India Bisphenol S Market Size, Share, By Application (Thermal Paper Coating, Epoxy Resins, Dyes & Dye Intermediates, Engineering Plastics & Polymers, And Others), By End Use (Packaging, Electronics & Electrical, Automotive, Healthcare, Food & Beverages, And Others), And India Bisphenol S Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Bisphenol S Market Insights Forecasts to 2035

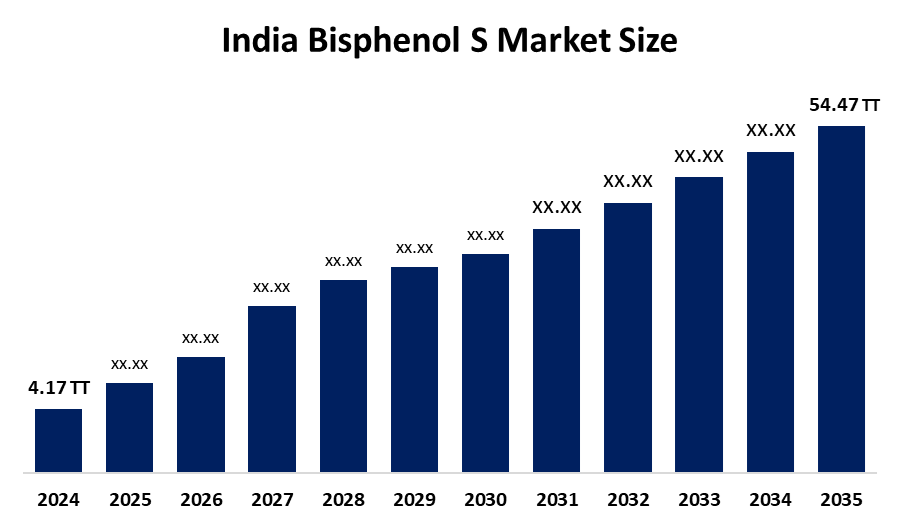

- India Bisphenol S Market 2024: 4.17 Thousand Tonnes

- India Bisphenol S Market Size 2035: 54.47 Thousand Tonnes

- India Bisphenol S Market CAGR 2024: 26.32%

- India Bisphenol S Market Segments: Application and End Use

Get more details on this report -

The India bisphenol s (BPS) market is a growing segment of the economy associated with the production, distribution and use of bisphenol s, an organic compound used in polymers, epoxy resins, thermal paper and many other industrial materials as an alternative to bisphenol a (BPA). BPS continues to receive attention as businesses are looking for safer alternatives to BPA due to increased regulatory restrictions on bisphenol in consumer and industrial products. Growth in the Indian market has been strong over the last several years, mostly as a result of increased use of BPS in thermal paper products and epoxy resin products used in construction, textiles and other export opportunities.

The bisphenol s in India are backed by government support, including the Food Safety and Standards Authority of India (FSSAI) to propose amendments to the Food Safety and Standards (Packaging) Regulations, 2018. FSSAI’s draft packaging amendment, open to stakeholder feedback, explicitly targets the elimination of BPA and PFAS from food contact polycarbonate and epoxy resins, indicating a broader shift in policy that could directly impact bisphenol markets and accelerate demand for alternatives like BPS.

As technology advances, India’s bisphenol s providers are now focused on innovative developments that help improve both the uses and designs of BPS related products. Also, the development of new types of plastics or resins will allow manufacturers to manufacture materials of higher quality, with better heat resistance, less negative impact on the environment, and better compatibility with high-performance epoxy-resins used for construction, electronics, and industrial coatings. All of these improvements lead to a larger industrial use, a better reduction in reliance of potentially harmful materials, and an alignment of global trends for Greener Chemical Solutions in India.

Market Dynamics of the India Bisphenol S Market:

The India bisphenol s market is driven by the regulatory pressure to phase out BPA, increased health and environmental concerns, growing demand from end-use industries, robust export opportunities supported by domestic capacity, increasing corporate focus on sustainability and safer chemical profiles, India’s expanding specialty chemicals sector, rising consumption in packaging and industrial applications, and developments in polymer and resin technologies further propel the market growth

.

The India bisphenol s market is restrained by the competitive pressure from low-cost imports, suppress domestic pricing, volatility in feedstock costs, influence on production economics, and ongoing scientific and regulatory scrutiny over bisphenol analogues challenges.

The future of India bisphenol s market is bright and promising, with versatile opportunities emerging from the increasing demand for BPA-free products due to the ever-tightening food safety regulations, the rise in the amount of BPA-free packaging and industrial uses, and the increase of production facilities to support the need for BPA-free products both in India and for export. In addition, India's strategic desire to implement safer chemical regulation, advancements in polymer technology and polymer manufacturing, and the development of global supply chain networks are also creating a opportunities for new investments, product development and creating competitive advantages in the global BPA-free market.

India Bisphenol S Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 4.17 Thousand Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 26.32% |

| 2035 Value Projection: | 54.47 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Application |

| Companies covered:: | Ganesh Polychem Limited, DMCC Speciality Chemicals Ltd., Prasol Chemicals Limited, Triveni Chemicals, Antares Chem Pvt Ltd., A B Enterprises, Pon Pure Chemical India Pvt Ltd., Sanjay Chemicals India Pvt Ltd., Multichem Specialties Pvt Ltd., B P S Product Pvt Ltd., and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India Bisphenol S Market share is classified into application and end use.

By Application:

The India bisphenol s market is divided by application into thermal paper coating, epoxy resins, dyes & dye intermediates, engineering plastics & polymers, and others. Among these, the thermal paper coating segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Rapid expansion of organized retail, e-commerce, and logistics, used as safer alternative to BPA, superior functionality, and cost effective application all contribute to the thermal paper coating segment's largest share and higher spending on bisphenol s when compared to other application.

By End Use:

The India bisphenol s market is divided by end use into packaging, electronics & electrical, automotive, healthcare, food & beverages, and others. Among these, the packaging segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The packaging segment dominates because it is crucial replacement of BPA in food-contact coatings, rapid growth in thermal paper, Expansion of e-commerce and retail, drop-in compatibility of bisphenol s, and provides high performance epoxy coatings.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India bisphenol s market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Bisphenol S Market:

- Ganesh Polychem Limited

- DMCC Speciality Chemicals Ltd.

- Prasol Chemicals Limited

- Triveni Chemicals

- Antares Chem Pvt Ltd.

- A B Enterprises

- Pon Pure Chemical India Pvt Ltd.

- Sanjay Chemicals India Pvt Ltd.

- Multichem Specialties Pvt Ltd.

- B P S Product Pvt Ltd.

- Others

Recent Developments in India Bisphenol S Market:

In October 2025, FSSAI proposed a ban on the use of bisphenol a and its derivatives in food-contact materials. This regulatory development is expected to accelerate the shift towards bisphenol s and other alternatives for food-contact packaging applications, promoting local production of safer alternatives.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India bisphenol s market based on the below-mentioned segments:

India Bisphenol S Market, By Application

- Thermal Paper Coating

- Epoxy Resins

- Dyes & Dye Intermediates

- Engineering Plastics & Polymers

- Others

India Bisphenol S Market, By End Use

- Packaging

- Electronics & Electrical

- Automotive

- Healthcare

- Food & Beverages

- Others

Frequently Asked Questions (FAQ)

-

What is the India bisphenol s market size?India bisphenol s market is expected to grow from 4.17 thousand tonnes in 2024 to 54.47 thousand tonnes by 2035, growing at a CAGR of 26.32% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the regulatory pressure to phase out BPA, increased health and environmental concerns, growing demand from end-use industries, robust export opportunities supported by domestic capacity, increasing corporate focus on sustainability and safer chemical profiles, India’s expanding specialty chemicals sector, rising consumption in packaging and industrial applications, and developments in polymer and resin technologies further propel the market growth.

-

What factors restrain the India bisphenol s market?Constraints include the competitive pressure from low-cost imports, suppress domestic pricing, volatility in feedstock costs, influence on production economics, and ongoing scientific and regulatory scrutiny over bisphenol analogues challenges.

-

How is the market segmented by application?The market is segmented into thermal paper coating, epoxy resins, dyes & dye intermediates, engineering plastics & polymers, and others

-

Who are the key players in the India bisphenol s market?Key companies include Ganesh Polychem Limited, DMCC Speciality Chemicals Ltd., Prasol Chemicals Limited, Triveni Chemicals, Antares Chem Pvt Ltd., A B Enterprises, Pon Pure Chemical India Pvt Ltd., Sanjay Chemicals India Pvt Ltd., Multichem Specialties Pvt Ltd., B P S Product Pvt Ltd., and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?