India Acetic Anhydride Market Size, Share, and COVID-19 Impact Analysis, By Application (Coating Material, Explosive, Plasticizer, Synthesizer, and Other), By End-User Industry (Tobacco, Pharmaceutical, Laundry & Cleaning, Agrochemical, Textile, and Other), and India Acetic Anhydride Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Acetic Anhydride Market Size Insights Forecasts To 2035

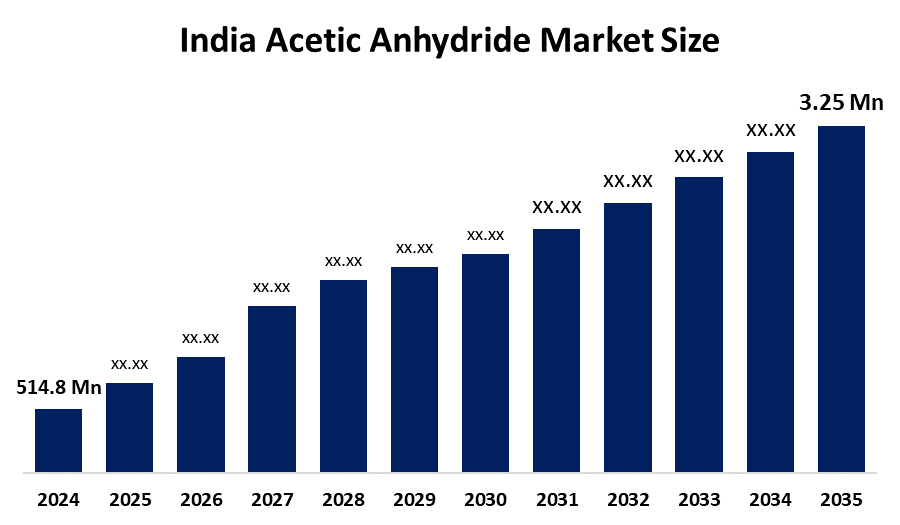

- The India Acetic Anhydride Market Size Was Estimated at USD 514.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 3.7% from 2025 to 2035

- The India Acetic Anhydride Market Size is Expected to Reach USD 768 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The India Acetic Anhydride Market Size Is Anticipated To Reach USD 768 Million By 2035, Growing At A CAGR Of 3.7% From 2025 To 2035. The India acetic anhydride market is driven by rising demand in pharmaceuticals, cellulose acetate production, and chemical intermediates. Increasing applications in textile, plastics, and acetylation processes, coupled with expanding industrial growth, are fuelling market growth in India.

Market Overview

Acetic anhydride is a colorless liquid organic compound widely used as a key chemical intermediate in the production of cellulose acetate, pharmaceuticals, and various acetylated chemicals. In India, the market size has witnessed significant growth due to the expanding pharmaceutical and textile industries, increasing demand for plastics and coatings, and rising use of acetic anhydride in chemical synthesis. The market growth is further supported by the government’s push for domestic chemical manufacturing and increasing exports to global markets, making India a critical hub for acetic anhydride production and consumption.

One major trend is the rising pharmaceutical applications, as acetic anhydride is used in producing aspirin, paracetamol, and other essential medicines. Second, growing demand in the textile sector drives usage for cellulose acetate production, used in fibers and films. Third, the shift toward sustainable and green chemistry has led to the adoption of eco-friendly acetylation processes, minimizing waste and emissions. Fourth, increased use of plasticizers and coatings has created new growth avenues, particularly in the packaging and automotive sectors, due to their ability to improve material properties and durability.

Technological advancements focus on catalyst-based processes that enhance yield and reduce energy consumption in acetic anhydride production. Innovative continuous flow reactors are being adopted to improve process efficiency, safety, and scalability. Additionally, bio-based and solvent-free synthesis methods are emerging, aligning with global sustainability trends. Integration of automation and digital monitoring in production plants ensures precise control of reactions, reduces operational risks, and lowers production costs. These technological innovations position India as a competitive player in the global acetic anhydride market.

Report Coverage

This research report categorizes the market size for the India acetic anhydride market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India acetic anhydride market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India acetic anhydride market.

India Acetic Anhydride Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 514.8 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 3.7% |

| 2023 Value Projection: | USD 768 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By End-User |

| Companies covered:: | Jubilant Ingrevia Limited, Laxmi Organic Limited, Luna Chemicals Industries Pvt. Ltd., Vizag Chemicals, Gujarat Dyestuff Industries, Ralingtonpharma LLP, Kakdiya Chemicals, Shree Maruti IMPEX India, Balaji Amines, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India acetic anhydride market size is primarily driven by the growing pharmaceutical industry, where it is essential for producing aspirin, paracetamol, and other drugs. Rising demand from the textile sector for cellulose acetate fibres and films further fuels growth. Expansion in plastics, coatings, and chemical intermediates applications boosts consumption, while increasing industrialization and manufacturing capacity in India enhances availability. Additionally, the focus on exports and adoption of advanced production technologies improves efficiency and reduces costs, collectively driving robust market growth across multiple end-use industries.

Restraining Factors

The India acetic anhydride market size faces restraints due to the hazardous and corrosive nature of the chemical, requiring strict handling and storage regulations. Fluctuating raw material prices and high production costs limit profitability. Additionally, environmental concerns, stringent government regulations, and the availability of safer alternative chemicals in certain applications slow market expansion and pose challenges for new manufacturers entering the industry.

Market Segmentation

The India acetic anhydride market share is classified into application and end-user industry.

- The synthesizer segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India acetic anhydride market size is segmented by application into coating material, explosive, plasticizer, synthesizer, and other. Among these, the synthesizer segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The synthesizer segment dominates the market because it is a critical raw material for producing pharmaceuticals, including widely used drugs like aspirin and paracetamol. Its role as a chemical intermediate in acetylation reactions for various organic compounds further strengthens demand. Additionally, the growing pharmaceutical industry in India, coupled with increasing exports of medicines, ensures consistent consumption. While other segments like coatings and plasticizers contribute to demand, the essential and high-volume use in pharmaceutical synthesis makes the synthesizer segment the market leader.

- The pharmaceutical segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India acetic anhydride market size is segmented by end-user industry into tobacco, pharmaceutical, laundry & cleaning, agrochemical, textile, and other. Among these, the pharmaceutical segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The pharmaceutical industry dominates the market size due to its essential role in producing widely used drugs like aspirin, paracetamol, and other chemical intermediates. The rapid growth of India’s pharmaceutical sector, driven by increasing domestic demand and global exports, ensures steady and high-volume consumption of acetic anhydride. While other industries like textiles, tobacco, and agrochemicals contribute to market demand, the critical and consistent usage in pharmaceutical manufacturing positions this segment as the leading end-user in the Indian market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India acetic anhydride market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Jubilant Ingrevia Limited

- Laxmi Organic Limited

- Luna Chemicals Industries Pvt. Ltd.

- Vizag Chemicals

- Gujarat Dyestuff Industries

- Ralingtonpharma LLP

- Kakdiya Chemicals

- Shree Maruti IMPEX India

- Balaji Amines

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India acetic anhydride market based on the below-mentioned segments:

India Acetic Anhydride Market, By Application

- Coating Material

- Explosive

- Plasticizer

- Synthesizer

- Other

India Acetic Anhydride Market, By End-user Industry

- Tobacco

- Pharmaceutical

- Laundry & Cleaning

- Agrochemical

- Textile

- Other

Frequently Asked Questions (FAQ)

-

What is acetic anhydride used for?Acetic anhydride is primarily used as a chemical intermediate in the production of pharmaceuticals, cellulose acetate, plastics, coatings, and other acetylated chemicals.

-

Which industry is the largest consumer of acetic anhydride in India?The pharmaceutical industry is the largest consumer due to its use in manufacturing drugs like aspirin and paracetamol.

-

What factors are driving the India acetic anhydride market?Key drivers include growing pharmaceutical production, increasing demand in textiles and plastics, industrial growth, and rising exports.

-

What are the major challenges in the market?Challenges include the hazardous nature of acetic anhydride, strict regulatory compliance, fluctuating raw material prices, and environmental concerns.

Need help to buy this report?