India Acrylic Acid Market Size, Share, By End Use (Water Treatment, Detergent, Acrylate Ester, Super Absorbent Polymer, And Others), By Sales Channel (Direct Sales And Indirect Sales), And India Acrylic Acid Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsIndia Acrylic Acid Market Insights Forecasts to 2035

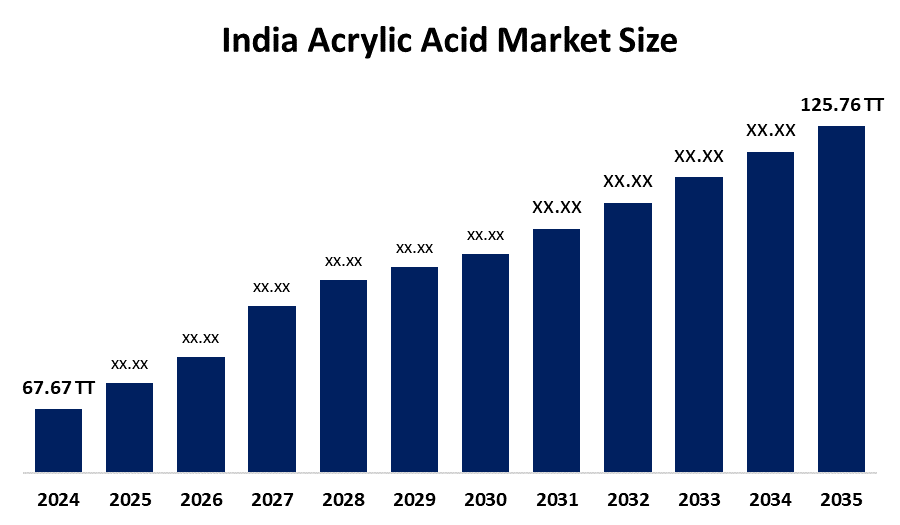

- India Acrylic Acid Market 2024: 67.67 Thousand Tonnes

- India Acrylic Acid Market Size 2035: 125.76 Thousand Tonnes

- India Acrylic Acid Market CAGR 2024: 5.8%

- India Acrylic Acid Market Segments: End Use and Sales Channel

Get more details on this report -

India acrylic acid market includes the producers, importers, wholesalers, retailers and end-users of acrylic acid and its associated derivatives who conduct business within India. Production of acrylic acid primarily take place through petrochemical processes and acrylic acid is a key ingredient for manufacturing other chemicals called acrylate esters, which are further processed into products like superabsorbent polymers, chemicals to treat water, adhesives and coatings, textiles and many types of plastics. Upstream producers supply acrylic acid and acrylic acid manufacturers with raw materials to manufacture. End-use industries include construction, automotive, hygiene, packaging and textiles.

The acrylic acid in India is backed by government support, including the Make in India and investment incentives in specialty chemicals, which aim to reduce import dependency and foster local production capacity. This initiative also aligns with strategic capacity expansions such as new acrylics/oxo-alcohol complexes, including acrylic acid units at the Gujarat Refinery inaugurated in 2025, which are intended to reduce import reliance and raise domestic output.

As technology advances, India’s acrylic acid providers are now using polymer chemistry and processes help manufacturers create higher-quality, more specialized acrylic derivatives for applications in water-based paints, high-performance textiles, and superabsorbent materials. There is also an increasing amount of R&D investment from both domestic companies and the government through programs designed to develop bio-based processes to produce acrylic and alternative processes that will be less harmful to the environment with less dependence on fossil fuels, therefore reducing the company’s overall carbon footprints.

India Acrylic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 67.67 Thousand Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.8% |

| 2035 Value Projection: | 125.76 Thousand Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 177 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By End Use,By Sales Channel |

| Companies covered:: | Bharat Petroleum Corporation Limited, Indian Oil Corporation Limited, BASF India, Arkema, LG Chem, Nippon Shokubai Co., Ltd., Evonik Industries AG, Mitsubishi Chemical Group Corporation, SNF India Pvt Ltd., Prasol Chemicals Pvt Ltd., Maxwell Additives Private Limited, Gujarat Polysol Chemicals Limited, Antares Chem Private Limited, Vizag Chemical International, Prakash Chemicals Agencies Pvt. Ltd., Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Acrylic Acid Market:

The India acrylic acid market is driven by the continued rise in industrialization, rapid urbanization, increased demand for acrylic acid derivatives in sectors like paints and coatings, textiles, and hygiene products, growth in the construction and automotive industries, supportive government policy on expanding manufacturing, benefit of reducing import dependency, domestic shifts toward water-based formulations in paints, driven by regulations on volatile organic compounds, and increased use of acrylic acid as traditional solvent-based systems.

The India acrylic acid market is restrained by the heavy reliance on imports for raw materials, high local pricing, supply sensitive to global crude and propylene markets, currency fluctuations, stringent environmental compliance costs, and complex regulatory frameworks add to operational expenses.

The future of India acrylic acid market is bright and promising, with versatile opportunities emerging from the growing demand for superabsorbent polymers in medical and hygiene products offers a large growth opportunity as well as the trend toward sustainable and biodegradable polymers. Rapid development of infrastructure in India is providing opportunities for acrylic acid-based products to be used in new application areas such as water treatment, agriculture, and personal care industries. Additionally, government efforts to increase domestic production capacities will also help develop new applications for specialty chemicals and provide investment and technological partnerships to help domestic companies grow and operate more significantly within global supply chains.

Market Segmentation

The India Acrylic Acid Market share is classified into end use and sales channel.

By End Use:

The India acrylic acid market is divided by end use into water treatment, detergent, acrylate ester, super absorbent polymer, and others. Among these, the acrylate ester segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Rapid industrialization, surging infrastructure projects, high demand in paints, coatings, and adhesives, offer superior adhesion, and excellent UV resistance features all contribute to the acrylate ester segment's largest share and higher spending on acrylic acid when compared to other end use.

By Sales Channel:

The India acrylic acid market is divided by sales channel into direct sales and indirect sales. Among these, the direct sales segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The direct sales segment dominates because of high volume B2B transactions, consumers preference for long term contracts, stable supply chain, volatility of raw material costs, and provides technical support from manufacturers, making direct relationships essential.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India acrylic acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Acrylic Acid Market:

- Bharat Petroleum Corporation Limited

- Indian Oil Corporation Limited

- BASF India

- Arkema

- LG Chem

- Nippon Shokubai Co., Ltd.

- Evonik Industries AG

- Mitsubishi Chemical Group Corporation

- SNF India Pvt Ltd.

- Prasol Chemicals Pvt Ltd.

- Maxwell Additives Private Limited

- Gujarat Polysol Chemicals Limited

- Antares Chem Private Limited

- Vizag Chemical International

- Prakash Chemicals Agencies Pvt. Ltd.

- Others

Recent Developments in India Acrylic Acid Market:

- In January 2026, a new 6000 TPA water-based acrylic adhesives production facility is planned in Surat, Gujarat, aimed at catering to increasing demand in the paints, coatings, and packaging sectors.

- In September 2025, IndianOil’s new acrylics/Oxo-Alcohol Complex was inaugurated at the Gujarat Refinery in Vadodara, featuring a 150 KTA butyl acrylate plant and an acrylic acid unit designed to convert refinery byproduct propylene into high-value acrylic acid.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India acrylic acid market based on the below-mentioned segments:

India Acrylic Acid Market, By End Use

- Water Treatment

- Detergent

- Acrylate Ester

- Super Absorbent Polymer

- Others

India Acrylic Acid Market, By Sales Channel

- Direct Sales

- Indirect Sales

Frequently Asked Questions (FAQ)

-

Q: What is the India acrylic acid market size?A: India acrylic acid market is expected to grow from 67.67 thousand tonnes in 2024 to 125.76 thousand tonnes by 2035, growing at a CAGR of 5.8% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the continued rise in industrialization, rapid urbanization, increased demand for acrylic acid derivatives in sectors like paints and coatings, textiles, and hygiene products, growth in the construction and automotive industries, supportive government policy on expanding manufacturing, benefit of reducing import dependency, domestic shifts toward water-based formulations in paints, driven by regulations on volatile organic compounds, and increased use of acrylic acid as traditional solvent-based systems.

-

Q: What factors restrain the India acrylic acid market?A: Constraints include the heavy reliance on imports for raw materials, high local pricing, supply sensitive to global crude and propylene markets, currency fluctuations, stringent environmental compliance costs, and complex regulatory frameworks add to operational expenses.

-

Q: How is the market segmented by end use?A: The market is segmented into water treatment, detergent, acrylate ester, super absorbent polymer, and others.

-

Q: Who are the key players in the India acrylic acid market?A: Key companies include Bharat Petroleum Corporation Limited, Indian Oil Corporation Limited, BASF India, Arkema, LG Chem, Nippon Shokubai Co., Ltd., Evonik Industries AG, Mitsubishi Chemical Group Corporation, SNF India Pvt Ltd., Prasol Chemicals Pvt Ltd., Maxwell Additives Private Limited, Gujarat Polysol Chemicals Limited, Antares Chem Private Limited, Vizag Chemical International, Prakash Chemicals Agencies Pvt. Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?