India Biopharmaceutical Excipients Market Size, Share, and COVID-19 Impact Analysis, By Scale of Operation (Preclinical/Clinical Scale and Commercial Scale), By Type of Modality (Solid, Semi-Solid, and Liquid), By Type of Excipients (Buffering Agents, Lyoprotectant Agents, Solubilizers and Surfactants, Tonicity Agents, pH Adjusting Agents, and Others), By Chemical Component (Carbohydrates, Polymers, Polyols, Proteins/Amino Acids, and Others), and India Biopharmaceutical Excipients Market, Insight, Industry Trend, Forecasts to 2035

Industry: HealthcareIndia Biopharmaceutical Excipients Market Insights Forecasts to 2035

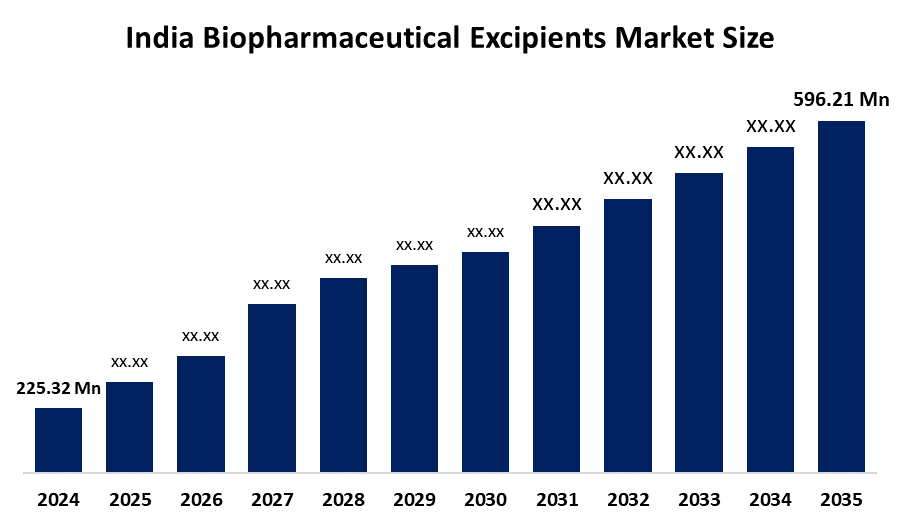

- India Biopharmaceutical Excipients Market Size 2024: USD 225.32 Million

- India Biopharmaceutical Excipients Market Size 2035: USD 596.21 Million

- India Biopharmaceutical Excipients Market CAGR: 8.79%

- India Biopharmaceutical Excipients Market Segments: Scale of Operation, Type of Modality, Type of Excipients, and Chemical Component

Get more details on this report -

Biopharmaceutical excipients are substances incorporated in biologic drugs with active pharmaceutical ingredients (APIs) for the stability, safety, bioavailability, and good efficacy without therapeutic benefits. Excipients act as protectants and play an important role in the stability of sensitive biologics such as antibodies, vaccines, proteins, and other biological products by countering detrimental physical, chemical, or biological conditions that lead to degradation of biologic drugs, such as temperature, light, pH, and agitation. The commonly used excipients in the formulation of biologic drugs are the stabilization, such as sugar and amino acid, buffers to adjust and maintain the pH, solubilizes, preservatives, cry protectants, and bulking agents that are suitable for the formulation type, such as injectable, lyophilized drug and vaccine and maintain the formulation consistent with long shelf-life and efficacy to administer to patients.

The department of pharmaceuticals, under the Ministry of Chemicals and Fertilizers, is responsible for matters related to the pricing and availability of affordable medicines, research and development, and international obligations. With a vision to make India the world’s largest provider of quality medicines at reasonable prices, the department’s efforts align with the Make in India initiative. The PLI Scheme for Pharmaceuticals was approved by the Union Cabinet on 24 February 2021, with a financial outlay of 15,000 crore and the production tenure from FY 2022 to 2023 to FY 2027 to 28, which provides financial incentives to 55 selected applicants for the manufacturing of identified products under three categories for a period of six years. Under this scheme, high-value pharmaceutical products such as patented/off-patented drugs, biopharmaceuticals, complex generics, anti-cancer drugs, and autoimmune drugs, among others, are manufactured.

India is picking up speed with faster progress in biologic drugs, vaccines, and new treatment types, all backed by stronger local manufacturing and national policies pushing independence. Lately, there’s been more interest in ultra-clean additives, fresh kinds of stabilizing agents, along with fat-like carriers used mainly for mRNA shots, copycat biologics, and medicines given through injection, opening doors for homegrown makers to build higher-value products. Firms and labs within the country now pour effort into developing smarter materials: think multi-role plastics, substitutes for common detergents, plus heat-tolerant protectors that follow strict worldwide rules.

Market Dynamics of the India Biopharmaceutical Excipients Market:

Biopharmaceutical excipient use rises as biologics, biosimilars, and advanced treatments grow fast - these need precise materials to stay stable, safe, and effective. Though often overlooked, helper substances gain importance because more people face long-term or complicated health conditions. Monoclonal antibodies join the list of approved products at a faster pace, alongside vaccines plus emerging cell and gene solutions, pushing needs upward. Patient-focused designs like preloaded syringes appear more often now, altering how medicines reach users. Cold storage demands tighten, requiring better ingredients that last longer under pressure. Regulators insist on cleaner components, capable of multiple roles within one formula. Science moves ahead steadily; new methods in delivery systems reshape what formulations can do. Market momentum builds quietly through these combined shifts behind the scenes.

Pricing often blocks progress when it comes to advanced excipients made for biological drugs. These materials are costly and tough to produce at scale. Regulatory demands pile on; every ingredient must pass long rounds of testing just to prove it won’t react badly or break down early. Few ingredients fit the needs of biologic medicines well, which tightens options even more. Problems pop up when inactive components interfere with proteins, possibly weakening how well treatments work. Some formulas require refrigerated transport, adding layers of difficulty.

Biopharmaceutical excipients enhance the stability, safety, and efficacy of biologic drugs by shielding the delicate molecules from deterioration caused by physical and chemical factors. They help to keep the product viable for a longer period of time and also make it possible to have more advanced dosage forms such as prefilled syringes and lyophilized products, which in turn improve patient compliance. Furthermore, they facilitate the development of complex therapies like biosimilars, vaccines, and next-generation biologics.

India Biopharmaceutical Excipients Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 225.32 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 8.79% |

| 2035 Value Projection: | USD 569.21 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Scale of Operation, By Type of Modality |

| Companies covered:: | Ankit Cellulose Ltd. India Glycols Ltd. M. B. Sugars & Pharmaceuticals Ltd. Nitika Pharmaceutical Specialties Pvt. Ltd. Novo Excipients Pvt. Ltd. Oceanic Pharma hem Pvt. Ltd. Rishi Chemical Works Pvt. Ltd. Signet Chemical Corporation Pvt. Ltd. Vinati Organics Ltd. Vinuthana Pharma Tech Pvt. Ltd. Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India biopharmaceutical excipients market share is classified into scale of operation, type of modality, type of excipients, and chemical component.

By Scale of Operation

The India biopharmaceutical excipients market is divided by scale of operation into preclinical/clinical scale and commercial scale. Among these, the commercial scale segment controlled the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The commercial scale segment dominated due to rising biosimilar commercialization, strong domestic manufacturing capacity, export demand, and long-term supply contracts, further supporting its dominance and sustained high growth during the forecast period.

By Type of Modality:

The India biopharmaceutical excipients market is divided by type of modality into solid, semi-solid, and liquid. Among these, the solid segment dominated the market in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The solid segment dominance is driven by their compatibility with lyophilized biologics, lower storage and transportation costs, and widespread use in large-scale manufacturing, further supporting strong demand and sustained growth during the forecast period.

By Type of Excipients:

The India biopharmaceutical excipients market is divided by type of excipient into buffering agents, lyoprotectant agents, solubilizers and surfactants, tonicity agents, pH-adjusting agents, and others. Among these, the buffering agents segment accounted for the highest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This segment growth is supported by their universal use across vaccines, monoclonal antibodies, and biosimilars, along with increasing biologics production and stricter quality requirements, supports both their dominant market share and strong growth outlook.

By Chemical Component:

The India biopharmaceutical excipients market is divided by chemical component into carbohydrates, polymers, polyols, proteins / amino acids, and others. Among these, the carbohydrates segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Carbohydrates segment is led due to their effectiveness in preventing protein aggregation, improving shelf life, compatibility with lyophilization, and broad regulatory acceptance drive both high adoption and strong growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India biopharmaceutical excipients market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Biopharmaceutical Excipients Market:

- Ankit Cellulose Ltd.

- India Glycols Ltd.

- M. B. Sugars & Pharmaceuticals Ltd.

- Nitika Pharmaceutical Specialties Pvt. Ltd.

- Novo Excipients Pvt. Ltd.

- Oceanic Pharma hem Pvt. Ltd.

- Rishi Chemical Works Pvt. Ltd.

- Signet Chemical Corporation Pvt. Ltd.

- Vinati Organics Ltd.

- Vinuthana Pharma Tech Pvt. Ltd.

- Others

Recent Developments in India Biopharmaceutical Excipients Market:

In December 2025, India launched a major initiative to boost its biopharmaceutical manufacturing. This plan aimed to reduce reliance on China for crucial drug components. It also sought to capitalize on the upcoming patent expirations of major global drugs. India focused on becoming a hub for biosimilars and emerging biologics. This strategy strengthened the nation's pharmaceutical industry on the global stage.

In June 2025, the Technology Development Board (TDB) extended support to Nitika Pharmaceutical Specialties Pvt. Ltd., Nagpur, Maharashtra, for the indigenous manufacturing of complex pharmaceutical excipients. The project was also aligned with the Government of India’s Production Linked Incentive (PLI) scheme for pharmaceuticals, under which selected as a beneficiary under Group C– MSME (Pharmaceuticals). TDB’s support complemented the broader national mission of fostering indigenous manufacturing, reducing import dependency, and expanding India’s export potential in high-value pharmaceutical components.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India biopharmaceutical excipients market based on the below-mentioned segments:

India Biopharmaceutical Excipients Market, By Scale of Operation

- Preclinical/Clinical Scale

- Commercial Scale

India Biopharmaceutical Excipients Market, By Type of Modality

- Solid

- Semi-Solid

- Liquid

India Biopharmaceutical Excipients Market, By Type of Excipients

- Buffering Agents

- Lyoprotectant Agents

- Solubilizers And Surfactants

- Tonicity Agents

- pH-Adjusting Agents

- Others

India Biopharmaceutical Excipients Market, By Chemical Component

- Carbohydrates

- Polymers

- Polyols

- Proteins / Amino Acids

- Others

Frequently Asked Questions (FAQ)

-

What are biopharmaceutical excipients?Biopharmaceutical excipients are inactive ingredients added to biologic drugs to improve stability, safety, shelf life, and effectiveness without providing therapeutic action

-

What is the market size of India’s biopharmaceutical excipients market?The market was valued at USD 225.32 million in 2024 and is projected to reach around USD 569.21 million by 2035, growing at a CAGR of 8.79%.

-

Which scale of operation dominates the biopharmaceutical excipients market?The commercial scale segment dominated the market in 2024 due to large-scale biologics production, rising biosimilar commercialization, export demand, and long-term supply contracts

-

Which type of modality leads the biopharmaceutical excipients market?The solid modality segment held the largest share in 2024, supported by its compatibility with lyophilized biologics, better stability, and lower storage and transportation costs

-

Which type of excipient accounts for the highest biopharmaceutical excipient market share?Buffering agents accounted for the highest share in 2024 because maintaining stable pH is critical for vaccines, monoclonal antibodies, and biosimilars

-

Which chemical component segment leads the biopharmaceutical excipients market?The carbohydrates segment led the market due to its wide use as stabilizers and lyoprotectants, strong regulatory acceptance, and effectiveness in preventing protein degradation.

-

What factors are driving the biopharmaceutical excipients market growth in India?Key drivers include rapid growth in biologics and biosimilars, government initiatives like Make in India and PLI schemes, rising vaccine production, innovation in advanced excipients, and increasing demand for patient-friendly drug formats

Need help to buy this report?