India Alkoxylates Market Size, Share, By Type (Fatty Alcohol Alkoxylates, Fatty Acid Alkoxylates, And Fatty Amine Alkoxylates), By Grade (Natural And Synthetic), And India Alkoxylates Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Alkoxylates Market Size Insights Forecasts To 2035

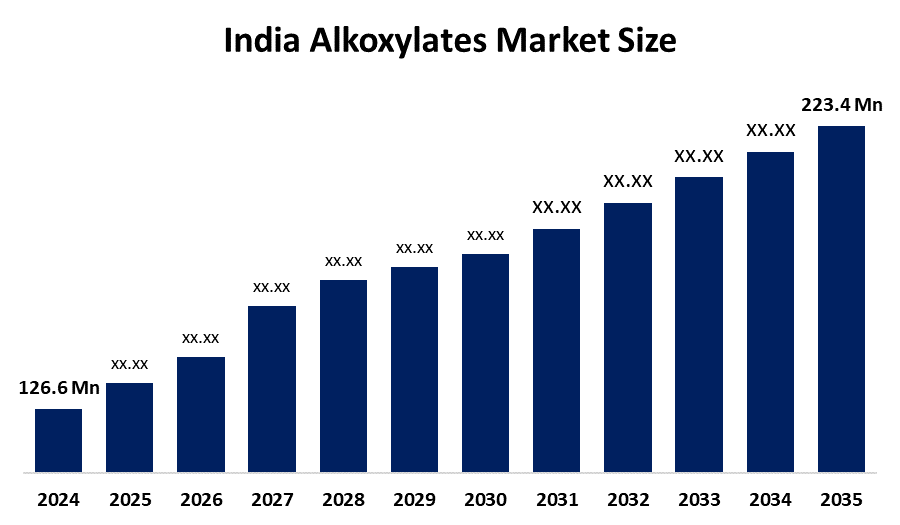

- India Alkoxylates Market Size 2024: 126.6 Thousand Tonnes

- India Alkoxylates Market Size 2035: 223.4 Thousand Tonnes

- India Alkoxylates Market Size CAGR 2024: 5.3%

- India Alkoxylates Market Size Segments: Type And Grade

Get more details on this report -

The India alkoxylates market size encompasses a sector which consists of production, selling, and distribution of chemical substances called alkoxylates, belonging to a family of surfactants that do not carry an electrical charge. They are manufactured by reacting fatty alcohol and alkylene oxides. Alkoxylates materials have very good wettability and emulsification characteristics; therefore, they are used as intermediates in the production of detergent products, industrial and household cleaning products, cosmetics and personal care products, pharmaceuticals, paints & coatings, metalworking fluids, and textile processing chemicals.

The alkoxylates in India are backed by government support, including the Production-Linked Incentive (PLI) scheme for the chemical industry and specialty chemicals, which offer performance-based incentives to manufacturers to expand domestic production capacity, enhance value addition, and reduce import dependence for high-value intermediates and specialty products. India is the sixth largest producer of chemicals in the world and the third largest in Asia, with the chemical industry contributing around 7% to the nation’s GDP, underlining the sector’s economic significance and growth potential.

As technology advances, India’s alkoxylates providers are now using advanced alkoxylation technologies, vertical integration of alkoxylation chemical through the use of modern production equipment, including automated controls and real time monitoring systems that improve production efficiency and increase environmental benefits. As more firms seek to develop bio-based feedstock and utilize green chemistry to reduce VOC emissions and adapt to the changing environmental regulations, there is a growing emphasis on companies providing eco-friendly products to meet the domestic and international regulatory needs of their customers.

India Alkoxylates Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 126.6 |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 5.3% |

| 2023 Value Projection: | 223.4 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Grade |

| Companies covered:: | India Glycols Limited, BASF India Ltd., Clariant Chemicals Ltd., Godrej Industries Ltd., Aarti Industries Ltd., Sasol India, Huntsman International Pvt Ltd., Stepan Company, Dow Chemical International Pvt Ltd., Indorama Ventures Public Company Limited, Core Chemicals Ltd., Matangi Industries, Fibrol Non-Ionics Pvt Ltd., and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Alkoxylates Market:

The India alkoxylates market size is driven by the rising consumption of detergents, personal care, and industrial cleaning agents, expanding consumer markets with hygiene awareness, growth of end-use industries such as textiles, pharmaceuticals, and paints & coatings, urbanization, rising disposable incomes, and increasing demand for everyday products that utilise alkoxylates for improved performance and stability.

The India alkoxylates market size is restrained by the price volatility, increased cost of key raw materials, complex influenced by global feedstock prices and supply chain constraints, domestic manufacturers cost competitiveness challenges, and complex regulations issue.

The future of India alkoxylates market size is bright and promising, with versatile opportunities emerging from the sustainable and biodegradable surfactants becoming increasingly popular due to their alignment with environmental regulations and consumer preferences worldwide. Furthermore, the increasing number of high-end personal care products and specialty industrial uses will provide more opportunities for value enhancement and product differentiation, which, when combined with increased manufacturing capabilities, can allow Indian manufacturers to capture a larger percentage of the higher-value, both domestic and international market.

Market Segmentation

The India Alkoxylates Market share is classified into type and grade.

By Type:

The India alkoxylates market size is divided by type into fatty alcohol alkoxylates, fatty acid alkoxylates, and fatty amine alkoxylates. Among these, the fatty alcohol alkoxylates segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Dominance in detergents & cleaning agents, growing environmental consciousness, strong shift towards more sustainable alternatives, and offer excellent performance in hard water all contribute to the fatty alcohol alkoxylates segment's largest share and higher spending on alkoxylates when compared to other type.

By Grade:

The India alkoxylates market size is divided by grade into natural and synthetic. Among these, the synthetic segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The synthetic segment dominates because of their cost effectiveness, high versatility, widespread industrial application across detergents, personal care, agrochemicals, and paints, and good stability and effectiveness as surfactants making them highly preferred.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India alkoxylates market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Alkoxylates Market:

- India Glycols Limited

- BASF India Ltd.

- Clariant Chemicals Ltd.

- Godrej Industries Ltd.

- Aarti Industries Ltd.

- Sasol India

- Huntsman International Pvt Ltd.

- Stepan Company

- Dow Chemical International Pvt Ltd.

- Indorama Ventures Public Company Limited

- Core Chemicals Ltd.

- Matangi Industries

- Fibrol Non-Ionics Pvt Ltd.

- Others

Recent Developments in India Alkoxylates Market:

- In October 2025, Bhageria Industries Limited set to commence commercial production of new specialized alkoxylates and plasticizers at its facility, following approval from the Maharashtra Pollution Control Board, strengthening its portfolio in specialized industrial surfactants.

- In July 2024, Godrej Industries Ltd. Chemicals acquires Shree Vallabh Chemicals Ethoxylation & Alkoxylation Unit 2 for approximately Rs45 crore. This acquisition specifically aimed to expand Godrej’s alcohol alkoxylates and ethoxylates, strengthening their position in the Indian surfactant market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India alkoxylates market based on the below-mentioned segments:

India Alkoxylates Market, By Type

- Fatty Alcohol Alkoxylates

- Fatty Acid Alkoxylates

- Fatty Amine Alkoxylates

India Alkoxylates Market, By Grade

- Natural

- Synthetic

Frequently Asked Questions (FAQ)

-

What is the India alkoxylates market size?India alkoxylates market is expected to grow from 126.6 thousand tonnes in 2024 to 223.4 thousand tonnes by 2035, growing at a CAGR of 5.3% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the rising consumption of detergents, personal care, and industrial cleaning agents, expanding consumer markets with hygiene awareness, growth of end-use industries such as textiles, pharmaceuticals, and paints & coatings, urbanization, rising disposable incomes, and increasing demand for everyday products that utilise alkoxylates for improved performance and stability.

-

What factors restrain the India alkoxylates market?Constraints include the price volatility, increased cost of key raw materials, complex influenced by global feedstock prices and supply chain constraints, domestic manufacturers cost competitiveness challenges, and complex regulations issue.

-

How is the market segmented by grade?The market is segmented into natural and synthetic.

-

Who are the key players in the India alkoxylates market?Key companies include India Glycols Limited, BASF India Ltd., Clariant Chemicals Ltd., Godrej Industries Ltd., Aarti Industries Ltd., Sasol India, Huntsman International Pvt Ltd., Stepan Company, Dow Chemical International Pvt Ltd., Indorama Ventures Public Company Limited, Core Chemicals Ltd., Matangi Industries, Fibrol Non-Ionics Pvt Ltd., and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?