India Bakery Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Biscuit, Bread, Cakes and Pastries, and Rusk), By Distribution Channel (Convenience Stores, Supermarkets and Hypermarkets, Independent Retailers, Artisanal Bakeries, Online, and Others.), and India Bakery Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsIndia Bakery Market Insights Forecasts to 2035

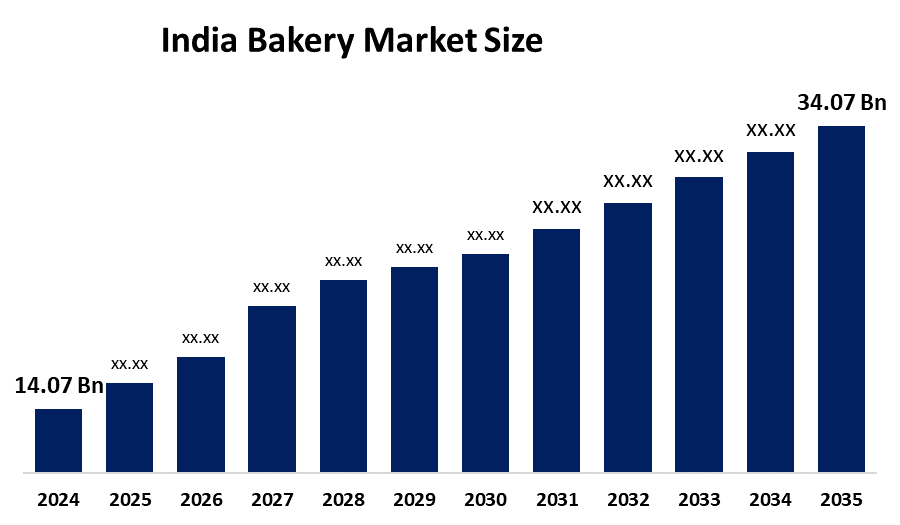

- The India Bakery Market Size Was Estimated at USD 14.07Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.37% from 2025 to 2035

- The India Bakery Market Size is Expected to Reach USD 34.07 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the India bakery market size is anticipated to reach USD 34.07 billion by 2035, growing at a CAGR of 34.07% from 2025 to 2035. The Indian bakery market is growing with the rise in urbanization levels, increase in financial income, changes in dietary habits, and the demand for ready-to-eat and convenience foods. The market is also driven by the rise of organized retailing, online food ordering, and café culture. The development of healthy, premium, and eggless products and the increase in demand from younger generations are also boosting the market.

Market Overview

The India Bakery Market Size operates through its three main activities, which involve producing baked goods, distributing them to various locations, and selling them through retail outlets and food service establishments. This market sector serves as a vital component of the food processing sector in India because it provides products that people consume on a daily basis and during special events. The market has shifted from its original state of local, unorganized bakeries to its current structured system, which includes branded manufacturers and modern retail chains, because urban areas have expanded, consumer spending power has increased, and dietary needs have changed.

The production of bakery products relies on essential ingredients, which include wheat flour, sugar, yeast, eggs, milk, butter, and edible oils, along with cocoa and flavoring agents. The rising health awareness among people has led to the development of three product lines, which include whole grain products, millet-based items, and low-sugar gluten-free vegan options. Young people and professionals who need quick food options make up the main group of customers who eat these products during breakfast and as snacks and desserts and on special festive occasions.

The market experiences growth because supermarkets and online food delivery services and café culture and premium artisanal bakeries continue to expand their presence. The PMFME scheme and the Production Linked Incentive (PLI) scheme for food processing and 100% FDI allowance serve as governmental programs that help businesses in their growth process. The Food Safety and Standards Authority of India (FSSAI) regulations establish food safety requirements and quality control standards and labeling rules and customer protection measures, which together enhance market development.

Report Coverage

This research report categorizes the market forThe India Bakery Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India bakery market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India bakery market.

Driving Factors

India Bakery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.07 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.37% |

| 2035 Value Projection: | USD 34.07 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel |

| Companies covered:: | Britannia Industries Limited, ITC Limited, Parle Products Private Limited, Surya Food and Agro Limited, Theobroma Foods Private Limited, Monginis Foods Private Limited, Anmol Industries Limited, SAJ Food Products Pvt Ltd., Mondelez India Foods Private Limited, Sona Agro Allied Foods Ltd, Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

The India Bakery Market Size gets its momentum from two factors which include the rapid urbanization that raises disposable incomes and changes in food consumption habits which make people prefer convenient ready-to-eat foods. The demand for bread and biscuits and cakes and snack items has increased because there is a large population of young people who are entering the workforce. The expansion of supermarkets and quick-service restaurants and café culture and online food delivery platforms has made it easier for consumers to obtain products. The market expands because consumers increasingly choose premium artisanal products which include healthy eggless options and millet-based bakery items. Government support for the food processing sector also encourages organized manufacturing and investment.

Restraining Factors

The India Bakery Market Size in India mostly constrained by the high price sensitivity among consumers, particularly in rural and semi-urban regions. The production costs of the company increase because raw material prices fluctuate between their base costs and current market rates for wheat, sugar, and edible oils. The unorganized local bakeries which sell low-priced products create strong competition challenges for branded players. The company faces operational difficulties and compliance problems because fresh bakery goods have short shelf lives and storage space is limited while food safety rules must be followed.

Market Segmentation

The India bakery market share is classified into product type and end users.

- The biscuit segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India Bakery Market Size is segmented by product type into biscuit, bread, cakes and pastries, and rusk. Among these, the biscuit segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The biscuit Categorized is growing due to affordable pricing, long shelf life, wide availability across urban and rural markets, rising demand for convenient snacks, increasing health-focused variants, and strong brand presence supported by aggressive marketing and expanding distribution networks.

- The convenience stores segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The India Bakery Market Size is segmented by distribution channel into convenience stores, supermarkets and hypermarkets, independent retailers, artisanal bakeries, online, and others. Among these, the convenience stores segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. These segment is growing due to strong neighbourhood presence, easy accessibility, frequent consumer footfall, and availability of affordable bakery products. Rising impulse purchases, expanding retail networks in semi-urban and rural areas, and quick restocking of fresh items further support sustained growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India bakery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Britannia Industries Limited

- ITC Limited

- Parle Products Private Limited

- Surya Food and Agro Limited

- Theobroma Foods Private Limited

- Monginis Foods Private Limited

- Anmol Industries Limited

- SAJ Food Products Pvt Ltd.

- Mondelez India Foods Private Limited

- Sona Agro Allied Foods Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In September 2025, ITC Foods has Launched fresh Parkaged Cookies, Cakes, and Chapatis under sunfeast and Aashirvaad, targeting the fast - growing quick commerce segment with a small-batch, urban-focused production strategy

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India bakery market based on the below-mentioned segments

India bakery Market, By Product Type

- Biscuit

- Bread

- Cakes and Pastries

- Rusk

India bakery Market, By Distribution channel

- Convenience Stores

- Supermarkets and Hypermarkets

- Independent Retailers

- Artisanal Bakeries

- Online

Others

Frequently Asked Questions (FAQ)

-

Q: What is the India bakery market size?A: India bakery market size is expected to grow from USD 14.07 billion in 2024 to USD 34.07 billion by 2035, growing at a CAGR of 8.37% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by urbanization, rising disposable incomes, expanding retail networks, changing food habits, growing demand for convenient snacks, and increasing preference for premium bakery products.

-

Q: What factors restrain the India bakery market?A: Constraints include the high price sensitivity, fluctuating raw material costs, strong competition from unorganized players, limited shelf life, and strict food safety regulations restrain market growth.

-

Q: Who are the key players in the India bakery market?A: Key players include Britannia Industries, ITC Limited, Parle Products, Surya Food & Agro, Monginis, Theobroma, Anmol Industries, Cremica, Bisk Farm, Modern Foods, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?