India Acetaldehyde Market Size, Share, and COVID-19 Impact Analysis, By Derivates (Pyridine and Pyridine Bases, Pentaerythritol, Acetic Acid, Ethyl Acetate, Butylene Glycol, Peracetic Acid, Acetate Esters, and Others), By Application (Chemical Synthesis, Food and Beverages, Pharmaceuticals, Plastics and Resins, Cosmetics, Paints and Coatings, Water Treatment, Paper and Pulp, and Others), and India Acetaldehyde Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia Acetaldehyde Market Size Insights Forecasts To 2035

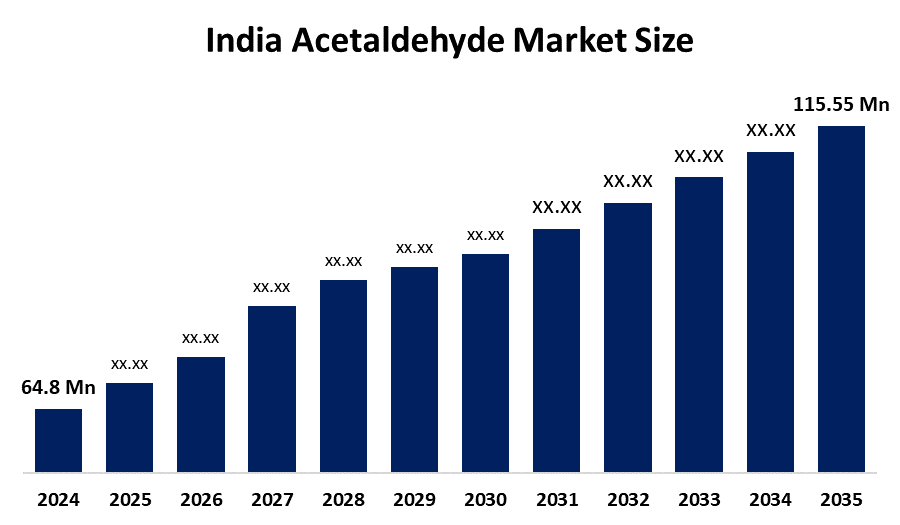

- The India Acetaldehyde Market Size Was Estimated at USD 64.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.4% from 2025 to 2035

- The India Acetaldehyde Market Size is Expected to Reach USD 115.55 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The India Acetaldehyde Market Size Is Anticipated To Reach USD 115.55 Million By 2035, Growing At A CAGR Of 5.4% From 2025 To 2035. The India acetaldehyde market is driven by rising demand from chemicals, pharmaceuticals, and plastics industries, growth in downstream products like acetic acid and pyridines, expanding industrialization, increasing agrochemical consumption, and improving domestic manufacturing capacities across the country.

Market Overview

The India acetaldehyde market size refers to the production and consumption of acetaldehyde, an important organic chemical used as an intermediate in the manufacture of acetic acid, pyridines, perfumes, dyes, pharmaceuticals, and agrochemicals. Market growth is supported by expanding chemical and pharmaceutical industries, rising demand for downstream derivatives, and increased use in food preservatives and flavouring agents. Rapid industrialization, growing domestic manufacturing, and government support for chemical sector investments further strengthen market expansion across India.

One key trend is the rising demand for acetaldehyde derivatives such as acetic acid and pyridines, driven by growth in pharmaceuticals and agrochemicals. Another trend is capacity optimization, where manufacturers focus on improving plant efficiency to reduce production costs. The third trend is increasing preference for domestic sourcing, as companies aim to reduce import dependency and strengthen supply chains. Lastly, regulatory compliance and environmental norms are encouraging producers to adopt cleaner production processes and better waste management practices.

Technological advancements in the India acetaldehyde market size focus on improving production efficiency, safety, and environmental performance. Modern plants increasingly adopt advanced oxidation and catalytic processes that enhance conversion rates and reduce by-product formation. Automation and digital monitoring systems are being integrated to ensure precise control over temperature, pressure, and reaction conditions, leading to consistent product quality. Energy-efficient distillation and recovery systems help lower operational costs and carbon emissions. Additionally, research efforts are directed toward developing bio-based routes using ethanol derived from renewable sources, aligning acetaldehyde production with sustainability goals. These innovations not only improve competitiveness but also support long-term compliance with evolving environmental regulations.

Report Coverage

This research report categorizes the market size for the India acetaldehyde market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India acetaldehyde market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the India acetaldehyde market.

India Acetaldehyde Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 64.8 Million |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 5.4% |

| 2023 Value Projection: | USD 115.55 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Derivates, By Application |

| Companies covered:: | AVI Scientific India, Naran Lala Pvt. Ltd., Moraya Global, Vizag Chemical International, Laxmi Organic Industries Ltd., Jubilant Ingrevia Limited, Triveni Chemicals, Central Drug House (P) Ltd., Godavari Biorefineries Ltd., and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The India acetaldehyde market size is primarily driven by growing demand from downstream industries such as acetic acid, pyridines, pharmaceuticals, and agrochemicals. Rapid industrialization and urbanization are boosting chemical production, while the expanding food and beverage sector increases the need for acetaldehyde as a flavoring and preservative agent. Additionally, government initiatives supporting domestic chemical manufacturing and efforts to reduce import dependence are encouraging local production. Rising investments in research and adoption of efficient production technologies further enhance output, making acetaldehyde a key intermediate in India’s industrial growth.

Restraining Factors

The India acetaldehyde market size faces restraints due to stringent environmental regulations on chemical emissions and hazardous waste management. High production costs, coupled with price volatility of raw materials like ethanol and ethylene, limit profitability. Additionally, dependence on imports for certain feedstocks and competition from alternative chemicals in downstream applications slows market growth and investment in new production capacities.

Market Segmentation

The India acetaldehyde market share is classified into derivates and application.

- The acetic acid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India acetaldehyde market size is segmented by derivates into pyridine and pyridine bases, pentaerythritol, acetic acid, ethyl acetate, butylene glycol, peracetic acid, acetate esters, and others. Among these, the acetic acid segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Acetic acid dominates the derivatives market because it is a vital intermediate in numerous industrial applications, including the production of vinyl acetate monomer, solvents, adhesives, and pharmaceuticals. Rapid growth in the textile, chemical, and construction sectors has significantly increased acetic acid demand. Additionally, acetaldehyde efficiently converts to acetic acid through established and cost-effective processes, making it the preferred route for manufacturers. This high industrial reliance ensures acetic acid consistently leads as the largest acetaldehyde derivative segment in India.

- The chemical synthesis segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The India acetaldehyde market size is segmented by application into chemical synthesis, food and beverages, pharmaceuticals, plastics and resins, cosmetics, paints and coatings, water treatment, paper and pulp, and others. Among these, the chemical synthesis segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The chemical synthesis segment dominates the market because acetaldehyde serves as a critical intermediate for producing acetic acid, pyridines, and various industrial chemicals. Rapid growth in downstream industries such as pharmaceuticals, agrochemicals, and solvents has significantly increased their consumption. Its versatility in synthesizing multiple chemicals and cost-effective production processes make it the preferred choice for manufacturers. Consequently, chemical synthesis remains the largest application segment, driving consistent demand for acetaldehyde across India’s industrial and manufacturing sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India acetaldehyde market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AVI Scientific India

- Naran Lala Pvt. Ltd.

- Moraya Global

- Vizag Chemical International

- Laxmi Organic Industries Ltd.

- Jubilant Ingrevia Limited

- Triveni Chemicals

- Central Drug House (P) Ltd.

- Godavari Biorefineries Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

In January 2024, Avient Corporation launched ColorMatrix AAnchor, an advanced acetaldehyde control technology for the packaging industry. This innovation helps maintain taste and odor integrity in PET bottled beverages by effectively controlling acetaldehyde levels. The technology is expected to drive demand in the packaging sector, particularly among beverage manufacturers seeking improved material solutions that comply with food safety and regulatory standards.

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India acetaldehyde market based on the below-mentioned segments:

India Acetaldehyde Market, By Derivates

- Pyridine and Pyridine Bases

- Pentaerythritol

- Acetic Acid

- Ethyl Acetate

- Butylene Glycol

- Peracetic Acid

- Acetate Esters

- Others

India Acetaldehyde Market, By Application

- Chemical Synthesis

- Food and Beverages

- Pharmaceuticals

- Plastics and Resins

- Cosmetics

- Paints and Coatings

- Water Treatment

- Paper and Pulp

- Others

Frequently Asked Questions (FAQ)

-

What is the India acetaldehyde market size?The India acetaldehyde market size is growing steadily due to increasing demand from chemical synthesis, pharmaceuticals, and food & beverage industries, with consistent expansion in domestic production capacities.

-

What are the major applications of acetaldehyde in India?Key applications include chemical synthesis, pharmaceuticals, food and beverages, plastics and resins, cosmetics, paints and coatings, water treatment, and paper and pulp.

-

Which derivative dominates the acetaldehyde market in India?Acetic acid is the largest derivative segment, driven by its extensive industrial use in solvents, adhesives, and downstream chemicals.

-

What are the key driving factors for market growth?Growth is fueled by rising industrialization, demand from downstream chemicals, expanding pharmaceutical and agrochemical sectors, and government support for domestic chemical manufacturing.

-

What restrains the India acetaldehyde market?Market growth is limited by strict environmental regulations, high raw material costs, import dependency for certain feedstocks, and competition from alternative chemicals.

Need help to buy this report?