India Ammonia Market Size, Share, and COVID-19 Impact Analysis, By Form (Anhydrous Ammonia, Aqueous Ammonia, and Other), By Sales Channel (Direct Sales Channel, Indirect Sales Channel, and Other), and India Ammonia Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Ammonia Market Insights Forecasts to 2035

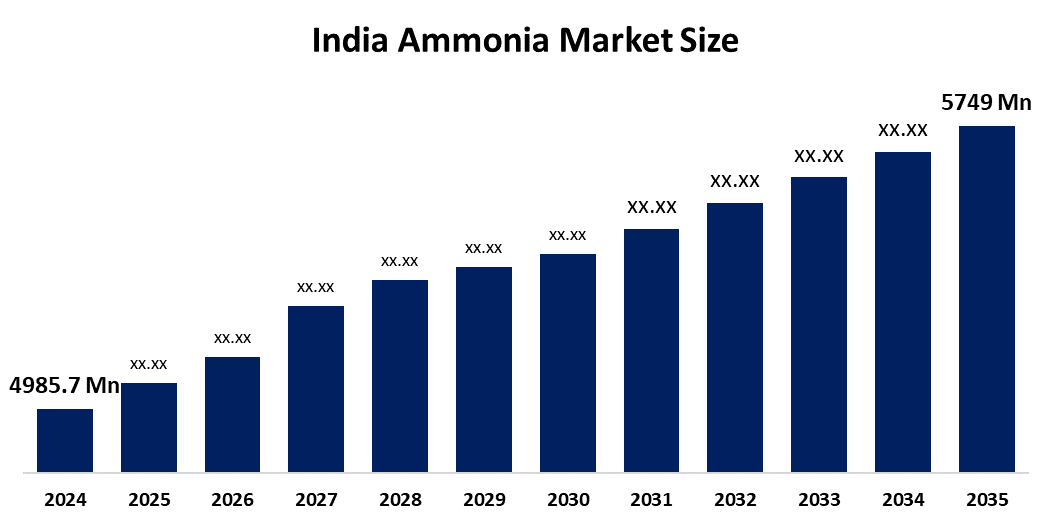

- The India Ammonia Market Size Was Estimated at USD 4985.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 1.3% from 2025 to 2035

- The India Ammonia Market Size is Expected to Reach USD 5749 Million by 2035

Get more details on this report -

According To A Research Report Published By Spherical Insights & Consulting, The India Ammonia Market Size Is Anticipated To Reach USD 5749 Million By 2035, Growing At A CAGR Of 1.3% From 2025 To 2035. The India ammonia market is driven by rising fertilizer demand from agriculture, government subsidies supporting urea production, expansion of chemical and pharmaceutical industries, growing population food needs, and increasing investments in domestic ammonia manufacturing to reduce import dependency.

Market Overview

The India ammonia market refers to the entire chain of producing, distributing, and consuming ammonia (NH), which is a crucial nitrogen compound largely used in fertilizers, chemicals, and various industrial sectors. The market depends greatly on urea and ammonium phosphate manufacturing, which in turn are essential for the productive agriculture needed to feed the ever-increasing population. The major growth factors include the escalating food demand, government incentives for fertilizers, and expanding industrial uses of chemicals, refrigeration, and wastewater treatment. Also, the increase in domestic production capacity and the initiative to minimize import reliance are resulting in continuous market expansion.

One significant trend is the adoption of green ammonia, which is made from renewable energy. Green ammonia is in line with sustainability targets and is environmentally friendly by significantly lowering the carbon footprint. Industrial integration within the region, such as in the states of Gujarat and Punjab, is becoming more efficient in production and distribution via well-planned petrochemical corridors. At the same time, there are growing international partnerships and export directions, wherein the global players are investing in massive ammonia plant projects that would adhere to the standards for low-carbon fuels. Moreover, facility improvements related to storage, handling, and transportation are raising safety levels, helping to increase the volume of trade, and making the products compliant with international standards, thus gaining a good competitive position in the India ammonia market in the world.

Technological innovation is reshaping the market. Traditional Haber-Bosch processes are being enhanced with carbon capture and storage (CCS) to reduce emissions, producing blue ammonia. Electrochemical synthesis and modular production units allow ammonia generation from nitrogen and water using renewable energy under milder conditions, cutting fossil fuel reliance. Adoption of digital twin technology and advanced process analytics is improving operational efficiency and plant performance. Moreover, safer storage and transport solutions are being implemented, strengthening compliance and supporting India’s climate objectives while boosting domestic and export competitiveness.

Report Coverage

This research report categorizes the market for the India ammonia market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India ammonia market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India ammonia market.

India Ammonia Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4985.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 1.3% |

| 2035 Value Projection: | USD 5749 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Form, By Sales Channel |

| Companies covered:: | India Farmers Fertiliser Cooperative Limited (IFFCO), Gujarat State Fertilizer & Chemicals Limited (GSFC), Madras Fertilizers Limited (MFL), National Fertilizers Limited (NFL), Krishak Bharati Co-operative Limited (KRIBHCO), Rashtriya Chemicals and Fertilizers Ltd (RCFL), Deepak Fertilisers and Petrochemicals Corporation Limited (DFPCL), Brahmaputra Valley Fertilizers Corporation Limited, Mysore Ammonia Pvt. Ltd., Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India ammonia market is primarily driven by rising demand for fertilizers, particularly urea and ammonium phosphate, to support the country’s growing population and agricultural productivity. Government subsidies and policies promoting domestic fertilizer production encourage higher ammonia consumption. Expanding industrial applications in chemicals, pharmaceuticals, refrigeration, and wastewater treatment further fuel demand. Increasing investment in domestic ammonia manufacturing reduces reliance on imports, while growing awareness of sustainable and low-carbon ammonia production supports green initiatives. Together, these factors are accelerating market growth and positioning India as a competitive ammonia producer.

Restraining Factors

The India ammonia market faces restraints from high energy and production costs, as traditional ammonia synthesis is energy-intensive and relies heavily on fossil fuels. Supply chain challenges, including raw material price fluctuations and infrastructure limitations, also hinder growth. Additionally, stringent environmental regulations on emissions and carbon footprint pose compliance challenges, slowing large-scale expansion and adoption of conventional ammonia production methods.

Market Segmentation

The India ammonia market share is classified into form and sales channel.

- The anhydrous ammonia segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India ammonia market is segmented by form into anhydrous ammonia, aqueous ammonia, and other. Among these, the anhydrous ammonia segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of anhydrous ammonia in India is primarily due to its high nitrogen concentration, making it highly efficient for fertilizer production, especially urea and ammonium-based fertilizers that support the country’s large agricultural sector. It is cost-effective, widely available, and easier to transport and store in bulk compared to aqueous ammonia. Additionally, government policies and subsidies favor its use in farming applications, reinforcing its prevalence. Industrial applications in chemicals and refrigeration further strengthen its market position over other ammonia forms.

- The direct sales channel segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India ammonia market is segmented by sales channel into direct sales channel, indirect sales channel, and others. Among these, the direct sales channel segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of the direct sales channel in the market is driven by the need for large-scale buyers, such as fertilizer and chemical manufacturers, to secure a consistent and reliable supply in bulk. Direct purchases reduce dependency on intermediaries, lower overall costs, and allow customized delivery schedules to meet production requirements. Additionally, direct engagement with producers ensures better quality control, timely supply, and stronger business relationships, making it more efficient and preferred over indirect channels for industrial and agricultural applications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India ammonia market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- India Farmers Fertiliser Cooperative Limited (IFFCO)

- Gujarat State Fertilizer & Chemicals Limited (GSFC)

- Madras Fertilizers Limited (MFL)

- National Fertilizers Limited (NFL)

- Krishak Bharati Co-operative Limited (KRIBHCO)

- Rashtriya Chemicals and Fertilizers Ltd (RCFL)

- Deepak Fertilisers and Petrochemicals Corporation Limited (DFPCL)

- Brahmaputra Valley Fertilizers Corporation Limited

- Mysore Ammonia Pvt. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India ammonia market based on the below-mentioned segments:

India Ammonia Market, By Form

- Anhydrous Ammonia

- Aqueous Ammonia

- Other

India Ammonia Market, By Sales Channel

- Direct Sales Channel

- Indirect Sales Channel

- Other

Frequently Asked Questions (FAQ)

-

1. What role does ammonia play in India’s industries?Ammonia serves as a building block for fertilizers, chemicals, and refrigeration, supporting agriculture and industrial production across the country.

-

2. Which ammonia form is most widely used in India?Anhydrous ammonia is preferred because it delivers higher nitrogen efficiency and is easier to transport and apply in large quantities.

-

3. How do companies primarily sell ammonia in India?Producers mostly supply directly to large manufacturers, ensuring stable volume, consistent quality, and tailored delivery schedules.

-

4. What factors are encouraging growth in the ammonia market?Rising crop cultivation, industrial demand, domestic production expansion, and government-backed programs are boosting ammonia consumption nationwide.

-

5. What challenges limit ammonia market expansion?Fluctuating raw material costs, high energy requirements, and strict environmental norms slow market development and investment.

Need help to buy this report?