India Butyl Acrylate Market Size, Share, By Product Type (I-Butyl Acrylate, N-Butyl Acrylate, And T-Butyl Acrylate), By Purity (High Purity And Common Purity), And India Butyl Acrylate Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Butyl Acrylate Market Insights Forecasts to 2035

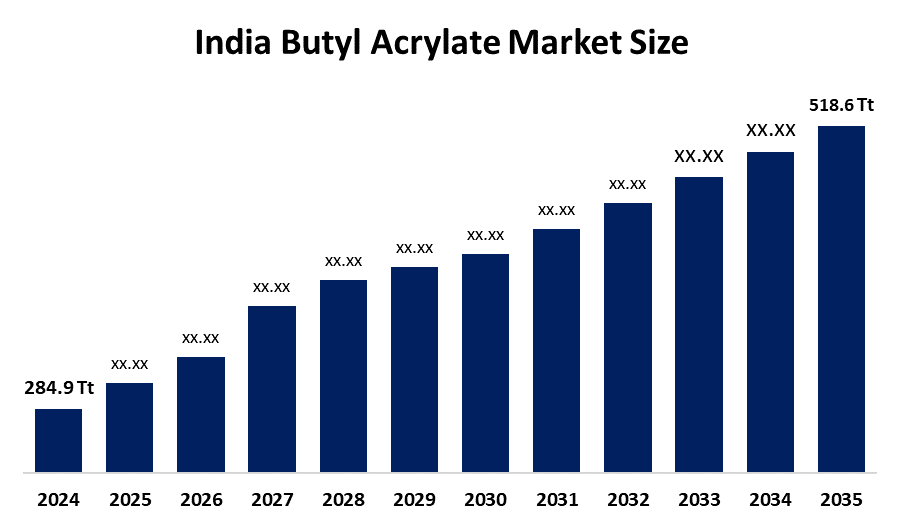

- India Butyl Acrylate Market Size 2024: 284.9 Thousand Tonnes

- India Butyl Acrylate Market Size 2035: 518.6 Thousand Tonnes

- India Butyl Acrylate Market CAGR 2024: 5.6%

- India Butyl Acrylate Market Segments: Product Type and Purity

Get more details on this report -

The India Butyl Acrylate Market Size encompasses the production, selling, and consumption of butyl acrylate across multiple industries, including construction and textiles. In the construction industry, butyl acrylates provide flexibility for these materials as well as chemical resistance. In addition to being used in construction materials, butyl acrylates can also be found in adhesives, sealants, paints, coatings, printing inks, textiles, and other plastic additives. The largest consumers of butyl acrylate in India are located in western India, namely Gujarat and Maharashtra, where there is a high level of chemical manufacturing and downstream manufacturing prevalence.

The butyl acrylate in India are backed by government support, including the Make in India campaign, aims to strengthen domestic chemical manufacturing by attracting investment, offering incentives, and reducing reliance on imports. Under this initiative, the government allocated significant funding approximately INR 2 trillion for chemical industry development to support facility creation and expansion in 2024 and beyond, fostering local production of specialty and intermediate chemicals such as butyl acrylate.

As technology advances, India’s butyl acrylate providers are now working hard on increasing production capacity, improving process efficiency, and being are more sustainable than ever before. Many of the new industrial developments in the last year have converted refinery by products into the raw materials that acrylic acid or butyl acrylate, thereby improving domestic supply and reducing reliance on imports. Capacity expansions are generally paired with modern catalytic processes and digital automation that improve yield and quality and provide downstream manufacturers of paints, adhesives, and plastics with more consistent and lower-cost supplies and lower energy consumption.

India Butyl Acrylate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 284.9 Thousand Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.6% |

| 2035 Value Projection: | 518.6 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type ,By Purity |

| Companies covered:: | BASF SE, Arkema, Mitsubishi Chemical Group, Nippon Shokubai Co., Ltd., LG Chem, Dow, Antares Chem Private Limited, A.B. Enterprises, Acme Synthetic Chemicals, Pravin Dyachem Pvt. Ltd., Sanjay Chemicals India Pvt Ltd., Triveni Chemicals, Colorchem Industries Ltd., Solvo Chem, Hwatsi Chemical Private Limited, and Other Key Players |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Market Dynamics of the India Butyl Acrylate Market:

The India Butyl Acrylate Market Size is driven by the growth in construction, automotive, and packaging sectors, rapid urbanization, increased investments in residential and commercial infrastructure, huge demand for paints, coatings, and sealants, expanding industrial output, high consumer preferences toward water-based and low-VOC formulations, and increase in environmental and health benefits.

The India Butyl Acrylate Market Size is restrained by the environmental and regulatory compliance costs, chemical production and disposal standards challenges, hazardous waste and air quality frameworks, higher operational expenses, supply chain risks and price volatility.

The future of India Butyl Acrylate Market Size is bright and promising, with versatile opportunities emerging from the expansion of infrastructure and the downstream Industries. There is an opportunity to continue diversifying into higher performance and specialized grades of butyl acrylate that are customized for use in medical adhesives, advanced coatings and niche polymer applications with the ability to command premium pricing and provide new opportunities for use. Additionally, the shifting of the marketplace include more bio-based and sustainable formulation systems supports globally growing environmental priorities and will capture segments within emerging markets.

Market Segmentation

The India Butyl Acrylate Market share is classified into product type and purity.

By Product Type:

The India Butyl Acrylate Market Size is divided by product type into i-butyl acrylate, n-butyl acrylate, and t-butyl acrylate. Among these, the n-butyl acrylate segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Growth in construction and automotive sectors, providing a balance of flexibility and hardness, ideal for high performance applications, urbanization, and super durability all contribute to the n-butyl acrylate segment's largest share and higher spending on styrene when compared to other product type.

By Purity:

The India Butyl Acrylate Market Size is divided by purity into high purity and common purity. Among these, the high purity segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The high purity segment dominates because of high consistency, efficiency in polymerization reactions, superior performance in high performance coatings, adhesives, and sealants, and increased demand for high purity standards in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Butyl Acrylate Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Butyl Acrylate Market:

- BASF SE

- Arkema

- Mitsubishi Chemical Group

- Nippon Shokubai Co., Ltd.

- LG Chem

- Dow

- Antares Chem Private Limited

- A.B. Enterprises

- Acme Synthetic Chemicals

- Pravin Dyachem Pvt. Ltd.

- Sanjay Chemicals India Pvt Ltd.

- Triveni Chemicals

- Colorchem Industries Ltd.

- Solvo Chem

- Hwatsi Chemical Private Limited

- Others

Recent Developments in India Butyl Acrylate Market:

In January 2026, Bharat Petroleum Corporation Limited was the sole domestic producer of butyl acrylate monomer, attributed to factors like seasonal demand and higher feedstock prices.

In July 2025, IndianOil’s first-ever butyl acrylate plant at the Gujarat Refinery Complex in Vadodara was commissioned. This facility has an annual production capacity of 150 KTA and aimed to reduce India’s reliance on imports, as the country previously depended entirely on imports for this product.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Decisions Advisors has segmented the India Butyl Acrylate Market Size based on the below-mentioned segments:

India Butyl Acrylate Market, By Product Type

- I-Butyl Acrylate

- N-Butyl Acrylate

- T-Butyl Acrylate

India Butyl Acrylate Market, By Purity

- High Purity

- Common Purity

Frequently Asked Questions (FAQ)

-

Q: What is the India butyl acrylate market size?A: India butyl acrylate market is expected to grow from 284.9 thousand tonnes in 2024 to 518.6 thousand tonnes by 2035, growing at a CAGR of 5.6% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the growth in construction, automotive, and packaging sectors, rapid urbanization, increased investments in residential and commercial infrastructure, huge demand for paints, coatings, and sealants, expanding industrial output, high consumer preferences toward water-based and low-VOC formulations, and increase in environmental and health benefits.

-

Q: What factors restrain the India butyl acrylate market?A: Constraints include the environmental and regulatory compliance costs, chemical production and disposal standards challenges, hazardous waste and air quality frameworks, higher operational expenses, supply chain risks and price volatility.

-

Q: How is the market segmented by product type?A: The market is segmented into i-butyl acrylate, n-butyl acrylate, and t-butyl acrylate.

-

Q: Who are the key players in the India butyl acrylate market?A: Key companies include BASF SE, Arkema, Mitsubishi Chemical Group, Nippon Shokubai Co., Ltd., LG Chem, Dow, Antares Chem Private Limited, A.B. Enterprises, Acme Synthetic Chemicals, Pravin Dyachem Pvt. Ltd., Sanjay Chemicals India Pvt Ltd., Triveni Chemicals, Colorchem Industries Ltd., Solvo Chem, Hwatsi Chemical Private Limited, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?