Global Implantable Cardioverter Defibrillators Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Transvenous Implantable Cardioverter-Defibrillators, and Subcutaneous Implantable Cardioverter Defibrillators), By End User (Hospitals, Ambulatory Surgical Centers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Implantable Cardioverter Defibrillators Market Size Insights Forecasts to 2035

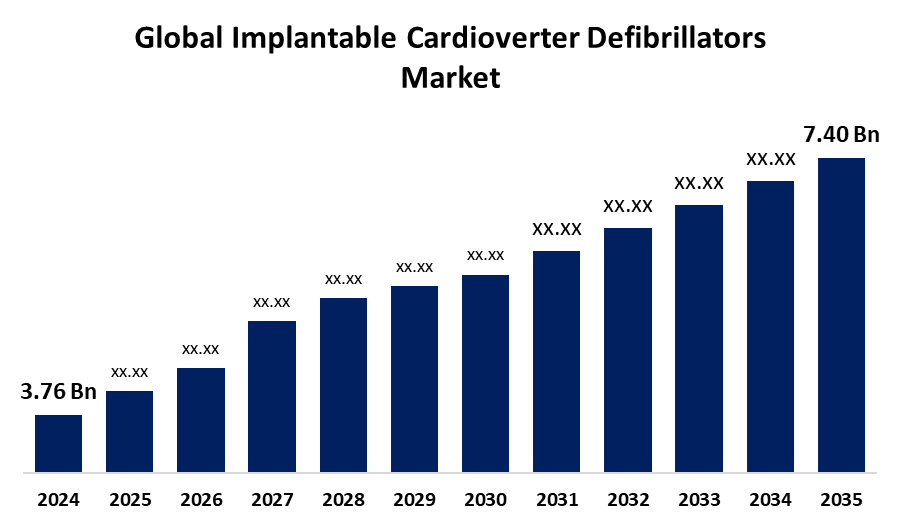

- The Global Implantable Cardioverter Defibrillators Market Size Was Estimated at USD 3.76 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.35% from 2025 to 2035

- The Worldwide Implantable Cardioverter Defibrillators Market Size is Expected to Reach USD 7.40 Billion by 2035

- Asia Pacific is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Implantable Cardioverter Defibrillators Market Size was worth around USD 3.76 Billion in 2024 and is predicted to grow to around USD 7.40 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 6.35% from 2025 and 2035. The need for sophisticated cardiac care solutions, such as ICDs, is anticipated to increase due to the increased prevalence of cardiovascular diseases (CVDs), providing opportunities for the Implantable Cardioverter Defibrillators Market.

Market Overview

The Global Industry devoted to the development, manufacturing, and distribution of electronic medical devices intended to monitor and control heart rhythms in people at risk of potentially fatal arrhythmias, such as ventricular tachycardia and ventricular fibrillation, is known as the implantable cardioverter defibrillators (ICD) market. The research, manufacturing, and distribution of medical devices intended to monitor and control cardiac rhythms in people at risk of potentially fatal arrhythmias are the main objectives of the implantable cardioverter defibrillator (ICD) market.

The rising incidence of cardiovascular illnesses and other cardiac conditions, the expansion of technological and product development efforts, and the awareness of subcutaneous ICDs are the main factors driving the implantable cardioverter defibrillators market's expansion. Technological developments, rising rates of sudden cardiac arrest, rising public awareness, and supporting government and healthcare organization policies are some of the factors propelling the implantable cardioverter defibrillators market. One of the main factors fueling the implantable cardioverter defibrillators market is the increase in the prevalence of cardiovascular conditions, such as heart failure and ventricular arrhythmias.

Report Coverage

This research report categorizes the implantable cardioverter defibrillators market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the implantable cardioverter defibrillators market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the implantable cardioverter defibrillators market.

Global Implantable Cardioverter Defibrillators Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.76 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.35% |

| 2035 Value Projection: | USD 7.40 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type, By End User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Abbott Laboratories, LivaNova plc, BIOTRONIK SE & Co. KG, Medtronic plc, FUKUDA DENSHI CO. Ltd, Boston Scientific Corporation, Nohen Kohden Corporation, MicroPort Scientific Corporation, CU Medical Germany GmbH, IMRICOR MEDICAL SYSTEMS, Koninklijke Philips N.V, MEDIANA Co., Ltd., Others, and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing prevalence of cardiovascular diseases, the aging population, ongoing improvements in ICD technology, and rising global healthcare expenditures are some of the factors contributing to implantable cardioverter defibrillators market expansion. The growing demand for data analytics and artificial intelligence (AI) in healthcare and ICD systems is another element influencing how the implanted cardioverter defibrillator market is developing. Technological developments, rising cardiovascular disease prevalence, an aging population, rising awareness, supporting healthcare policies, and increased accessibility in hospitals and surgical centers are the main factors driving the market for implantable cardioverter defibrillators.

Restraining Factors

The market for implantable cardioverter defibrillators is restricted by factors such as high device costs, difficulties with reimbursement, complicated regulations, surgical risks, low awareness, and supply chain interruptions that impact accessibility and acceptance.

Market Segmentation

The implantable cardioverter defibrillators market share is classified into product type and end user.

- The transvenous implantable cardioverter-defibrillators segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the implantable cardioverter defibrillators market is divided into transvenous implantable cardioverter-defibrillators, and subcutaneous implantable cardioverter defibrillators. Among these, the transvenous implantable cardioverter-defibrillators segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The transvenous implantable cardioverter-defibrillators (T-ICDs) segment can be ascribed to the fact that T-ICDs provide significant benefits in the treatment of potentially fatal ventricular arrhythmias as well as in the reduction of invasive surgery-related problems and medical expenses.

- The hospitals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the implantable cardioverter defibrillators market is divided into hospitals, ambulatory surgical centers, and others. Among these, the hospitals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Hospitals are a popular option for medical treatments due to their ability to offer patients better care, which is one of the causes contributing to their industry.

Regional Segment Analysis of the Implantable Cardioverter Defibrillators Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the implantable cardioverter defibrillators market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the implantable cardioverter defibrillators market over the predicted timeframe. Hospitals, clinics, and other medical institutions are all part of North America's sophisticated and well-established healthcare system. The industry is further strengthened by the existence of major manufacturers like Abbott, Boston Scientific Corporation, and Medtronic. Medtronic's introduction of extravascular ICDs (EV-ICDs) has encouraging prospects. Additionally, there is a significant prevalence of CVD in the area, notably hypertension, which makes ICD use necessary. The market's potential for growth is influenced by the clinical effectiveness of EV-ICDs in treating ventricular arrhythmias and tachycardia in comparison to conventional T-ICDs and S-ICDs.

Asia Pacific is expected to grow at a rapid CAGR in the implantable cardioverter defibrillators market during the forecast period. The need for cardiac medical devices, such as ICDs, for diagnosis and treatment is rising as a result of the high prevalence of CVDs in nations like China, India, and Japan. In addition, companies in China, India, and Japan are actively creating and launching cutting-edge solutions to alleviate the healthcare burden, which is propelling the Asia Pacific market's expansion. The significant prevalence of CVD and associated deaths emphasizes the region's need for cutting-edge solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the implantable cardioverter defibrillators market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- LivaNova plc

- BIOTRONIK SE & Co. KG

- Medtronic plc

- FUKUDA DENSHI CO. Ltd

- Boston Scientific Corporation

- Nohen Kohden Corporation

- MicroPort Scientific Corporation

- CU Medical Germany GmbH

- IMRICOR MEDICAL SYSTEMS

- Koninklijke Philips N.V

- MEDIANA Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2023, French-based MicroPort CRM, a pioneer in the field of cardiac rhythm management, announced the arrival of its INVICTA defibrillation lead and ULYS implantable cardioverter defibrillator in Japan. These devices can be implanted as a system and are compatible with 1.5T and 3T MRIs. Its offers will be expanded, and its chances of making money in Japan will be enhanced, thanks to this debut.

- In October 2023, Medtronic plc was approved by the FDA to treat extremely fast cardiac rhythms that can cause SCA with the Aurora EV-ICD MRI SureScan and Epsila EV MRI SureScan defibrillation leads. The company's portfolio can be improved by this improvement, which will increase its serviceability.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the implantable cardioverter defibrillators market based on the below-mentioned segments:

Global Implantable Cardioverter Defibrillators Market, By Product Type

- Transvenous Implantable Cardioverter-Defibrillators

- Subcutaneous Implantable Cardioverter Defibrillators

Global Implantable Cardioverter Defibrillators Market, By End User

- Hospitals

- Ambulatory Surgical Centers

- Others

Global Implantable Cardioverter Defibrillators Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the CAGR of the implantable cardioverter defibrillators market over the forecast period?The global implantable cardioverter defibrillators market is projected to expand at a CAGR of 6.35% during the forecast period.

-

2.What is the market size of the implantable cardioverter defibrillators market?The global implantable cardioverter defibrillators market size is expected to grow from USD 3.76 Billion in 2024 to USD 7.40 Billion by 2035, at a CAGR of 6.35% during the forecast period 2025-2035.

-

3.Which region holds the largest share of the implantable cardioverter defibrillators market?North America is anticipated to hold the largest share of the implantable cardioverter defibrillators market over the predicted timeframe.

Need help to buy this report?