Global Hydroquinone Market Size, Share, and COVID-19 Impact Analysis, By Formulation Type (Creams, Lotions, Gels, and Powders), By Application (Skin Lightening Products, Photographic Developer, Rubber Manufacturing, Hair Dyes, and Industrial Chemicals), By End Use (Cosmetics, Pharmaceuticals, Food Industry, and Textiles), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: Chemicals & MaterialsGlobal Hydroquinone Market Insights Forecasts to 2035

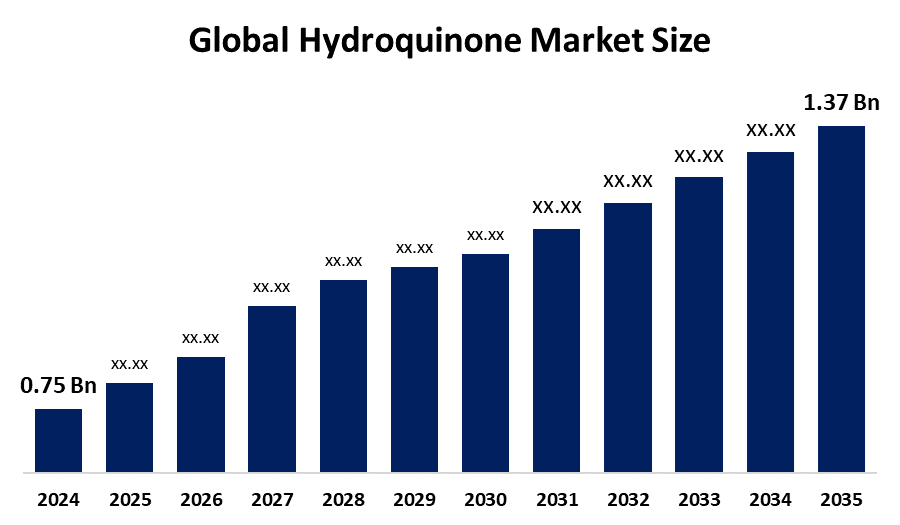

- The Global Hydroquinone Market Size Was Estimated at USD 0.75 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.63% from 2025 to 2035

- The Worldwide Hydroquinone Market Size is Expected to Reach USD 1.37 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global hydroquinone market size was worth around USD 0.75 billion in 2024 and is predicted to grow to around USD 1.37 billion by 2035 with a compound annual growth rate (CAGR) of 5.63% from 2025 to 2035. The hydroquinone market is growing due to increasing demand from cosmetics, particularly for skin lightening, expanding use in pharmaceuticals, rubber, and photographic industries, increasing consumer awareness, technological gains in the production process, and rising disposable income in emerging economies.

Market Overview

The global hydroquinone market refers to the manufacturing and application of hydroquinone, an organic compound that, due to its antioxidant, bleaching, and reduction properties, finds widespread application in industries. The principal applications of hydroquinone are in cosmetics and personal care products, particularly for skin lightening and anti-aging preparations, and in topical pharmaceutical preparations. Besides these applications, hydroquinone also finds extensive use in industrial applications such as photographic development, the inhibition of polymerization, and as an antioxidant in rubber and a number of other processes involving chemicals. The increase in consumer awareness about skin care, the rise in disposable incomes, and the growing demand for personal care and cosmetic products across the globe drive the market. Growth in industrial applications and the development of newer technologies in manufacturing processes have also boosted the growth of this market.

Market innovation is targeted at the manufacturing of safer, greener, and high-purity variants of hydroquinone to meet regulatory requirements and satisfy consumer and industrial needs. New opportunities are emerging in unpenetrated markets of the Asia Pacific and Latin America, which are experiencing growing middle-class populations and rapid urbanization that boost product consumption. Major market participants such as BASF, Lanxess, and Merck are developing their presence in the market through research and development, strategic partnerships, and sustainable technologies for production. Adoption of green chemistry approaches, optimization through digitization of processes, and supply chain management further help these players achieve regulatory compliance and control product quality consistently. On September 18, 2025, Australia's TGA proposed to remove hydroquinone from Schedule 2. This would make cosmetics containing hydroquinone available only by prescription, except for certain exemptions, such as hair products up to 0.3% and nail products up to 0.02%. This move by Australia aligns its regulations with EU and US standards related to skin-lightening products.

Report Coverage

This research report categorizes the hydroquinone market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hydroquinone market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the hydroquinone market.

Global Hydroquinone Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.75 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.63% |

| 2035 Value Projection: | USD 1.37 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 227 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Formulation Type, By Application, By End Use, By Region |

| Companies covered:: | Mitsui Chemicals, BASF, Eastman Chemical Company, Lanxess, UBE Corporation, Solvay, Merck, Evonik Industries, LG Chem, Syensqo, Wanhua Chemical, Shin-Etsu Chemical, Camlin Fine Sciences Ltd., Jiangsu Sanjili Chemical Co., Ltd. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global hydroquinone market is driven by growing demand from the cosmetics and personal care industry, particularly for skin-lightening and anti-aging products. Expanding applications in photographic development, rubber antioxidants, and polymerization inhibitors further boost market growth. Rising consumer awareness regarding skin care, along with increased disposable incomes, fuels the cosmetics segment. Besides this, the pharmaceutical industry uses hydroquinone for topical treatments, thereby increasing the demand for the chemical. Industrial growth in emerging economies and technological advancements in manufacturing processes improve production efficiency and supply. Government regulations supporting safe usage and rising global trade also favor market growth, thereby making hydroquinone a critical chemical for many industries.

Restraining Factors

The hydroquinone market is restrained by stringent regulatory policies due to health and safety concerns, possible side effects in cosmetic and pharmaceutical applications, and hazards during manufacturing and waste disposal. Availability of safer alternatives and fluctuating raw material prices are other limiting factors in market growth and adoption by industries.

On May 22, 2025, the European Network of Official Cosmetics Control Laboratories (OCCLs) conducted a study on skin whitening products in Europe, revealing that 18% were non-compliant. These products contained banned substances such as hydroquinone, mercury, and glucocorticoids, all prohibited under EU cosmetic safety regulations.

Market Segmentation

The hydroquinone market share is classified into formulation type, application, and end use.

- The creams segment dominated the market in 2024, approximately 56% and is projected to grow at a substantial CAGR during the forecast period.

Based on the formulation type, the hydroquinone market is divided into creams, lotions, gels, and powders. Among these, the creams segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The creams segment dominated the hydroquinone market due to the widespread use of hydroquinone creams in skin-lightening and cosmetic treatments, their higher efficacy compared to other formulations, ease of application, and strong consumer preference. Moreover, increasing awareness about hyperpigmentation solutions and the rise in demand for effective dermatological products contribute to the continued expansion of the segment globally.

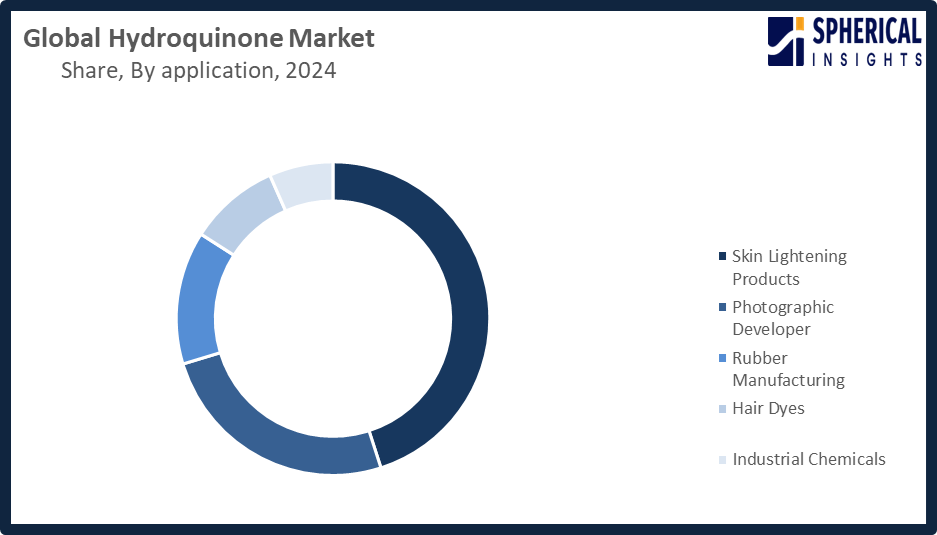

- The skin lightening products segment accounted for the largest share in 2024, approximately 45% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the hydroquinone market is divided into skin lightening products, photographic developer, rubber manufacturing, hair dyes, and industrial chemicals. Among these, the skin lightening products segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment will continue to grow owing to increasing awareness among consumers about skincare, a rise in demand for cosmetic products that address hyperpigmentation and uneven skin tone, and the popularity of dermatological treatments. Growing industries related to beauty and personal care drive market growth even further across the globe.

Get more details on this report -

- The cosmetics segment accounted for the highest market revenue in 2024, approximately 42% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end use, the hydroquinone market is divided into cosmetics, pharmaceuticals, food industry, and textiles. Among these, the cosmetics segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Growth in the cosmetics segment is driven by the growing utilization of hydroquinone for skin-lightening creams, lotions, and other cosmetic products, increasing awareness among consumers about skincare and beauty solutions, growing demand for treatments related to hyperpigmentation, and expansion in the global personal care and cosmetic industries.

Regional Segment Analysis of the Hydroquinone Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the hydroquinone market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the hydroquinone market over the predicted timeframe. The Asia Pacific region is expected to dominate the hydroquinone market during the forecast period, with approximately 48% of market share, owing to the increased development of cosmetic, pharmaceutical, and other industrial sectors in the region. Growing awareness among consumers about skincare and increased demand for skin-whitening products, especially in China, India, Japan, and South Korea, has resulted in market growth. Fast urbanization, increasing disposable incomes, and a young population further boost product consumption. In addition, the region's solid manufacturing base, low labor cost, and supportive regulatory environment encourage large-scale production. Further, thriving e-commerce channels and advancements in cosmetic formulations also reinforce the prominence of the hydroquinone market across the Asia Pacific.

North America is expected to grow at a rapid CAGR in the hydroquinone market during the forecast period. North America is rapidly growing in the hydroquinone market during the forecast period, with an approximate 21% market share, due to a surge in demand for advanced skincare and dermatological products. The United States has a leading share in the regional market on account of an excellent cosmetics and pharmaceutical industry, complemented by high consumer awareness and widespread use of professional skin treatments. Increasing investments in research and development focused on producing safer, high-purity hydroquinone formulations and compliance with stringent regulatory requirements add strength to growth. Besides these, expanding distribution networks coupled with innovations in skin-care formulation further enhance market prospects across the North American region.

The European region represents a steadily growing hydroquinone market, as demand for premium skin and cosmetic care products keeps increasing. Due to the strong cosmetics industry and advanced dermatological studies, countries such as Germany, France, and the United Kingdom have taken the lead. Regulatory measures for ensuring safety and sustainable manufacturing encourage innovation. Moreover, increasing awareness among people about skin health and the adoption of advanced formulation methods for treating pigmentation problems are factors that add to the growth of the hydroquinone market in Europe

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hydroquinone market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsui Chemicals

- BASF

- Eastman Chemical Company

- Lanxess

- UBE Corporation

- Solvay

- Merck

- Evonik Industries

- LG Chem

- Syensqo

- Wanhua Chemical

- Shin-Etsu Chemical

- Camlin Fine Sciences Ltd.

- Jiangsu Sanjili Chemical Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2025, Nigeria’s NAFDAC advised consumers to avoid bleaching creams with excessive hydroquinone, warning that such products pose significant health risks and urging caution to protect public health.

- In February 2025, Senegalese authorities detected unauthorized hydroquinone in Lightup Dark Spots Correcting Lotion, prompting increased scrutiny of cosmetic safety standards and raising concerns about regulatory compliance and consumer protection

- In February 2023, Solvay, a global specialty materials supplier, announced that its hydroquinone (HQ) and hydroquinone monomethyl ether (MeHQ) production in Saint-Fons, France, is now accredited under the ISCC PLUS system, complying with the mass balance accounting regime for sustainability and carbon certification.

- In February 2023, Solvay announced that its Saint-Fons, France, production of hydroquinone and p-hydroxyanisole (PMP) received ISCC PLUS certification. The facility will implement the system’s mass balance accounting, enabling the company to produce hydroquinone and PMP with lower carbon emissions, aligning with sustainability and carbon reduction goals.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the hydroquinone market based on the below-mentioned segments:

Global Hydroquinone Market, By Formulation Type

- Creams

- Lotions

- Gels

- Powders

Global Hydroquinone Market, By Application

- Skin Lightening Products

- Photographic Developer

- Rubber Manufacturing

- Hair Dyes

- Industrial Chemicals

Global Hydroquinone Market, By End Use

- Cosmetics

- Pharmaceuticals

- Food Industry

- Textiles

Global Hydroquinone Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the hydroquinone market over the forecast period?The global hydroquinone market is projected to expand at a CAGR of 5.63% during the forecast period.

-

2. What is the market size of the hydroquinone market?The global hydroquinone market size is expected to grow from USD 0.75 billion in 2024 to USD 1.37 billion by 2035, at a CAGR of 5.63% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the hydroquinone market?Asia Pacific is anticipated to hold the largest share of the hydroquinone market over the predicted timeframe.

-

4. What is the hydroquinone market?The hydroquinone market is a global market for the chemical compound hydroquinone, which is used in products such as polymers, cosmetics, and paints.

-

5. Who are the top 10 companies operating in the global hydroquinone market?Mitsui Chemicals, BASF, Eastman Chemical Company, Lanxess, UBE Corporation, Solvay, Merck, Evonik Industries, LG Chem, Syensqo, Wanhua Chemical, Shin-Etsu Chemical, Camlin Fine Sciences Ltd., Jiangsu Sanjili Chemical Co., Ltd., and Others.

-

6. What factors are driving the growth of the hydroquinone market?The growth of the hydroquinone market is driven by its diverse applications across various industries, primarily as a polymerization inhibitor and for use in cosmetics and pharmaceuticals.

-

7. What are the market trends in the hydroquinone market?Market trends in hydroquinone include a growing demand from the expanding cosmetic and personal care industries, especially for hyperpigmentation treatments, and its use as a polymerization inhibitor in the growing polymers industry.

-

8. What are the main challenges restricting wider adoption of the hydroquinone market?The main challenges restricting wider adoption of the hydroquinone market are stringent regulatory constraints and bans, significant public perception and safety concerns, and competition from an increasing array of perceived safer substitute products.

Need help to buy this report?