India Bromine Market Size, Share, and COVID-19 Impact Analysis, By Derivative (Organo Bromine, Clear Brine Fluids, Hydrogen Bromide, and Other), By Application (Flame Retardants, Oil & Gas Drilling, PTA Synthesis, Water Treatment, and Other), and India Bromine Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Bromine Market Size Insights Forecasts To 2035

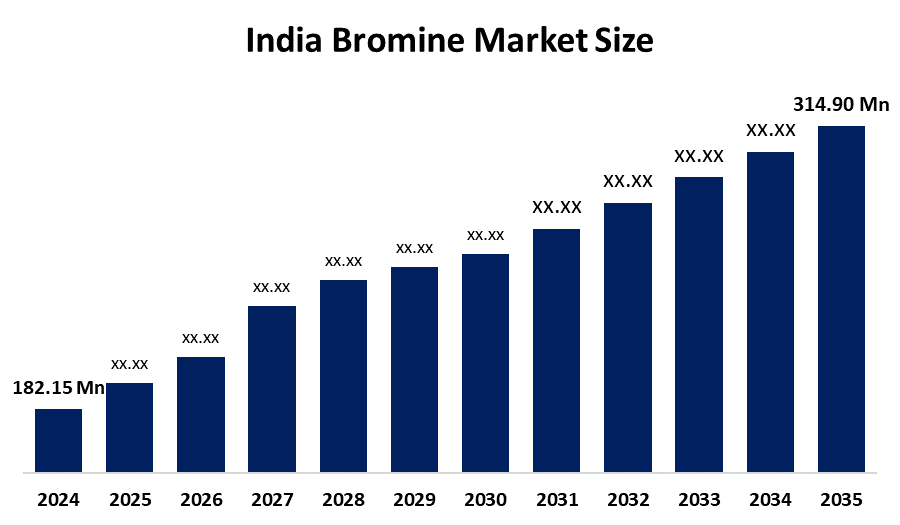

- The India Bromine Market Size Was Estimated at USD 182.15 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.1% from 2025 to 2035

- The India Bromine Market Size is Expected to Reach USD 314.90 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The India Bromine Market Size Is Anticipated To Reach USD 314.90 Million By 2035, Growing At A CAGR Of 5.1% From 2025 To 2035. The India bromine market is driven by rising demand from pharmaceuticals, agrochemicals, flame retardants, and water treatment industries, supported by expanding chemical manufacturing, increasing industrialization, infrastructure development, and growing use of bromine derivatives in specialty and high-value applications.

Market Overview

The India bromine market size involves the production, distribution, and consumption of bromine and its derivatives, which are widely used in pharmaceuticals, flame retardants, agrochemicals, and water treatment applications. Bromine is a versatile halogen element known for its chemical reactivity and utility in specialty chemicals. The market is witnessing steady growth due to increasing industrialization, expansion of the chemical manufacturing sector, and rising demand from end-use industries such as agriculture, pharmaceuticals, and electronics. Additionally, government initiatives promoting industrial development and the growing need for high-performance materials are contributing to the market’s positive trajectory.

Several trends are shaping the India bromine market size. First, the rising demand for flame retardants in construction, electronics, and automotive industries is boosting bromine consumption. Second, growth in pharmaceuticals is driving demand for brominated intermediates used in drug synthesis. Third, the expansion of the agrochemical sector is increasing the use of bromine-based pesticides and fumigants. Fourth, environmentally friendly applications, such as water treatment and eco-friendly flame retardants, are gaining traction, supporting sustainable growth. These trends indicate a diversification of bromine applications and highlight its importance in high-value industries.

Technological advancements are enhancing bromine production efficiency and reducing environmental impact. Modern extraction techniques from brine and seawater, coupled with improved purification processes, are increasing yield and quality. Innovations in brominated flame retardants and specialty bromine derivatives are expanding their applicability in electronics and pharmaceuticals. Furthermore, research into green bromine technologies and catalytic bromination processes is helping reduce hazardous byproducts, promoting sustainable chemical manufacturing, and providing cost-effective solutions to meet growing industrial demand.

Report Coverage

This research report categorizes the market size for the India bromine market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India bromine market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India bromine market.

India Bromine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 182.15 Million I |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 5.1% |

| 2023 Value Projection: | USD 314.90 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Derivative, By Application |

| Companies covered:: | Archean Chemical Industries Ltd, Satyesh Brine Chem, Agrocel Industries Pvt. Ltd, Nirma Limited, Tata Chemicals Ltd, Dev Salt Private Ltd, Lanxess India Private Limited, Israel Chemicals Ltd. (ICL), Albemarle Corporation, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India bromine market size is primarily driven by increasing demand from key end-use industries such as pharmaceuticals, agrochemicals, flame retardants, and water treatment. Rapid industrialization, expanding chemical manufacturing, and growing infrastructure projects are further boosting consumption. Rising awareness of fire safety standards in construction, electronics, and automotive sectors has accelerated the adoption of brominated flame retardants. Additionally, the surge in specialty chemical production, coupled with government initiatives supporting industrial growth and technological advancements in bromine extraction and processing, is propelling market expansion and creating new high-value applications.

Restraining Factors

The India bromine market size faces restraints due to environmental and health concerns associated with bromine handling and disposal. High production costs, complex extraction processes, and stringent government regulations on chemical emissions also limit growth. Additionally, the availability of alternative chemicals and substitutes in flame retardants and water treatment applications poses challenges to market expansion.

Market Segmentation

The India bromine market share is classified into derivative and application.

- The organo bromine segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India bromine market size is segmented by derivative into organo bromine, clear brine fluids, hydrogen bromide, and other. Among these, the organo bromine segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of the organo-bromine segment in the market is driven by its extensive use in flame retardants, pharmaceuticals, and agrochemicals, which are high-growth industries in the country. Organobromine compounds offer superior chemical reactivity and versatility, making them essential for specialty chemical applications. Rising industrialization, increased construction activities, and stricter fire safety regulations in electronics and automotive sectors further boost demand. This combination of broad applicability and growing end-use requirements positions organo bromine as the leading segment in the market.

- The flame retardants segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India bromine market size is segmented by application into flame retardants, oil & gas drilling, PTA synthesis, water treatment, and other. Among these, the flame retardants segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The flame retardants segment dominates the market size because of the rising emphasis on fire safety across the construction, electronics, and automotive industries. Brominated flame retardants are highly effective and widely used in building materials, electronic devices, and vehicles to meet strict safety standards. Rapid industrialization, urban development, and growth in electronics and infrastructure sectors are significantly boosting demand. Additionally, increasing awareness of safety regulations and the need for durable, fire-resistant materials further reinforces flame retardants as the leading application segment in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India bromine market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archean Chemical Industries Ltd

- Satyesh Brine Chem

- Agrocel Industries Pvt. Ltd

- Nirma Limited

- Tata Chemicals Ltd

- Dev Salt Private Ltd

- Lanxess India Private Limited

- Israel Chemicals Ltd. (ICL)

- Albemarle Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India bromine market based on the below-mentioned segments:

India Bromine Market, By Derivative

- Organo Bromine

- Clear Brine Fluids

- Hydrogen Bromide

- Other

India Bromine Market, By Application

- Flame Retardants

- Oil & Gas Drilling

- PTA Synthesis

- Water Treatment

- Other

Frequently Asked Questions (FAQ)

-

What is the India bromine market?The India bromine market refers to the production, distribution, and consumption of bromine and its derivatives, used in flame retardants, pharmaceuticals, agrochemicals, water treatment, and other specialty chemical applications.

-

What are the key drivers of the India bromine market?Key drivers include rising demand from pharmaceuticals, agrochemicals, and flame retardants, industrial growth, urbanization, increasing fire safety regulations, and technological advancements in bromine production.

-

Which bromine derivative dominates the market?The organobromine segment dominates due to its extensive applications in flame retardants, pharmaceuticals, and agrochemicals.

-

Which application segment is the largest?Flame retardants are the largest application segment, driven by demand from construction, electronics, and automotive sectors requiring fire-safe materials.

-

What are the major challenges in this market?Challenges include environmental and health concerns, high production costs, stringent regulations, and the presence of chemical substitutes.

Need help to buy this report?