India Benzoic Acid Market Size, Share, By Product Form (Liquid, Solid, And Crystalline), By End Use (Food & Beverages, Pharmaceuticals, Chemical Industries, And Others), And India Benzoic Acid Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsIndia Benzoic Acid Market Insights Forecasts to 2035

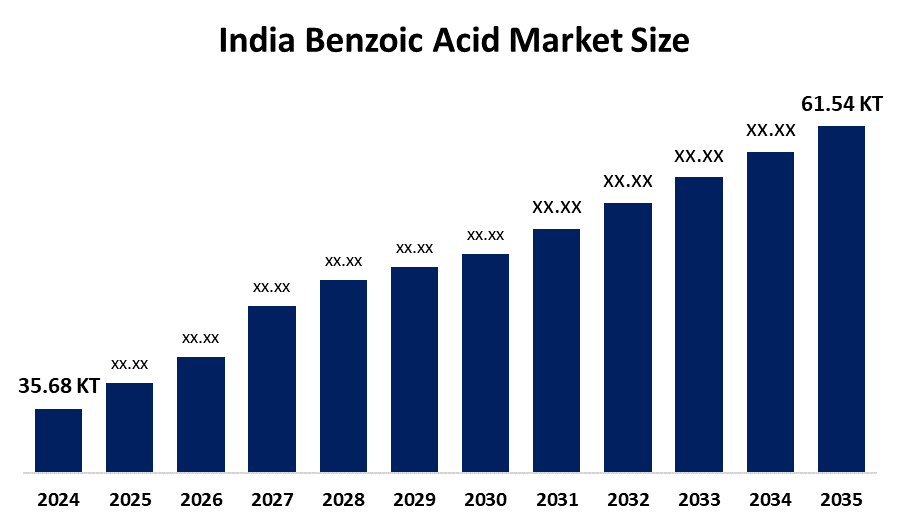

- India Benzoic Acid Market Size 2024: 35.68 Thousand Tonnes

- India Benzoic Acid Market Size 2035: 61.54 Thousand Tonnes

- India Benzoic Acid Market CAGR 2024: 5.08%

- India Benzoic Acid Market Segments: Product Form and End Use

Get more details on this report -

The India Benzoic Acid Market Size includes the manufacturing and distribution of benzoic acid along with the consumption of benzoic acid. It is an organic compound acts as both a preservative and an intermediate for making other chemicals, includes sodium benzoate and potassium benzoate. Benzoic acid is used in many different industries such as food and beverage, pharmaceuticals, plastics, paints, and coatings. Commercially, benzoic acid is produced through the oxidation of toluene and is vital to the preservation of acidic food, stabilization of pharmaceutical preparations and as a precursor for many plasticizers and resin precursors, making it a key component in India's specialty and fine chemical industry.

The benzoic acid in India are backed by government support, including the Production-Linked Incentive (PLI) Scheme for the Chemicals and Petrochemicals Sector, designed to strengthen domestic manufacturing and reduce import reliance by providing incentives on incremental sales of products manufactured in India. India’s chemical industry contributes around 7% of the country’s GDP and about 14% of overall industrial output, while India ranks as the sixth-largest producer of chemicals globally and the third largest in Asia. This statistic underscores the strategic importance of chemicals including benzoic acid to the national economy, and helps explain why domestic consumption and production infrastructure continue to grow.

As technology advances, India’s benzoic acid providers are now using production process through optimising catalyst performance for toluene oxidation and enhancing quality so that products meet demanding end-users in terms of quality and safety. R&D resources are being directed toward developing more sustainable production processes and bio-based options, which allow the refining industry to lower its environmental impacts and comply with industry safety and quality regulations. These technological advances will allow manufacturers to produce more yields at lower costs, while producing greater product consistency, which are key advantages for manufacturers who participate in stringent quality markets for both domestic and export products.

Market Dynamics of the India Benzoic Acid Market:

The India Benzoic Acid Market Size is driven by the rising demand from the food and beverage industry for preservatives, growth of the pharmaceutical and personal care sectors, increasing use in plasticizers and resin, urbanisation, rising disposable incomes, and a growing preference for ready-to-eat and processed foods further support higher demand for benzoic acid applications.

The India Benzoic Acid Market Size is restrained by the regulatory and health concerns related to synthetic preservatives, growing consumer preference for natural alternatives, volatility in raw material prices, and environmental constraints associated with industrial chemical production.

The future of India Benzoic Acid Market Size is bright and promising, with versatile opportunities emerging from the broader usage in animal feeds and cosmetics, greater applicability in chemical derivatives of value, along with the continuous integration of benzoates into green packing and construction. While there is also an opportunity for manufacturers to grow through exporting products outside the country, localising their supply chain would cut down on importing material, as well as focus on developing new, eco-friendly formulas that will satisfy regulatory requirements and consumer wants in India.

India Benzoic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 35.68 Thousand Tonnes |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 5.08% |

| 2035 Value Projection: | 61.54 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By End Use, By Product Form |

| Companies covered:: | SISCO Research Laboratories Pvt. Ltd. Chemcrux Enterprises Ltd. Sanjay Chemicals Halogens Hema Pharmaceuticals Vizag Chemical Central Drug House Ltd. Shreeji Pharma International Friedrich Organic Chemicals India Pvt Ltd. Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India Benzoic Acid Market share is classified into product form and end use.

By Product Form:

The India Benzoic Acid Market Size is divided by product form into liquid, solid, and crystalline. Among these, the crystalline segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Widely used for industrial purposes, easy to handle, fine consistency for uniform distribution, and demand for packaged food and ready-to-drink beverages all contribute to the crystalline segment's largest share and higher spending on benzoic acid when compared to other product form.

By End Use:

The India Benzoic Acid Market Size is divided by end use into food & beverages, pharmaceuticals, chemical industries, and others. Among these, the food & beverages segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The food & beverages segment dominates because of rapid expansion of the packaged, processed food industry, increasing demand for preservatives, rising disposable incomes, and widely accepted as a safe preservative in food industry of India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India benzoic acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Benzoic Acid Market:

- SISCO Research Laboratories Pvt. Ltd.

- Chemcrux Enterprises Ltd.

- Sanjay Chemicals

- Halogens

- Hema Pharmaceuticals

- Vizag Chemical

- Central Drug House Ltd.

- Shreeji Pharma International

- Friedrich Organic Chemicals India Pvt Ltd.

- Others

Recent Developments in India Benzoic Acid Market:

In May 2025, Chemcrux Enterprises Limited established an exclusive purchase and marketing agreement with Deepak Nitrite Limited for Para Nitro Benzoic Acid, aimed at capitalizing on the growing demand for speciality benzoic acid derivatives.

In February 2024, I G Petrochemicals Limited commissioned their PA-5 Phthalic Anhydride plant at Taloja, which includes a 1,000 MTPA capacity for benzoic acid.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Benzoic Acid Market Size based on the below-mentioned segments:

India Benzoic Acid Market, By Product Form

- Liquid

- Solid

- Crystalline

India Benzoic Acid Market, By End Use

- Food & Beverages

- Pharmaceuticals

- Chemical Industries

- Others

Frequently Asked Questions (FAQ)

-

What is the India benzoic acid market size?India benzoic acid market is expected to grow from 35.68 thousand tonnes in 2024 to 61.54 thousand tonnes by 2035, growing at a CAGR of 5.08% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the rising demand from the food and beverage industry for preservatives, growth of the pharmaceutical and personal care sectors, increasing use in plasticizers and resin, urbanisation, rising disposable incomes, and a growing preference for ready-to-eat and processed foods further support higher demand for benzoic acid applications.

-

What factors restrain the India benzoic acid market?Constraints include the regulatory and health concerns related to synthetic preservatives, growing consumer preference for natural alternatives, volatility in raw material prices, and environmental constraints associated with industrial chemical production.

-

How is the market segmented by product form?The market is segmented into liquid, solid, and crystalline.

-

Who are the key players in the India benzoic acid market?Key companies include SISCO Research Laboratories Pvt. Ltd., Chemcrux Enterprises Ltd., Sanjay Chemicals, Halogens, Hema Pharmaceuticals, Vizag Chemical, Central Drug House Ltd., Shreeji Pharma International, Friedrich Organic Chemicals India Pvt Ltd., and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Need help to buy this report?