbon Dioxide Market, By Application

- Food & Beverages

- Oil & Gas

- Medical

- Rubber

- Fire Fighting

- Others

Frequently Asked Questions (FAQ)

-

1.what is carbon dioxide mainly used for in India?Carbon dioxide is widely used in food and beverage carbonation, medical procedures, welding, firefighting systems, and industrial processing.

-

2. Which industry consumes the most carbon dioxide in India?The food and beverage industry is the largest consumer due to its use in soft drinks, packaged foods, and cold storage.

-

3. Why is the carbon dioxide supply sometimes unstable in India?Supply depends heavily on fertilizer and ammonia plants, so plant shutdowns or maintenance can disrupt availability.

-

4. Is medical-grade carbon dioxide different from industrial-grade carbon dioxide?Medical-grade carbon dioxide requires higher purity levels and strict quality standards for safe healthcare use.

-

5. How does carbon dioxide support cold chain logistics?It is used as dry ice to maintain low temperatures during the transport of vaccines, food, and pharmaceuticals.

-

6. What role does carbon dioxide play in firefighting?Carbon dioxide is used in fire extinguishers to suppress fires without leaving residue or damaging equipment.

Need help to buy this report?