Global Ice Cream Packaging Market Size, Share, and COVID-19 Impact Analysis, By Packaging Type (Cup, Tub, Stick Pack, Folding Carton, and Others), By Material (Plastic, Paper & Paperboard, Glass and Others), By Sales Channel (Online and Offline), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Ice Cream Packaging Market Insights Forecasts to 2035

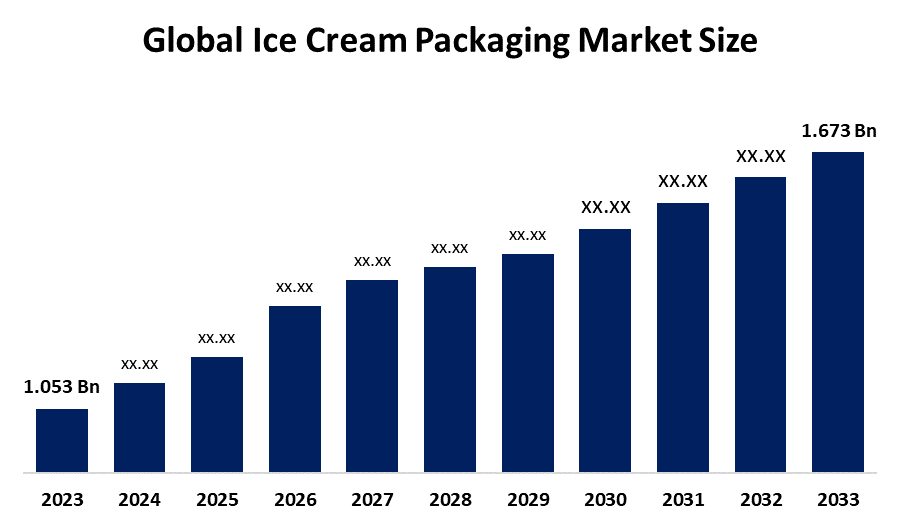

- The Global Ice Cream Packaging Market Size Was Estimated at USD 1.053 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.3% from 2025 to 2035

- The Worldwide Ice Cream Packaging Market Size is Expected to Reach USD 1.673 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global ice cream packaging market size was worth around USD 1.053 billion in 2024 and is predicted to grow to around USD 1.673 billion by 2035 with a compound annual growth rate (CAGR) of 4.3% from 2025 to 2035. The ice cream packaging industry is expanding as a result of increasing ice cream consumption, the need for single-portion products, and a significant consumer and regulatory move towards sustainable, environmentally friendly materials. Additionally, creative branding and the growth of e-commerce play roles.

Market Overview

The worldwide ice cream packaging industry refers to materials and containers (such as tubs, cups, cartons) utilized to store, shield and showcase ice cream items, ensuring freshness, avoiding freezer burn and acting as a branding element. Major functions include preserving the product throughout the supply chain, drawing buyers at the point of sale and offering ease of use for both single-serve and bulk varieties. The market is propelled by the surge in ice cream consumption, the growing popularity of on-the-move snacking requiring single-portion convenience, and an expanding consumer inclination toward luxury and aesthetically pleasing packaging. A key factor is the shift towards sustainability prompted by requirements from consumers and regulators calling for eco, recyclable and biodegradable substances.

In November 2025, the U.S. California’s CAA mandates 65% recyclability through EPR by 2032, with $500M mitigation funded by producers. Oregon implements eco-packaging rules starting in 2025. Minnesota’s EPR necessitates waste financing, and the federal SIPS Act eliminates single-use plastics, forbidding paper straws in parks by 2027. In this regard, growth prospects within the market exist for plant-based and low-calorie ice creams that demand differentiated packaging solutions and integrated smart packaging technologies, including QR codes and temperature sensors, to promote digital engagements among consumers and ensure traceability of these perishable products. Key market participants in the industry innovate to address the growing need for differentiated packaging, including Amcor Plc, Huhtamaki Oyj, Berry Global Group, and Tetra Laval.

Report Coverage

This research report categorizes the ice cream packaging market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ice cream packaging market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the ice cream packaging market.

Global Ice Cream Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.053 Billion |

| Forecast Period: | 2024 – 2035 |

| Forecast Period CAGR 2024 – 2035 : | CAGR of 4.3% |

| 024 – 2035 Value Projection: | USD 1.673 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Packaging Type, By Material |

| Companies covered:: | Berry Global, Amcor Plc, Tetra Laval, Stora Enso Oyj, Delkor Systems Inc., Huhtamaki Oyj, Stanpac Inc., Uniflex, Sirane Limited, International Paper Company, ITC Packaging, Sonoco Products Company, Insta Polypack, Sealed Air Corporation, And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global ice cream packaging sector is primarily propelled by the growing intake of ice cream fueled by disposable incomes, urban expansion, and evolving lifestyle trends. The increasing demand for ready-to-eat desserts has spurred the need for durable and appealing packaging options. Movements toward eco-friendliness encourage manufacturers to adopt recyclable and biodegradable materials. Advances in packaging technology, such as barrier properties and smart packaging, aim to further extend shelf life, product safety and quality. Additionally, the expansion of retail chains, online food delivery services, and premium ice cream segments contributes to the robust growth of the packaging market globally.

Restraining Factors

The market for ice cream packaging is constrained by packaging expenses, particularly for upscale and novel materials. Environmental issues related to waste and regulations on non-biodegradable packaging curb growth. Moreover, supply chain difficulties, variable raw material costs and consumer demand for packaging may impede market development.

Market Segmentation

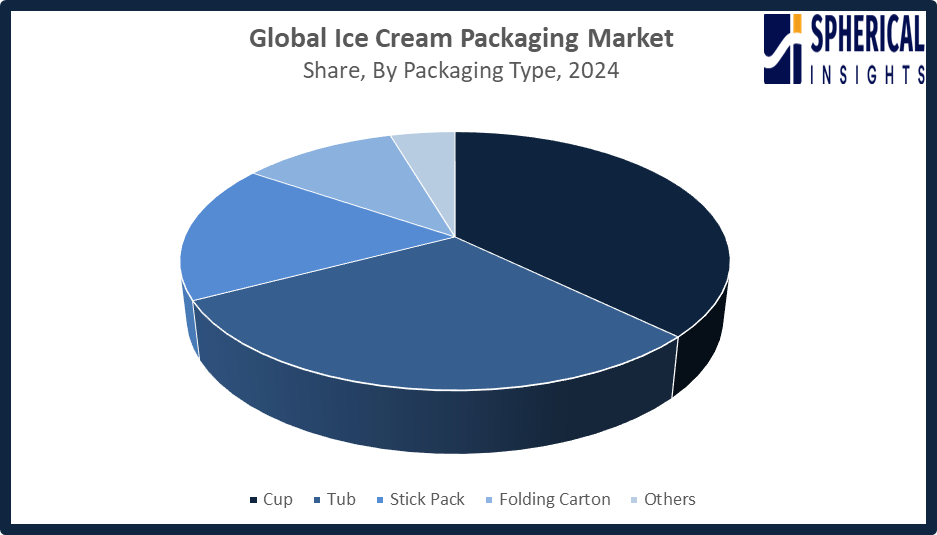

The ice cream packaging market share is classified into packaging type, material, and sales channel.

- The cup segment dominated the market in 2024, approximately 37% and is projected to grow at a substantial CAGR during the forecast period.

Based on the packaging type, the ice cream packaging market is divided into cup, tub, stick pack, folding carton, and others. Among these, the cup segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Cup containers dominate the ice cream packaging sector due to their ease of use, transportability and excellent branding opportunities. Their ability to be stacked enhances cold-chain logistics, and adaptable portion sizes attract both health customers and those seeking indulgence. Perfect for buying cups, it also facilitates seasonal campaigns and striking visuals, making it the favored choice among leading brands.

Get more details on this report -

- The plastic segment accounted for the largest share in 2024, approximately 52% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the material, the ice cream packaging market is divided into plastic, paper & paperboard, glass and others. Among these, the plastic segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Plastic continues to be the material for ice cream packaging owing to its strength, low weight, cost-effectiveness and effective insulation. Commonly utilized for tubs and bags, plastics such as PET, HDPE and PP provide barrier properties that help avoid freezer burn. Their adaptability allows for containers, resealable caps and user-friendly designs, improving convenience and attractiveness, for both consumers and manufacturers.

- The offline segment accounted for the highest market revenue in 2024, approximately 72% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the sales channel, the ice cream packaging market is divided into online and offline. Among these, the offline segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The offline segment market growth is due to strong consumer preference for in-store purchases, where ice cream is often bought impulsively. Supermarkets, hypermarkets, and convenience stores provide reliable cold-chain storage, wide product visibility, and attractive displays. Enhanced packaging appeal, better assortment, and immediate product availability further strengthen offline dominance in the ice cream packaging market.

Regional Segment Analysis of the Ice Cream Packaging Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the ice cream packaging market over the predicted timeframe.

North America is anticipated to hold the largest share of the ice cream packaging market over the predicted timeframe. The ice cream packaging market is projected to be led by North America, with an approximate 39% market share, due to per-capita ice cream consumption, robust demand for premium and distinctive products and continuous progress in recyclable packaging technologies. The United States leads this area, driven by competition among brands at retail and investments in eco-materials such as bio-based plastics and paper packaging. Canada contributes well, supported by rising demand for dairy-based desserts and government emphasis on packaging programs. Enhanced cold-chain systems and widespread use of single-serve options keep driving the market's expansion.

Asia Pacific is expected to grow at a rapid CAGR in the ice cream packaging market during the forecast period. The ice cream packaging industry in the Asia Pacific is expected to have a 30% market share, driven by rising incomes, urban growth, and an increase in frozen dessert consumption among younger demographics. China dominates the market, supported by broadening distribution networks and high demand for packaging options. India is experiencing growth in the FMCG sector an increasing preference for single-serve items and supportive policies, such as in June 2022 ban on single-use plastics aimed at reducing pollution. Japan contributes to growth through an appetite for premium products and innovative packaging innovations. Expanding cold-chain infrastructure and e-commerce adoption further accelerate regional growth.

Europe’s ice cream packaging market grows due to rising demand for sustainable, recyclable, and premium formats, supported by strict EU environmental regulations and eco-conscious consumers. Germany leads with advanced recycling and high packaged ice cream consumption, while Italy and France drive artisanal and premium markets. Innovations in paper-based tubs, biodegradable films, and portion-controlled packs boost growth. In February 2025 EU Packaging and Packaging Waste Regulation furthers sustainability by promoting recycling, reuse, refill systems, improving resource efficiency, reducing emissions, and fostering a circular economy across Member States.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the ice cream packaging market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Berry Global

- Amcor Plc

- Tetra Laval

- Stora Enso Oyj

- Delkor Systems Inc.

- Huhtamaki Oyj

- Stanpac Inc.

- Uniflex

- Sirane Limited

- International Paper Company

- ITC Packaging

- Sonoco Products Company

- Insta Polypack

- Sealed Air Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, Huhtamaki introduced new ice cream cups made from responsibly sourced certified paperboard, designed to be home and industrially compostable and recyclable. Featuring a bio-based coating and under 10% plastic content, the cups support the company’s shift from fossil-based plastics, helping customers reduce their environmental footprint.

- In April 2025, Stora Enso launched Performa Nova, a next-generation folding boxboard (FBB) combining high yield and excellent performance. Designed for dry, frozen, chilled food, chocolate, and confectionery, it addresses the growing demand for renewable, recyclable, and efficient packaging solutions across multiple consumer segments.

- In November 2024, Berry Global won the IICC Best Packaging Solution award for Diplom Is’s Royal ice cream. The recognition highlighted a new non-carbon black color, enhancing recyclability and design modifications that improved production efficiency and reduced waste, marking a significant achievement in sustainable ice cream packaging.

- In September 2024, Unilever’s Magnum launched Magnum BonBon, premium bite-sized chocolate-covered ice cream treats. Packaged in fully recyclable, pint-sized paper tubs and lids with luxurious gold metallized foil, both manufactured by Huhtamaki in Europe, the packaging reflects the brand’s indulgent and sustainable premium positioning.

- In October 2022, Huhtamaki launched ICON packaging for ice cream containers and lids in the U.S., using 95% renewable, biobased materials. Combining SFI-certified paperboard with a water-based barrier, the packaging is fully recyclable in communities with paper recycling programs, offering a major sustainable solution.

- In February 2020, Unilever Finland introduced Ingman ice cream in 1-litre cartons made from Stora Enso’s fully renewable and recyclable Performa Cream board with plant-based PE Green coating. This packaging supports Unilever’s goal to halve its environmental footprint by reducing fossil-based materials and waste.

- In March 2019, Stanpac Inc. launched a plant-based packaging solution for ice cream, partnering with Coconut Bliss. Using Sentinel Renewable Ice Cream Paperboard from Evergreen Packaging, coated with bio-based polyethylene from sugarcane, the initiative utilizes renewable resources, offering an eco-friendly alternative that reduces environmental impact.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ice cream packaging market based on the below-mentioned segments:

Global Ice Cream Packaging Market, By Packaging Type

- Cup

- Tub

- Stick Pack

- Folding Carton

- Others

Global Ice Cream Packaging Market, By Material

- Plastic

- Paper & Paperboard

- Glass

- Others

Global Ice Cream Packaging Market, By Sales Channel

- Online

- Offline

Global Ice Cream Packaging Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the ice cream packaging market over the forecast period?The global ice cream packaging market is projected to expand at a CAGR of 4.3% during the forecast period.

-

2. What is the market size of the Ice Cream Packaging market?The global ice cream packaging market size is expected to grow from USD 1.053 billion in 2024 to USD 1.673 billion by 2035, at a CAGR of 4.3% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the ice cream packaging market?North America is anticipated to hold the largest share of the ice cream packaging market over the predicted timeframe.

-

4. What is the ice cream packaging market?The ice cream packaging market is a global industry focused on creating and supplying packaging for frozen desserts, including tubs, cups, cones, and wrappers.

-

5. Who are the top 10 companies operating in the global ice cream packaging market?Berry Global, Amcor Plc, Tetra Laval, Stora Enso Oyj, Delkor Systems Inc., Huhtamaki Oyj, Stanpac Inc., Uniflex, Sirane Limited, International Paper Company, and Others.

-

6. What factors are driving the growth of the ice cream packaging market?The growth of the ice cream packaging market is primarily driven by shifting consumer preferences for convenience and sustainability, a rising demand for innovative and premium products, and the expansion of e-commerce and retail channels.

-

7. What are the market trends in the ice cream packaging market?The main trends in the ice cream packaging market are the shift towards sustainable materials like biodegradable and recyclable options, a demand for convenient and portable formats such as single-serve packs, and a move towards premium and customizable designs that reflect product quality.

-

8. What are the main challenges restricting wider adoption of the ice cream packaging market?The main challenges restricting the wider adoption of innovative or sustainable ice cream packaging are high production costs, performance trade-offs, a lack of consistent recycling infrastructure, and complex regulations.

Need help to buy this report?