India Acetic Acid Market Size, Share, By Application (VAM, PTA, Anhydride, Ethyl Acetate, Butyl Acetate, And Others), By End Use (Plastics & Polymers, Food & Beverage, Inks, Paints & Coatings, Chemicals, Pharmaceuticals, And Others), And India Acetic Acid Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Acetic Acid Market Size Insights Forecasts to 2035

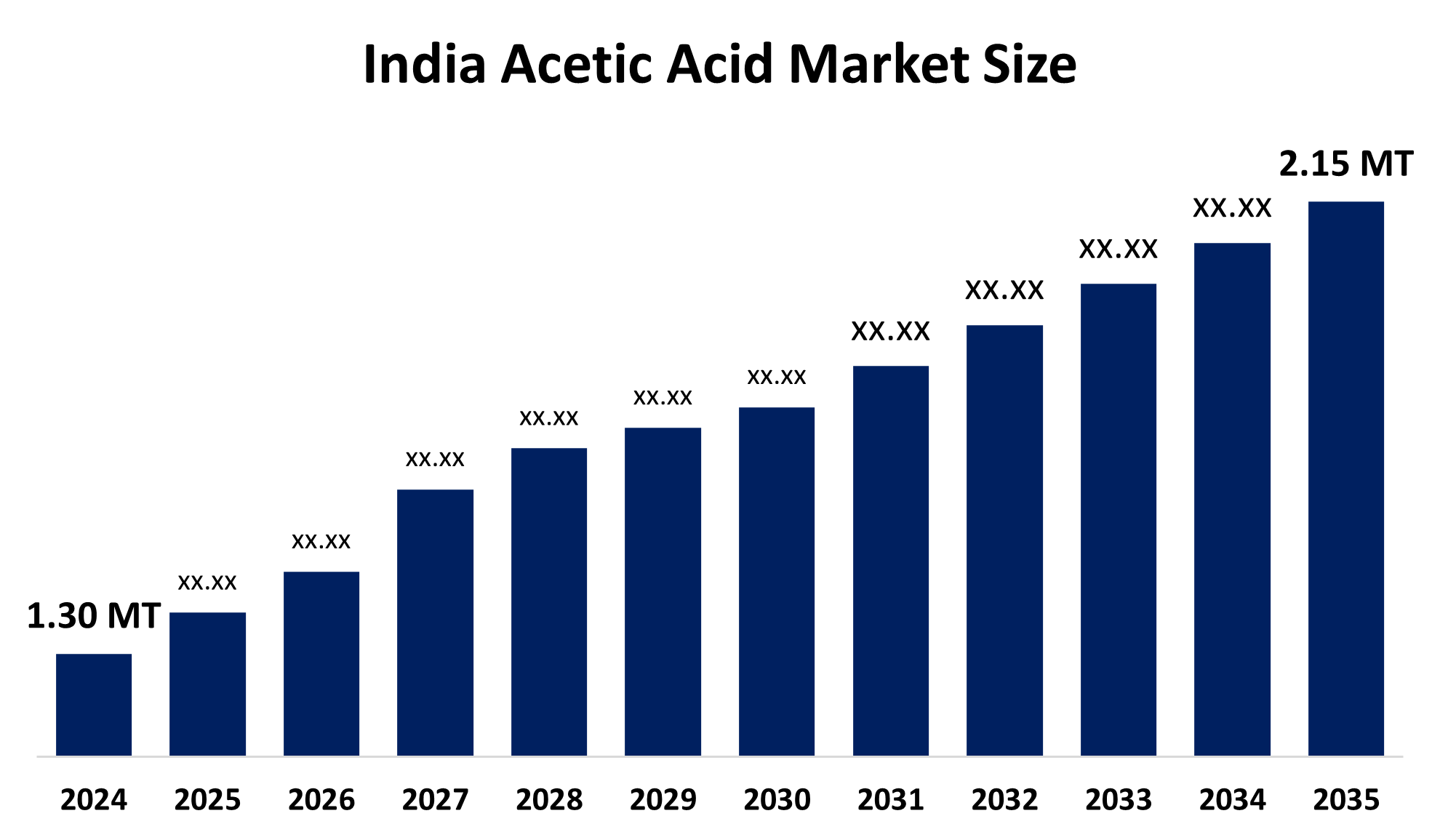

- India Acetic Acid Market 2024: 1.30 Million Tons

- India Acetic Acid Market Size 2035: 2.15 Million Tons

- India Acetic Acid Market CAGR 2024: 4.68%

- India Acetic Acid Market Segments: Application and End Use

Get more details on this report -

The India Acetic Acid Market involves the production, distribution and consumption of acetic acid, which is an important organic chemical. Acetic acid is a colorless substance with a long association to food as vinegar but is now more commonly used as an industrial chemical. Acetic acid is used to create a variety of industrial products such as vinyl acetate monomer (VAM), which is used in paint, coatings and adhesives; purified terephthalic acid (PTA), which is used in polyester fibers and plastics, butyl acetates, acetic anhydride, and all of the esters and chemical companies that manufacture these chemicals.

The acetic acid in India are backed by government support, including the Make in India and Atmanirbhar Bharat encourage investment in local chemical production facilities and reduce dependence on imports for key intermediates like acetic acid, strengthening the domestic supply chain and enhancing industrial competitiveness.

As technology advances, Indian acetic acid providers are now using advanced catalyst technology and process control methods that have resulted in increased yield, improved energy efficiency, and lower overall operating costs. Several companies in the industry and academic researchers are investigating alternate routes to produce acetic acid using bio-based feedstocks through fermentation processes to produce greener alternatives to petroleum-derived raw materials, which is consistent with India’s sustainability and environmental objectives. The use of these new processes will improve competitiveness and also enable the production of high purity grades used in pharmaceuticals and food applications where quality standards are extremely high.

Market Dynamics of the India Acetic Acid Market:

The India Acetic Acid Market is driven by the expanding downstream industries, rapid manufacturing growth, rising domestic production of purified terephthalic acid, rapid chemical industry’s expansion, increased use of VAM and other acetic acid derivatives in paints, coatings, adhesives, and plastics, burgeoning food processing sector, rising consumption of processed foods and vinegar, rapid growth in pharmaceuticals industry, technological upgrades for production of high purity grades acetic acid, and strong government support strengthening domestic supply chains further propel the market growth.

The India Acetic Acid Market is restrained by the high production costs, increased price volatility, increase operational uncertainty, stringent environmental regulations, requiring chemical manufacturers to invest in pollution control equipment, infrastructure compliance challenges, chemical storage and transportation add logistical complexity, and limiting efficient distribution issues.

The future of India Acetic Acid Market is bright and promising, with versatile opportunities emerging from the increasing the production of bio-acetic acid using renewable feedstocks will create a value-added product for global markets that require sustainability and have bio-content requirements. The increased consumption of bio-acetic acid in the pharmaceutical industry from both domestic and export markets will create a high-value market for USP-grade acetic acid for use in synthesizing active pharmaceutical ingredients. Furthermore, investments in green chemistry, capacity expansions by large manufacturers, and enhanced chemical logistics infrastructure will enable India to reduce its dependency on imported products while capturing a higher share of the domestic and global markets.

India Acetic Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 1.30 Million Tons |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.68% |

| 2035 Value Projection: | 2.15 Million Tons |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Application, By End Use |

| Companies covered:: | Gujarat Narmada Valley Fertilizers & Chemicals Limited, Jubilant Ingrevia Limited, Celanese Corporation, Pon Pure Chemicals Group, Assam Bio-Refinery Private Limited, Godavari Biorefineries Ltd., Eastman Chemical Company, Prakash Chemicals International Pvt. Ltd., Vizag Chemical, Tanfac Industries Ltd., Ashok Alco Chem Limited, Pentokey Organy, Indian Oil Corporation Ltd., Daicel Corporation, Saanvi Corp and Other Key Players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Market Segmentation

The India acetic acid market share is classified into application and end use.

By Application:

The India Acetic Acid Market is divided by application into VAM, PTA, anhydride, ethyl acetate, butyl acetate, and others. Among these, the VAM segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. Primary feedstock for producing PVA & EVA, booming Indian construction and automotive sectors, growing demand for packaging materials, and strong shift towards low-VOC all contribute to the VAM segment's largest share and higher spending on acetic acid when compared to other application.

By End Use:

The India Acetic Acid Market is divided by end use into plastics & polymers, food & beverage, inks, paints & coatings, chemicals, pharmaceuticals, and others. Among these, the plastics & polymers segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The plastics & polymers segment dominates because of high demand for VAM & PTA, rapid industrial growth in coatings, adhesives, packaging, and textiles, increasing production capacity, and well established industrial hubs for acetic acid in India.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India Acetic Acid Market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India Acetic Acid Market:

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- Jubilant Ingrevia Limited

- Celanese Corporation

- Pon Pure Chemicals Group

- Assam Bio-Refinery Private Limited

- Godavari Biorefineries Ltd.

- Eastman Chemical Company

- Prakash Chemicals International Pvt. Ltd.

- Vizag Chemical

- Tanfac Industries Ltd.

- Ashok Alco Chem Limited

- Pentokey Organy

- Indian Oil Corporation Ltd.

- Daicel Corporation

- Saanvi Corp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India Acetic Acid Market based on the below-mentioned segments:

India Acetic Acid Market, By Application

- VAM

- PTA

- Anhydride

- Ethyl Acetate

- Butyl Acetate

- Others

India Acetic Acid Market, By End Use

- Plastics & Polymers

- Food & Beverage

- Inks, Paints & Coatings

- Chemicals

- Pharmaceuticals

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the India acetic acid market size?A: India acetic acid market is expected to grow from 1.30 million tons in 2024 to 2.15 million tons by 2035, growing at a CAGR of 4.68% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the expanding downstream industries, rapid manufacturing growth, rising domestic production of purified terephthalic acid, rapid chemical industry’s expansion, increased use of VAM and other acetic acid derivatives in paints, coatings, adhesives, and plastics, burgeoning food processing sector, rising consumption of processed foods and vinegar, rapid growth in pharmaceuticals industry, technological upgrades for production of high purity grades acetic acid, and strong government support strengthening domestic supply chains further propel the market growth.

-

Q: What factors restrain the India acetic acid market?A: Constraints include the high production costs, increased price volatility, increase operational uncertainty, stringent environmental regulations, requiring chemical manufacturers to invest in pollution control equipment, infrastructure compliance challenges, chemical storage and transportation add logistical complexity, and limiting efficient distribution issues.

-

Q: Who are the key players in the India acetic acid market?A: Key companies include Gujarat Narmada Valley Fertilizers & Chemicals Limited, Jubilant Ingrevia Limited, Celanese Corporation, Pon Pure Chemicals Group, Assam Bio-Refinery Private Limited, Godavari Biorefineries Ltd., Eastman Chemical Company, Prakash Chemicals International Pvt. Ltd., Vizag Chemical, Tanfac Industries Ltd., Ashok Alco Chem Limited, Pentokey Organy, Indian Oil Corporation Ltd., Daicel Corporation, Saanvi Corp, and Others.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?