Global Icing Sugar Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Organic Icing Sugar and Conventional Icing Sugar), By Application (Bakery, Confectionery, Dairy, Beverages, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Food & BeveragesGlobal Icing Sugar Market Insights Forecasts to 2035

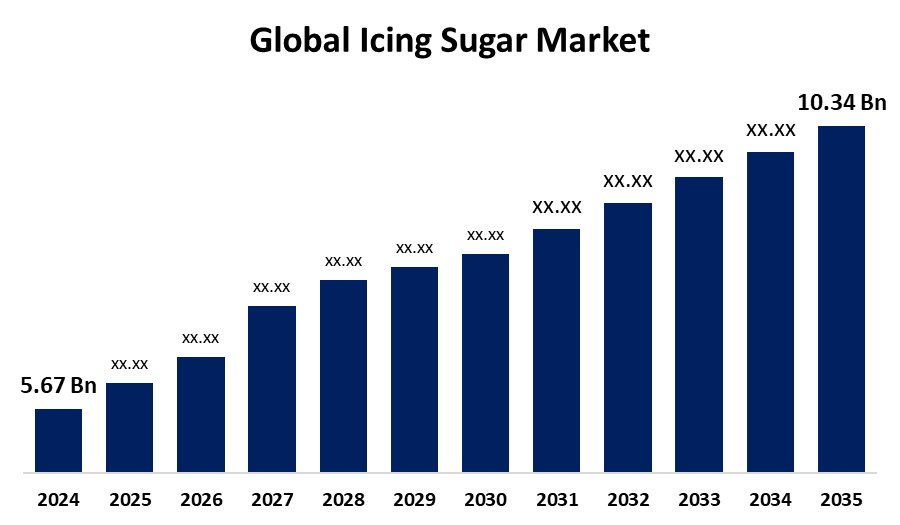

- The Global Icing Sugar Market Size Was Estimated at USD 5.67 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.61% from 2025 to 2035

- The Worldwide Icing Sugar Market Size is Expected to Reach USD 10.34 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Icing Sugar Market sSize was Worth around USD 5.67 Billion in 2024 and is predicted to Grow to around USD 10.34 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 5.61% from 2025 and 2035. Increased demand for baked products, growing foodservice sector, increasing home baking patterns, and innovations such as organic and flavored icing sugar boost the market. Urbanization and lifestyle changes further enhance consumption in both commercial and retail markets.

Market Overview

The Icing Sugar Industry is the business engaged in the manufacturing, distribution, and sale of icing sugar or powdered or confectioners' sugar. Icing sugar is grounded sugar blended with anti-caking agents, found in extensive use in bakery, confectionery, dairy, and beverage industries. Icing sugar is necessary for frosting, glazing, and baking decoration, improving the texture, sweetness, and appearance of baked goods. The market aims to satisfy the growing consumer demand for sweet, aesthetically pleasing products in commercial bakeries, food service sectors, and home baking. It delivers consistent sweetness and helps create the attractive appearance and mouthfeel of cakes, pastries, and desserts. It is versatile enough for use in diverse applications other than baking, such as beverages and dairy foods. Additionally, manufacturers are introducing organic, flavored, and specialty icing sugars to address consumer needs for healthier and gourmet alternatives. Clean-label, allergen-free, and low-calorie products are becoming more popular, responding to dietary needs and broadening the consumer base of the market. Ongoing innovation and increasing usage across food segments keep the market dynamic and competitive globally.

Report Coverage

This research report categorizes the icing sugar market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the icing sugar market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the icing sugar market.

Global Icing Sugar Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.67 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.61% |

| 2035 Value Projection: | USD 10.34 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application, By Application |

| Companies covered:: | Tate & Lyle, Cargill, Archer Daniels Midland Company, Associated British Foods plc, SAdzucker AG, Nordzucker AG, Wilmar International Limited, Louis Dreyfus Company, American Crystal Sugar Company, Imperial Sugar Company, Domino Foods, Inc., Mitr Phol Sugar Corporation, Tereos Group, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing consumption of cakes, pastries, cookies, and desserts globally propels the demand for icing sugar, used in frosting and decorations. Growing urbanization and changing lifestyles enhance greater consumption of baked goods, driving market growth. Further, companies are catering to consumer demand by introducing organic, flavored, and specialty icing sugar products. These new developments appeal to health-aware consumers and food connoisseurs seeking distinctive, premium offerings. Product expansion also encompasses clean-label and allergen-free versions, addressing the increasing demand for natural and safer food ingredients. Such innovation enlarges the market reach and propels growth by satisfying changing consumer preferences and dietary regimes.

Restraining Factors

Growing consciousness regarding the adverse health effects of high sugar consumption, including obesity, diabetes, and heart disease, is prompting consumers to lower their sugar intake. This move towards a healthier diet curbs demand for icing sugar, particularly in developed economies with rising health awareness. Additionally, the increased popularity of sugar alternatives and other sweeteners provides consumers with low-calorie or sugar-free products. They diminish the need for conventional icing sugar in bakery and confectionery foods to some extent, restricting market growth.

Market Segmentation

The icing sugar market share is classified into product type and application.

- The conventional icing sugar segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the icing sugar market is divided into organic icing sugar and conventional icing sugar. Among these, the conventional icing sugar segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to conventional icing sugar being made through traditional refining processes, thus being in general availability and low cost. Due to its lower cost than organic options, it is the choice of large commercial bakeries and food companies in mass production, commanding its leading market share.

- The bakery segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the icing sugar market is divided into bakery, confectionery, dairy, beverages, and others. Among these, the bakery segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to icing sugar is a necessity within bakery foods since it produces silky, fine-textured frostings, glazes, and decorative dustings needed for cakes, cupcakes, and pastries. Its quick dissolvability and glossy finish render it ideal for visually pleasing and great-tasting bakery foods. Its significant use in both taste and appearance enhancement of baked food products continues to lead to regular high demand by commercial bakeries and home bakers across the globe.

Regional Segment Analysis of the Icing Sugar Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the icing sugar market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the icing sugar market over the predicted timeframe. Asia-Pacific is undergoing rapid urbanization, causing hectic lifestyles and increased demand for easily consumed food items such as bakery products. Urban consumers are converting to Western dietary patterns, which are popularizing cakes and pastries containing icing sugar. Increased opening of cafes, bakeries, and food outlets in cities drives demand. Moreover, younger consumers are driven by global eating trends, which stimulate the intake of sweet baked foods boosting the icing sugar market.

North America is expected to grow at a rapid CAGR in the icing sugar market during the forecast period. North American consumers look more and more for gourmet and artisan bakery products that employ icing sugar for decoration and texture. Specialty dessert houses and craft bakeries are growing at a rapid rate, providing unusual flavored frostings and elaborate cake designs. The trend fosters a steady demand for quality icing sugar. The admiration for superior bakery products, which is frequently displayed on social media, fuels more frequent consumption, further stimulating the growth of the icing sugar market.

Europe is predicted to hold a significant share of the icing sugar market throughout the estimated period. Europe's strong baking tradition commands a steady demand for icing sugar in classic and contemporary desserts. France, Germany, and Italy are countries with rich pastry cultures, with icing sugar being a necessary component. This cultural affinity underpins a strong and consistent market for icing sugar, both in industrial bakeries and domestic baking.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the icing sugar market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Tate & Lyle

- Cargill

- Archer Daniels Midland Company

- Associated British Foods plc

- SAdzucker AG

- Nordzucker AG

- Wilmar International Limited

- Louis Dreyfus Company

- American Crystal Sugar Company

- Imperial Sugar Company

- Domino Foods, Inc.

- Mitr Phol Sugar Corporation

- Tereos Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2021, Graceco Limited launched a new packaging for its Baker's Choice Icing Sugar to boost brand identity as well as improve the product. The new package has a more attractive look, better durability for easier storage, and has customer contact details for inquiries. Moreover, the product features a superior anti-caking agent guaranteeing a white, fine, and consistent texture suitable for decorations in smooth creamy items such as buttercream, fudge icing, and almond paste. To assure clients of the uniqueness of the new packaging, Graceco has assured customers through different media, prompting customers to call for assistance through social media in case of concerns over product authenticity.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the icing sugar market based on the below-mentioned segments:

Global Icing Sugar Market, By Product Type

- Organic Icing Sugar

- Conventional Icing Sugar

Global Icing Sugar Market, By Application

- Bakery

- Confectionery

- Dairy

- Beverages

- Others

Global Icing Sugar Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the icing sugar market over the forecast period?The global icing sugar market is projected to expand at a CAGR of 5.61% during the forecast period.

-

2. What is the market size of the icing sugar market?The global icing sugar market size is expected to grow from USD 5.67 Billion in 2024 to USD 10.34 Billion by 2035, at a CAGR of 5.61% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the icing sugar market?Asia Pacific is anticipated to hold the largest share of the icing sugar market over the predicted timeframe.

Need help to buy this report?