India Acrylate Ester Market Size, Share, By Derivative (Acrylic Esters, Acrylic Polymers, Others), By Application (Surface Coating, Adhesives and Sealants, Surfactants, Sanitary Products, Textiles, and Other), India Acrylate Ester Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Acrylate Ester Market Insights Forecasts to 2035

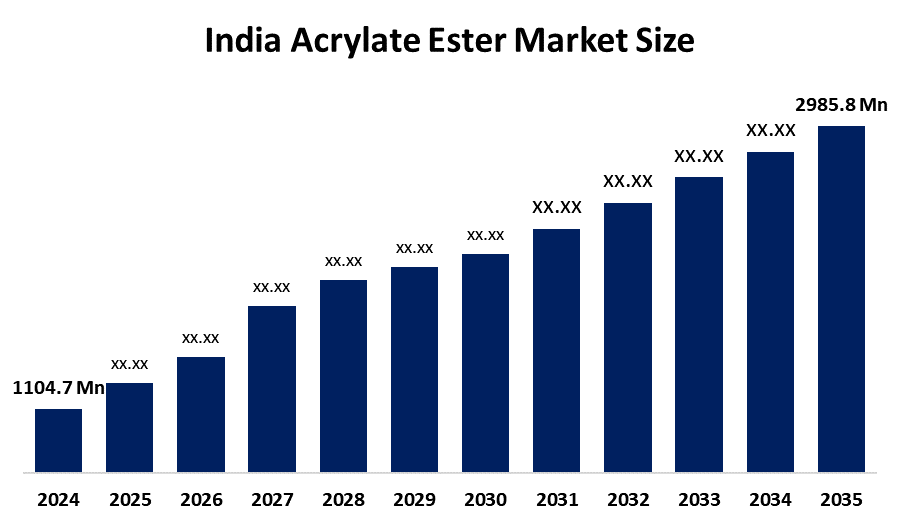

- India Acrylate Ester Market Size 2024: USD 1104.7 Mn

- India Acrylate Ester Market Size 2035: USD 2985.8 Mn

- India Acrylate Ester Market CAGR 2024: 9.46%

- India Acrylate Ester Market Segments: Derivatives and Applications

Get more details on this report -

The India acrylate ester market represents the national market for acrylate esters, which are utilized in paints and coatings, adhesives and textiles, plastics and construction applications. Industrial expansion, together with infrastructure development, drives demand for acrylate esters, which are used in this market.

The Dow Company and other major chemical corporations launched their new acrylic-emulsion product line, which focuses on architectural coatings and adhesives to deliver both performance benefits and flexible application options.

The Indian Government's Make in India program has dedicated substantial financial resources, together with tax benefits, to enhance domestic chemical production capabilities for petrochemical products, including acrylate ester manufacturing. This policy promotes the establishment of domestic production sites, which will decrease import requirements while enhancing the supply network for acrylic acid and acrylate ester intermediate products.

The Indian market for acrylate esters will experience substantial growth prospects because the construction, paints and coatings and adhesives markets continue to develop, and infrastructure development, urbanization, and domestic production growth drive the construction sector.

India Acrylate Ester Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1104.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 9.46% |

| 2035 Value Projection: | USD 2985.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 143 |

| Segments covered: | By Derivative,By Application |

| Companies covered:: | CMIC Group EPS Corporation PRA Health Sciences Japan I’rom Group Cliantha Research Japan Shonan Health Innovation Park Translational Research Informatics Center (TRI) Medical Network Systems (MNS) Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Acrylate Ester Market:

The India acrylate ester market is driven by the paints and coatings industry, construction industry, adhesives industry, textiles industry, and packaging industry experience rapid expansion. The market expands because of rising infrastructure development and urbanization growth, and increasing automotive production and demand for water-based low-VOC coatings.

The India acrylate ester market is restrained by the production costs and profit margins of the business, faces challenges from five main factors, which include unstable raw material costs, the industry's need for crude oil-based products, the implementation of strict environmental laws, the requirement for substantial financial investments and the presence of foreign competition.

The future of India acrylate ester market is bright and promising, with the growing domestic production, rising demand from coatings, adhesives, and textiles, adoption of eco-friendly formulations, and government support for the chemical manufacturing sector.

Market Segmentation

The India acrylate ester market share is classified into derivatives and applications.

By Derivative:

The India acrylate ester market is divided by derivative into acrylic esters, acrylic polymers, and others. Among these, the acrylic esters dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Acrylic esters lead due to extensive use in paints, coatings, adhesives, and textiles, offering high performance, versatility, and strong industrial demand.

By Application:

The India acrylate ester market is divided by application into surface coating, adhesives and sealants, surfactants, sanitary products, textiles, and others. Among these, the surface coating segment accounted for the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Surface coatings dominate because construction, automotive, and decorative paints drive high consumption of acrylate esters for durability, aesthetics, and protective properties.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India acrylate ester market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Acrylate Ester Market:

- CMIC Group

- EPS Corporation

- PRA Health Sciences Japan

- I’rom Group

- Cliantha Research Japan

- Shonan Health Innovation Park

- Translational Research Informatics Center (TRI)

- Medical Network Systems (MNS)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India acrylate ester market based on the below-mentioned segments:

India Acrylic Acid Market, By Derivative

- Acrylic Esters

- Acrylic Polymers

- Others

India Acrylate Ester Market, By Application

- Surface Coating

- Adhesives and Sealants

- Surfactants

- Sanitary Products

- Textiles

- Other

Frequently Asked Questions (FAQ)

-

Q: What is the India acrylate ester market size?A: India acrylate ester market is expected to grow from USD 1104.7 million in 2024 to USD 2985.8 million by 2035, growing at a CAGR of 9.46% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the paints and coatings industry, construction industry, adhesives industry, textiles industry, and packaging industry experience rapid expansion. The market expands because of rising infrastructure development and urbanization growth, and increasing automotive production and demand for water-based low-VOC coatings.

-

Q: What factors restrain the India acrylate ester market?A: Constraints include the production costs and profit margins of the business, faces challenges from five main factors, which include unstable raw material costs, the industry's need for crude oil-based products, the implementation of strict environmental laws, the requirement for substantial financial investments and the presence of foreign competition.

-

Q: How is the market segmented by derivative?A: The market is segmented into acrylic esters, acrylic polymers, and others.

-

Q: Who are the key players in the India acrylate ester market?A: Key companies include CMIC Group, EPS Corporation, PRA Health Sciences Japan, I’rom Group, Cliantha Research Japan, Shonan Health Innovation Park, Translational Research Informatics Center (TRI), Medical Network Systems (MNS), and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?