India Acrylic Adhesives Market Size, Share, By Technology (Water-Based, Solvent-Based, Reactive, and Others), By Application (Furniture, Construction, Electronics & Appliances, Automotive, Footwear, Packaging), India Acrylic Adhesives Market Size Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsIndia Acrylic Adhesives Market Size Insights Forecasts to 2035

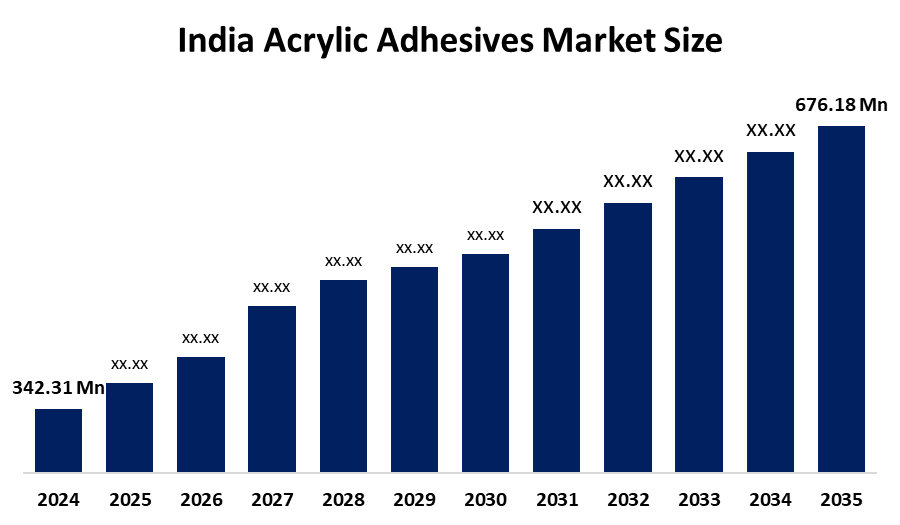

- India Acrylic Adhesives Market Size 2024: USD 342.31 Mn

- India Acrylic Adhesives Market Size 2035: USD 676.18 Mn

- India Acrylic Adhesives Market Size CAGR 2024: 6.38%

- India Acrylic Adhesives Market Size Segments: Technology and Application

Get more details on this report -

India Acrylic Adhesives Market Size covers bonding solutions that use acrylic polymer resins as their main component and are designed to provide durable, high, performing adhesion in industrial and commercial manufacturing applications. These adhesives have been widely used in India because they possess strong bonding capability, are resistant to temperature and chemicals, and are effective on substrates such as plastics, metals, wood, glass, and composites. The market is growing as a result of increased availability of construction and infrastructure development, the rise of furniture and interior manufacturing, the growth of the automotive industry and the steady development of the electronics, footwear, and packaging industries.

The implementation of government, led initiatives such as Make in India, Production Linked Incentive (PLI) schemes, and large, scale public infrastructure investments are some measures that are indirectly facilitating the domestic manufacturing output, which in turn is leading to increased demand for acrylic adhesives. Besides that, the increasing use of water, based and low, VOC acrylic adhesive technologies that are in line with environmental regulations is further helping the market to grow in the organized industrial sectors.

India Acrylic Adhesives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 342.31 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.38% |

| 2035 Value Projection: | 676.18 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Technology, By Application |

| Companies covered:: | Pidilite Industries Limited, Henkel Adhesives Technologies India Private Limited, Sika India Pvt. Ltd., H.B. Fuller India Adhesives Pvt. Ltd., 3M India Limited, Arkema India Pvt. Ltd. (Bostik India), HP Adhesives Limited, Astral Adhesives, Jubilant Agri and Consumer Products Limited, Anabond Limited, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Acrylic Adhesives Market:

The India Acrylic Adhesives Market Size is fueled by increasing demand from various sectors like the construction, furniture, automotive, electronics, and packaging industries, where durable and efficient bonding solutions are being preferred more and more over mechanical fastening. As a result of growth in infrastructure projects, residential construction, and organized manufacturing, the consumption of acrylic adhesives has gone up in multiple end use segments.

The market is limited by factors such as fluctuations in raw material prices, regulatory pressure on solvent, based formulations, and competition from alternative adhesive technologies like epoxy and polyurethane adhesives in certain high, performance applications. The cost sensitivity of small, scale manufacturers may also limit the uptake of advanced acrylic adhesive formulations in such entities.

The India Acrylic Adhesives Market Size has a positive future outlook that is being kept alive by the factors such as increasing usage of water, based and reactive acrylic adhesives, continued technological advancement with a focus on sustainability, and rising investments in the construction, automotive manufacturing, and electronics production sectors across India.

Market Segmentation

The India Acrylic Adhesives Market Size share is classified into technology and application.

By Technology

The India Acrylic Adhesives Market Size is segmented by technology into water-based, solvent-based, reactive, and others. Among these, the water-based segment dominated the market in 2024 and is expected to grow at a notable CAGR during the forecast period. This major position is basically kept due to more strictly environmental regulations, higher preference of low, VOC formulations, better safety during industrial use, cost effectiveness, and increased usage of furniture manufacturing, construction activities, and high, volume packaging sectors in India.

By Application

The India Acrylic Adhesives Market Size is segmented by application into furniture, construction, electronics & appliances, automotive, footwear, and packaging. Among these, the construction segment dominated the market in 2024 and is expected to grow at a notable CAGR during the forecast period Expansion is powered by grand, scale infrastructure projects, development of residential housing, increased usage of bonded materials in place of mechanical fasteners, and continuous government spending on roads, buildings, and urban development throughout India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India acrylic adhesives market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Acrylic Adhesives Market:

- Pidilite Industries Limited

- Henkel Adhesives Technologies India Private Limited

- Sika India Pvt. Ltd.

- H.B. Fuller India Adhesives Pvt. Ltd.

- 3M India Limited

- Arkema India Pvt. Ltd. (Bostik India)

- HP Adhesives Limited

- Astral Adhesives

- Jubilant Agri and Consumer Products Limited

- Anabond Limited

Recent Developments in India Acrylic Adhesives Market:

In February 2025, Henkel Adhesive Technologies India opened a 17, 000 sq. ft. Application Engineering Centre in Chennai and started the establishment of an adhesive materials manufacturing plant at Kurkumbh, Pune. This move is aimed at enhancing product development and local production of high, performance adhesives for the electronics and industrial sectors, thus strengthening the supply chain's resilience and India, focused innovation.

In July 2024, Henkel Adhesives Technologies India has successfully accomplished Phase III of its Kurkumbh manufacturing facility near Pune by unveiling a new Loctite plant for the production of advanced adhesive and sealant solutions. The local production capacity has been increased, import dependence has been reduced, and the high, growth sectors such as automotive, construction, and industrial manufacturing have been supported.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India acrylic adhesives market based on the below-mentioned segments:

India Acrylic Adhesives Market, By Technology

- Water-Based

- Solvent-Based

- Reactive

- Others

India Acrylic Adhesives Market, By Application

- Furniture

- Construction

- Electronics & Appliances

- Automotive

- Footwear

- Packaging

Frequently Asked Questions (FAQ)

-

What is the India acrylic adhesives market size?India Acrylic Adhesives Market is expected to grow from USD 342.31 million in 2024 to USD 676.18 million by 2035, growing at a CAGR of 6.38% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by rising demand from construction, furniture, automotive, electronics, footwear, and packaging sectors, increasing infrastructure and housing projects, government initiatives like Make in India and PLI schemes, and adoption of water-based and low-VOC acrylic adhesives for sustainable industrial use.

-

What factors restrain the India acrylic adhesives market?Constraints include raw material price fluctuations, regulatory pressures on solvent-based formulations, competition from alternative adhesives such as epoxy and polyurethane, and cost sensitivity among small-scale manufacturers limiting advanced acrylic adhesive adoption.

-

How is the market segmented by technology?The market is segmented into water-based, solvent-based, reactive, and others, with the water-based segment dominating due to environmental compliance, low VOC emissions, safety, and adoption in furniture, construction, and packaging sectors.

-

How is the market segmented by application?The market is segmented into furniture, construction, electronics & appliances, automotive, footwear, and packaging, with construction leading due to extensive use in flooring, panels, insulation, and structural bonding in infrastructure and housing projects.

-

Who are the key players in the India acrylic adhesives market?Key companies include Pidilite Industries Limited, Henkel Adhesives Technologies India Private Limited, Sika India Pvt. Ltd., H.B. Fuller India Adhesives Pvt. Ltd., 3M India Limited, Arkema India Pvt. Ltd. (Bostik India), HP Adhesives Limited, Astral Adhesives, Jubilant Agri and Consumer Products Limited, and Anabond Limited.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?