India Acetone Market Size, Share, By Manufacturing Process (Cumene Process, Dow Process, And Ranching-Hooker Process), By Application (Methyl Methacrylate, Bisphenol A, Solvents, Powder, And Others), And India Acetone Market Insights, Industry Trend, Forecasts to 2035

Industry: Specialty & Fine ChemicalsIndia Acetone Market Insights Forecasts to 2035

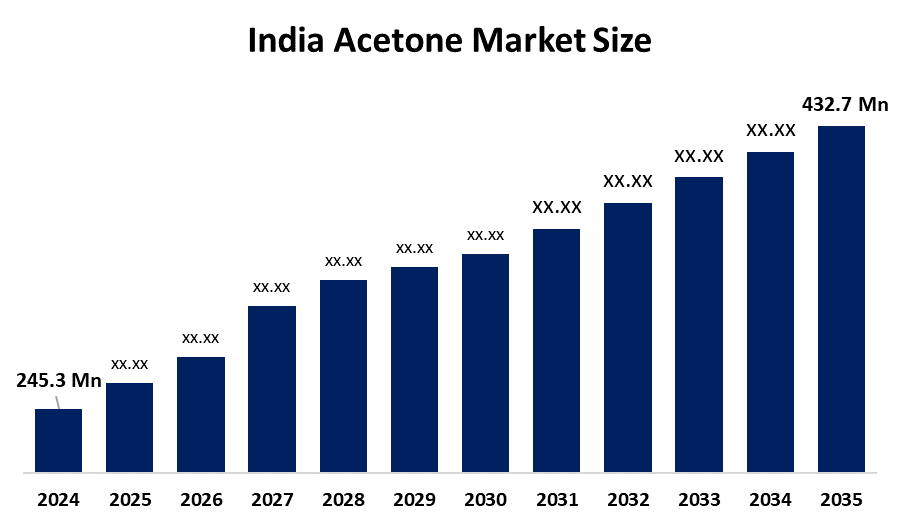

- India Acetone Market Size 2024: USD 245.3 Million

- India Acetone Market Size 2035: USD 432.7 Million

- India Acetone Market CAGR 2024: 5.3%

- India Acetone Market Segments: Manufacturing Process and Application

Get more details on this report -

The India Acetone Market Size encompasses a sector that produces, distribute, consume and import acetone. Acetone is a clear, colourless, volatile and very flammable organic solvent and is most commonly produced as a co-product of the cumene process in phenol manufacture. Acetone is an important chemical intermediate for pharmaceuticals, paints and coatings, adhesives, cosmetics, personal care products, plastic and chemical synthesis. It is also an essential feedstock for the manufacturing of methyl methacrylate (MMA) and bisphenol-A (BPA).

The acetone in India is backed by government support, including the Make in India and the National Chemical Policy, aims to reduce import dependence and strengthen India’s position as a global chemical manufacturing hub. Indian chemicals and petrochemicals sector contributes around 7% to India’s GDP and accounts for nearly 14% of industrial production, highlighting the sector’s scale and strategic importance of acetone.

As technology advances, Indian acetone providers are now using production efficient & optimized processes of integrating petrochemical plants into their overall operations to produce more valuable products with less environmental impact than before. This can be attributed to several factors including improvements made to catalyst technologies as well as new energy-efficient cumene production methods which allow for higher yields of acetone while lowering operating costs. Furthermore, the use of digital process control systems and other automated processes will provide new opportunity to increase acetone production quality, consistency, safety, and throughput in India as well as globally.

India Acetone Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 245.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.3% |

| 2035 Value Projection: | USD 432.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Application ,By Manufacturing Process |

| Companies covered:: | Deepak Phenolics Limited, Hindustan Organic Chemicals Ltd., SI Group India Limited, Haldia Petrochemicals Ltd., Prasol Chemicals Pvt Ltd., Vizag Chemicals, Purosolv, Sisco Research Laboratories Pvt Ltd., Helm India Pvt Ltd., and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India Acetone Market:

The India Acetone Market Size is driven by rapid expansion of the pharmaceutical and healthcare sectors, growth in construction and infrastructure development, increasing consumption of paints, coatings, and adhesives, rising demand for plastics, resins, and consumer goods, increasing urbanization, industrialization, gradual expansion of domestic phenol and BPA capacities, and technological increased adoption of digital process controls and automation further propel the market growth.

The India Acetone Market Size is restrained by the volatility in raw material prices, high production costs and pricing stability, global supply disruptions, currency fluctuations, acetone’s flammable nature and strict handling requirements, high regulatory compliance costs, and complex environmental regulations related to emissions, solvent recovery, and workplace safety.

The future of India Acetone Market Size is bright and promising, with versatile opportunities emerging from the expanding domestic capacity for phenol-acetone plants under import substitution strategies can significantly reduce reliance on overseas suppliers. Strong growth prospects exist in pharmaceutical manufacturing, specialty chemicals, and high-performance plastics, where demand for high-purity acetone is increasing. Opportunities are also emerging in downstream derivative production such as MMA and BPA, driven by rising demand for polycarbonates, resins, and lightweight materials. As India strengthens its chemical manufacturing ecosystem and focuses on value-added production, acetone is well positioned to benefit from deeper integration across the domestic chemical value chain.

Market Segmentation

The India Acetone Market share is classified into manufacturing process and application.

By Manufacturing Process:

The India Acetone Market Size is divided by manufacturing process into cumene process, dow process, and ranching-hooker process. Among these, the cumene process segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Cost effectiveness, integrated phenol-acetone plant, shift towards domestic manufacturing, high demand from downstream derivatives, and India’s strong petrochemical refining sector, all contribute to the cumene process segment's largest share and higher spending on acetone when compared to other manufacturing process.

By Application:

The India Acetone Market Size is divided by application into methyl methacrylate, bisphenol a, solvents, powders, and others. Among these, the solvents segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The solvents segment dominates because of widespread use across various industries, rapid urbanization, utilizing acetone’s excellent ability to dissolve substances, high volatility, and fast evaporation characteristics of solvents.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Acetone Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Acetone Market:

- Deepak Phenolics Limited

- Hindustan Organic Chemicals Ltd.

- SI Group India Limited

- Haldia Petrochemicals Ltd.

- Prasol Chemicals Pvt Ltd.

- Vizag Chemicals

- Purosolv

- Sisco Research Laboratories Pvt Ltd.

- Helm India Pvt Ltd.

- Others

Recent Developments in India Acetone Market:

In April 2025, Deepak Chem Tech Limited announced a major investment of approx. Rs3500 crores to set up a new plant including production of 185 KTA of acetone in Dahej, Gujarat designed to integrate with a new polycarbonate plant, enhancing India’s self-sufficiency.

In November 2024, Haldia Petrochemicals Ltd. boosted investment by Rs2000 crore for a acetone plant in West Bengal, which was expected to be operational by Q12026, producing 185 KTPA of acetone.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India acetone market based on the below-mentioned segments:

India Acetone Market, By Manufacturing Process

- Cumene Process

- Dow Process

- Ranching-Hooker Process

India Acetone Market, By Application

- Methyl Methacrylate

- Bisphenol A

- Solvents

- Powders

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India acetone market size?A: India acetone market is expected to grow from USD 245.3 million in 2024 to USD 432.7 million by 2035, growing at a CAGR of 5.3% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rapid expansion of the pharmaceutical and healthcare sectors, growth in construction and infrastructure development, increasing consumption of paints, coatings, and adhesives, rising demand for plastics, resins, and consumer goods, increasing urbanization, industrialization, gradual expansion of domestic phenol and BPA capacities, and technological increased adoption of digital process controls and automation further propel the market growth.

-

Q: What factors restrain the India acetone market?A: Constraints include the volatility in raw material prices, high production costs and pricing stability, global supply disruptions, currency fluctuations, acetone’s flammable nature and strict handling requirements, high regulatory compliance costs, and complex environmental regulations related to emissions, solvent recovery, and workplace safety.

-

Q: How is the market segmented by manufacturing process?A: The market is segmented into cumene process, dow process, and ranching-hooker process.

-

Q: Who are the key players in the India acetone market?A: Key companies include Deepak Phenolics Limited, Hindustan Organic Chemicals Ltd., SI Group India Limited, Haldia Petrochemicals Ltd., Prasol Chemicals Pvt Ltd., Vizag Chemicals, Purosolv, Sisco Research Laboratories Pvt Ltd., Helm India Pvt Ltd., and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?