India Cannabis Cultivation Market Size, Share, By Biomass (Hemp And Marijuana), By Application (Medical, Adult Use, And Industrial), And India Cannabis Cultivation Market Insights, Industry Trend, Forecasts to 2035.

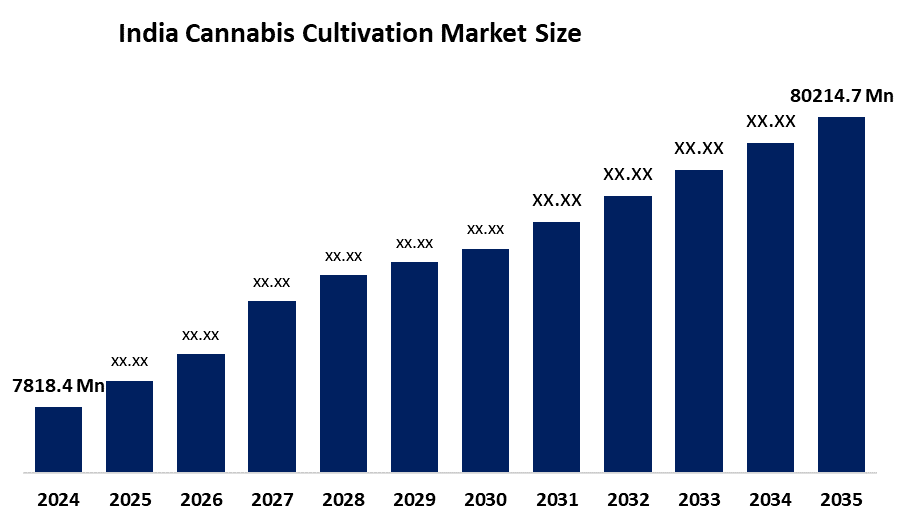

Industry: Healthcare- India Cannabis Cultivation Market Size 2024: USD 7818.4 Mn

- India Cannabis Cultivation Market Size 2035: USD 80214.7 Mn

- India Cannabis Cultivation Market CAGR 2024: 23.57%

- India Cannabis Cultivation Market Segments: Biomass and Application

Get more details on this report -

India cannabis cultivation market is the growing and commercialising of the cannabis sativa plant for multiple applications, including industrial hemp, medical use, and possibly regulated consumer goods. The cannabis cultivation market in India includes the growing of the plant for industrial hemp and enforcing the growing of the plant for other products downstream, which allows downstream industries to benefit from the way that processed and finished cannabis-derived products can be used across multiple industries including textiles, health and wellness products, food and beverage products, cosmetics and pharmaceuticals. Overall, this market is focused on the cultivation of industrial hemp to produce fibres, seeds, oils, textiles, paper, building materials, nutraceuticals, and cosmetics as well as the cultivation of medical cannabis for pharmaceutical and ayurvedic formulations.

The cannabis cultivation in India are backed by government support, including the "Green to Gold" programme, which aims to cultivate industrial hemp in a regulated manner in order to transform cannabis from a historically wild plant into an agricultural product of high value. The programme is expected to result in substantial annual revenue and support farmers and young people by allowing them to grow hemp legally and sustainably. The agricultural trade and export monitoring organisation, which is closely associated with official government sources, has estimated that India will produce between 10,000 and 15,000 metric tonnes of hemp each year, according to a framework developed by individual states and in keeping with the guidelines of the national NDPS Act.

As technology advances, India’s cannabis cultivation providers are now using precision agriculture technology along with the use of drones and space satellite technology will help to comply with India’s cannabis regulations while maintaining healthy crops. With the advancements made in seed genetic research for hemp, there is been more hemp seeds created that produce high yields and have lower THC content. Digital marketplaces and online marketplaces have improved distribution through increased consumer access and decreased cost-to-consumer for legal cannabis products. These new technologies have allowed for more efficient cultivation, monitoring, and value addition in all areas of the cannabis supply chain, creating higher productivity and traceability of the cannabis market.

Market Dynamics of the India Cannabis Cultivation Market:

The India cannabis cultivation market is driven by the demand for cannabis products rise, hemp–based wellness products gain support, supporting evidence for traditional use of cannabis in ayurvedic and wellness products leads to increased acceptance of cannabis products, more access to online platforms increases accessibility to consumers, increased market visibility requires less water and pesticides to grow sustainable agricultural crop, technological advancement and government support further drives the market.

The India cannabis cultivation market is restrained by the legal and regulatory restrictions, limits large-scale adoption, complex licensing procedures and ambiguity in enforcement, persistent illegal cultivation and complex government regulation for legitimate businesses.

The future of India cannabis cultivation market is bright and promising, with versatile opportunities emerging from the increasing worldwide acceptance of cannabis for medical, industrial, and wellness purposes represents a new opportunity for exports. Additionally, the increased value from processing into textiles, nutraceuticals, CBD oils, edibles, cosmetics and eco-friendly building materials can provide new revenue as well. Further, as regulatory frameworks continue to change and increasing numbers of states begin to contemplate issuing controlled cultivation licenses, investment and research opportunities related to seed genetics, processing infrastructure and product formulation are expected to grow substantially.

India Cannabis Cultivation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7818.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 23.57% |

| 2035 Value Projection: | USD 80214.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Bombay Hemp Company, India Hemp Organics, HempCann Solutions, Health Horizons, Himalayan Hemp, Ananta Hemp Works, Satliva, Cannarma, Awshad, Qurist, Wholeleaf, India Hemp & Co., HempStreet, Cure By Design, B.E Hemp India, Others, and Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India Cannabis Cultivation Market share is classified into biomass and application.

By Biomass:

The India cannabis cultivation market is divided by biomass into hemp and marijuana. Among these, the hemp segment held the largest revenue market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Strict government controls on cannabis for recreational use, leveraging sustainability and versatility, and heavy investment of country in developing hemp processing and manufacturing all contribute to the hemp segment's largest share and higher spending on cannabis cultivation when compared to other biomass.

By Application:

The India cannabis cultivation market is divided by application into medical, adult use, and industrial. Among these, the industrial segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The industrial segment dominates because of established business of hemp cultivation for variety of industrial purposes including textiles and fibre, nutraceuticals, cosmetics and pharmaceuticals sector supported by government.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India cannabis cultivation market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Cannabis Cultivation Market:

- Bombay Hemp Company

- India Hemp Organics

- HempCann Solutions

- Health Horizons

- Himalayan Hemp

- Ananta Hemp Works

- Satliva

- Cannarma

- Awshad

- Qurist

- Wholeleaf

- India Hemp & Co.

- HempStreet

- Cure By Design

- B.E Hemp India

- Others

Recent Developments in India Cannabis Cultivation Market:

In January 2025, The Himachal Pradesh government approved a pilot project for the controlled cultivation of cannabis for medicinal and industrial purposes. The initiative aimed to boost the state’s rural economy, leverage the plant for sustainable materials, and support Ayurveda-Linked Industries.

In March 2024, BOHECO, a leading cannabis health-tech company, raised $2.04 million in series funding to expand its operation, which include R&D and manufacturing of cannabis-derived wellness products.

In November 2023, HempStreet Company provides cannabis formulations and medical consultations via a network of Ayurveda practitioners and raised $1 million in seed funding.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the India cannabis cultivation market based on the below-mentioned segments:

India Cannabis Cultivation Market, By Biomass

- Hemp

- Marijuana

India Cannabis Cultivation Market, By Application

- Medical

- Adult Use

- Industrial

Frequently Asked Questions (FAQ)

-

Q: What is the India cannabis cultivation market size?A: India cannabis cultivation market is expected to grow from USD 7818.4 million in 2024 to USD 80214.7million by 2035, growing at a CAGR of 23.57% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rising demand for medical cannabis products, acceptance of hemp-based wellness offerings are expanding, traditional use of cannabis in ayurvedic and wellness products supports broader acceptance, increased online platforms are improving accessibility for consumers and businesses, elevating market visibility requiring less water and fewer pesticides make it attractive as a sustainable agricultural crop with multiple industrial uses.

-

Q: What factors restrain the India cannabis cultivation market?A: Constraints include the legal and regulatory restrictions, limits large-scale adoption, complex licensing procedures and ambiguity in enforcement, persistent illegal cultivation and complex government regulation for legitimate businesses.

-

Q: How is the market segmented by biomass?A: The market is segmented into hemp and marijuana.

-

Q: Who are the key players in the India cannabis cultivation market?A: Key companies include Bombay Hemp Company, India Hemp Organics, HempCann Solutions, Health Horizons, Himalayan Hemp, Ananta Hemp Works, Satliva, Cannarma, Awshad, Qurist, Wholeleaf, India Hemp & Co., HempStreet, Cure By Design, B.E Hemp India, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?