Global Immune Cell Engineering Market Size, Share, and COVID-19 Impact Analysis, By Cell Type (T Cells, NK Cells, Dendritic Cells, Tumor Cells, Stem Cells, and Others), By End User Type (Research Institutes, Biotechnological & Pharmaceutical Organizations, Diagnostic Centres or Labs, and Academics or Educational Centres), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Immune Cell Engineering Market Insights Forecasts to 2035

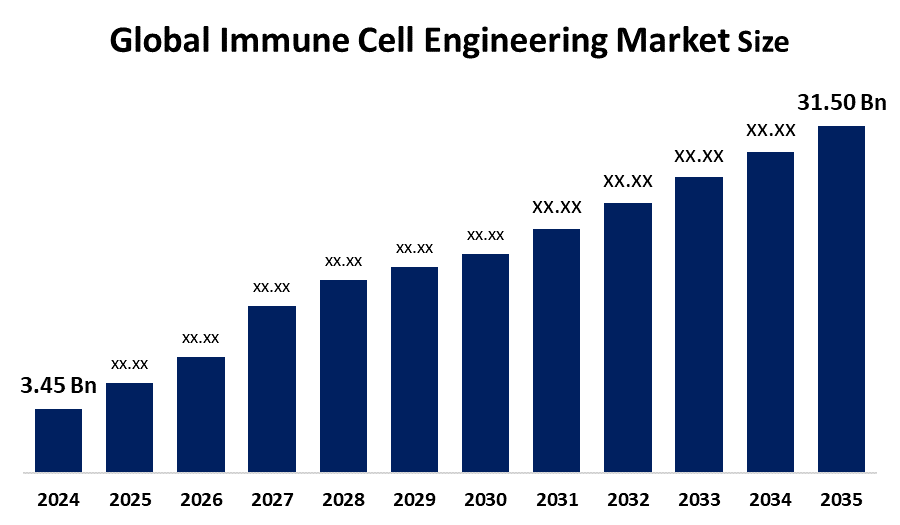

- The Global Immune Cell Engineering Market Size Was Estimated at USD 3.45 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 22.27% from 2025 to 2035

- The Worldwide Immune Cell Engineering Market Size is Expected to Reach USD 31.50 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global immune cell engineering market size was worth around USD 3.45 Billion in 2024 and is predicted to grow to around USD 31.50 Billion by 2035 with a compound annual growth rate (CAGR) of 22.27% from 2025 and 2035. The market for immune cell engineering has a number of opportunities to grow due to ongoing clinical and preclinical studies for modifying the fate and function of immune cells for applications like cancer and infectious disease.

Market Overview

The Global Immune Cell Engineering Market Size refers to a sector focused on the use of engineering principles to modify immune cells, like T-cells and natural killer cells, for therapeutic purposes. Immune engineering refers to a new discipline that helps in creating engineering tools to both investigate and change the immune system. It is a revolutionary tool, as dysfunction of the immune system plays an important role in several diseases, ranging from inflammation to cancer via autoimmunity and transplant rejection. New vaccines, including nicotine vaccines, are constructed by immunoengineering out of a range of diverse materials like liposomes carrying DNA to protect against malaria, and biodegradable polymeric nanoparticles.

Innovation and market expansion are anticipated as a result of major players' growing R&D expenditures and the expanding partnerships for promoting advancements in development of novel therapeutics. For instance, in November 2025, Harbour BioMed, a global biopharmaceutical company committed to the discovery and development of novel antibody therapeutics in immunology and oncology, and Evinova, a global health-tech company accelerating the delivery of better health outcomes by propelling the life sciences sector forward in digital health, announced a strategic collaboration in artificial intelligence (AI). The increasing advancement in immune cell engineering, along with the adoption of CAR immune cell immunotherapy for tumor treatment, is driving a huge surge in the global immune cell engineering market.

Report Coverage

This research report categorizes the immune cell engineering market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the immune cell engineering market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the immune cell engineering market.

Global Immune Cell Engineering Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 31.50 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 22.27% |

| 2035 Value Projection: | USD 31.50 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Cell Type , By End Use |

| Companies covered:: | Bristol-Myers Squibb Novartis Kite Pharma AbbVie Adicet Bio Autolus Therapeutics Bellicum Pharmaceuticals Bluebird Bio Celyad Gilead Sciences ImmunoCellular Therapeutics Pfizer Regeneron Pharmaceuticals Sorrento Therapeutics TCR2 Therapeutics and others, key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Immune Cell Engineering Market Size is driven by the growing prevalence of autoimmune diseases, especially in developing countries. As per a study, it was estimated that autoimmune diseases cumulatively affect 5 to 10% of the industrialised world population. Surging advancements in CAR-T cell therapy, which is due to the development of cutting-edge gene engineering tools, are contributing to propel market demand. Programming immune cells for targeted cancer therapy is promoting the market growth.

Restraining Factors

The Immune Cell Engineering Market Size is restricted by the increased cost and regulatory complexities, limiting patient accessibility to advanced treatments. Further, the complex manufacturing processes and side effects associated with immune cell therapies are challenging the market growth.

Market Segmentation

The immune cell engineering market share is classified into cell type and end user type.

- The T cells segment dominated the market with a significant share of about 30.0% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the cell type, the immune cell engineering market size is divided into T cells, NK cells, dendritic cells, tumor cells, stem cells, and others. Among these, the T cells segment dominated the market with a significant share of about 30.0% in 2024 and is projected to grow at a substantial CAGR during the forecast period. Genetically engineered T cell immunotherapy provides remarkable clinical success for treating B cell acute lymphoblastic leukemia by harnessing patients’ own T cells to kill cancer, providing therapeutic benefit for cancer, infectious diseases, and autoimmunity. For instance, the Food and Drug Administration (FDA) approved the first CAR T-cell therapy to treat children with acute lymphoblastic leukemia (ALL). Upsurging advancements in gene editing by enabling more precise genetic manipulation for enhancing T cell engineering and function are propelling the market growth.

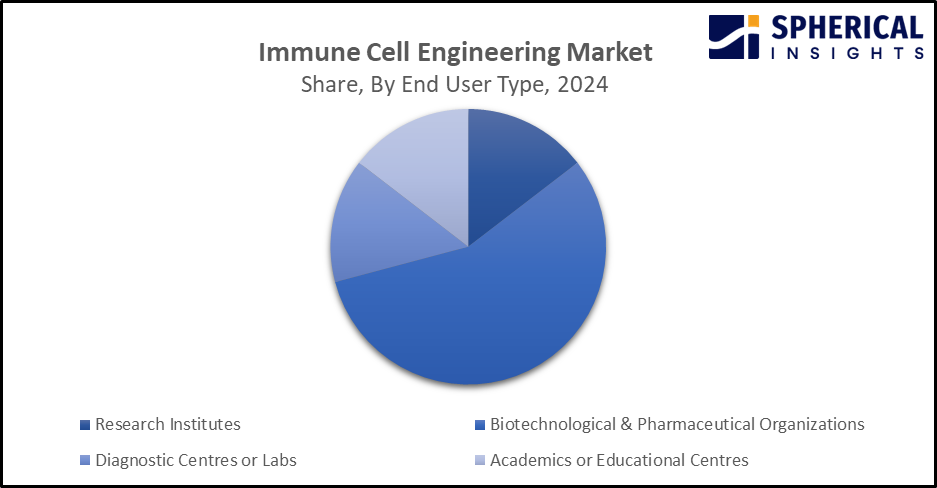

- The biotechnological & pharmaceutical organizations segment accounted for the dominant market share of about 58.5% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user type, the immune cell engineering market size is divided into research institutes, biotechnological & pharmaceutical organizations, diagnostic centres or labs, and academics or educational centres. Among these, the biotechnological & pharmaceutical organizations segment accounted for the dominant market share of about 58.5% in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Immune cells act as a living drug, approved for treating hematologic malignancies. Further, an increasingly innovative approach by companies like AstraZeneca, providing an opportunity for delivery next next-generation therapeutics, is driving the market growth in the biotechnological & pharmaceutical organizations segment.

Get more details on this report -

Regional Segment Analysis of the Immune Cell Engineering Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the Immune Cell Engineering market over the predicted timeframe.

North America is anticipated to hold the largest share ranging 40-53% in the immune cell engineering market over the predicted timeframe. The market ecosystem in North America is strong, due to cutting-edge startups like Eradivir, Modulo Bio, Cellinfinity Bio, Liberate Bio focusing on innovative cell therapy. The market for immune cell engineering has been driven by the region's increased adoption of immunotherapies, along with the presence of biopharma companies and cancer research. The United States is the dominant country in the North America immune cell engineering market, accounting for nearly 80-90% in 2024, driven by increasing government support towards cell therapy programs. For instance, in October 2025, the US government pumped money into in vivo cell therapy programs.

Get more details on this report -

Asia Pacific is expected to grow at a rapid CAGR of over 22.5% in the immune cell engineering market during the forecast period. The Asia Pacific area has a thriving market for immune cell engineering due to increasing biotech innovation, along with an increasing advancement in regenerative medicine. Further, the development of immune cell therapies by biotech companies is promoting the market. For instance, in September 2025, Cartherics Pty Ltd, a biotechnology company developing off-the-shelf immune cell therapies focusing on high-impact women’s diseases, with lead programs in ovarian cancer and endometriosis, announced that it has been named ‘Most Promising iPSC Therapy Pipeline in APAC’ in the Asia Pacific Cell & Gene Therapy Excellence Awards 2025. China is dominating the Asia Pacific immune cell engineering market during the forecast period, due to an exponential rise in clinical R&D activities and the development of innovative drugs and therapies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the immune cell engineering market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bristol-Myers Squibb

- Novartis

- Kite Pharma

- AbbVie

- Adicet Bio

- Autolus Therapeutics

- Bellicum Pharmaceuticals

- Bluebird Bio

- Celyad

- Gilead Sciences

- ImmunoCellular Therapeutics

- Pfizer

- Regeneron Pharmaceuticals

- Sorrento Therapeutics

- TCR2 Therapeutics

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, Ailux, Lilly partnered to advance bispecific antibody development. Through this collaboration, Lilly would gain access to Ailux's AI-powered bispecific antibody engineering platform.

- In May 2025, REPROCELL, a global leader in providing products and services, introduced StemEdit Human iPSC non-HLA class 1 and StemEdit Human iPSC non-HLA class 1/2 (B2M/CIITA Homo double KO) cell lines.

- In March 2025, AstraZeneca commit up to $11B+ to Chinese Collaborations, Beijing R&D hub. Pharma giant launches drug and vaccine partnerships with Harbour Biomed, Syneron Bio, and BioKangtai; Plans $2.5M Beijing R&D Hub; and alliance with Beijing Cancer Hospital.

- In January 2025, Cell BioEngines, Inc., a clinical-stage biotechnology company developing a universal ‘plug-and-play’ allogenic stem cell therapy platform and a portfolio of ‘off-the-shelf’ cell therapies for the treatment of hematologic and solid tumor malignancies, announced that it has signed a new lab lease at the Center for Engineering and Precision Medicine (CEPM), launched by the Rensselaer Polytechnic Institute and the Icahn School of Medicine at Mount Sinai.

- In August 2022, Poseida Therapeutics, Inc., a clinical-stage biopharmaceutical company utilizing proprietary genetic engineering platform technologies to create cell and gene therapeutics with the capacity to cure, announced it has entered into a broad strategic collaboration and license agreement with Roche, focused on developing allogeneic CAR-T therapies directed to hematologic malignancies.

- In June 2022, Astellas Pharma Inc. and Sutro Biopharma, Inc. announced a worldwide, strategic collaboration and licensing agreement focused on the discovery and development of novel immunostimulatory antibody-drug conjugates (iADCs).

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the immune cell engineering market based on the below-mentioned segments:

Global Immune Cell Engineering Market, By Cell Type

- T Cells

- NK Cells

- Dendritic Cells

- Tumor Cells

- Stem Cells

- Others

Global Immune Cell Engineering Market, By End User Type

- Research Institutes

- Biotechnological & Pharmaceutical Organizations

- Diagnostic Centres or Labs

- Academics or Educational Centres

Global Immune Cell Engineering Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the immune cell engineering market?The global immune cell engineering market size is expected to grow from USD 3.45 Billion in 2024 to USD 31.50 Billion by 2035, at a CAGR of 22.27% during the forecast period 2025-2035.

-

2.Which region holds the largest share of the immune cell engineering market?North America is anticipated to hold the largest share of the immune cell engineering market over the predicted timeframe.

-

3.What is the forecasted CAGR of the Global Immune Cell Engineering Market from 2024 to 2035?The market is expected to grow at a CAGR of around 22.27% during the period 2024–2035.

-

4.Who are the top companies operating in the Global Immune Cell Engineering Market?Key players include Bristol-Myers Squibb, Novartis, Kite Pharma, AbbVie, Adicet Bio, Autolus Therapeutics, Bellicum Pharmaceuticals, Bluebird Bio, Celyad, Gilead Sciences, ImmunoCellular Therapeutics, Pfizer, Regeneron Pharmaceuticals, Sorrento Therapeutics, and TCR2 Therapeutics.

-

5.Can you provide company profiles for the leading immune cell engineering manufacturers?Yes. For example, Bristol-Myers Squibb is a global biopharmaceutical company whose mission is to discover, develop and deliver innovative medicines that help patients prevail over serious diseases. Novartis is a Swiss multinational pharmaceutical corporation based in Basel, Switzerland, and is one of the largest pharmaceutical companies in the world and was the eighth largest by revenue in 2024.

-

6.What are the main drivers of growth in the immune cell engineering market?The growing prevalence of autoimmune diseases and advancement in T cell therapy are major market growth drivers of the immune cell engineering market.

-

7.What challenges are limiting the immune cell engineering market?Increased cost and regulatory complexities, along with side effects associated with immune cell therapies, remain key restraints in the immune cell engineering market.

Need help to buy this report?