Global Inconel Market Size, Share, and COVID-19 Impact Analysis, By End-Use (Automobile, Energy and Environmental Engineering, Aerospace, Chemical Processing Industry, Electronic and Electrical Engineering, and Others), By Sales Channel (Direct Sale and Indirect Sale), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Inconel Market Size Insights Forecasts to 2035

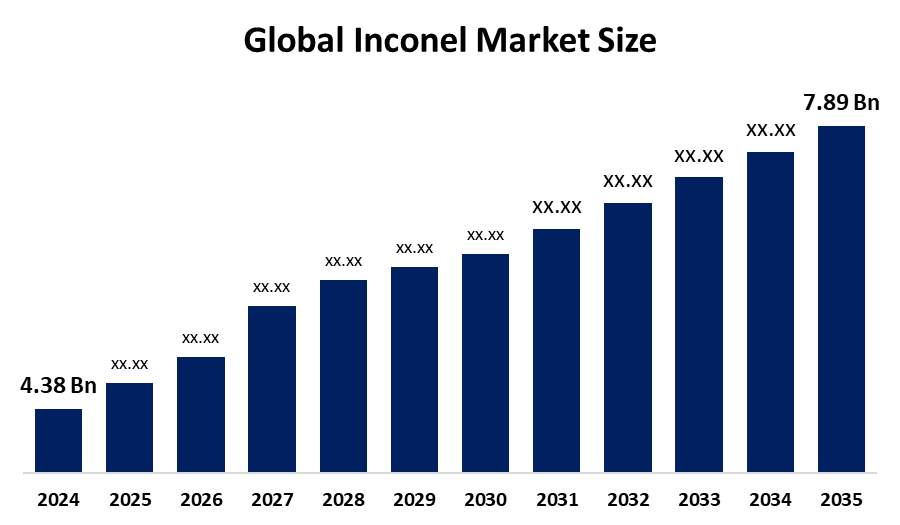

- The Global Inconel Market Size Was Valued at USD 4.38 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.5% from 2025 to 2035

- The Worldwide Inconel Market Size is Expected to Reach USD 7.89 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Inconel Market Size was worth around USD 4.38 Billion in 2024 and is predicted to grow to around USD 7.89 Billion by 2035 with a compound annual growth rate (CAGR) of 5.5% from 2025 to 2035. The global market for Inconel is driven by an increase in demand for heat-resistant superalloys used in aerospace, deep-water oil drilling equipment, and nuclear energy production.

Market Overview

The international market for inconel is a family of nickel-chromium-based superalloys that exhibit superior tensile, corrosion, and high-temperature stability, making them more reliable for use under extreme environmental conditions. The global market for Inconel exhibits promising prospects for growth on account of the increasing market demand for high-performance alloys in aerospace industry applications, together with growing energy sector needs for high-temperature alloys. The industry presents considerable business prospects for new market development towards renewable energy infrastructure development, oil exploration at deeper ocean depths, together with enhancing market requirements for Inconel-based alloys to improve automotive industry applications.

The market for Inconel alloys is dominated by industry market leaders, Special Metals Corporation, Allegheny Technologies, Sandvik AB, VDM Materials GmbH & Co., and Carpenter Technology. Industry leaders seek to capture more market space by focusing on product innovation strategies, together with enhancing market route development for their business to stay on course with escalating global industry market needs. In June 2025, the U.S. DOE provides a Harsh Environment Materials Roadmap to guide the development of future nickel-based superalloys such as Inconel, to serve nuclear, geothermal, solar, hydrogen, and fossil fuels applications. With $70M+ backing, it prioritizes high-temperature, corrosion, and hydrogen resistance through AI/ML and additive printing and supply chain security to increase efficiency and reduce emissions and maintenance costs.

Report Coverage

This research report categorizes the Inconel Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Inconel Market Size. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Inconel Market Size.

Inconel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.38 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.5% |

| 2035 Value Projection: | USD 7.89 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By End-Use, By Sales Channel |

| Companies covered:: | Special Metals Corporation, Sandvik AB, Allegheny Technologies, VDM Materials GmbH & Co., Haynes International, Inc, ATI Inc, Carpenter Technology, Proterial, Ltd., Outokumpu Oyj, Aperam S.A, Precision Castparts Corp., Fushun Special Steel Co., Ltd, VSMPO-AVISMA Corporation, Altemp Alloys, Inc., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Inconel Market Size across the globe is influenced by growing demand for better material usage for maintaining high performance even at extreme pressure, corrosion, and temperature. Some of the key market growth contributors include growing aerospace and defense production where Inconel is used for jet engine production to produce turbo machinery, growing investment in oil & gas industry production involving Inconel for its use at high pressure and high-temperature usage, growing demand for electric generation within renewable energy sources, rapid industrialization, increases in additive manufacturing technologies used for Inconel production, use of Inconel for automotive industry production to produce durable Inconel material used for characteristic chemical corrosion resistance.

Restraining Factors

The global Inconel Market Size is also experiencing restraints in the form of its high production and material costs. Similarly, its complex production procedures, lack of recyclability, and competition with other super alloys/stainless steel materials are constraining the Inconel Market Size. In addition to these, economic fluctuations are also affecting the Inconel Market Size.

Market Segmentation

The Inconel Market Size share is classified into end-use and sales channel.

- The aerospace segment dominated the market in 2024, approximately 45% and is projected to grow at a substantial CAGR during the forecast period.

Based on the end-use, the Inconel Market Size is divided into automobile, energy and environmental engineering, aerospace, chemical processing industry, electronic and electrical engineering, and others. Among these, the aerospace segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The aerospace segment has dominated the Inconel Market Size because of the rising need to use top-notch alloys with high resistance to heat and corrosion in the production of parts in the aircraft and space industries. Companies such as Boeing and Airbus are leading in the production of aircraft, which has led to the dominance of this segment.

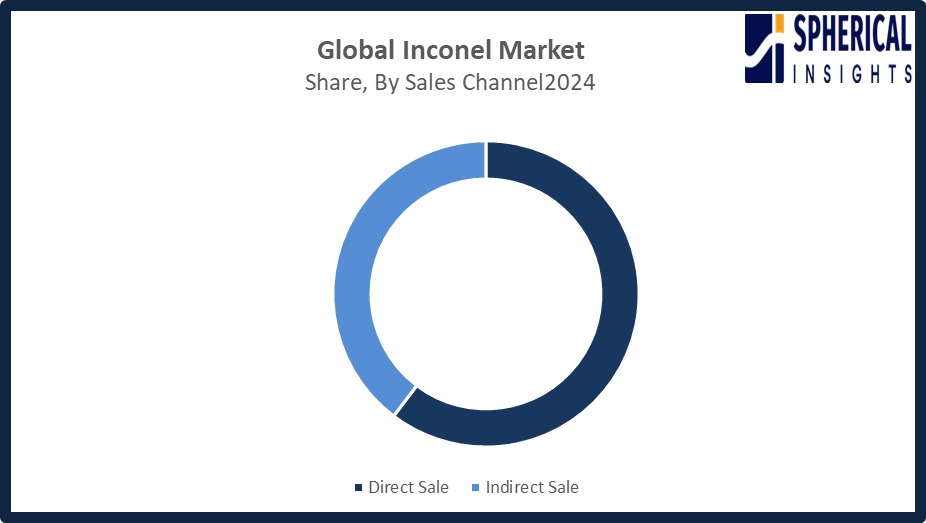

- The direct sale segment accounted for the highest market revenue in 2024, approximately 60% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the sales channel, the Inconel Market Size is divided into direct sale and indirect sale. Among these, the direct sale segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The direct sales market contributed to the highest level of market growth, with all market players entering into long-term contracts with large industries, which include aerospace, energy, and defense. Directly reaching manufacturers increases market value by creating customer relationships, allowing them to deliver efficiently to certain industrial applications, which represents a large market share in terms of revenue.

Get more details on this report -

Regional Segment Analysis of the Inconel Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the Inconel Market Size over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the Inconel Market Size over the predicted timeframe. The region that is expected to have the 40% share in the market for Inconel is North America, and this growth may be attributed largely to the USA. The increased demand from the defense sector, including Aerospace and Boeing or even Lockheed Martin, necessitates super-alloys resistant to temperature and corrosive effects in aircraft engines or space exploration equipment. The energy sector, including fossil fuels or geothermal and even the highly stressed chemical reactors in the nuclear sector, also exhibits an increased need for such niche sectors as Inconel. The positive governmental policies in place guarantee the development of this region.

Asia Pacific is expected to grow at a rapid CAGR in the Inconel Market Size during the forecast period. Asia Pacific is expected to have 25% market share of the Inconel Market Size, led by the growth of economies such as China, India, and Japan. These economies are witnessing fast industrialization, expansion of aero-defence manufacturing, and development of more energy infrastructure facilities, which is helping the Inconel Market Size grow. Aircraft manufacturing in China, Make in India in the aero-defence segment, and manufacturing facilities in Japan, with a focus on advanced manufacturing and energy, contribute positively. In addition, there is an increasing focus in this segment due to the growth in electric vehicles and renewable energy.

The market size in Europe is increasing steadily, with Germany, France, and the UK leading the way. Aerospace and defense activities, such as those in companies like Airbus, contribute to market growth in Europe. Additionally, Europe’s commitment to clean technologies like renewable energy and advanced power technologies like gas turbines and nuclear reactors contributes to market growth in Europe, with government initiatives to support R&D activities further fueling market growth in Europe.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Inconel Market Size, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Special Metals Corporation

- Sandvik AB

- Allegheny Technologies

- VDM Materials GmbH & Co.

- Haynes International, Inc

- ATI Inc

- Carpenter Technology

- Proterial, Ltd.

- Outokumpu Oyj

- Aperam S.A

- Precision Castparts Corp.

- Fushun Special Steel Co., Ltd

- VSMPO-AVISMA Corporation

- Altemp Alloys, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Proterial Metals, Ltd., a 100% subsidiary of Proterial, Ltd., developed a plating technology for conductive nickel-phosphorus (Ni-P) particles. The new plated Ni-P particles enhance semiconductor performance, reduce power consumption by lowering electrical resistance, and maintain heat resistance, expanding the company’s advanced semiconductor materials product lineup.

- In October 2024, Aperam S.A. announced a definitive agreement to acquire Universal Stainless & Alloy Products for $45 per share, valuing the company at $539 million. The all-cash deal, expected to close in H1 2025, strengthens Aperam’s US presence and expands its specialty steel offerings in aerospace and industrial sectors.

- In February 2024, Acerinox announced plans to acquire Haynes International for USD 61 per share, valuing the deal at USD 798 million. Approved by both companies’ boards, the acquisition aims to strengthen Acerinox’s global leadership in high-performance alloys and expand opportunities in aerospace and the US market.

- In January 2024, VDM Metals, representing Acerinox Group’s High-Performance Alloys division, announced major investments at its Unna site. The company, producing nickel alloys and high-alloy stainless steels in sheet, strip, bar, wire, and powder, is adding three remelting units and a second powder atomization plant to expand production.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Inconel Market Size based on the below-mentioned segments:

Global Inconel Market Size, By End-Use

- Automobile

- Energy and Environmental Engineering

- Aerospace

- Chemical Processing Industry

- Electronic and Electrical Engineering

- Others

Global Inconel Market Size, By Sales Channel

- Direct Sale

- Indirect Sale

Global Inconel Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Inconel Market Size over the forecast period?The global Inconel Market Size is projected to expand at a CAGR of 5.5% during the forecast period.

-

2. What is the market size of the Inconel Market Size?The global Inconel Market Size is expected to grow from USD 4.38 billion in 2024 to USD 7.89 billion by 2035, at a CAGR of 5.5% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Inconel Market Size?North America is anticipated to hold the largest share of the Inconel Market Size over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Inconel Market Size?Special Metals Corporation, Sandvik AB, Allegheny Technologies, VDM Materials GmbH & Co., Haynes International, Inc, ATI Inc, Carpenter Technology, Proterial, Ltd., Outokumpu Oyj, Aperam S.A, and Others.

-

5. What factors are driving the growth of the Inconel Market Size?Growth of the Inconel Market Size is driven by rising aerospace and defense demand, expansion of energy and chemical industries, need for high-temperature corrosion-resistant materials, and increasing adoption in advanced manufacturing.

-

6. What are the market trends in the Inconel Market Size?Key trends include increased aerospace demand, adoption in electric vehicles, advanced alloy innovations, supply chain optimization, and growth in Asia Pacific industrial applications.

-

7. What are the main challenges restricting wider adoption of the Inconel Market Size?Main challenges restricting Inconel adoption include high production and raw material costs, complex manufacturing processes, limited supplier availability, stringent quality requirements, and competition from alternative superalloys and corrosion-resistant materials.

Need help to buy this report?