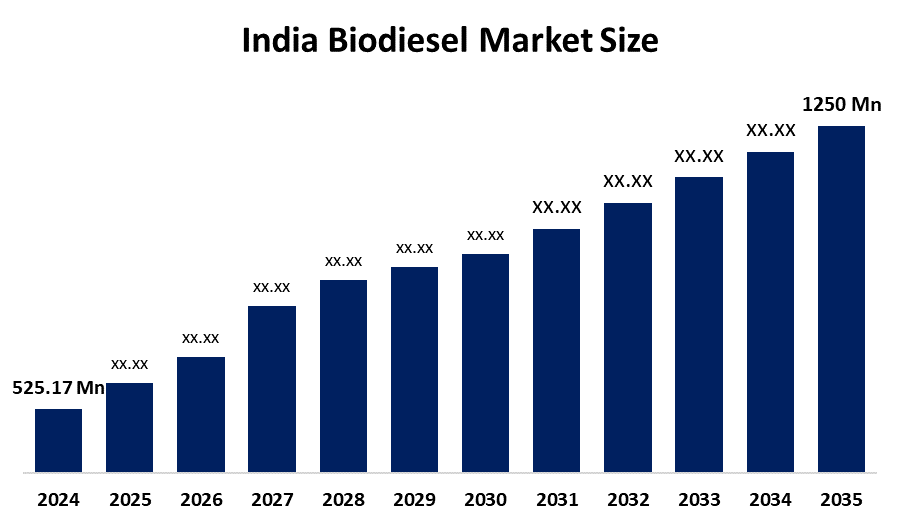

India Biodiesel Market Size Is Expected To Grow From USD 525.17 Million In 2024 To USD 1250 Million By 2035, Growing At A CAGR Of 8.2% During The Forecast Period 2025-2035.

Industry: Chemicals & MaterialsIndia Biodiesel Market Size Insights Forecasts To 2035

- The India Biodiesel Market Size Was Estimated at USD 525.17 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.2% from 2025 to 2035

- The India Biodiesel Market Size is Expected to Reach USD 1250 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The India Biodiesel Market Size Is Anticipated To Reach USD 1250 Million By 2035, Growing At A CAGR Of 8.2% From 2025 To 2035. The India biodiesel market is driven by rising demand for renewable and eco-friendly fuels, government initiatives promoting bioenergy, increasing crude oil prices, growing awareness of environmental pollution, and technological advancements in biodiesel production from feedstocks like jatropha, algae, and waste oils.

Market Overview

The India biodiesel market size refers to the production, distribution, and consumption of bio-based diesel derived from renewable feedstocks such as jatropha, soybean, algae, and used cooking oil. Biodiesel serves as a cleaner alternative to conventional fossil fuels, reducing greenhouse gas emissions and dependency on crude oil imports. The market is witnessing steady growth due to supportive government policies, increasing environmental awareness, rising fuel demand, and advancements in feedstock cultivation and biodiesel production technologies, making India a significant player in the global biofuel sector.

One major trend is the shift toward non-edible feedstocks like jatropha and karanja, ensuring food security while producing biodiesel sustainably. Second, government initiatives and mandates, including blending targets for diesel with biodiesel (B10, B20), are encouraging large-scale adoption. Third, the integration of waste-to-energy approaches, using used cooking oil and industrial waste, is gaining momentum, reducing environmental impact and production costs. Fourth, private sector investment and public-private partnerships are expanding infrastructure for biodiesel refining, storage, and distribution, supporting market expansion. These trends collectively enhance biodiesel availability, cost-effectiveness, and environmental benefits across India.

Technological advancements are reshaping biodiesel production in India. Transesterification process improvements have increased yield efficiency and reduced production time. Enzymatic and heterogeneous catalysis methods are gaining attention for their eco-friendly and cost-efficient profiles. Additionally, algae-based biodiesel research is emerging, offering higher energy density and faster growth cycles compared to conventional feedstocks. Innovations in blending and storage technologies ensure biodiesel stability in varying climatic conditions. Furthermore, digital monitoring, IoT-enabled plants, and AI-assisted feedstock management are optimizing production efficiency, reducing operational costs, and enhancing the scalability of biodiesel operations across India.

Report Coverage

This research report categorizes the market size for the India biodiesel market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India biodiesel market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India biodiesel market.

India Biodiesel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 525.17 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 8.2% |

| 2023 Value Projection: | USD 1250 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Feedstock, By Production Process |

| Companies covered:: | Indian Oil Corporation Limited (IOCL), Bharat Petroleum Corporation Limited (BPCL), Emami Agrotech Limited, G Energetic Biofuels Pvt. Ltd., Biomax Fuels, Biodiesel Technocrats, Indian Biofuels Corporation (IBFC), Jindal Biotech, Praj Industries Limited, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India biodiesel market size is primarily driven by the need to reduce dependence on imported fossil fuels and curb greenhouse gas emissions. Government policies promoting biofuel blending mandates, subsidies, and incentives support market growth. Rising environmental awareness and initiatives to mitigate climate change encourage adoption. Additionally, the availability of diverse feedstocks such as jatropha, algae, and waste oils, along with technological advancements in cost-efficient biodiesel production, further propel the market, making biodiesel a sustainable and economically viable alternative fuel in India.

Restraining Factors

The India biodiesel market size faces restraints due to high production costs compared to conventional diesel and limited availability of non-edible feedstocks. Infrastructure challenges, including inadequate storage, transportation, and distribution networks, hinder large-scale adoption. Additionally, fluctuating crude oil prices and inconsistent government policies can affect profitability, while technical challenges in production and quality standardization further slow market growth.

Market Segmentation

The India biodiesel market share is classified into feedstock and production process.

- The vegetable oils segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India biodiesel market size is segmented by feedstock into vegetable oils, waste cooking oil, tallow, and others. Among these, the vegetable oils segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of the vegetable oils segment in the market is driven by its widespread availability and consistent quality, which ensures higher and more efficient biodiesel yields. Non-edible oils like jatropha and karanja are promoted by government initiatives to avoid competition with food crops, supporting sustainable production. Vegetable oils are easier to process using existing transesterification technologies, and their predictable chemical properties enhance fuel performance. These factors make vegetable oils the most reliable and commercially viable feedstock for India’s biodiesel industry.

- The trans-esterification segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India biodiesel market size is segmented by production process into trans-esterification, hydro-treated vegetable oil, and co-processed/co-refined diesel and other. Among these, the trans-esterification segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of the transesterification segment in the market is due to its efficiency, cost-effectiveness, and adaptability to multiple feedstocks such as vegetable oils and waste cooking oil. It produces high-quality biodiesel compatible with existing diesel engines and blending mandates. The process requires relatively simple infrastructure and lower capital investment compared to hydro-treated or co-processed methods. Additionally, extensive government support, research, and established industrial practices have reinforced transesterification as the preferred and most commercially viable biodiesel production process in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India biodiesel market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Indian Oil Corporation Limited (IOCL)

- Bharat Petroleum Corporation Limited (BPCL)

- Emami Agrotech Limited

- G Energetic Biofuels Pvt. Ltd.

- Biomax Fuels

- Biodiesel Technocrats

- Indian Biofuels Corporation (IBFC)

- Jindal Biotech

- Praj Industries Limited

- Others

Key Target Audience

- Market Players

- Investors

- End Users

- Government Authorities

- Consulting and Research Firms

- Venture Capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India biodiesel market based on the below-mentioned segments:

India Biodiesel Market, By Feedstock

- Vegetable Oils

- Waste Cooking Oil and Tallow

- Other

India Biodiesel Market, By Production Process

- Trans-Esterification

- Hydro-Treated Vegetable Oil

- Co-processed/Co-refined Diesel

- Other

Frequently Asked Questions (FAQ)

-

What is biodiesel?Biodiesel is a renewable, biodegradable fuel produced from vegetable oils, animal fats, or waste oils, used as an alternative to conventional diesel in engines.

-

What are the main feedstocks for biodiesel in India?The main feedstocks include vegetable oils (jatropha, soybean, sunflower), waste cooking oil, and tallow.

-

Which production process is most commonly used in India?The transesterification process is the dominant method due to its cost-effectiveness, efficiency, and scalability.

-

What are the key drivers of the India biodiesel market?Drivers include government biofuel policies, rising crude oil prices, environmental concerns, and availability of diverse feedstocks.

-

What challenges does the biodiesel market face in India?Challenges include high production costs, limited feedstock availability, inadequate infrastructure, and fluctuating crude oil prices.

Need help to buy this report?