India Acrylate Esters Market Size, Share, By Type (Butyl Acrylate, 2-Ethylhexyl Acrylate, Methyl Acrylate, And Ethyl Acrylate), By Application (Paints & Coatings, Adhesives & Sealants, Textiles, Plastic Additives, And Detergents), And India Acrylate Esters Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsIndia Acrylate Esters Market Insights Forecasts to 2035

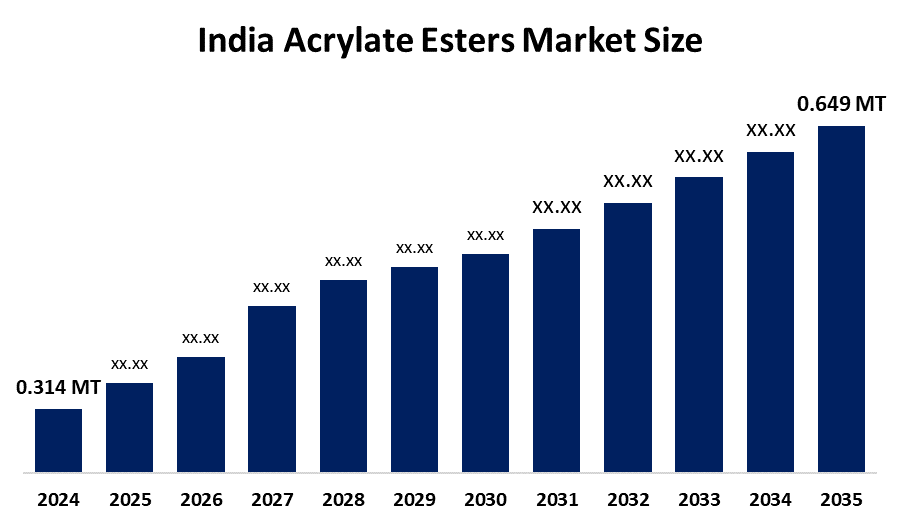

- India Acrylate Esters Market Size 2024: 0.314 Million Tonnes

- India Acrylate Esters Market Size 2035: 0.649 Million Tonnes

- India Acrylate Esters Market CAGR 2024: 6.82%

- India Acrylate Esters Market Segments: Type and Application

Get more details on this report -

The India Acrylate Esters Market Size encompass the part of the economy that produces, imports, and uses acrylate esters, a chemical compounds derived from combining acrylic acid and various kinds of alcohols. These compounds provide the basis for many products including polymers, adhesives, paints, textiles, plastics, and many other specialty types of products. Butyl acrylate, ethyl acrylate, and methyl acrylate are available in this market and have desirable properties such as good adhesion, flexibility, resistance to weather conditions, and improved performance in the final product after formulation.

The Acrylate Esters in India are backed by government support, including the Bureau of Indian Standards (BIS) certification deadline for acrylic esters, including ethyl and methyl acrylate, which was set to help mitigate shortages and facilitate imports of these crucial raw materials in the short term. This policy move, extended to March 31, 2026, reflects regulatory support aimed at ensuring supply continuity for industries that rely on these esters for producing coatings, adhesives, and plastics, thereby addressing a key supply constraint for domestic manufacturers.

As technology advances, Indian acrylate esters providers are using polymerization technology and production process advancements has improved efficiency and sustainability. Advanced manufacturing techniques result in higher yield, better quality products and environmentally safe, low-VOC formulations, all of which comply with ever-increasingly stringent environmental regulations. Technology advances to produce specialty acrylate products designed for meeting the increasing demands for the high-performance markets, including water-based paints, industrial coatings, and high-strength adhesive systems.

Market Dynamics of the India Acrylate Esters Market:

The India Acrylate Esters Market Size is driven by rapid urbanization, infrastructure development, expansion of the construction sector, stronger demand for paints and coatings, growth of the packaging and textiles industries, favourable government initiatives in housing and manufacturing, rising domestic industrial output and infrastructure investments, increasing demand for higher-performance and environmentally friendly products, and shift toward sustainable raw materials and bio-based acrylate esters further propel the market growth.

The India Acrylate Esters Market Size is restrained by the volatility of raw material prices, petrochemical feedstocks challenges, high production costs, fluctuations in global crude oil prices, stringent environmental regulations require investments in cleaner technologies, and competition from alternative polymers.

The future of India Acrylate Esters Market Size is bright and promising, with versatile opportunities emerging from the rising consumers demand for better-performing and more environmentally friendly products, including water-based coatings, advanced-packaging materials, and specialty adhesives. Regulated and consumer-based changes in preferences toward safe, low-VOC products continue to make these three categories highly attractive for future growth. The movement toward using sustainable renewable raw materials and bio-based acrylate esters will provide new opportunities for domestic manufacturers to meet global sustainability goals and reduce their reliance on imported intermediates.

India Acrylate Esters Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 0.314 Million Tonnes |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.82% |

| 2035 Value Projection: | 0.649 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Application |

| Companies covered:: | BASF SE Arkema S.A. Nippon Shokubai Co., Ltd. Dow Chemical Company LG Chem Ltd. Mitsubishi Chemical Corporation Evonik Industries AG Sasol Ltd. Toagosei Co., Ltd. Sibur Holdings PJSC Synthomer PLC Wanhua Chemical Group Co., Ltd. Prasol Chemicals Limited Kamsons Chemicals Pvt. Ltd. Vizag Chemical Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Segmentation

The India Acrylate Esters Market share is classified into type and application.

By Type:

The India Acrylate Esters Market Size is divided by type into butyl acrylate, 2-ethylhexyl acrylate, methyl acrylate, and ethyl acrylate. Among these, the butyl acrylate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. High dominance in paints & coatings, provides flexibility, durable quality, increasing demand for high performance sealants, and shift towards water-based coatings all contribute to the butyl acrylate segment's largest share and higher spending on acrylate esters when compared to other type.

By Application:

The India Acrylate Esters Market Size is divided by application into paints & coatings, adhesives & sealants, textiles, plastic additives, and detergents. Among these, the paints & coatings segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The paints & coatings segment dominates because of rapid growth of construction sector, stringent environmental regulations, essential in producing high performance and water resistant acrylic emulsions for paints, and increased in consumer preference for water based paints in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India acrylate esters market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Acrylate Esters Market:

- BASF SE

- Arkema S.A.

- Nippon Shokubai Co., Ltd.

- Dow Chemical Company

- LG Chem Ltd.

- Mitsubishi Chemical Corporation

- Evonik Industries AG

- Sasol Ltd.

- Toagosei Co., Ltd.

- Sibur Holdings PJSC

- Synthomer PLC

- Wanhua Chemical Group Co., Ltd.

- Prasol Chemicals Limited

- Kamsons Chemicals Pvt. Ltd.

- Vizag Chemical

- Others

Recent Developments in India Acrylate Esters Market:

In September 2025, IndianOil commissioned new Acrylics at the Gujarat Refinery in Vadodara, featuring an acrylic acid unit and a 150 KTA butyl acrylate plant designed to convert refinery byproduct propylene into high-value acrylates.

In February 2025, Henkel Adhesives Technologies India announced the establishment of an adhesive materials manufacturing plant at Kurkumbh, Pune, aimed to boost local production of high performance adhesives, which rely heavily on acrylate monomers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India acrylate esters market based on the below-mentioned segments:

India Acrylate Esters Market, By Type

- Butyl Acrylate

- 2-Ethylhexyl Acrylate

- Methyl Acrylate

- Ethyl Acrylate

India Acrylate Esters Market, By Application

- Paints & Coatings

- Adhesives & Sealants

- Textiles

- Plastic Additives

- Detergents

Frequently Asked Questions (FAQ)

-

What is the India acrylate esters market size?India acrylate esters market is expected to grow from 0.314 million tonnes in 2024 to 0.649 million tonnes by 2035, growing at a CAGR of 6.82% during the forecast period 2025-2035

-

What are the key growth drivers of the market?Market growth is driven by the rapid urbanization, infrastructure development, expansion of the construction sector, stronger demand for paints and coatings, growth of the packaging and textiles industries, favourable government initiatives in housing and manufacturing, rising domestic industrial output and infrastructure investments, increasing demand for higher-performance and environmentally friendly products, and shift toward sustainable raw materials and bio-based acrylate esters further propel the market growth

-

What factors restrain the India acrylate esters market?Constraints include the volatility of raw material prices, petrochemical feedstocks challenges, high production costs, fluctuations in global crude oil prices, stringent environmental regulations require investments in cleaner technologies, and competition from alternative polymers.

-

How is the market segmented by type?The market is segmented into butyl acrylate, 2-ethylhexyl acrylate, methyl acrylate, and ethyl acrylate

-

Who are the key players in the India acrylate esters market?Key companies include BASF SE, Arkema S.A., Nippon Shokubai Co., Ltd., Dow Chemical Company, LG Chem Ltd., Mitsubishi Chemical Corporation, Evonik Industries AG, Sasol Ltd., Toagosei Co., Ltd., Sibur Holdings PJSC, Synthomer PLC, Wanhua Chemical Group Co., Ltd., Prasol Chemicals Limited, Kamsons Chemicals Pvt. Ltd., Vizag Chemical, and Others

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?