Global Hydrogenated Nitrile Butadiene Rubber (HNBR) Market Size, Share, and COVID-19 Impact Analysis, By Type (Partially Hydrogenated HNBRF and ully Hydrogenated HNBR), By Application (Automotive Seals & Gaskets, Oil & Gas Industry, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Hydrogenated Nitrile Butadiene Rubber (HNBR) Market Insights Forecasts to 2035

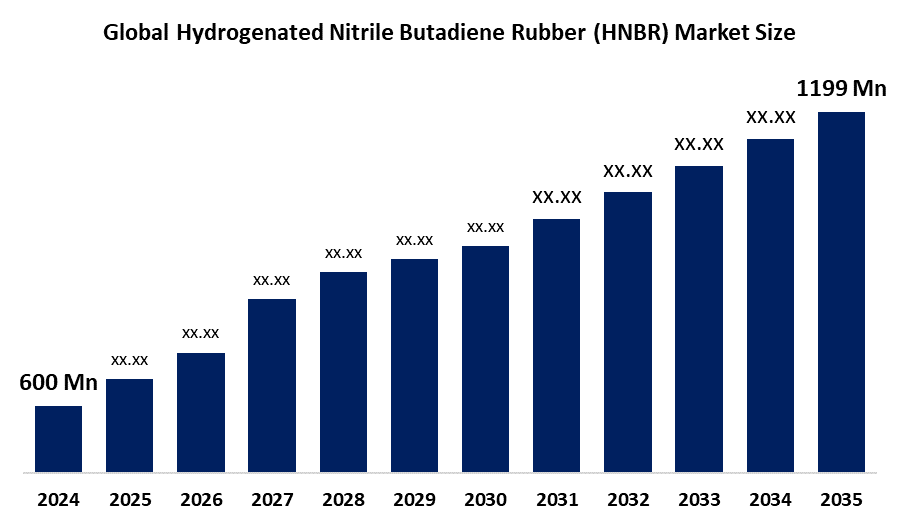

- The Global Hydrogenated Nitrile Butadiene Rubber (HNBR) Market Size Was Estimated at USD 600 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.5% from 2025 to 2035

- The Worldwide Hydrogenated Nitrile Butadiene Rubber (HNBR) Market Size is Expected to Reach USD 1199 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Hydrogenated Nitrile Butadiene Rubber (HNBR) Market Size was worth around USD 600 Million in 2024 and is predicted to grow to around USD 1199 Million by 2035 with a compound annual growth rate (CAGR) of 6.5% from 2025 and 2035. The market for hydrogenated nitrile butadiene rubber (HNBR) has a number of opportunities to grow, driven by its remarkable qualities, which include high mechanical strength, chemical resistance, and thermal stability. These qualities make it essential in demanding applications in the oil and gas, automotive, aerospace, and industrial industries.

Market Overview

Hydrogenated nitrile butadiene rubber (HNBR), also known as highly saturated nitrile, is a synthetic elastomer that is produced by hydrogenating the butadiene segments of nitrile butadiene rubber. The market for synthetic rubber is a prime illustration of how growth is encouraged by instability. When the economic downturn and low pricing began to hurt the natural rubber business, the synthetic rubber market entered the scene. Due to industrialization, it has now grown to be a significant commodity that meets the growing demand. Among the many synthetic rubbers available on the market, hydrogenated nitrile butadiene rubber is widely used in many different industries. TMR estimates that by the end of 2027, the global market for hydrogenated nitrile butadiene rubber will be worth around US $63 million. One of the main tactics used by companies to increase their worldwide presence in the market for hydrogenated nitrile butadiene rubber is the expansion of production facilities in developing nations. For example, KACO GmbH and Co. KG opened a new facility in Ningguo City, Anhui province, in July 2015 with the goal of producing dynamic sealing parts and providing them to the domestic and foreign car sectors.

The governments of major rubber producing nations have put in place a number of programs to encourage the research and manufacturing of hydrogenated nitrile butadiene rubber. For example, to boost rubber exports, Thailand's government has set up free trade agreements with nations like Australia and New Zealand. Through trade shows and buyer seller meetings, India has also helped rubber producers and farmers, opening up markets and promoting industry expansion. These initiatives seek to support innovation and competitiveness in the rubber sector, particularly improvements in the manufacture of HNBR.

Report Coverage

This research report categorizes the hydrogenated nitrile butadiene rubber (HNBR) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the hydrogenated nitrile butadiene rubber (HNBR) market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the hydrogenated nitrile butadiene rubber (HNBR) market.

Hydrogenated Nitrile Butadiene Rubber (HNBR) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 600 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.5% |

| 2035 Value Projection: | USD 1199 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Type, By Application and By Region |

| Companies covered:: | Zeon Corporation, LANXESS AG, ARLANXEO, Asahi Kasei Corporation, Kraton Polymers, Kraton Corporation, Evonik Industries, Hexpol, Kuraray Co., Ltd., SABIC, Ravago Manufacturing, Kumho Petrochemical Co., Ltd., Nippon Polyurethane Industry Co., Ltd., Wacker Chemie AG, LG Chem, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The hydrogenated nitrile butadiene rubber (HNBR) market is driven by the developing sectors like aerospace, electric vehicles, and renewable energy. HNBR is finding new opportunities as a result of the continuous transition to sustainable energy sources and greener technologies. The use of solar power generation equipment and wind energy systems, for example, offers opportunities for HNBR in sealing applications because the material's ability to withstand harsh environmental conditions and temperatures is crucial for the longevity and functionality of renewable energy infrastructure. Furthermore, it is anticipated that the aerospace industry's growing need for high performance gaskets and seals will stimulate the HNBR market.

Restraining Factors

The hydrogenated nitrile butadiene rubber (HNBR) market is restricted by factors like the high cost of manufacture. Raw materials and specialized technology are used in the production process, which might be costly. Because of this, HNBR is more expensive than other elastomers like natural rubber or regular NBR, which may restrict its use in sectors where cost is a concern.

Market Segmentation

The hydrogenated nitrile butadiene rubber (HNBR) market share is classified into type and application.

- The partially hydrogenated HNBRF segment dominated the market in 2024, accounting for approximately 35.45% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the hydrogenated nitrile butadiene rubber (HNBR) market is divided into partially hydrogenated HNBRF and fully hydrogenated HNBR. Among these, the partially hydrogenated HNBRF segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven because of its improved mechanical qualities, which include increased resistance to heat, oil, and chemicals. This category is expected to maintain its leadership position in the automotive and industrial sectors.

Get more details on this report -

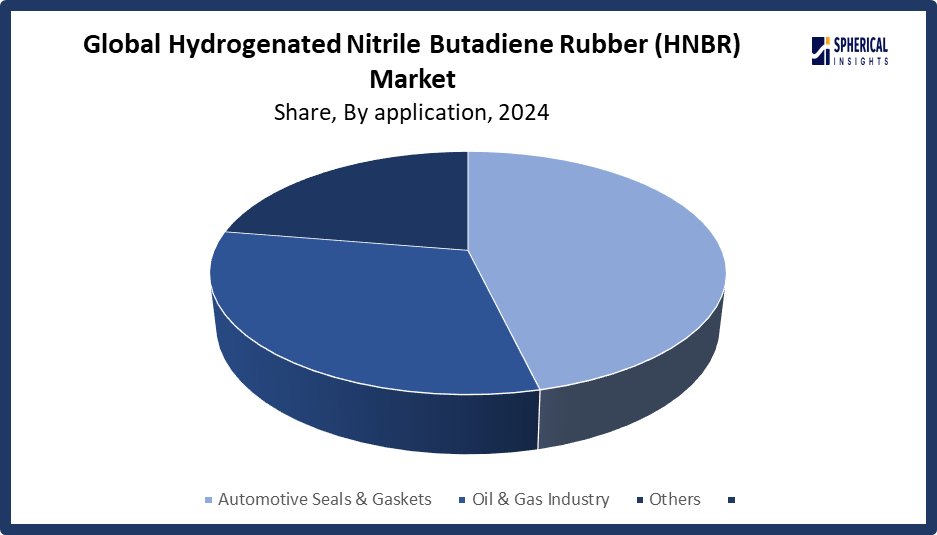

- The automotive Seals & Gaskets segment accounted for the largest share in 2024, accounting for approximately 46% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the hydrogenated nitrile butadiene rubber (HNBR) market is divided into automotive seals & gaskets, oil & gas industry, and others. Among these, the automotive seals & gaskets segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is because of its remarkable resistance to heat, oil, and fuel additives, HNBR is the material of choice for under the hood parts like air conditioning hoses, fuel system seals, and timing belts. The need for HNBR based solutions is expected to rise as automakers work to improve vehicle longevity and adhere to more stringent emission standards.

Regional Segment Analysis of the Hydrogenated Nitrile Butadiene Rubber (HNBR) Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share, representing nearly 32.1% of the Hydrogenated Nitrile Butadiene Rubber (HNBR) market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share, representing nearly 32.1% of the hydrogenated nitrile butadiene rubber (HNBR) market over the predicted timeframe. In the Asia Pacific market, the is rising because of their growing automotive, industrial, and energy industries, China, Japan, South Korea, and India continue to play a key role in regional growth. The demand for HNBR components used in battery systems and electric drive assemblies is increased by the growth in the manufacturing of electric vehicles in China and Japan. Southeast Asia's fast industrialization and infrastructural growth open up new markets for diaphragms, hoses, and seals. HNBR is being used more and more in the oil and gas industry in China and Australia for long lasting sealing elements in upstream operations. To satisfy the expanding demands of the domestic and international markets, regional manufacturers make investments in HNBR based solutions. It bases its supremacy on high production volume, cost effective manufacturing, and improving material quality standards.

North America is expected to grow at a rapid CAGR, representing nearly 28.4% in the hydrogenated nitrile butadiene rubber (HNBR) market during the forecast period. The North America area has a thriving market for Hydrogenated Nitrile Butadiene Rubber (HNBR) due to the area's gains from a well-established automobile manufacturing sector, especially in the US and Mexico, where HNBR is widely utilized in timing belts, fuel system seals, and under the hood parts. Strong demand for HNBR based sealing systems, gaskets, and packers is driven by the U.S. oil and gas sector, particularly in shale exploration and offshore production. It facilitates crucial performance in harsh chemical media and high pressure settings. HNBR is used in hydraulic applications that need extended service intervals by machinery and industrial equipment manufacturers throughout the Midwest. Regional adoption is also supported by ongoing investments in emission control technologies, petrochemical upgrading, and refining.

Europe represented the global hydrogenated nitrile butadiene rubber (HNBR) market with a 25.6% share due to automobile production in Germany, France, and Italy benefits the region, as OEMs use HNBR for high performance elastomer applications. Long lasting gaskets and seals are still in high demand for electric and hybrid powertrain systems. The use of vibration dampers, diaphragms, and rotary seals is increased by the existence of reputable industrial machinery and automation firms. Stricter environmental regulations in the EU are driving industries to use more sophisticated elastomers that are resistant to chemicals and have longer operational lives. The North Sea's oil and gas industry keeps up with HNBR's need for offshore machinery that can withstand high temperatures and corrosion. It is essential to help Europe make the shift to low maintenance, effective engineering systems.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the hydrogenated nitrile butadiene rubber (HNBR) market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zeon Corporation

- LANXESS AG

- ARLANXEO

- Asahi Kasei Corporation

- Kraton Polymers

- Kraton Corporation

- Evonik Industries

- Hexpol

- Kuraray Co., Ltd.

- SABIC

- Ravago Manufacturing

- Kumho Petrochemical Co., Ltd.

- Nippon Polyurethane Industry Co., Ltd.

- Wacker Chemie AG

- LG Chem

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the hydrogenated nitrile butadiene rubber (HNBR) market based on the below-mentioned segments:

Global Hydrogenated Nitrile Butadiene Rubber (HNBR) Market, By Type

- Partially Hydrogenated HNBRF

- Fully Hydrogenated HNBR

Global Hydrogenated Nitrile Butadiene Rubber (HNBR) Market, By Application

- Automotive Seals & Gaskets

- Oil & Gas Industry

- Others

Global Hydrogenated Nitrile Butadiene Rubber (HNBR) Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the hydrogenated nitrile butadiene rubber (HNBR) market over the forecast period?The global hydrogenated nitrile butadiene rubber (HNBR) market is projected to expand at a CAGR of 6.5% during the forecast period.

-

2. What is the market size of the hydrogenated nitrile butadiene rubber (HNBR) market?The global hydrogenated nitrile butadiene rubber (HNBR) market size is expected to grow from USD 600 Million in 2024 to USD 1199 Million by 2035, at a CAGR of 6.5% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the hydrogenated nitrile butadiene rubber (HNBR) market?Asia Pacific is anticipated to hold the largest share of the hydrogenated nitrile butadiene rubber (HNBR) market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global hydrogenated nitrile butadiene rubber (HNBR) market?Zeon Corporation, LANXESS AG, ARLANXEO, Asahi Kasei Corporation, Kraton Polymers, Kraton Corporation, Evonik Industries, Hexpol, Kuraray Co., Ltd., SABIC, Ravago Manufacturing, Kumho Petrochemical Co., Ltd., Nippon Polyurethane Industry Co., Ltd., Wacker Chemie AG, LG Chem, and Others.

-

5. What factors are driving the growth of the hydrogenated nitrile butadiene rubber (HNBR) market?The hydrogenated nitrile butadiene rubber (HNBR) market growth is driven by rising industrial, oil and gas, and automobile demand. HNBR is perfect for crucial parts like gaskets, hoses, and seals because of its exceptional durability, chemical resistance, and temperature stability.

-

6. What are market trends in the hydrogenated nitrile butadiene rubber (HNBR) market?The hydrogenated nitrile butadiene rubber (HNBR) market trends include automotive sector expansion, oil & gas industry growth, aerospace applications, bio-based and low-VOC developments, and regional market dynamics.

-

7. What are the main challenges restricting wider adoption of the hydrogenated nitrile butadiene rubber (HNBR) market?The hydrogenated nitrile butadiene rubber (HNBR) market trends include its high production costs, which are caused by intricate manufacturing procedures and the usage of catalysts made of precious metals, making it significantly more costly than substitutes like Nitrile Butadiene Rubber. Because of this price difference, it can only be used in high performance applications, which limits its wider acceptance.

Need help to buy this report?