India 4-Octylphenol Market Size, Share, By Type (99% Purity And 99.5% Purity), By Application (Resins, Surfactants, Chemical Intermediates, Pesticides, And Others), And India 4-Octylphenol Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsIndia 4-Octylphenol Market Size Insights Forecasts To 2035

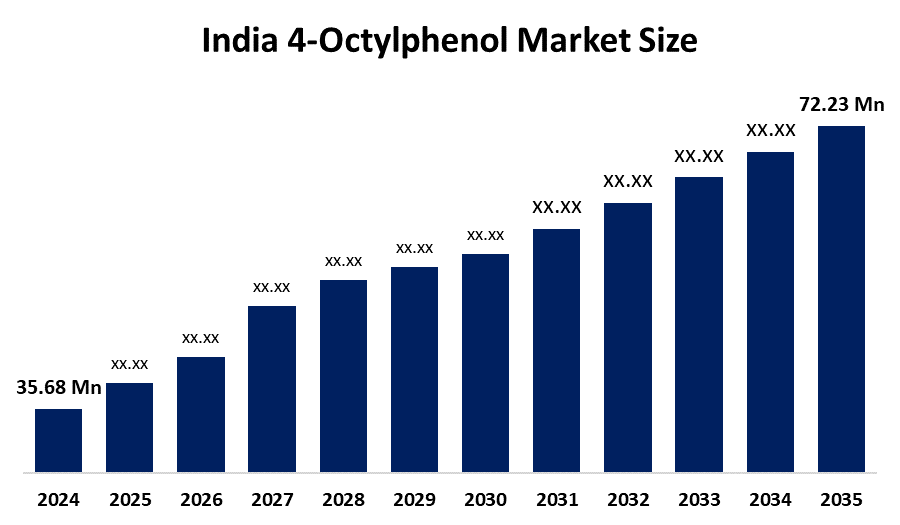

- India 4-Octylphenol Market Size 2024: 35.68 Thousand Tonnes

- India 4-Octylphenol Market Size 2035: 72.23 Thousand Tonnes

- India 4-Octylphenol Market Size CAGR 2024: 6.62%

- India 4-Octylphenol Market Size Segments: Type and Application

Get more details on this report -

The India 4-octylphenol market size encompasses the production, selling, and distribution of 4-octylphenol in that country. 4-Octylphenol is a chemical raw material called an alkylphenol which is mainly used in producing specialty chemicals like producing phenolic resins, surfactants, emulsifiers, dispersants, wetting and cleaning agents, additives for rubber products, lubricant oils, and moulding compounds. This country has experienced significant development with respect to 4-octylphenol with demand for product being especially strong in North and South regions of country. The supply of 4-octylphenol in-country depends on how much phenol and diisobutylene can be purchased in India.

The 4-octylphenol in India are backed by government support, including the Make in India programme, which promotes domestic manufacturing across key industrial categories, including specialty and petrochemicals. India’s chemical industry contributes around 7% of the country’s GDP and is the sixth-largest chemical producer globally, underscoring the sector’s significance and reinforcing demand for intermediate chemicals such as 4-octylphenol.

As technology advances, India’s 4-octylphenol providers are using advancements in chemical synthesis and production techniques, help increase efficiency and purity, as well as reduce the environmental impacts of producing alkylphenols. Producers are beginning to implement advanced catalytic processes and optimization methods to create high-quality 4-octylphenol with reduced energy use, while others are working on developing greener chemistries to further decrease the negative impact of alkylphenol production on the environment.

India 4-Octylphenol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2020-2023 |

| Forecast Period CAGR 2020-2023 : | 6.62% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Swadesh Chemical Private Limited, Prasol Chemicals Pvt. Ltd., Vinati Organics Limited, SI Group India, Sigma-Aldrich, TCI Chemicals, Solvay S.A., Stepan Company, SABIC, Fibrol Non Ionics Pvt. Ltd., Monini Auxi Chem Pvt. Ltd., Leo Chemo Plast Pvt. Ltd., and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics of the India 4-Octylphenol Market:

The India 4-octylphenol market size is driven by the increasing demand from downstream industries, growing electrical equipment manufacturing sector, urbanization, rising demand from consumers, needs for high-performance materials, increased demand for phenolic resins and related intermediates, supportive government initiative, and advancements in technologies further drives the market.

The India 4-octylphenol market size is restrained by the high operational costs, dependency on volatile raw material markets, regulatory pressures, supply chain risks, environmental and health concerns associated with alkylphenols, and stricter regulations issues.

The future of India 4-octylphenol market size is bright and promising, with versatile opportunities emerging from the urbanization, increasing industrial output, and the drive toward sustainability are contributing to the growing diversity and degree of specialization of the chemical industry’s applications. There is market opportunity to produce bio-based intermediate chemicals that have characteristics that meet performance and environmental criteria. Additionally, there is an opportunity to expand domestic production capacity in the India to accommodate increasing domestic demand and decrease reliance on imports.

Market Segmentation

The India 4-Octylphenol Market share is classified into type and application.

By Type:

The India 4-octylphenol market size is divided by type into 99% purity and 99.5% purity. Among these, the 99.5% purity segment held the largest revenue market share in 2024 and is predicted to grow at a remarkable CAGR during the forecast period. High reactivity, consistent for producing premium surfactants, phenols, and antioxidants, widely used across Indian industries, and cost effective all contribute to the 99.5% purity segment's largest share and higher spending on 4-octylphenol when compared to other type.

By Application:

The India 4-octylphenol market size is divided by application into resins, surfactants, chemical intermediates, pesticides, and others. Among these, the resins segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The resins segment dominates because of providing high-durability coatings, adhesives, and rubber products, rapidly growing automotive and construction sector, and providing superior thermal and chemical resistance.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the India 4-octylphenol market size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in India 4-Octylphenol Market:

- Swadesh Chemical Private Limited

- Prasol Chemicals Pvt. Ltd.

- Vinati Organics Limited

- SI Group India

- Sigma-Aldrich

- TCI Chemicals

- Solvay S.A.

- Stepan Company

- SABIC

- Fibrol Non Ionics Pvt. Ltd.

- Monini Auxi Chem Pvt. Ltd.

- Leo Chemo Plast Pvt. Ltd.

- Others

Recent Developments in India 4-Octylphenol Market:

- In June 2025, a report by CRISIL indicated that India’s phenol derivatives shifted towards local manufacturing. Imports of phenol-related products dropped, with Chinese import shares falled from high levels to 4% by fiscal 2025 as domestic production and specialized downstream manufacturing like 4-octylphenol production increased.

- In 2024-2025, Swadesh India Chemical Pvt. Ltd. expanded its portfolio of octylphenol ethoxylates and octylphenol-based non-ionic surfactants, targeting demand in textiles, agrochemicals, and industrial coatings.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the India, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the India 4-octylphenol market based on the below-mentioned segments:

India 4-Octylphenol Market, By Type

- 99% Purity

- 99.5% Purity

India 4-Octylphenol Market, By Application

- Resins

- Surfactants

- Chemical Intermediates

- Pesticides

- Others

Frequently Asked Questions (FAQ)

-

What is the India 4-octylphenol market size?India 4-octylphenol market is expected to grow from 35.68 thousand tonnes in 2024 to 72.23 thousand tonnes by 2035, growing at a CAGR of 6.62% during the forecast period 2025-2035.

-

What are the key growth drivers of the market?Market growth is driven by the increasing demand from downstream industries, growing electrical equipment manufacturing sector, urbanization, rising demand from consumers, needs for high-performance materials, increased demand for phenolic resins and related intermediates, supportive government initiative, and advancements in technologies further drives the market.

-

What factors restrain the India 4-octylphenol market?Constraints include the high operational costs, dependency on volatile raw material markets, regulatory pressures, supply chain risks, environmental and health concerns associated with alkylphenols, and stricter regulations issues.

-

How is the market segmented by type?The market is segmented into 99% purity and 99.5% purity.

-

Who are the key players in the India 4-octylphenol market?Key companies include Swadesh Chemical Private Limited, Prasol Chemicals Pvt. Ltd., Vinati Organics Limited, SI Group India, Sigma-Aldrich, TCI Chemicals, Solvay S.A., Stepan Company, SABIC, Fibrol Non Ionics Pvt. Ltd., Monini Auxi Chem Pvt. Ltd., Leo Chemo Plast Pvt. Ltd., and Others.

-

Who are the target audiences for this market report?The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs)

Need help to buy this report?