India Acrylonitrile Butadiene Styrene Market Size, Share, and COVID-19 Impact Analysis, By Processing Technology (Injection Blow Molding, Extrusion Blow Molding, and Other), By End-User Industry (Automotive and Transportation, Electronics, and Other), and India Acrylonitrile Butadiene Styrene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Acrylonitrile Butadiene Styrene Market Insights Forecasts to 2035

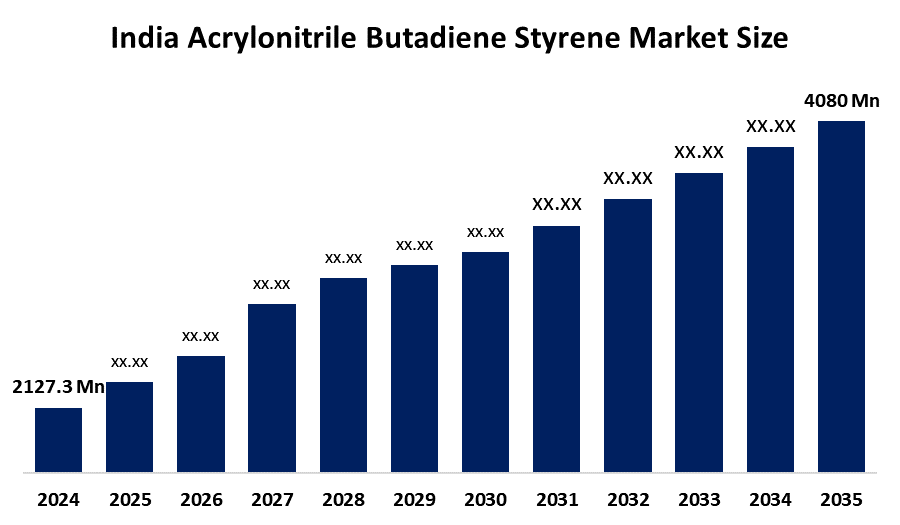

- The India Acrylonitrile Butadiene Styrene Market Size Was Estimated at USD 2,127.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.1% from 2025 to 2035

- The India Acrylonitrile Butadiene Styrene Market Size is Expected to Reach USD 4,080 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the India acrylonitrile butadiene styrene market size is anticipated to reach USD 4,080 million by 2035, growing at a CAGR of 6.1% from 2025 to 2035. The India acrylonitrile butadiene styrene (ABS) market is driven by rising demand from the automotive, consumer electronics, and appliances industries, rapid urbanization, infrastructure growth, lightweight material adoption, and increasing domestic manufacturing supported by government initiatives like Make in India.

Market Overview

The India acrylonitrile butadiene styrene (ABS) market refers to the domestic production and consumption of ABS, a high-performance thermoplastic known for its strength, impact resistance, and excellent surface finish. ABS is widely used in automotive components, consumer electronics, appliances, construction materials, and medical devices. Market growth is primarily driven by rapid industrialization, rising automotive and electronics manufacturing, increasing urban infrastructure projects, and growing demand for lightweight, durable plastics. Government initiatives such as Make in India, expanding middle-class consumption, and the replacement of traditional materials like metal and wood further support steady market expansion.

Key trends shaping the Indian ABS market include, first, growing demand from the automotive sector due to vehicle lightweighting, improved fuel efficiency requirements, and increased use of ABS in interiors, dashboards, and trims. Second, the surge in consumer electronics and home appliances manufacturing has boosted ABS consumption because of its aesthetics, electrical insulation, and durability. Third, increasing adoption in construction applications, such as pipes, fittings, and panels, is driven by urban housing growth and infrastructure development. Fourth, sustainability and recycling trends are gaining momentum, with manufacturers focusing on recycled and low-emission ABS grades to meet environmental regulations and corporate sustainability goals.

A key technological advancement in the Indian ABS market is the development of specialty and high-performance ABS grades, including heat-resistant, flame-retardant, and high-gloss variants. These advanced materials cater to electric vehicles, electronics, and premium appliance applications requiring higher safety and performance standards. Additionally, improvements in polymer blending, compounding technologies, and recycled ABS processing have enhanced material efficiency, reduced costs, and supported circular economy initiatives.

Report Coverage

This research report categorizes the market for the India acrylonitrile butadiene styrene market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India acrylonitrile butadiene styrene market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India acrylonitrile butadiene styrene market.

India Acrylonitrile Butadiene Styrene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,127.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.1% |

| 2035 Value Projection: | USD 4,080 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 155 |

| Companies covered:: | Bhansali Engineering Polymers INEOS Styrolution India Limited LG Polymers India Pvt. Ltd. Supreme Petrochem Ltd. Saudi Basic Industries Corporation (SABIC) Lotte Chemical Corporation Toray Industries, Inc. CHIMEI Corporation Formosa Chemicals & Fiber Corporation Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India acrylonitrile butadiene styrene (ABS) market is primarily driven by rapid growth in the automotive, electronics, and consumer appliances sectors, where ABS is preferred for its strength, impact resistance, and lightweight properties. Increasing urbanization and infrastructure development fuel demand in construction applications. Government initiatives like Make in India and rising domestic manufacturing further support market expansion. Additionally, consumer preference for durable, aesthetically appealing products and the shift from traditional materials like metal and wood to plastics are accelerating ABS adoption across industries.

Restraining Factors

The India ABS market is restrained by high raw material costs and price volatility of acrylonitrile, butadiene, and styrene, which impact profitability. Strict environmental regulations and growing concerns over plastic waste limit large-scale usage. Additionally, competition from alternative materials like polypropylene, polycarbonate, and recycled plastics poses challenges, especially in cost-sensitive applications, slowing the overall market growth despite rising demand from key industries.

Market Segmentation

The India acrylonitrile butadiene styrene market share is classified into processing technology and end-user industry.

- The injection blow molding segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India acrylonitrile butadiene styrene market is segmented by processing technology into injection blow molding, extrusion blow molding, and other. Among these, the injection blow molding segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of injection molding in the market is driven by its ability to produce high-precision, complex-shaped components efficiently, which is crucial for automotive parts, electronics, and consumer appliances. It ensures excellent surface finish, dimensional accuracy, and structural strength, meeting both functional and aesthetic requirements. Additionally, injection molding supports high-volume production, reducing per-unit costs, and allows integration of advanced materials like flame-retardant or high-gloss ABS grades. These advantages make it more preferred than extrusion blow molding or other processing technologies.

- The automotive and transportation segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India acrylonitrile butadiene styrene market is segmented by end user industry into automotive and transportation, electronics, and other. Among these, the automotive and transportation segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The automotive and transportation segment dominates the market due to the material’s excellent impact resistance, strength, and lightweight properties, making it ideal for dashboards, interior trims, bumpers, and structural components. Rapid growth in vehicle production, increasing demand for fuel-efficient and lightweight vehicles, and adoption of modern designs with enhanced safety standards further boost ABS usage. Additionally, government initiatives supporting domestic automotive manufacturing and rising consumer preference for durable, aesthetically appealing vehicle components drive the segment’s market dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India acrylonitrile butadiene styrene market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bhansali Engineering Polymers

- INEOS Styrolution India Limited

- LG Polymers India Pvt. Ltd.

- Supreme Petrochem Ltd.

- Saudi Basic Industries Corporation (SABIC)

- Lotte Chemical Corporation

- Toray Industries, Inc.

- CHIMEI Corporation

- Formosa Chemicals & Fiber CorporationOthers

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India acrylonitrile butadiene styrene market based on the below-mentioned segments:

India Acrylonitrile Butadiene Styrene Market, By Processing Technology

- Injection Blow Molding

- Extrusion Blow Molding

- Other

India Acrylonitrile Butadiene Styrene Market, By End-User Industry

- Automotive and Transportation

- Electronics

- Other

Frequently Asked Questions (FAQ)

-

Q1: What is acrylonitrile butadiene styrene (ABS) and where is it used?Acrylonitrile Butadiene Styrene (ABS) is a high-performance thermoplastic known for impact resistance, toughness, and aesthetic finish. It is widely used in automotive components, electronics, household appliances, construction materials, and medical devices.

-

Q2: What factors are driving the India acrylonitrile butadiene styrene (ABS) market?Growth in the automotive, electronics, and consumer appliances sectors, increasing urbanization, infrastructure development, and government initiatives like Make in India are key drivers.

-

Q3: What are the main restraints in the India acrylonitrile butadiene styrene (ABS) market?High raw material costs, price volatility of acrylonitrile, butadiene, and styrene, strict environmental regulations, and competition from alternative materials like polypropylene and polycarbonate.

-

Q4: Which processing technology dominates the India acrylonitrile butadiene styrene (ABS) market?Injection molding dominates due to its ability to produce high-precision, complex-shaped components efficiently with excellent surface finish and dimensional accuracy.

-

Q5: Which end-user industry consumes the most acrylonitrile butadiene styrene (ABS) in India?The automotive and transportation sector is the largest consumer of ABS, used in dashboards, trims, bumpers, and structural components.

Need help to buy this report?