Global Ice Cream Service Supplies Market Size, Share, and COVID-19 Impact Analysis, By Equipment (Freezers & Display Cases, Mixers & Blenders, Dispensers & Soft-Serve Machines, Dipping Cabinets, Ice Cream Vending Machines, and Cleaning & Maintenance Equipment), By Buyers (Ice Cream Shops & Parlors, Restaurants & Cafes, Catering Services, and Ice Cream Producers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Consumer GoodsGlobal Ice Cream Service Supplies Market Insights Forecasts to 2035

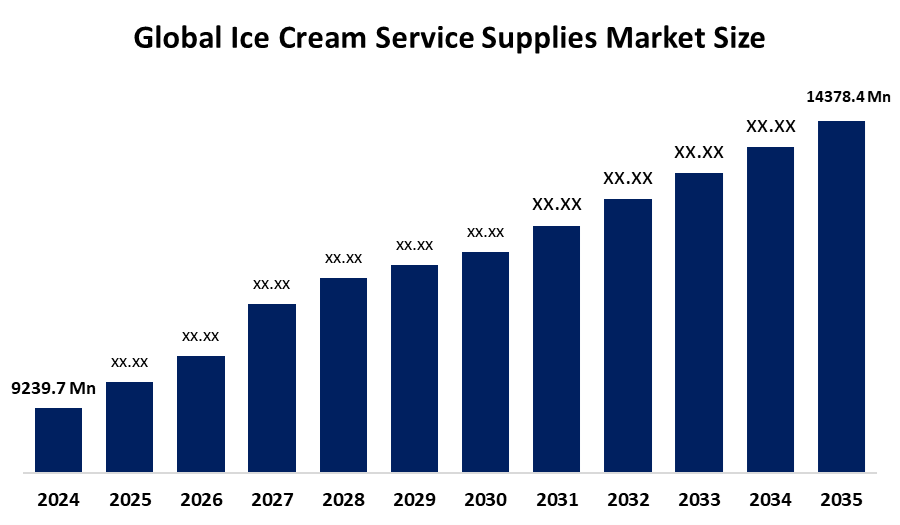

- The Global Ice Cream Service Supplies Market Size Was Estimated at USD 9239.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.1% from 2025 to 2035

- The Worldwide Ice Cream Service Supplies Market Size is Expected to Reach USD 14378.4 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global ice cream service supplies market size was worth around USD 9239.7 million in 2024 and is predicted to grow to around USD 14378.4 million by 2035 with a compound annual growth rate (CAGR) of 4.1% from 2025 to 2035. The market for ice cream service supplies is expanding due to ice cream consumption, the growth of fast-food outlets, and heightened demand for takeout and delivery options. The preference for premium, appealing, and environmentally friendly packaging also promotes usage, supporting consistent growth in both the commercial and retail sectors.

Market Overview

The worldwide ice cream service supplies market refers to manufacturing and distributing products such as cups, cones, tubs, spoons, lids, napkins, and display or dispensing tools used for serving ice cream in retail stores, parlours, fast-food restaurants, and delivery services. These supplies facilitate portion management, sanitation, branding and ease of use for both dine-in and takeaway experiences. The market expansion is driven by the increase in ice cream intake, the growth of QSR chains, heightened interest in premium and artisanal treats and the surging trend of delivery and portable formats. Potential exists in creating eco-biodegradable and customizable packaging as companies adapt to sustainability regulations and consumers’ demand for environmentally conscious products. Prominent participants in the market consist of Huhtamaki, Dart Container Corporation, Pactiv Evergreen, Genpak, Stanpac, BioPak and local specialized packaging producers, all emphasizing advancements, lightweight materials and eco-friendly designs to address changing market demands. In July 2025, the International Dairy Foods Association (IDFA) and U.S. Ice cream manufacturers committed to eliminating certified colors such as Red 3, Red 40, Blue 1, Blue 2, Green 3, Yellow 5 and Yellow 6 from ice cream and frozen dairy treats by 2028. The commitment covers over 90% of U.S. ice cream production.

Report Coverage

This research report categorizes the ice cream service supplies market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ice cream service supplies market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the ice cream service supplies market.

Global Ice Cream Service Supplies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14378.4 Million |

| Forecast Period: | 2025 – 2035 |

| Forecast Period CAGR 2025 – 2035 : | CAGR of 4.1% |

| 025 – 2035 Value Projection: | USD 14378.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 85 |

| Segments covered: | By Equipment ,By Buyers |

| Companies covered:: | Unilever Plc, Genpak LLC, Huhtamaki Group, Pactiv Evergreen, WestRock Company, BioPak, Nestlé, Stanpac, Dart Container Corporation, Eco-Products, Inc., Mars Incorporated, General Mills, Froneri International Limited, MTY Food Group Inc. and Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global ice cream service supplies market is primarily driven by the rising consumption of ice cream, the expansion of fast-food restaurants, and the growing preference for dessert choices. Urbanization and evolving lifestyles lead to an increase in on-the-move purchases, boosting the demand for items like cups, cones, spoons, lids, napkins and friendly packaging. The focus on customizable service products additionally promotes market growth as businesses seek distinctiveness amid tightening single-use plastic regulations. Seasonal promotions, innovative flavors, and the growth of food-delivery platforms also elevate the need for durable, hygienic, and visually appealing ice-cream service materials across both retail and commercial channels.

Restraining Factors

The ice cream service supply market encounters limitations due to increasing raw material prices for paper, plastics and eco-friendly materials. Stringent environmental laws regarding single-use packaging elevate compliance costs. Disruptions in the supply chain, issues with waste management, and rising demands for sustainability further complicate manufacturing, restricting scalability and intensifying production challenges for service supply providers.

Market Segmentation

The ice cream service supplies market share is classified into equipment and buyers.

- The freezers & display cases segment dominated the market in 2024, approximately 35% and is projected to grow at a substantial CAGR during the forecast period.

Based on the equipment, the ice cream service supplies market is divided into freezers & display cases, mixers & blenders, dispensers & soft-serve machines, dipping cabinets, ice cream vending machines, and cleaning & maintenance equipment. Among these, the freezers & display cases segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The freezers & display cases category led the ice cream service supplies market, driven by increased demand, from ice cream shops, parlors and restaurants seeking storage and appealing product display. Their capacity to preserve temperatures improves product visibility and facilitates large-scale operations, rendering them indispensable, fueling widespread adoption and expansion of the market worldwide.

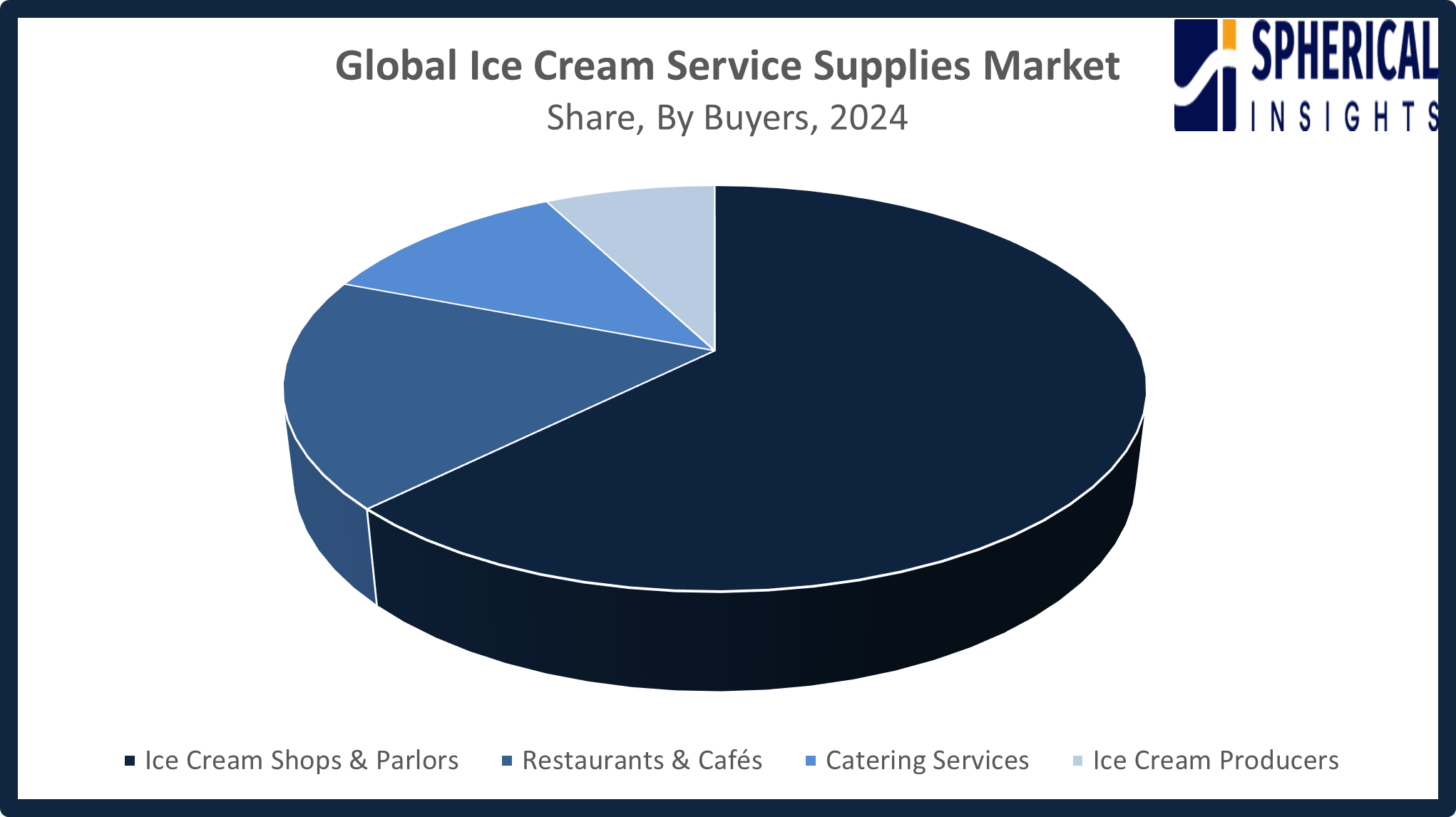

- The ice cream shops & parlors segment accounted for the highest market revenue in 2024, approximately 63% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the buyers, the ice cream service supplies market is divided into ice cream shops & parlors, restaurants & cafes, catering services, and ice cream producers. Among these, the ice cream shops & parlors segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The ice cream shops and parlors segment market growth, driven by increasing consumer demand for premium and artisanal ice creams, rising disposable incomes, and the growing trend of indulgent, on-the-go desserts. Innovative flavors, seasonal offerings, and unique in-store experiences further attract customers, fueling rapid expansion and strengthening the segment’s market dominance.

Get more details on this report -

Regional Segment Analysis of the Ice Cream Service Supplies Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the ice cream service supplies market over the predicted timeframe.

North America is anticipated to hold the largest share of the ice cream service supplies market over the predicted timeframe. North America is anticipated to maintain the 32% market share of the ice cream service supplies market due to consumer demand, the prevalence of ice cream shops, cafés and fast-food outlets, along with high disposable incomes that encourage premium products. The U.S. Propels expansion through foodservice infrastructure, cold-chain logistics and a cultural preference for portable treats. Sustainable, branded and convenient service supplies additionally strengthen the market leadership. Furthermore, in 2024, U.S. Dairy Checkoff Programs broadened school dairy availability, featuring chocolate milk trials in over 700 districts, enhanced exports and collaborations, with retailers elevating ice cream prominence and consumer confidence.

Asia Pacific is expected to grow at a rapid CAGR in the ice cream service supplies market during the forecast period. The Asia Pacific region is anticipated to have 22% market share in the ice cream service supplies sector owing to increasing urban development, greater disposable earnings and a growing middle-class demographic. Nations such as China, India and Japan propel the need for premium, takeout ice cream products. The proliferation of parlors, cafés and fast-food outlets, combined with cold-chain facilities and the use of branded, environmentally conscious service supplies, supports this expansion. In 2025, industrial reforms along with innovation subsidies in India and China boost dairy equipment production, aiding ice cream supply manufacturing and the expansion of plant-based ice cream in the area.

Europe’s ice cream service supplies market growth is driven by strong consumer preference for premium and artisanal ice cream, a robust cafe and dessert shop culture, and rising demand for sustainable packaging. Germany, France, and the UK lead due to established foodservice infrastructure and hygiene regulations. In 2024, the EU began enforcing phased bans on non-recyclable single-use plastics, promoting compostable alternatives, accelerating the adoption of eco-friendly ice cream cups and spoons, and influencing global trends toward biodegradable service supplies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the ice cream service supplies market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Unilever Plc

- Genpak LLC

- Huhtamaki Group

- Pactiv Evergreen

- WestRock Company

- BioPak

- Nestlé

- Stanpac

- Dart Container Corporation

- Eco-Products, Inc.

- Mars Incorporated

- General Mills

- Froneri International Limited

- MTY Food Group Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2025, Nestlé reported double-digit ice cream sales growth, rebounding after two years of decline. Xu Dai, Senior VP of Nestlé Greater China, highlighted the strong performance at the Nestlé Ice Cream National Distributor Conference, marking an impressive recovery for the brand.

- In July 2025, Huhtamaki launched new ice cream cups that are both home and industrial-compostable and recyclable. The innovative packaging combines sustainability with consumer appeal, offering an eco-friendly solution designed to advance the ice cream industry’s move toward more environmentally responsible packaging.

- In April 2025, Magnum Ice Cream, Unilever’s demerged ice cream business, will open its first global operations centre in Pune with a RS 900 crore investment. The centre will create over 500 jobs and support IT, supply chain, finance, and HR functions for Magnum’s global operations.

- In September 2024, Magnum launched Magnum BonBon, premium bite-sized, chocolate-covered ice cream treats. The indulgent snacks come in fully recyclable, pint-sized paper tubs and lids with luxurious gold foil decoration, all produced at Huhtamaki’s European factory, combining sustainable packaging with a high-end, indulgent consumer experience.

- In October 2022, Huhtamaki launched ICON packaging for ice cream containers and lids, featuring a water-based barrier coating and SFI-certified paperboard. Made with 95% renewable biobased material, the packaging is recyclable in U.S. paper recycling programs, offering a significant sustainable solution for consumers.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ice cream service supplies market based on the below-mentioned segments:

Global Ice Cream Service Supplies Market, By Equipment

- Freezers & Display Cases

- Mixers & Blenders

- Dispensers & Soft-Serve Machines

- Dipping Cabinets

- Ice Cream Vending Machines

- Cleaning & Maintenance Equipment

Global Ice Cream Service Supplies Market, By Buyers

- Ice Cream Shops & Parlors

- Restaurants & Cafés

- Catering Services

- Ice Cream Producers

Global Ice Cream Service Supplies Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the ice cream service supplies market over the forecast period?The global ice cream service supplies market is projected to expand at a CAGR of 4.1% during the forecast period

-

2. What is the ice cream service supplies market?The ice cream service supplies market includes products and equipment, cups, cones, spoons, lids, dispensers, and display units, used for serving, packaging, and presenting ice cream globally.

-

3. What is the market size of the ice cream service supplies market?The global ice cream service supplies market size is expected to grow from USD 9239.7 million in 2024 to USD 14378.4 million by 2035, at a CAGR of 4.1% during the forecast period 2025-2035

-

4. Which region holds the largest share of the ice cream service supplies market?North America is anticipated to hold the largest share of the ice cream service supplies market over the predicted timeframe

-

5. Who are the top 10 companies operating in the global ice cream service supplies market?Unilever Plc, Genpak LLC, Huhtamaki Group, Pactiv Evergreen, WestRock Company, BioPak, Nestlé, Stanpac, Dart Container Corporation, Eco-Products, Inc., and Others

Need help to buy this report?