Global Implantable Neurostimulators Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Spinal Cord Stimulators, Deep Brain Stimulators, Sacral Nerve Stimulators, Vagus Nerve Stimulators, and Gastric Electrical Stimulation), By Application (Pain Management, Epilepsy, Parkinson’s Disease, Urinary and Fecal Incontinence, Gastroparesis, and Others), By End Use (Hospitals & Ambulatory Surgery Centers (ASC), Clinics & Physiotherapy Centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Implantable Neurostimulators Market Size Insights Forecasts to 2035

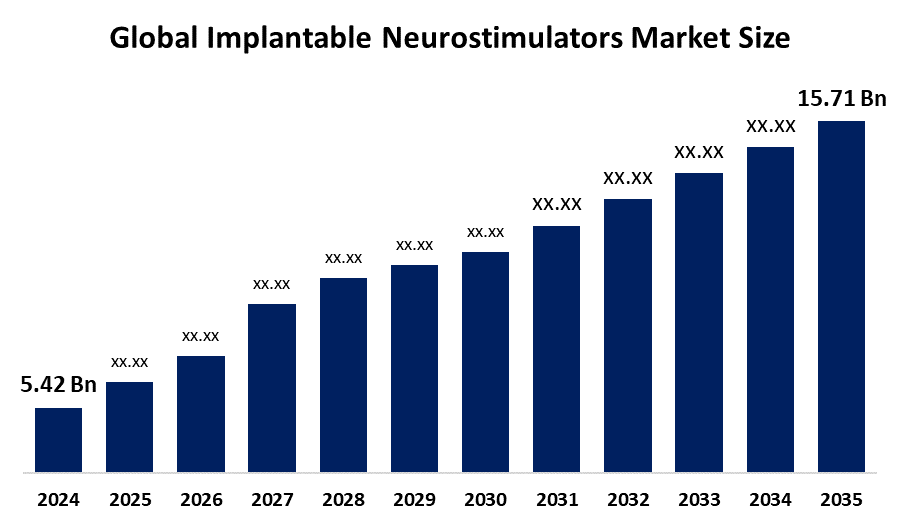

- The Global Implantable Neurostimulators Market Size Was Estimated at USD 5.42 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.16% from 2025 to 2035

- The Worldwide Implantable Neurostimulators Market Size is Expected to Reach USD 15.71 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Implantable Neurostimulators Market Size was worth around USD 5.42 Billion in 2024 and is predicted to Grow to around USD 15.71 Billion by 2035 with a compound annual growth rate (CAGR) of 10.16% from 2025 to 2035. Market growth for implantable neurostimulators is driven by growing cases of neurological disorders, technological innovation in devices, growing awareness among patients, and a growing population with an aging demographic, promoting demand for efficient, minimally invasive procedures for chronic pain, epilepsy, and movement disorders.

Market Overview

The implantable neurostimulators market refers to the manufacture and sale of devices to provide electrical stimulation directly to the nervous system in order to help manage neurological and chronic illinesses, Implantable neurostimulators or neuromodulation devices are extensively applied to treat illnesses such as chronic pain, Parkinson's disease, epilepsy, movement disorders, and urinary incontinence. These technologies modulate neural function, yield symptomatic benefit, enhance quality of life, and minimize reliance on pharmacological treatments. Market expansion is spurred by increased incidence of neurological disorders, an aging population, higher healthcare spending, and enhanced awareness among patients and physicians of the efficacy of neuromodulation therapies. Technological advancements, such as rechargeable systems, minimally invasive implantation methods, adaptive stimulation, and remote programming features, have further accelerated adoption by enhancing safety, effectiveness, and patient compliance.

Growth opportunities are available in broader applications in emerging therapeutic areas, including depression and obesity, as well as in emerging markets where awareness of neurological disease is growing. The market is supported by a robust ecosystem of players worldwide, such as Medtronic, Boston Scientific, Abbott Laboratories, NeuroPace, and Nevro Corp., that are actively focusing on research and development to make devices more functional, minimize complications, and provide affordable solutions. Strategic partnerships, mergers, and collaborations between manufacturers, research institutes, and healthcare providers are also driving innovation and market penetration. The American Urological Association (AUA) and the Society of Urodynamics, Female Pelvic Medicine & Urogenital Reconstruction (SUFU) revised clinical guidelines for idiopathic overactive bladder (OAB) in May 2024, acknowledging implantable tibial nerve stimulation (ITNS) as a treatment. This addition is likely to increase the usage of implantable neurostimulator devices in the treatment of OAB.

Report Coverage

This research report categorizes the implantable neurostimulators market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the implantable neurostimulators market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the implantable neurostimulators market.

Global Implantable Neurostimulators Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.42 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.16% |

| 2035 Value Projection: | USD 15.71 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 264 |

| Tables, Charts & Figures: | 142 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Medtronic, Abbott Laboratories, LivaNova, Boston Scientific, NeuroPace, Stryker, Nevro Corp., Inspire Medical Systems, Synapse Biomedical Inc., Cognito Therapeutics, Aleva Neurotherapeutics, Saluda Medical Pty Ltd., Axonics Modulation Technologies, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The implantable neurostimulators market globally is mainly boosted by the increasing incidence of neurological disorders such as Parkinson's disease, chronic pain, epilepsy, and movement disorders, thereby raising the demand for effective therapeutic intervention. Improvements in neurostimulation technology in terms of minimally invasive treatments, rechargeable systems, and adaptive stimulation systems improve the efficiency of treatment and patient compliance. Increased awareness on the part of patients and healthcare professionals regarding the advantages of neurostimulation therapies further drives the growth of the market. Also, increased population aging, growing healthcare spending, and augmenting government and private sector investments in neurological research fuel the growth of the implantable neurostimulators market on a global scale.

Restraining Factors

The implantable neurostimulators market is hindered by expensive devices and surgery prices, lack of insurance coverage, and complex implantation procedures. Adverse side effects, including infections, device failure, and neurological issues, are also limiting adoption. Lack of awareness in developing markets and stringent regulatory demands are other challenges for the market's growth.

Market Segmentation

The implantable neurostimulators market share is classified into product type, application, and end use.

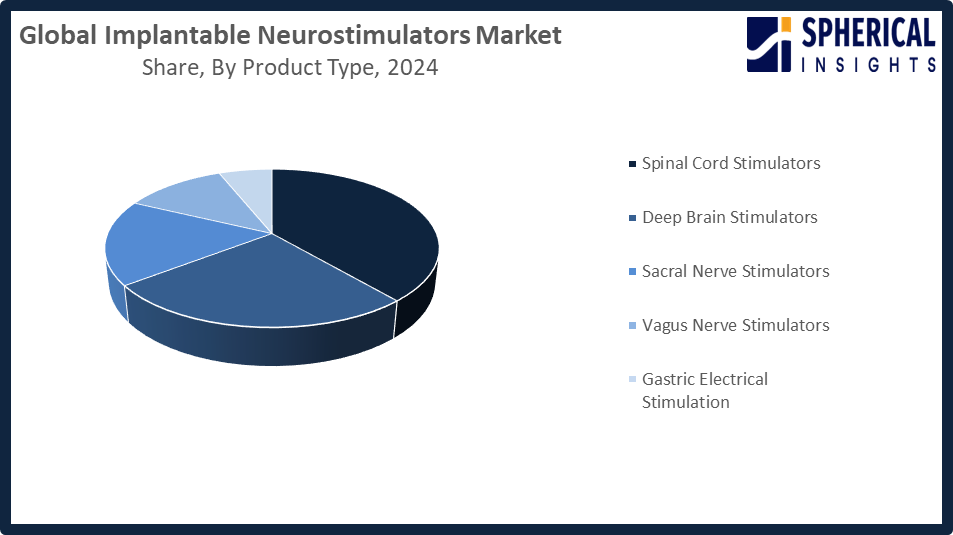

- The spinal cord stimulators segment dominated the market in 2024, approximately 39% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the implantable neurostimulators market is divided into spinal cord stimulators, deep brain stimulators, sacral nerve stimulators, vagus nerve stimulators, and gastric electrical stimulation. Among these, the spinal cord stimulators segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. This segment dominated the market with its efficiency in treating chronic pain by transmitting electrical impulses to interrupt pain signals. Increasing incidence of neuropathic pain, failed back surgery syndrome, and diabetic neuropathy, combined with technological developments that reduce the invasiveness and enhance the performance of devices, have driven adoption. Enhanced patient outcomes and increasing provider awareness continue to enhance their leadership in the market.

Get more details on this report -

- The pain management segment accounted for the largest share in 2024, approximately 50% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the implantable neurostimulators market is divided into pain management, epilepsy, parkinson’s disease, urinary and fecal incontinence, gastroparesis, and others. Among these, the pain management segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The pain management sector led the market as the incidence of chronic pain disorders such as arthritis, fibromyalgia, and neuropathic pain grew. Neurostimulation offers an alternative that is not pharmacological in nature, lowering the dependence on opioids, and technological innovation allows for exact, tailored treatments. Increasing emphasis on effective pain approaches, with the opioid issues in place, guarantees this sector holds its top market position.

- The hospitals & ambulatory surgery centers (ASC) segment accounted for the highest market revenue in 2024, approximately 55% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the implantable neurostimulators market is divided into hospitals & ambulatory surgery centers (ASC), clinics & physiotherapy centers, and others. Among these, the hospitals & ambulatory surgery centers (ASC) segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment leads the market due to its sophisticated technology and experienced personnel for performing complex implantable neurostimulator procedures. Chronic conditions on the rise, growing patient volumes, and investment in next-generation technologies boost care and outcomes. Moreover, increased emphasis on outpatient procedures also lends support to their leadership, as patients demand effective treatments that minimize hospitalization.

Regional Segment Analysis of the Implantable Neurostimulators Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the implantable neurostimulators market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the implantable neurostimulators market over the predicted timeframe. The North America implantable neurostimulators market led the world with a 43.7% share in revenue in 2024, led by the high incidence of chronic pain and neurological diseases. Well-developed healthcare infrastructure and high medical technology investment have propelled neurostimulation therapy uptake. Strong R&D efforts promote innovative, efficient products, while increased awareness among patients and healthcare professionals stimulates demand. Supportive reimbursement policies in the U.S. also stimulate adoption. With the increasing demand for efficient pain management solutions, North America will continue to lead the market for implantable neurostimulators during the forecast period.

On July 11, 2024, Valencia Technologies announced that the U.S. CMS published the 2025 Medicare Hospital Outpatient and ASC Proposed Rule, including guidance for the eCoin system, a leadless implantable tibial nerve stimulation (ITNS) device designed to treat urgency urinary incontinence (UUI).

Asia Pacific is expected to grow at a rapid CAGR in the implantable neurostimulators market during the forecast period. Asia Pacific is rapidly growing in the market for implantable neurostimulators, with an approximate 23% market share, led mainly by China, India, and Japan. Increasing incidence of neurological diseases, growing healthcare awareness, and an expanding medical infrastructure propel market growth. China dominates with its vast patient bases and government support for advanced medical equipment, and India's expanding healthcare availability and implementation of new therapies drive demand. Japan's emphasis on geriatric care and advanced medical solutions further drives the region's fast market growth.

Europe is experiencing consistent growth in the implantable neurostimulators market, led primarily by Germany, the UK, and France. The increasing incidence of chronic pain and neurological conditions, combined with sophisticated healthcare infrastructure and high patient awareness, underpins growth. Germany is a leader based on strong uptake of medical technology and positive reimbursement policies, while the UK and France contribute through rising investment in next-generation neurostimulation devices and government support for the use of advanced pain management solutions, contributing to regional growth together.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the implantable neurostimulators market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medtronic

- Abbott Laboratories

- LivaNova

- Boston Scientific

- NeuroPace

- Stryker

- Nevro Corp.

- Inspire Medical Systems

- Synapse Biomedical Inc.

- Cognito Therapeutics

- Aleva Neurotherapeutics

- Saluda Medical Pty Ltd.

- Axonics Modulation Technologies

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, Saluda Medical, Inc. announced the U.S. full commercial launch of EVA, its next-generation sensing technology for chronic neurological conditions. EVA, approved by the FDA in December 2024, is fully compatible with all commercially implanted Evoke SmartLoop System patients, enhancing neuromodulation therapy effectiveness.

- In April 2025, Abbott launched a next-generation delivery system for its neuromodulation business to enhance electrode implantation with the Proclaim DRG neurostimulation system. The system simplifies procedures for patients suffering from complex regional pain syndrome (CRPS) Type 1 and causalgia (CRPS Type 2) affecting the lower extremities.

- In August 2024, Inspire Medical Systems, Inc. announced FDA approval of its Inspire V therapy system, featuring a next-generation neurostimulator with a Bluetooth-enabled patient remote and physician programmer. The innovative, minimally invasive solution is designed to treat patients suffering from obstructive sleep apnea (OSA) effectively.

- In March 2023, Nevro Corp. announced the U.S. full market launch of its HFX iQ spinal cord stimulation (SCS) system after a successful limited release. The advanced system provides personalized, effective solutions for chronic pain management, strengthening Nevro’s position in neuromodulation technology.

- In October 2022, EuroPace announced the first patient implantation of its responsive neurostimulation (RNS) system in the ongoing NAUTILUS clinical trials for patients aged 12 and above. The system targets idiopathic generalized epilepsy (IGE), representing 15-20% of epilepsy cases, affecting nearly five million people globally each year, per the WHO.

- In February 2022, LivaNova PLC announced the first patient implantation in its IDE clinical study, OSPREY, evaluating the Aura6000 System, an implantable hypoglossal neurostimulator. The randomized controlled trial aims to assess the device’s safety and effectiveness in treating adults with moderate to severe obstructive sleep apnea (OSA).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the implantable neurostimulators market based on the below-mentioned segments:

Global Implantable Neurostimulators Market, By Product Type

- Spinal Cord Stimulators

- Deep Brain Stimulators

- Sacral Nerve Stimulators

- Vagus Nerve Stimulators

- Gastric Electrical Stimulation

Global Implantable Neurostimulators Market, By Application

- Pain Management

- Epilepsy

- Parkinson’s Disease

- Urinary and Fecal Incontinence

- Gastroparesis

- Others

Global Implantable Neurostimulators Market, By End Use

- Hospitals & Ambulatory Surgery Centers (ASC)

- Clinics & Physiotherapy Centers

- Others

Global Implantable Neurostimulators Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the implantable neurostimulators market over the forecast period?The global implantable neurostimulators market is projected to expand at a CAGR of 10.16% during the forecast period.

-

2. What is the market size of the implantable neurostimulators market?The global implantable neurostimulators market size is expected to grow from USD 5.42 billion in 2024 to USD 15.71 billion by 2035, at a CAGR of 10.16% during the forecast period 2025-2035.

-

3. What is the implantable neurostimulators market?The implantable neurostimulators market is a global industry for medical devices that are surgically placed in the body to deliver electrical signals to the nervous system to treat neurological disorders.

-

4. Which region holds the largest share of the implantable neurostimulators market?North America is anticipated to hold the largest share of the implantable neurostimulators market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global implantable neurostimulators market?Medtronic, Abbott Laboratories, LivaNova, Boston Scientific, NeuroPace, Stryker, Nevro Corp., Inspire Medical Systems, Synapse Biomedical Inc., Cognito Therapeutics, Aleva Neurotherapeutics, Saluda Medical Pty Ltd., Axonics Modulation Technologies, and Others.

-

6. What factors are driving the growth of the implantable neurostimulators market?The implantable neurostimulators market is experiencing significant growth due to the rising prevalence of neurological disorders, ongoing technological advancements, and increasing demand for effective pain management.

-

7. What are the market trends in the implantable neurostimulators market?Market trends in implantable neurostimulators include rapid growth driven by the rising prevalence of neurological disorders such as chronic pain and Parkinson's disease, combined with an aging population.

-

8. What are the main challenges restricting wider adoption of the implantable neurostimulators market?The wider adoption of the implantable neurostimulators market is restricted by several key challenges, including the high cost of devices and procedures, significant regulatory hurdles, and risks associated with the surgery and long-term device performance.

Need help to buy this report?