India Acetonitrile Market Size, Share, and COVID-19 Impact Analysis, By Application (Organic Synthesis, Specialty Chemicals, HPLC Solvents, Pharmaceutical, Extraction, DNA and RNA Synthesis, and Others), By End-User (Pharmaceutical Industry, Analytical Industry, Agricultural Industry, and Others), and India Acetonitrile Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Acetonitrile Market Size Insights Forecasts To 2035

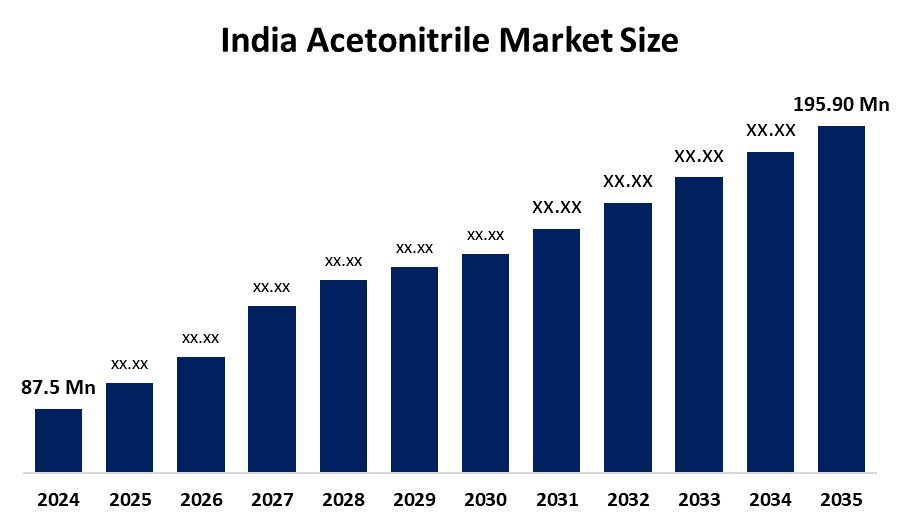

- The India Acetonitrile Market Size Was Estimated at USD 87.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.6% from 2025 to 2035

- The India Acetonitrile Market Size is Expected to Reach USD 195.90 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The India Acetonitrile Market Size Is Anticipated To Reach USD 195.90 Million By 2035, Growing At A CAGR Of 7.6% From 2025 To 2035. The India acetonitrile market is driven by rising demand from the pharmaceutical and chemical industries, expanding laboratory and research activities, growth in high-performance liquid chromatography (HPLC) applications, and increasing use in agrochemicals, paints, and electronics manufacturing sectors.

Market Overview

Acetonitrile is a colorless, volatile liquid primarily used as a solvent in chemical, pharmaceutical, and laboratory applications. It plays a crucial role in high-performance liquid chromatography (HPLC), the synthesis of vitamins, and the production of agrochemicals. The India acetonitrile market is witnessing significant growth due to increasing pharmaceutical manufacturing, expanding chemical industries, and rising research and development activities. Additionally, growing electronics and automotive sectors are driving demand for high-purity acetonitrile. Increasing imports and domestic production capacity are further supporting market expansion across India.

Recent technological advancements in acetonitrile production focus on sustainability and efficiency. New methods involve the recovery of acetonitrile from acrylonitrile manufacturing, reducing environmental waste and improving yield. High-purity acetonitrile production techniques are also being refined for sensitive analytical applications like HPLC. Companies are adopting automation and advanced distillation technologies to ensure consistent quality and reduce operational costs. These innovations enable manufacturers to meet rising demand from the pharmaceuticals, biotech, and electronics sectors while also adhering to stricter environmental regulations and minimizing carbon footprints.

Key trends shaping the market size include the rising demand for high-purity acetonitrile in pharmaceuticals and research labs, the expansion of domestic production capacities, and growing imports to meet industrial requirements. Another trend is the increased use of acetonitrile in electronics and battery manufacturing, driven by India’s growing renewable energy and electric vehicle sectors. Additionally, collaborations between chemical manufacturers and research institutions are promoting product innovation. The push toward sustainable production and recycling methods is gaining momentum, positioning India as a competitive player in the global acetonitrile market.

Report Coverage

This research report categorizes the market size for the India acetonitrile market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India acetonitrile market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India acetonitrile market.

India Acetonitrile Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 87.5 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 7.6% |

| 2023 Value Projection: | USD 195.90 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By End-User |

| Companies covered:: | INEOS Group, Asahi Kasei Corporation, Reliance Industries Limited, SASOL Limited, Balaji Amines Ltd., Shagun Chem, Meru Chem Pvt. Ltd, Manas Petro Chem, SBH Foods Pvt. Ltd, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India acetonitrile market size is primarily driven by the growing pharmaceutical and chemical industries, where it is extensively used as a solvent and reagent. Rising demand from high-performance liquid chromatography (HPLC) applications in laboratories and research centers is boosting consumption. Expansion of the electronics and battery sectors, especially for lithium-ion batteries, is increasing industrial usage. Additionally, the growth of the agrochemicals, paints, and coatings industries supports market demand. Increasing domestic production capacity, coupled with imports to meet high-purity requirements, further propels market growth across India.

Restraining Factors

The India acetonitrile market size faces restraints due to high production costs and dependence on acrylonitrile-derived supply, which can be volatile. Strict environmental regulations and handling safety concerns for this toxic and flammable chemical limit large-scale manufacturing. Additionally, fluctuations in raw material availability and import dependency create supply chain uncertainties, hindering consistent market growth.

Market Segmentation

The India acetonitrile market share is classified into application and end user.

- The HPLC solvents segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India acetonitrile market size is segmented by application into organic synthesis, specialty chemicals, HPLC solvents, pharmaceuticals, extraction, DNA and RNA synthesis, and others. Among these, the HPLC solvents segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The HPLC solvents segment dominates the market because acetonitrile is a critical solvent in high-performance liquid chromatography (HPLC), widely used for drug testing, chemical analysis, and quality control. India’s growing pharmaceutical industry and expanding research and laboratory activities significantly drive demand for HPLC-grade acetonitrile. While other applications like organic synthesis, specialty chemicals, and DNA/RNA synthesis consume acetonitrile, the consistent and high-volume usage in analytical testing and pharmaceutical R&D makes the HPLC solvents segment the largest and most influential in the market.

- The pharmaceutical industry segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India acetonitrile market size is segmented by end user into the pharmaceutical industry, analytical industry, agricultural industry, and others. Among these, the pharmaceutical industry segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The pharmaceutical industry segment dominates the market because acetonitrile is essential for high-performance liquid chromatography (HPLC), drug synthesis, and quality control testing. India’s rapidly expanding pharmaceutical manufacturing and R&D sectors drive consistent demand for high-purity acetonitrile. While other end users, like analytical and agricultural industries, contribute to consumption, the pharmaceutical sector requires large volumes for laboratory analysis, formulation, and chemical synthesis. This sustained, high-volume usage makes pharmaceuticals the largest and most influential segment in the Indian acetonitrile market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India acetonitrile market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- INEOS Group

- Asahi Kasei Corporation

- Reliance Industries Limited

- SASOL Limited

- Balaji Amines Ltd.

- Shagun Chem

- Meru Chem Pvt. Ltd

- Manas Petro Chem

- SBH Foods Pvt. Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India acetonitrile market based on the below-mentioned segments:

India Acetonitrile Market, By Application

- Organic Synthesis

- Specialty Chemicals

- HPLC Solvents

- Pharmaceutical

- Extraction

- DNA and RNA Synthesis

- Others

India Acetonitrile Market, By End-User

- Pharmaceutical Industry

- Analytical Industry

- Agricultural Industry

- Others

Frequently Asked Questions (FAQ)

-

What is the current market size of the India acetonitrile market?The market is growing steadily due to rising demand from pharmaceuticals, laboratories, and chemical industries, with increasing domestic production and imports.

-

What are the main applications of acetonitrile in India?Key applications include HPLC solvents, pharmaceuticals, organic synthesis, specialty chemicals, DNA/RNA synthesis, extraction processes, and industrial uses.

-

Which segment dominates the India acetonitrile market?The HPLC solvents segment dominates due to extensive use in pharmaceutical testing, chemical analysis, and quality control.

-

Which end-user industry consumes the most acetonitrile?The pharmaceutical industry is the largest consumer, driven by drug synthesis, testing, and laboratory research requirements.

Need help to buy this report?